Have I Given Up on the Smith Manoeuvre?

Out of many investing topics written about on Million Dollar Journey, the Smith Manoeuvre was one of the first and among the most popular investment strategies discussed.

What is the Smith Manoeuvre?

But, what is the Smith Manoeuvre and why is it so popular? This investment strategy was named after Frasier Smith, a financial advisor who popularized this strategy through his book. The Smith Manoeuvre, in its simplest form, is a leverage investment strategy that uses your home as collateral. It’s popular because borrowing to invest makes the interest eligible for a tax deduction. So to frame it in an enticing way, Canadians, it enables Canadians to convert their regular mortgage into a tax-deductible mortgage.

How does it work? If you have a home with some equity, the simplest way is to obtain a Home Equity Line of Credit (HELOC) and invest in the stock market with the balance. To make it the true Smith Manoeuvre, you would need to obtain a readvanceable mortgage that increases your HELOC balance as you pay down your instalment mortgage. Using your HELOC balance to invest within a taxable investment account, over time, your regular mortgage shrinks while your HELOC balance (and hopefully your taxable investment account) grows. In the end, you have a fully tax-deductible HELOC that has replaced your regular mortgage.

Sounds risky right? Well, leveraged investing is definitely risky so you’ll definitely need to have a high-risk tolerance to implement this strategy. You can read much more detail about the nuts and bolts of the Smith Manoeuvre Strategy here.

My Implementation of the Smith Manoeuvre

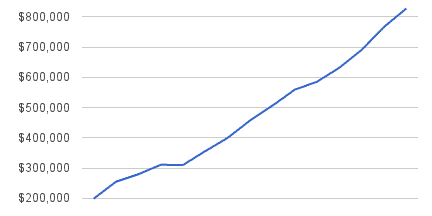

As many readers know, I implemented the Smith Manoeuvre many moons ago in 2007/2008. I obtained a readvanceable mortgage from BMO, withdrew $50,000 and invested in Canadian Dividend stocks. Yes, right before the financial crisis! While the timing wasn’t great, I knew that I was in it for the long haul, with the goal to generate dividend income to one day fund early retirement.

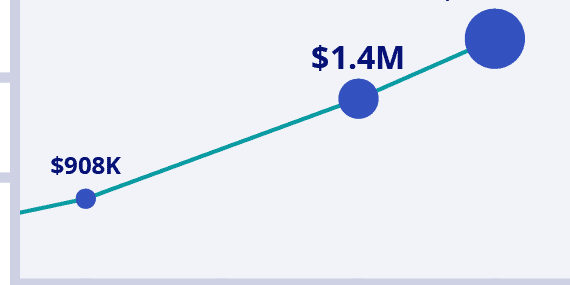

We eliminated the regular instalment mortgage in our early 30’s but never really maxed out the HELOC. In total, we borrowed over $100k, and used the HELOC to pay for itself (we capitalized the interest) and let the balance and tax-deductible interest grow.

Fast forward to today, the strategy is still alive and well, but it looks a little bit different than in 2007/2008. While we capitalized the interest (used the HELOC available credit to cover the monthly payment) for many years, the balance also grew over time. That is until over the past year where we are now using the dividends to slowly pay down the HELOC balance.

In my last update, I reported that my leveraged investment accounts pays out about $7.8k in dividends per year from a 3.68% yield – which equates to a portfolio size of approximately $212k. Based on the underlying investment loan (my HELOC), I pay about $3,600/year in interest, with the difference (about $4k) to slowly pay down the investment loan balance. At this rate, based on my projection and assuming that I do not borrow more, the HELOC should be paid off between 25-30 years. While the spread between dividends and interest paid is wide right now, it may start to close in as interest rates rise. If this ever gets inverted, I may need to revise my plan and start aggressively paying down the loan.

Why the shift from capitalizing the interest to paying down the HELOC? Basically, we are reducing a little risk/liability in preparation for semi/early retirement! After hitting the million dollar net worth milestone in 2014, we turned our focus on building our passive income to the point where it would cover our recurring expenses. We basically doubled down and put pure focus on building our dividend and indexed portfolios.

By mid-2020, we managed to hit a big financial milestone – we reached financial independence by growing our dividend income enough to cover our family’s expenses. At the time, it just felt like another day. What I didn’t realize was that it started a subtle shift in the way I thought about my day-to-day life. It might have been party because of the COVID pandemic restrictions, or partly due to working from home full time – but my taste and underlying wanting for more freedom was growing stronger.

So I have taken the leap in phasing out of full-time work and moving into a phase of working on new projects and hobbies. While these projects and hobbies aren’t very lucrative, we have been making the shift from accumulation of assets, to finally spending some of those dividends that have been growing over the past 13+ years. I’ve also noticed that the accumulation of assets is pretty straightforward compared to the puzzle of efficiently decumulating your assets!

Have I Given up on the Smith Manoeuvre Strategy?

So have I given up on the Smith Manoeuvre strategy? Not a chance! The portfolio predominantly holds companies that pay a growing dividend. Over the long-term, the dividends should continue to increase (and theoretically the portfolio size), and the investment loan balance should decrease. In 25 years, the portfolio should be over twice the current size, with a HELOC balance of almost $0. On the other hand, looking at it from another perspective, when the investment loan gets paid off in the future, it’s no longer the Smith Manoeuvre! So maybe my future self will give up on the Smith Manoeuvre after all.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

I unfortunately have just learned about this now!

I have 2 years left on my conventional mortgage @ 2.49%. I have a ton of equity in my house. Can this be done with a heloc in 2nd position and use the dividends to hammer the mortgage? I guess at this point it would just be leveraged investing if I took 600,000 and bought dividend stocks with it.

Yup – it would still likely benefit you from a tax perspective too Vic. Especially where interest rates are now.

Thank you for this excellent update FT and congratulations once again for your fantastic saving and investment journey. I know that you no longer practice “capitalizing the interest”. You have now gone past that phase, which is great. For a beginner, this is a great strategy. Would you mind explaining once again the best way to implement it, i.e. how to capitalize the interest in a way that serves a clear record keeping? I seem to understand the concept but am still figuring out how best to act on it. Many thanks.

Hey Norman,I have an image created on the money flow, but comments will not let me upload here. You can email me for the image: frugaltrader [at] gmail dot com.

Great article FT and timely too.

I have recently been refinancing my mortgage as I am part way through the Smith Maneuver myself. I have a few questions from the mid to end game of the process. FT mentioned both outcomes of the SM in that you can either partially pay off the tax deductible HELOC or keep the full balance to offset future income with the interest payments. I have taken the step of transferring the HELOC balance back into mortgage form to take advantage of lower interest rates and to use the HELOC room to recapitalize interest (like a cash dam) to maximize our own cash flow.

My first question is on how the banks will view a person / family’s ability to service the loan once the family reaches financial independence or is in a position to semi-retire. Given the focus of banks on actual income and not on assets, have any of you near / in retirement have found it hard to qualify for competitive mortgage or HELOC rates on a 3 or 5 year basis despite having a large asset base that will cover the total debt? Does that affect your decision to leave a traditional job until the mortgage portion is paid off? My questions are only based on my experiences it may be ignorant to other factors.

My second question is on the pragmatism of keeping the balance of the fully tax deductible debt maxed out in retirement. While I understand that, in ideal conditions, it would be optimal from an opportunity cost and deferred tax perspective to max out the debt and keep assets growing in value. However, if you intend on moving, settling the debt will incur immediate and significantly high taxes. Are there any other options in managing the debt balance outside of investing in dividend stocks? For example, have people tried chipping away at stocks with high capital gains over time and reborrowing to stay within a tax bracket?

Thanks!

You have some great questions Alter Ego. I’ll take a stab at answering some of them:

This is great, thanks for the update on the Smith Maneuver. I’m in my early thirties right now, and if I use the Smith Maneuver, I think I will be able to finish the mortgage portion prior to my 40’s.

This was a good confidence booster. I had the resources to initiate SM available back in May, but was just hesitant to start.

Thanks for stopping by Johannes. The best tip I can give is to keep your eye on the long-term. Over the very long term, your portfolio should dwarf your investment loan providing that you invest properly.