Financial Freedom Update (Q3) 2020 – New Market High Edition ($61,050 in Dividend Income)!

Welcome to the Million Dollar Journey 2020 (Q3) Financial Freedom Update – New Market High Edition! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter.

For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses.

Here is a little more detail on our passive income goals:

Financial Goals

Our current annual recurring expenses are in the $52-$54k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money ever becomes tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full time salaries (we are currently an one income family). At that point, I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and entrepreneurial pursuits.

The Previous Update

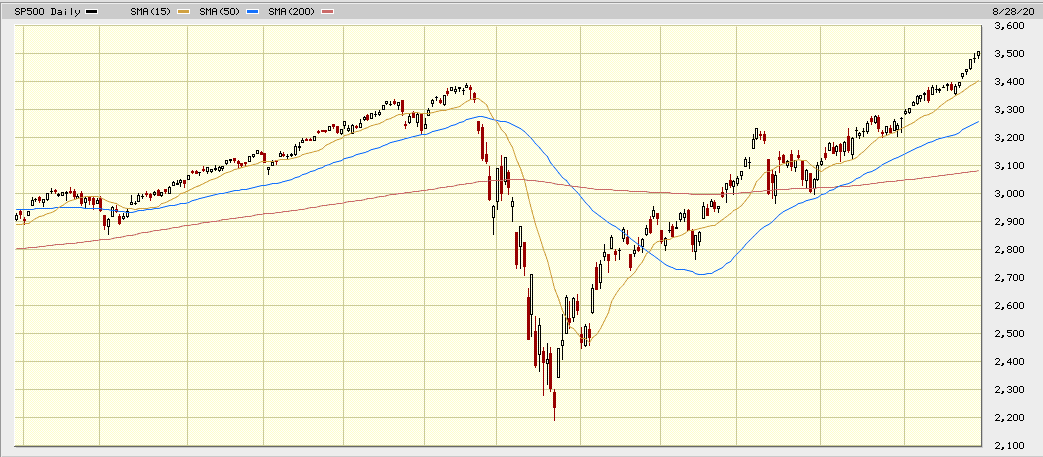

In the previous update, I wrote about the stock markets v-shape recovery from the COVID19 sell-off. The stock market has been a good representation of the craziness of 2020. From market all-time highs (first half of Q1 2020), to the fastest 35% correction in history (second half of Q1), then to one of the fastest recoveries recorded (S&P500)!

As I’ve mentioned in many other updates, I like to buy quality dividend companies (and indexes) when their valuations are attractive. In other words, when they are being sold off (ie. dip). You can see some of my favourite Canadian dividend stocks here.

Here is a summary of the last update:

Q2 2020 Dividend Income Update

| Account | Dividends/year | Yield |

| Smith Manoeuvre Portfolio | $7,700 | 3.96% |

| TFSA 1 | $4,250 | 4.72% |

| TFSA 2 | $4,000 | 4.75% |

| Non-Registered | $3,700 | 4.22% |

| Corporate Portfolio | $29,500 | 3.77% |

| RRSP 1 | $8,000 | 2.59% |

| RRSP 2 | $3,400 | 2.44% |

- Total Portfolio Value: $1,513,160

- Total Yield: 4.00%

- Total Dividends: $60,550/year (+1.7%)

Current (Q3) Update

In the last update, the S&P500 was trading around 3,100 which I thought was an impressive recovery from the COVID19 bottom (2,200).

As of this post, the S&P500 is making new all-time highs and trading at 3,500! With the surge in technology stocks now representing the largest companies in the world, and S&P500 representing the 500 largest companies in the US, it makes sense that this index is making new highs.

With all eyes on technology, the upward trend will depend on big technology earnings, interest rates remaining low, and of course, governments maintaining infinite liquidity.

Is this recovery too fast and too soon? Certainly feels like it! The stock market is known to be forward-looking, but the most recent recovery was propped by the infinite liquidity by the US. What happens next, in the short term, remains to be seen. On the other hand, the market has proven time and time again that over the long term, it will continue to chug along in an upward direction – and that’s what I’m betting on.

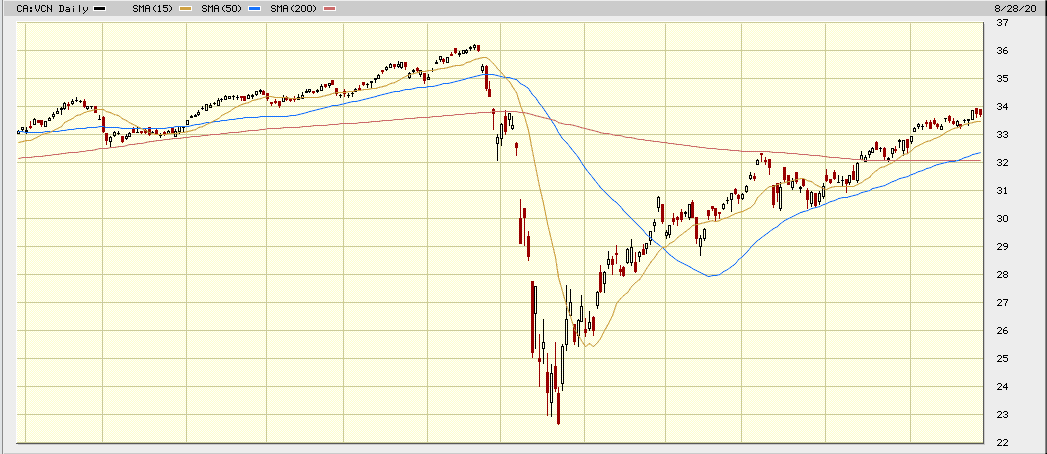

On the other hand, if you are building the Canadian allocation of your portfolio, the TSX hasn’t quite reached all-time highs yet but appears to be approaching.

As I’ve mentioned in many other updates, I like to buy quality dividend companies (and indexes) when their valuations are attractive. In other words, when they are being sold off (ie. dip). You can see some of my favourite Canadian dividend stocks here.

While I deployed a lot of capital during the 2020 correction, over the last couple of quarters has resulted in less investment on my part. Partly because of less capital available to invest, but also the quick recovery caused me to pause a little.

Thus far in this past quarter, I deployed capital into the following :

- Algonquin Power & Utilities (AQN)

The goal of the dividend growth strategy is to pick strong companies with a long track record of dividend increases. In terms of dividend increases, despite the fastest correction in history, this year has proven to be lucrative for dividend growth investors.

2020 Dividend Raises

So far in 2020, the Canadian portion of my portfolio received raises from:

- CU.TO (3% increase)

- MRU.TO (12.5% increase)

- CNR.TO (7% increase)

- XTC.TO (5% increase)

- BIP.UN (7% increase)

- BCE.TO (5% increase)

- SU.TO (10.7% increase)

- GWO.TO (6.1% increase)

- TRP.TO (8% increase)

- RY.TO (3% increase)

- MG (9.6% increase)

- TD.TO (6.8% increase)

- CM.TO (3% increase)

- PWF.TO (10% increase)

- MFC (12% increase)

- ENB.TO (9.8% increase)

- TRI.TO (5.5% increase)

- TD.TO (6.8% increase)

- CM.TO (3.0% increase)

- ENGH.TO (22% increase)

- CNQ.TO (13% increase)

- POW (10% increase)

- EMP.A (8% increase)

- CP (14.5% increase)

- AQN (10% increase)

- CPX (6.8% increase)

But what about dividend cuts? 2020 has been especially tough on dividend cuts. With an oil crash and many companies closed during this pandemic, struggling companies have made the decision to preserve capital by either suspending their dividend or cutting the dividend.

There have been a number of casualties so far in my portfolio namely positions in (mostly energy-related):

- High Arctic Energy (HWO)

- NFI Group (NFI)

- Inter Pipeline (IPL)

- CAE (CAE)

- Husky Energy (HSE)

- Suncor (SU)

- Ensign Energy (ESI)

- Mullen Group (MTL)

- Leon’s Furniture (LNF)

- Pason Systems (PSI)

For a more complete list of dividend cuts of 2020, you can see a full list here.

Top 10 Holdings

In our overall portfolio, here are the current top 10 largest holdings:

- Canadian National Railway (CNR)

- TransCanada Corp (TRP)

- Emera (EMA)

- Royal Bank (RY)

- Fortis (FTS)

- TD Bank (TD)

- CIBC (CM)

- Enbridge (ENB)

- Bell Canada (BCE)

- Canadian Utilities (CU)

*not counting index ETFs (they are my largest holding).

Dividend Income Update

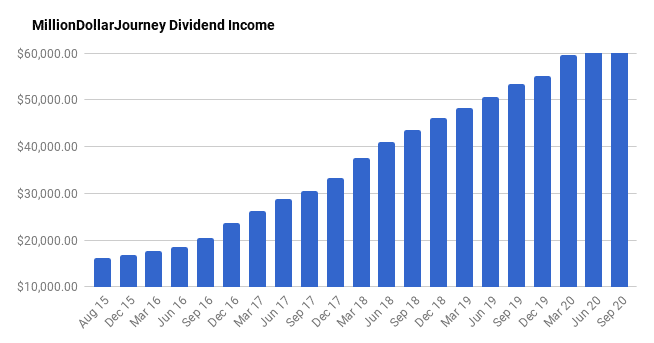

As you can see in detail below, we have increased our dividend income to $61,050 which represents a very small increase quarter over quarter.

While it represents the smallest quarter/quarter increase since I’ve started reporting, when we hit $60k in dividend income, it represented our long-term passive income goal. We will continue to build upon our portfolio with new savings and by reinvesting those dividends.

Here are the numbers.

Q3 2020 Dividend Income Update

| Account | Dividends/year | Yield |

| Smith Manoeuvre Portfolio | $7,700 | 4.32% |

| TFSA 1 | $4,250 | 5.16% |

| TFSA 2 | $4,000 | 4.86% |

| Non-Registered | $3,700 | 4.67% |

| Corporate Portfolio | $30,000 | 3.97% |

| RRSP 1 | $8,000 | 2.67% |

| RRSP 2 | $3,400 | 2.37% |

- Total Portfolio Value: $1,621,139

- Total Yield: 3.77%

- Total Dividends: $61,050/year

Reviewing the “Total Portfolio Value” for this update is quite the contrast from earlier this year. The portfolio has recovered around $400k from the bottom of the 2020 correction! Just goes to show the volatility of the stock market, and the importance of keeping your eyes on the longer-term.

Final Thoughts

Deploying less cash than normal has resulted in the smallest dividend bump since I have started reporting. Even though we have reached our passive income goal, we will continue to invest our savings and reinvest the incoming dividends.

I’ve noticed that other dividend investors/bloggers are comparing their dividend income to a comparable income/hr. Depending on taxation in your area, in ON, $60k in dividend income is about equivalent to an $80k salary, which is about $40/hr. Not a bad way to psychologically frame passive income.

If you are also interested in the dividend growth strategy, here is a post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

If you want a simpler investing strategy that outperforms most mutual funds out there, check out my post on the best all in one ETFs in Canada. I’m a fan of indexing as the iShares XAW is my top individual holding.

Keep investing that cashflow and stick with a long-term plan. Your future wealthier self will thank you for it.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Since your goal is early retirement and a portion of your dividend income is within an RRSP, are you counting that as dividend income in early retirement? I don’t personally because it’s not easily accessible money – withdrawing it early has penalties. What’s your plan?

Hi Mark, I’ve been following you a long time and first of all congratulations on achieveing your goals and thanks a lot for sharing your journey. I do have the following question: do you take into account the taxes related to pulling money from your RRSP if you actually had to start tapping into your dividends to cover living expenses? How do you account for this if at all? My current target is to get $80k/year on dividends, and this is to assume that we would get taxed on the RRSP if we had to pull money away from it, but am I wrong in this assumption? Thanks a lot in advance!

Os

Simply incredible :)

We’re closing in on $21K per year from our TFSAs and taxable account + similar amount from RRSPs ($21K) for over $42K.

All that to say, I have some catching up to you my friend!

Mark

I was always curious about the following, this is because this problem bothers me too. What do you do with the dividend income inside your corp portfolio? If you leave your dividends there, they are taxed away at around 50% (well, depends on the province, but that’s close enough). If it’s taxed away so severely, are you really getting 30K per year of dividend income? If you take it out of the corp as a salary, then part of it goes into payroll expenses, then it’s added to your (or your wife’s) income and taxed away at your personal rate, which might be lower, but not that far away (say, 40% of that dividend income evaporates in payroll deductions and taxes). If you take it out as dividends, then the picture becomes even more complex, but the result remains pretty much the same – huge chunk of that income disappears.

Could you pls share the secret what else can one do with the dividend income inside the corporation?

Amazing stuff Frugal Trader. It’s always inspirational to see where you’re at and compare with our dividend income. We previously aimed to hit $30k in dividend income for 2020 but with all the cuts and suspensions, I think we are on track for ~$26k, possibly higher. :)