Your Canadian Expat Investing Toolbox: DIY Discount Brokerages and Robo Advisors

Once you have taken a hard look in the mirror and decided what your target asset allocation should be (with some help if you need it), it’s time to look at just how you should go about actually getting money from your paycheque into an indexed investment.

An index fund is a general term that covers a few different specific types of investments. When we talk about an investing “index” – that’s just code for “all of the assets in a given market”. That given market could be all of the stocks in Canada, or it could be a broad sampling of government bonds in the USA. An index can also be a much smaller and somewhat complicated niche, such as one that tracks the prices for agricultural companies and is called “COW” (I’m not making this up).

For 99.99% of us, we only need to focus on the most basic indexes. They are super cheap and list every single one of the biggest companies in the world, or include easy-to-understand bonds that are extremely safe to own.

If you Google “index funds” you’re likely to be bombarded by ads for a financial industry that is trying to sell you high-fee products under the guise of being friendly to low-cost investors. What happened here is that the big financial companies realized that low-cost index investors, who didn’t want to pay crazy high fees to invest in mutual funds, were killing their golden goose. So, they started to invent different products that stole the common names that had been applied to this newer, cheaper style of investing.

All you really need to know is that the best and cheapest way to invest in the world’s biggest, broadest indexes – and to guarantee yourself the average returns of that asset class while paying the lowest price possible – is to buy a product called an Exchange Traded Fund (ETF).

ETFs sound complicated, but they are really straightforward. In a prior article I quoted investment legend John Bogle as saying, “Don’t look for the needle in the haystack. Just buy the haystack!” An ETF is the quickest way to “buy the whole haystack”. In this odd-yet-effective metaphor, the haystack in question is a group of stocks or bonds.

For example:

- The Horizons S&P/TSX 60 Index ETF (HXT) takes your investment dollar and uses it to buy small chunks of the 60 biggest companies in Canada. You will get the average return and the average dividend from this diverse group of companies.

- The Horizons S&P 500 Index ETF (HXS) buys small chunks of the 500 biggest companies in the USA.

- The Horizons CDN Select Universe Bond ETF (HBB) splits your investment dollar into hundreds of the lowest-risk bonds in Canada. You will get the average interest rate that these bonds are charging their borrowers, and the average of the very small capital gain movement that they will experience as well.

The Tradeoff Between Convenience and Cost

ETFs are the cheapest way to harness the power of index investing. I’ll get into my specific recommendations for ETFs another day, but for now, I want to focus on the two main ways you can access ETFs.

1) Go online, open a discount brokerage account, put money into that account, and buy the ETFs directly using stock exchanges such as the Toronto Stock Exchange (TSX).

2) Open an account with CI Direct Investments and automatically send them money each month – which they will then take and invest into ETFs on your behalf. This type of investing platform is often referred to as a “robo advisor”.

ETFs charge a small fee for allowing you to buy a large group of stocks and bonds all in one bundle. This fee is called a Management Expense Ratio (MER). Each year the ETF will charge you somewhere between .03% and .50% on the total value of what you own.

So, if you owned 10,000 units (similar to “shares” of a stock) of an ETF, and that ETF was worth $10 per unit, then the ETF company would charge you between $30 and $500 per year ($100,000 x .0003-.005).

It’s important to understand that a lot of the value in these ETFs (and from index investing in general) is that there are no highly-paid people involved in the process. No one is trying to “pick the best stocks” and then charging you for the secretary, fancy technology, and beautiful office that they use to do their job.

The ETF is a computer-calculated product that simply buys a small part of all of the assets that make up its index. It’s mathematically certain to get the average of whatever group that it is made up of. This is quite valuable, because as we mentioned earlier in the show, human beings are really bad at picking investments, and whether you’re a financial professional or not, you’re probably going to lose a lot of money if you try.

Now, opening a discount brokerage and going full DIY as you handle your own investments is very doable for most people. You’ll probably have to dedicate a few hours to the reading and paperwork so that you can get properly set up. After that, it will take you literally a few minutes each year to handle your investing – if you stick to simple index investing that is.

However, a lot of people get intimidated by this process. A lot of the terminology can be kind of scary, and while we’re generally fine with spending hundreds of dollars to purchase clothes online, buying hundreds of dollars of ETFs online proves to be a much easier process to endlessly procrastinate. I, personally, have recommended index investing through discount brokerages to hundreds of people over the years, and I bet close to 90% left our chats saying that they were definitely going to do it.

The most common result?

They did nothing. They didn’t open a discount brokerage account. They didn’t buy ETFs. They didn’t start investing.

Maybe I’m just not much of a motivational speaker!

That psychological hurdle of getting started and actually clicking “buy”, combined with the small paperwork obstacle, has proven to be a very large mountain to climb for most people who are busy in their day-to-day lives.

This result is nothing short of a financial tragedy.

Anything that prevents people from investing or indirectly funnels them into the clutches of slick-talking financial salespeople means that folks are giving up a ton of financial freedom in their lives. They’re giving up family trips or early retirement. They’re giving up the incredible feeling of financial independence. And they’re giving it up because the financial industry has worked really hard to tell them that they can’t invest on their own, and to confuse the mathematical facts of how long-term investing truly works.

Into this gaping chasm of information and action stepped the robo advisors.

Robo Advisors – the automated solution for your investing needs

About ten years ago a service began to exist that basically said, “Send us a small amount of money each month [or each year…or whenever] and we’ll instantly invest it into a pre-arranged batch of index ETFs for you. Oh – and we’ll also be around to answer any questions you might have about how to use the platform, or how taxes work on this investing stuff. Basically, email us or use our online chat, and we’ll answer your questions. In return for this convenience, we’re going to charge you somewhere in the neighborhood of about $60 annually for every $10,000 that you invest with us (an MER of .60%).

Initially, I was skeptical of any financial service, but these platforms were sticking to index investing, and using most of the same ETFs that I was – so they couldn’t be all bad. I started to recommend them to a few of my friends who hadn’t been able to climb the DIY discount brokerage mountain.

Then a magical thing happened: nearly all of the people who I recommended the robo advisor option to actually did it!

My friends opened an instant index investing portfolio and hooked up their bank accounts within minutes. They loved how simple it was. They loved that they could ignore the math involved with rebalancing their asset allocation. I loved that they had someone at the robo advisor to answer all of their questions – because then we could talk about more fun things at dinner parties!

All of that being said, I still feel slightly hypocritical at times recommending a product that I don’t personally use. I feel that for my individual preferences, opening a discount brokerage and cutting my investment costs to the bone is worth the tradeoff in time and convenience. That said, I’m also a geek who likes to read financial books for fun – so I’m not a great test group. You’ll have to decide if the cost is worth it for you.

If you’re just starting out, and this is all a bit intimidating, I’d heavily lean toward recommending the robo advisor option simply because I’ve seen over and over again how people with good investing intentions can get sidetracked, and then paralyzed as they endlessly analyze. They often start reading snippets here and there, or watching the odd business news clip, and then they start questioning their commitment to index investing, and that leads to an endless cycle of half-hearted research followed by procrastination and indecision. The robo advisor option lets you get started TODAY, gives you someone to talk to in a pinch, and gives you automated excellence.

*For several options below, Million Dollar Journey has an affiliate relationship where we get paid a small amount if you use our affiliate link to get an exclusive discount.

CI Direct Investing (formerly known as Wealthbar): Canada’s Robo Advisor for Expats

As of 2020 there is only one robo advisor option available for Canadian citizens who are also non-residents for tax purposes (aka: expats). CI Direct Investing was known as Wealthbar until August 2020 and as far as services, investments, and pricing go, the offerings are identical.

When doing my research, I did come across a couple of robo advisor-style platforms based out of Switzerland and Singapore – but they were prohibitively expensive and quite complicated to use. In my opinion, CI Direct Investments is by far the better option for Canadian expats.

I am very impressed with what CI has put together for their expat clients. If you want the easiest way to get into index investing as a Canadian expat – this is far and away the best solution! You’re going to pay a bit more than you would if you were index investing using a Canadian discount brokerage, but depending on how big your portfolio is, it’s quite possible that you’ll pay less in overall fees than you would with an international discount brokerage – plus you get a ton of additional services in return for your money.

The one caveat here is that CI Direct Investments is not available in the USA or certain other countries such as North Korea, Iran, etc.

Let’s dive in to see just what the artist formerly known as Wealthbar has in store for potential Canadian expat investors.

Investing

Before we get to the extras, let’s tackle the most important stuff: What exactly is your investment dollar buying?

When you first sign up with CI Direct Investing, they’ll set you up with an advisor that you can talk to via email, phone, or online chat. This advisor will help determine your risk profile and answer any initial questions that you have. Additionally, they’ll look at your goals and overall financial situation before recommending an investment solution.

CI Direct Investing has one main investing path (which is probably what you want) and they also offer a second option called “Private Investment Portfolios”. Those private investments are a mix of unique assets such as preferred shares, private equity, and mortgages. They also come with a much higher price tag. Feel free to learn more about them, but personally I’m not all that interested, and wouldn’t use them in my portfolio.

Focusing on the main ETF Portfolios at CI, there are five asset allocation options: Aggressive, Growth, Balanced, Conservative, and Safety.

Each of these all-in-one solutions is going to be made up of the following ETFs – just held in different proportions depending on how much risk you want to take.

Horizons S&P 500 ETF (HXS) = US stocks

iShares Core MSCI EAFE IMI (XEF) = Non-Canada or US stocks from developed countries

BMO High Yld US Corp Bd Hdgd to CAD ETF (ZHY) = Bonds from USA corporations

Horizons S&P/TSX 60 ETF (HXT) = Canadian stocks

Horizons Equal Weight Canada REIT ETF (HCRE) = Canadian real estate

BMO Mid Corporate Bond Index ETF (ZCM) = Bonds from Canadian corporations

BMO Mid-Term US IG Corporate Bond Hedged to CAD Index ETF (ZMU) = Bonds from USA corporations

Then the super-safe portfolios will also use the Vanguard Canadian Short-Term Bond ETF (VSB), which consists of bonds issued by the Canadian federal and provincial governments.

CI Direct Investing offers a “clean-tech add on” for investors interested in the Socially Responsible Investing (SRI) models. This is accomplished by allocating a part of your portfolio to the PowerShares (PZD) ETF – which is comprised of companies focused on renewable energy and water purification.

The higher your risk profile, the more long term your goals are, the more of your money CI will put in US/Canada/International stocks – and less in bonds.

Fees

Your portfolio is going to have two levels of fees when you invest through CI Direct Investing.

1) The fees that your underlying ETFs will charge you.

2) The fees that CI will take for helping you out on your investing journey.

The underlying ETF fees are going to cost between .18% and .26%.

CI’s fees are charged under the following annual structure:

.60% on your first $150,000 invested

.40% on $150,000-$500,000

.35% on anything over $500,000

So, if you had $100,000 invested, you’d owe CI about $600 for the year, and your ETFs would charge you an additional $200 for the year.

If you had $750,000 invested with CI Direct Investing, you’d owe:

$150,000 x .6 = $900

$350,000 x .4 = $1,400

$250,000 x .35 = $875

Total CI Fees = $3,175

ETF Fees = $1,350-$1,950

That’s it – pretty transparent and easy to calculate!

Services

In return for those fees you’re going to get a financial advisor to help with stuff like:

- Financial planning

- Insurance needs and recommendations

- Estate planning

- Tax optimization

- Basic Canadian personal finance help

Now, you could do some reading on all of that yourself, but there is certainly a value to the convenience that CI brings to investing.

You can also rest easy knowing that when you use CI Direct Investing, your money is protected under the Canadian Investor Protection Fund (CIPF) for up to $1 Million per account type, in case CI went bankrupt for some reason. Long story short – it’s as safe to invest with CI as with any other bank or investment company in Canada.

Canadian Expat Investing Q/A with CI Direct Investing

When I contacted CI Direct Investing to find out about their options for expat investors, here’s what I found out:

1) What do Canadian Expats need in order to open up a robo advisor account with CI Direct Investing?

- $25,000 account minimum

- Your downloaded account statement for a Canadian bank account

- An electronic document issued by a Canadian government agency, or a cell phone company, or a utility company

- Canadian SIN

- Any foreign tax ID numbers that have been assigned to you

- A signature (electronic signature is accepted)

2) Do I have to be in Canada at any point or have a Canadian address in order to open a non-resident account with CI Direct?

Absolutely not.

3) What accounts can I open as a Canadian non-resident?

Stick to a plain vanilla non-registered account. However you could also transfer over any existing RRSP and/or TFSA accounts you have in order to keep life simple and have all your investments under one roof.

4) What taxes will I have to pay with CI Direct Investing?

The same taxes you’d have to pay anywhere else as a Canadian non-resident. Namely, the withholding tax on Canada-sourced income. This tax calculator from the CRA should give you a pretty good estimate.

5) How does having a CI Direct Investing account affect my non-resident status – and is it a strong resident tie?

Neither a non-resident CI Direct Investing account or a non-resident discount brokerage account is going to be a secondary residential tie to Canada. It will not be enough – by itself – for the CRA to consider you a factual resident. If you also own a car in Canada that you use when you come for the holidays, never cancelled your provincial health insurance, and still have a provincial driving license… The combination of all of those things might start to tilt the scales toward being considered a factual resident.

DIY Investing with a Discount Brokerage

If you want to embrace cutting your index investing costs to the absolute minimum, then you’re going to want to go to your “investing store” and purchase your index ETFs for yourself. That “investing store” is called a discount brokerage (aka online broker). If you have a bank account with a Canadian bank, they will have discount brokerage options available, but I wouldn’t recommend them. They also aren’t very fond of opening brokerage accounts for expats.

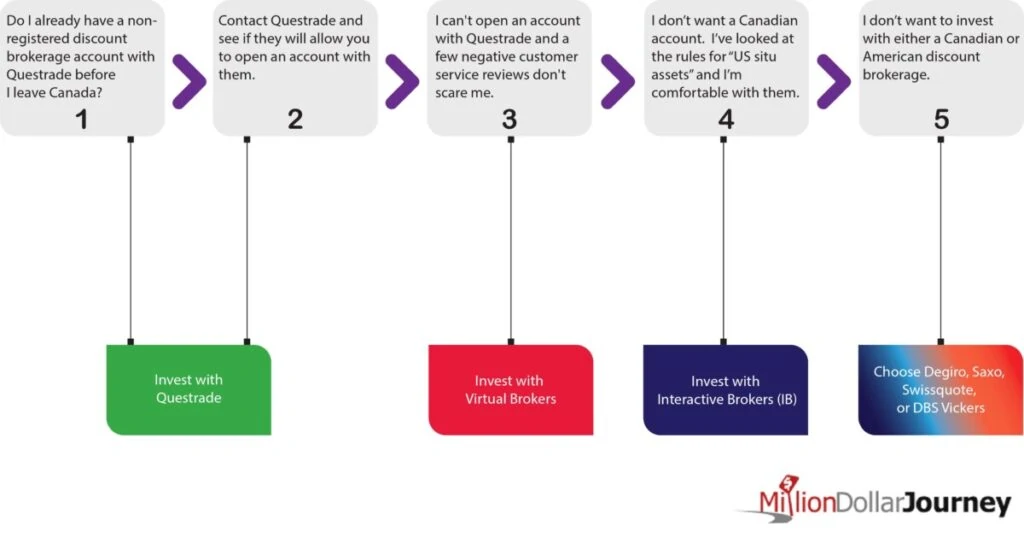

Here’s the TL;DR decision tree that I would use for choosing a discount brokerage for myself – keeping in mind that no one discount brokerage solution is inherently “the best” for all situations (read below for more info):

We’ve been doing Canadian discount brokerage reviews for over a decade here at Million Dollar Journey, so we thought we had a pretty good handle on the different platforms available to DIY investors. It turns out that the international discount brokerage game is a completely different animal.

The fees involved with opening a discount brokerage account outside of Canada or the USA are a labyrinth of different types of fees that make them hard to break down, and even more difficult to compare in an apples-to-apples fashion. The lack of transparency with these brokerages is more than enough to make me run home to our preferred Canadian discount brokerage (see our full Questrade Review).

When I contacted Questrade to ask about their availability to non-residents, they responded: “Questrade will accept and review account applications from clients residing in all countries except: Democratic People’s Republic of Korea (North Korea), United States (with some restrictions), Syria, Cuba.” Note that this does not guarantee your application to open an account will be accepted – it merely means that Questrade will look at the documents you present and make a decision on your application.

There are varying reports all over the internet of Canadian expats being able to open non-registered accounts with Canadian discount brokerages, or being told that option was not available to them. The bottom line is that non-resident clients are a bit of a pain for Canadian financial institutions because they have to do a bunch of extra reporting on our behalf. Consequently, banks and brokerages may be reluctant to take on new expat clients.

That said, if you can catch on with a Canadian discount brokerage, I would do so in a heartbeat. Our Canadian banking system is highly regulated and I feel very confident in these companies over the long term. Their fees are very low and transparent, plus their platforms are very user-friendly.

If Questrade doesn’t work for you, my next choice for Canadian expats to check out would be Virtual Brokers. VB has been among the lowest-cost Canadian discount brokerage options for many years. They were also recently purchased by CI Direct Investments, so you can be sure their staff will be able to answer expat-related questions.

The main reason I’d recommend Questrade over Virtual Brokers is the reputation for customer service over the years. VB has had some real issues in this area, and the platform was built to appeal more to people who spend a fair amount of time trading stocks, as opposed to simple index investors. That said, they accept Canadian non-residents, and allow Canadians to access a cheap discount broker solution.

The American Alternative for Canadian Expats

One of the most popular online brokerage options for Canadian expats is International Brokers (IBKR). Ever since they came out with their new IBKR Lite and IBKR Pro streaming options last year, they have gotten even more attractive for international investors.

This value proposition is even more straightforward if you are living in the USA as a Canadian expat! The reason for this clarity is that if you are living and working in the USA, you’re going to have to deal with US taxes anyway, so there is no added complexity by using American brokerages. In fact, as a Canadian living in the USA, there is a strong argument to be made for using Interactive Brokers, and using US-based ETFs in order to invest – even ahead of Questrade.

As a non-resident Canadian, the new IBKR Lite platform will let you invest for close to $0. No trading fees, no annual account fees, no custodian fees, no “I’m calling it a different name” fees, and the world’s best foreign exchange rates. It’s an excellent overall deal.

There is a really ugly fly in the ointment however: US Federal Estate Taxes.

Now, you might be asking yourself: I’m not an American Citizen, nor am I an American resident, why would I have to worry about US taxes at all?

That’s a good question.

The answer is that the US reserves the right to tax all “U.S. Situs Assets” upon a person’s death – no matter what their citizenship is or where they reside for tax purposes. This is commonly referred to as the estate tax.

Here are the facts as I perceive them after reading several guides by Vanguard, PWC, BDO and Deloitte, as well as talking to several experienced international investors who use IBKR. Keep in mind, I am not an international tax expert.

For Canadian expats (non-residents) not located in the USA

- If you have more than $60,000 USD of assets “domiciled” in the USA at the time of your death, you have “U.S. Situs Assets” and need to file a tax return.

- ETFs or stocks that are domiciled in the USA are likely to be considered U.S. Situs Assets. This would include popular ETFs such as VT, VTI, or VXUS.

- You can still have exposure to US stocks, AND invest with IBKR, AND avoid the estate tax – but your ETFs have to be domiciled (or “based in”) another country such as Canada or Ireland. Ireland currently has a unique tax-friendly structure with the USA, so an ETF such as FTSE All-World UCITS ETF (VWRL) would fit the bill.

- It is not the discount brokerage account that is important, it’s the actual investments in the account. So if you have an IBKR account do not use it to invest directly in US-bonds, ETFs, stocks, or even have $60,000+ in cash sitting in it.

For Canadian Residents

- Due to various US federal tax credits and the Canadian-US tax treaty, any estate that has worldwide assets of less than $11.2 Million USD is exempt from the US federal estate tax.

- If you have a worldwide estate worth more than $11.2M, then only the amount that is considered U.S. Situs Assets would be taxed. That amount could be taxed at a rate of up to 40%.

- In 2018 some tax changes were brought in that boosted the then-$5.34M USD worldwide asset estate tax exempt level to $11.2M+, but this level can change at any time, and the new boost is set to roll back automatically to $5.34M level in 2025.

- PWC states that: Fortunately, Canada’s tax treaty with the United States provides some relief for Canadians. It allows you to reduce your estate tax liability by claiming a tax credit equal to the greater of:

$13,000

or

$4,425,800 x the value of your US assets ÷ value of your worldwide assets

For example, if your US stock portfolio accounts for 10% of the value of your worldwide assets, you will be entitled to a credit of $442,580 ($4,425,800 x 10%).

- I have used TaxTips.ca as an excellent resource for many years, and they have a US estate tax calculator for Canadian residents (note: if you’re an expat, you would not be a Canadian resident).

Should I Still Use International Brokers and US-Based ETFs Despite This Tax Stuff?

I first of all need to re-state the obvious fact that I am not a US Estate Tax expert. If you still have questions after reading those reports, it might be best for you to pay for an hour of a tax expert’s time.

In saying that, if you really want to cut costs and the Questrade/VB options won’t work for you, then I honestly think understanding these tax laws is worth it, in order to make use of the IBKR platform. The reason for this is that using the other international brokerages from around the world is a really confusing and expensive proposition – and IBKR’s new lite stream is so much cheaper than the other options available.

This US Tax Stuff Scares Me – What Are My Other Options?

Having never used a discount brokerage account located in another country (such as Singapore or Switzerland) before, the first things that jumped out to me when researching the best discount brokerage options outside of Canada and the USA were just how expensive they are and difficult it is to compare these companies. The sheer complexity of how they will take money out of your account makes me grind my teeth!

In Canada and the USA you generally have fees for each trade you make (some difference in calculation there, but pretty affordable no matter what) and then, perhaps, an annual fee. These annual fees and the old-school inactivity fees are slowly being eliminated thanks to competition from ultra-low cost brokerages.

In the rest of the world there are custodial fees, “spread fees” (some arbitrary amount between what someone sells a stock for and what someone else buys a stock for), inactivity fees, account fees, etc. Here’s my best shot at trying to compare the relevant facts on the leading contenders for your international brokerage dollars (if you decide that IBKR isn’t for you).

Provider | Monthly/Annual Account Fees | Per-Trade ETF Fees | Inactivity Fees | Account Minimum |

Swissquote | 60-200 CHF | - CHF 9 for Swiss-listed ETFs - 25 to 190USD for all other ETFs (depending on transaction value) | None | None |

DBS Vickers | SGD 2 per stock per month and capped at SGD 150 per quarter. Waive the custodian fee if there are at least 2 transactions per month or 6 transactions per quarter. Aims for 600SGD (585 CAD) per year through accounts fees or transaction fees. | $10-$30 CAD | See Account Fees | None |

Saxo | -Custody fee of 0.25 % annually, with a monthly minimum fee of EUR 5.00. -The minimum custody fee will always be applied to a default account. The custody fee will be calculated daily using the end of day values and charged on a monthly basis. Regional differences may apply. | $15-20 CAD | Inactivity fee of $100 USD where the client does not execute any trades on his/her account for a period of 6 consecutive months (180 days). | $10,000 USD |

Degiro | No custodial fee, but a unique fee called a connection fee if you trade outside of your “home exchange”. For the connection fees you will pay a maximum of 0.25% of your total portfolio value (with a maximum charge of €2.50) per annum for each exchange with the exception of Irish Stock Exchange. The connection fee for US options is €5.00 per exchange per calendar month. | Worldwide €2.00 + 0.03% | No | No |

A few notes:

- Saxo bank has 3 tiers (assets at less than $200,000, $200,000-$1M, and $1M+). The fees above are for the lowest tier, but they go down as you get more assets.

- Degiro has a neat little feature where you can buy one ETF for free per month. Click here for all of the details on Degiro’s offer. If you’re based in a European country and you don’t want to go with IBKR, this feature alone would cause me to favour Degiro.

Honestly, trying to compare these companies made my head hurt – and I think my recommendation would be to follow Andrew Hallam’s advice when it comes to choosing between these “other” broker options. The basic idea is that these online brokers tend to weave in and out of new fees frequently. It’s likely best to just pick one (assuming Canadian brokerages and IBKR are not to your tastes) and stick with it.

Bottom Line for Index Investing Options as an Expat

Which store you use to purchase your investment products is a big decision – and one that I researched pretty thoroughly. It basically boils down to:

1) If convenience and a little advice are valuable to you, then CI Direct Investing is unquestionably worthy of your consideration.

2) If you want to cut costs to the bone, a Canadian discount brokerage such as Questrade or Virtual Brokers should be near the top of your list.

3) If you are living and working in the USA, use an American discount brokerage like IBKR.

4) If you’re a Canadian expat who is not living in the USA, doesn’t want to use CI Direct, and doesn’t like the looks of Questrade or Virtual Brokers, then become familiar with US estate taxes (and Irish-domiciled ETFs) and consider the IBKR-Lite package.

5) There are other options if none of the first four options appeal to you.

Also – just to reiterate, having investment options in Canada WILL NOT make you a resident for tax purposes.

These investment accounts (whether they are through Questrade, Virtual Brokers, or CI Direct Investing) are a secondary residential tie. Take a look through our Canadian Expat Taxes article.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Thanks, very interesting article. An option I am using is IBKR given the ease of use and liw fees, but wondering about transferring securities in kind (ie not liquidating them) to a Canadian brokerage firm allowing accounts for Canadian non-residents when the value of investments reaches USD $60K. Do you have any information about the practicality and potential impacts of this?

It should not be difficult at all Benoit. Once you have a Canadian brokerage account open, I’d get in touch with the customer service and they’ll guide you through the process. In terms of tax implications though, that will be determined by the country that you’re living in.