Best High Yield Canadian Stocks 2024

Many people love investing in dividend stocks for their predictable income stream. One of our most popular articles is our best Canadian dividend stocks list. Many investors are looking in particular for the best high yield Canadian stocks, so each year we provide the updated list below.

You may notice we haven’t picked the stocks with the absolute highest dividend payouts and may be curious why we wouldn’t simply load up on those.

Well, different investors have different goals.

Some investors are looking for immediate income, and the highest yielding stocks are how they can achieve that high cash flow today. They don’t want to wait for dividends and capital gains to build their savings over the long-term.

We, on the other hand, tend to align with the perspective of dividend expert Mike Heroux of DSR in emphasizing:

- Consistent dividend growth, and

- A focus on overall Earnings Per Share (EPS) over pure yield

Why? Because this is statistically the path to long-term success in our dividend portfolios.

Top 7 High Yield Stocks in Canada

*Note: This is not a stock screen of the highest yielding stocks in Canada, it’s our picks out of the pool of stocks that have relatively high yields. For example, Gibson Energy (GEI) has a 7.22% yield, but given the company’s volatility and small market cap, we would never recommend investing in it.

1) Canada’s “Big Six” Banks

- RBC (RY.TO) – 4.07%

- Bank of Montreal (BMO.TO) – 4.91%

- TD Bank (TD.TO) – 5.14%

- National Bank of Canada (NA.TO) – 3.76%

- CIBC (CM.TO) – 5.56%

- ScotiaBank (BNS) – 6.70%

Ok, so I’m cheating right off the bat by only using one spot to invest in Canadian bank stocks. If you’re a patient investor there is a lot to love here. Banks have had a few rough years which has led to these increased dividend yields that we’re seeing. However, they’re currently a great value with the big banks operating in a secure oligopoly here in Canada.

Sure, if Canadian housing crashes in a worst case scenario there could be some headwinds, but the accompanying high interest rate would mean that the banks saw increased earnings from deposit vs lending spreads.

We know that these companies make money in all markets, and that they enjoy rewarding their shareholders. They’re not “cheap” at the moment, but they are reasonably priced compared to many other stocks.

There is an interesting theory when it comes to the bank stocks, that if you simply buy shares in the one that has the highest yield, you’ll come out ahead in the end. The idea would be that the banks overall tend to revert to the mean, and the highest yield usually indicates which bank has seen their share price beat up a bit for some reason. Personally, it’s not my thing, but it’s an interesting idea.

I’d definitely caution against getting too excited when you look at Scotiabank’s (also known as Bank Of Nova Scotia) high dividend yield of 6.60%. While the company has been around since 1832 and serves clients in multiple countries, it may not be the great deal it appears at first glance.

Dividend yields have risen while the share price has been declining, indicating it’s out of favour with investors. Additionally, its high payout ratio makes us question the sustainability of that high dividend. We’d consider it a laggard with an unclear future when compared to its peers in the list above.

2) Power Corp (POW.TO) – 6.11%

Another “boring” Canadian financial company that just seems to make money in all types of economic environments. High interest rates have hurt stock values here because people looking for a guaranteed yield have gone to bonds the last few years.

However, that means this may be the ideal time to buy. Going to get disrupted by new technologies? Simple, just buy the new technologies and win no matter what direction the winds blow. Their early stage investing of Fintech companies, alongside their very profitable legacy lines of business just continue to churn out profits for this Canadian stalwart. Tough to find a safer 6%.

3) Keyera Corp (KEY.TO) – 5.60%

It’s not my favourite of the mid-stream Canadian companies (see the next two entries for more details), but it is the one that is most dedicated to rewarding shareholders. Like Power Corp, stock values have decreased due to people flocking to bonds, but that’s not an indicator that you should avoid investing here.

It’s tough to go wrong betting on natural gas at the moment. Sure, rising interest rates can be rough on capital-intensive companies, but the Canadian energy sector as a whole just looks really well positioned for the short- and medium-term. See our list of the best Canadian energy stocks for more suggestions.

4) Enbridge (ENB.TO) – 7.75%

Enbridge has been on many of our top lists for the past few years and they continue to take a place here as a great high yield stock, as well as on our Canadian Dividend Kings list. They are the largest pipeline company in North America, also investing in renewable energy, and have been increasing their dividend for the past 29 consecutive years!

It’s a great company, and obviously, with the world’s renewed focus on energy stability, it’s a super solid bet to continue to pass along juicy yields.

5) TC Energy (TRP.TO) – 7.83%

Closing out our run of Canada’s mid-stream companies, and taking the top spot for best pipeline stock in Canada, is TC Energy. It might actually be the best positioned for long-term capital gains increases with strong earnings that are forecasted to stay high.

It’s tough to go wrong with any of these mid-stream companies at the moment, as quantities of oil and gas haven’t been in this high demand for a long time, and with railway companies seeing labour cost pressures that makes pipelines even more attractive.

And a dividend of 7.83%? Yes, please!

6) Canadian Natural Resources (CNQ.TO) – 4.05% + Maybe a Special Dividend?

It’s super rare that you find a company paying a 4% yield – while at the same time having a payout ratio sitting below 50%. That gives you some idea of just how much cash CNQ has floating around on its balance sheet right now. Last year they reached production records and increased reserves for the company.

This year they’ve announced a benchmark (net debt level of $10 billion or less) at which to start returning 100% of free cash flow to shareholders and a 2-for-1 stock split.

I’m always conscious of coming in too late on a trend, and obviously if Russian oil gets market access in the short-term then CNQ could find its profits falling back down to Earth. That said, this oil giant was able to trim costs admirably during the downturn, and appears to be a lean money-making machine in its current form.

Already up roughly 27% over the past year, I don’t know how much runway is left on the capital gain side of things, but folks looking for high yield stocks in 2024 will love the potential that this company has for a special one-time dividend this year. I’ve seen several analysts whispering about this development over the last few weeks.

Note: A special dividend is when the Board votes to pay shareholders a one-time payment in addition to the normally-scheduled cheques being sent out.

7) Telus (T.TO) – 6.88%

Yawn – another super safe company that will just keep sending you money each year. Their strong presence in the wireless industry, and their proven track record of growth in revenue, earnings, and dividend payout should allow you to invest with confidence.

Telus bumped Bell off our list of Best High Yield Stocks for this year but any of Canada’s telecommunications stocks are great at rewarding high-yield-loving shareholders. Canada’s increasing population should keep Telus (as well as close competitors Bell and Rogers) growing into the future.

Mike Heroux at Dividend Stocks Rock (my go-to source for yield info) also has Telus on his list of favourite telcos to invest in.

Beyond the market of telcos, Telus even made it onto our Best Canadian Dividend Stocks List for the month.

While inflation might play havoc with some companies’ ability to sustain earnings, I believe the solid Canadian telecommunications oligopoly will continue to just pass those increased costs along to their customers and keep those profit margins right where shareholders want them.

Best Canadian High Yield ETF: ZWC – 7.51%

If you’re looking for a Canadian high yield ETF, you could do a lot worse than ZWC.

There are a few higher yielding ETFs out there at the moment, but ZWC’s diversification and 7.32% average yield over the last five years is quite impressive.

ZWC is able to generate this high yield by stuffing their fund full of Canadian banks, mid-stream companies, and telecommunications giants (not surprising given the list above), along with a solid helping of utilities stocks and natural resource exposure as well.

In other words, they include many Canadian wide moat stocks: dividend-paying companies operating in an oligopoly situation and holding a competitive advantage over the long-term. No single stock makes up more than 5.2% of the total holdings of ZWC.

Then ZWC uses a unique covered call options strategy to give it a further high yield boost – at the cost of some capital gains going really well. The idea here is that the fund will sell a call option on the stocks that they own as part of this ETF.

What happens is that the people buying these options get the right (or “option”) to buy these stocks from the ETF if the price goes up during a specific time frame (usually the next 30-90 days).

So, either the stock price goes down – and ZWC keeps the stock plus pockets the price paid for the option.

Or the stock price stays the same and/or goes up a small amount – and ZWC keeps the stock plus pockets the price paid for the option.

Or the stock prices go up by a substantial amount – and ZWC is forced to sell the stock for solid profit, but loses out on whatever the difference is between what they were forced to sell at, and what the stock is now worth. This is often referred to as a “capped upside” because if a stock does really well there is a ceiling on how much of the gain that ZWC will get to enjoy.

Most investors who want high yielding stocks are happy to sacrifice the potential for large capital gains in exchange for a steady reliable income-producing portfolio builder.

You can buy this ETF at any online Canadian broker, but our top pick is Qtrade – even though ZWC isn’t included in their list of over 100 free ETFs. Read our Qtrade review to find out why, or visit their site by clicking the button below.

FAQ About High Yield Stocks in Canada

What is The Highest Yield TSX Stock in 2024?

Well, it depends on what exactly you mean by “highest yielding stock”.

If you mean “stock” as in common shares of a traditional corporation, then that would be Bell Canada Enterprises Inc. (BCE) with a dividend yield of 8.91%. If you’re wondering why it didn’t make our list for best high yield Canadian stocks it’s because the share price keeps going down due as some investors believe the dividend may be cut eventually.

If you mean “stock” as in anything that I can buy on Toronto Stock Exchange, then there is an interesting high-risk option called Canacol Energy (CNE).

Given that it’s currently offering a forward yield of 22.61% it often raises a few eyebrows.

Canacol Energy Ltd. is a natural gas exploration and production company based out of Colombia. It’s a very small and risky company, and a good example of why dividend yield isn’t the only thing you should look at when selecting dividend stocks.

While the dividend is enticingly high, they have a high level of non-cash earnings, not enough earnings to easily cover payments, and their profit margins are lower than last year.

You’d be taking a huge chance here!

While that might turn out well for you, it’s also an incredibly volatile ride given the realities of investing in commodities, whether it be Canadian or International.

High yielding stocks are certainly attractive – who doesn’t want a quick and generous payout? However, as we’ve said throughout this article, they’re statistically not your best bet for the long-term. For long-term success in overall portfolio growth, check out our best Canadian dividend stocks for a well-rounded selection.

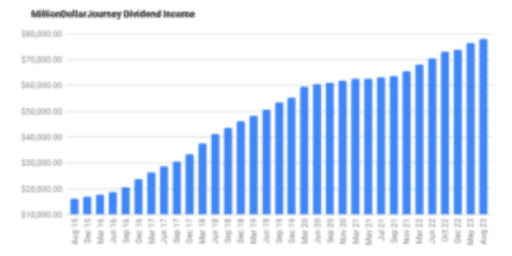

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?