Can You Invest Solely in ETFs?

As regular readers of MillionDollarJourney know, we are big fans of Exchange Traded Funds (ETFs) which are one of the fastest growing products in the market.

Were it not for the fact that financial firms and advisors have less incentives to sell ETFs than other investments such as mutual funds (that provide them with annual fees), the growth would probably be even more spectacular.

Having said that, ETFs don’t always have the best performance, and are sometimes outperformed significantly by other investment options. This also means that over years, the standard composition of most ETFs has shifted – with fixed income, commodities and FX now representing a much larger piece of the pie.

For most investors, ETFs represent the easiest and cheapest way to gain exposure in a variety of different sectors or asset classes. Investing in currencies or commodities was done by pension funds or hedge funds only a few years ago but it is now just as easy to do so for individual investors.

It might not be 100%, but a very large majority of individuals and professionals believe that portfolio diversification represents an important way to gain the same return but with lower risk. 20 years ago that meant buying bonds, private investments, etc. The major problem with that strategy is illiquid investments are often very expensive if you are not pouring a major amount of capital.

A prime example is looking at the prices of a bond when you are buying $50,000 worth. It is understandable of course that sellers will give better prices to buyers of millions of dollars as it is an easier trade for them. Take a few percentage points here and there and you will see just how much of an impact it can have over a life of savings and investing.

Are You Saving Enough for Retirement?

Answer your retirement savings questions with 4 Steps to a Worry-Free Retirement. The first online course for Canadian retirement.

Try Worry Free Retire with 100% Money Back Guarantee

Investing in ETFs – Pros and Cons

So, should you invest mostly (or only) in ETFs? Here are some of the common pros and cons to help you decide:

ETF Investing Advantages

- Most diversified

- More tax efficient (read our article on capital gains in Canada)

- Easiest and quickest way to invest

ETF Investing Disadvantges

- Costs can be high, depending on the broker you use

- Still has some investing risks

Should Canadians Invest Just in ETFs?

In many ways, ETFs provide a viable alternative as they offer the opportunity to get broad (corporate bonds) or specific (1-3 year treasuries) positions that will not cost you much in terms of commission. Furthermore, ETFs will get you much better pricing and potentially much improved returns over the long term.

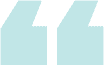

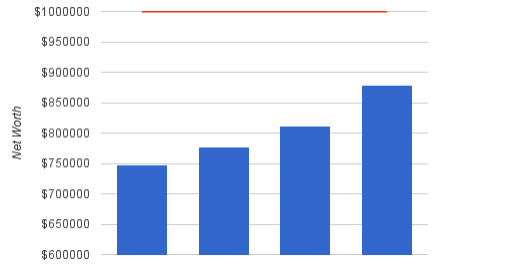

Because of that, I believe that in most cases, investors can keep over 90% of their portfolios in ETFs. Of course, the more money you have to manage, the greater the possibilities which at that point, ETFs might not represent as much of a bargain. If that’s the case, read our guide for high net worth investing to see how you can further balance your investments.

Other recommended articles:

- Best ETFs in Canada

- Best All-In-One ETFs

- Best Canadian Dividend ETFs

- Best Canadian Brokers

- How To Buy Stocks in Canada

- Qtrade Review (Buy and Sell ETFs for Free)

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

For most people, I think being 100% in ETFs will give you the best performance. It’ll also save you a ton of time to focus on other, more important things (career, family, health). Can’t recommend them enough!

Hello

i am a private Investor I invest my money in only good business proposal that will generate a good return to its share holders.I invest in personal,loans,business loans,and company loans.I am willing to

help if the person i am investing in has a good business proposal.I am looking forward to hear from you.free to contact me with this .. Tell: +447035975497 E-mail chief_raymondd@yahoo.com

Chief Raymond

CMR/Frank, there is no Canadian index fund with a lower MER than XIU at .17. The index mutual funds offered by the big banks and other providers range in the .65/.70 MERs, and more in many cases. The closest is TD e-Series Canadian Index, at .31, which is ideal for pre-authorized purchases since it can be bought in small amounts (which is the main advantage of the index mutual funds). When enough money is amassed to justify the trading expenses, it would be better to sell the index mutual fund and purchase the equivalent ETF. This is what I do with RBC Canadian Index/XIU. Very practical and it avoids the long-term drag of a higher MER on the index fund. If you’re going the passive investment route, why pay higher fees than absolutely necessary?

Frank:

The MER for the iShares ETF “XIU” is 0.17%. I’d be curious to see which index mutual funds are lower than that (maybe those exist, but I simply don’t know them).

–

I really like ETFs as investment vehicles. The diversification abilities and ease of purchase make them a viable option for investing.

Thanks for this very informative post. This is a nice blog and will be looking forward to read more from you.

I’m thinking of using a ETF spread portfolio within my TFSA (mainly to support my RRSP), is this a wise thing todo or am i better using something else?

I’m a huge fan of ETFs and the TD eFunds. That said there are two places where I would stay from index investing…

Once I get a new house and mortgage, I will begin a Smith Manoeuvre and buy Canadian stocks directly so that I can specifically go after strong, dividend paying companies without the drag of any fees.

The second is Canadian REITs. The MER is a little high on these, a better return could likely be achieved by buying the largest REITs in the index.

The most important think when selecting ETF’s is to understand the strategy behind the fund. There have been a lot of developments recently including currency harvest funds, as well as other “acive strategy” based ETF’s which capitalized on short-term trends.

Surely, you must know that ETFs charge annual management fees just like other mutual funds. You didn’t think that they were operated as charities did you? And it cannot surprise anybody that the huge growth in them over the past decade was fuelled by the fact that those fees are higher than equivalent open-end index mutual funds. Can it?

ETFs have several advantages over open-end mutual funds. They trade like stocks, so you can short them, buy them on margin, and day-trade them. And in some cases you can get small-scale access to exotic asset classes not available elsewhere.

But most of the time, most people are better off in an open-end no-load mutual fund that follows the same index as the ETF. The management fees will be lower and transactions in and out will be free.