Best Stock Trading Apps in Canada

As a DIY investor, it has been quite rewarding to watch Canada’s best stock trading apps transform over the last nineteen years. When I first kicked off Million Dollar Journey, the trading app options were limited and often quite clunky – nearly all were controlled by the big banks. If you wanted to buy or sell a stock on the go, you were stuck with high fees and a rudimentary user interface that felt like a chore.

In 2025 though, agile fintech startups continue to shake up the status quo and challenge banks to meet stock traders’ demands for lower fees and better functionality. You can see that shift in features like near-instant account openings, zero-commission ETF trades, and way better mobile apps.

Now, even though I still prefer my desktop for most of my in-depth DIY investing, which you’ll find reflected in my Best Online Brokers in Canada comparison, I believe it’s important to consider the mobile side of things, too. In some cases, you can’t beat the immediacy of your phone. These apps are no longer niche add-ons – they’re core parts of a well-rounded investing strategy.

Best Stock Investing Apps of 2025 Compared

$6.95 - $8.75

Free buying AND selling of 100+ ETFs

$4.95 - $9.95

Free BUY of ETFs (full prices for ETF sales)

Only TD ETFs are free via Easy Trade, otherwise $9.99 per trade

$9.99 (first 50 trades free)

$9.95

Free buying and selling of 80+ ETFs

No Available Promotion

$6.95

$6.95

No Available Promotion

Free

Free to Buy And Sell

My personal reviews come from the Android side of the fence (Samsung user here), but several of our MDJ team members are Apple loyalists as well. So we make sure to test each stock trading app on both major platforms so we can give you the most balanced, real-world feedback possible.

Below, we’ll break down each investing app’s strengths and weaknesses in areas such as user experience, research tools, and pricing. Hopefully, you’ll come away with a crystal-clear idea of which mobile platform will fit your investing style best!

Best Stock Trading App: Qtrade

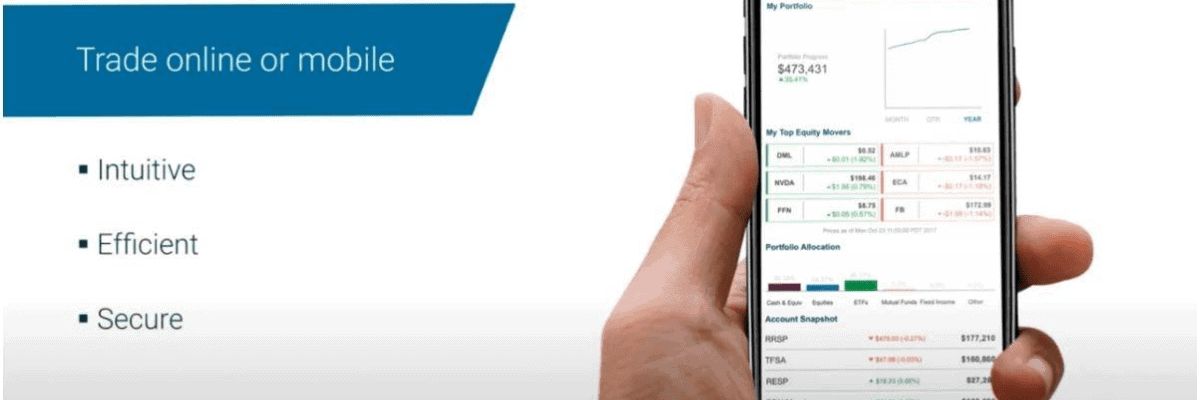

Qtrade’s app is fast and, easy to use and navigate, and Qtrade also has excellent customer support, making it perfect for beginners who need some extra assistance.

The mobile app gives users access to extensive information on major North American exchanges and real time quotes for individual stocks. It also uses the latest encryption technology for enhanced security features.

“Qtrade excels in every area – especially in customer service.”

Mark Brown, Investing and Rankings Editor for MoneySense

The team of writers at MDJ has made no secret of our love for QTrade, consistently ranking it as our top recommended DIY online broker in Canada over the years. Qtrade has consistently rewarded our faith and support by innovating impressive new details and re-investing in elite customer service, plus outstanding user experience.

Qtrade also consistently offers the best sign up promotions that we see when it comes to Canadian Trading Apps. Currently, if you go to Qtrade and open a TFSA, RRSP, RESP, FHDA or a non-registered account, they’re going to give you $150 cash. Then they’re going to give you more cash back depending on how much you start investing with.

- Minimum Balance: $0

- Trading Fees: $6.95 – $8.75 (Free to buy and sell ETFs)

- Account Options: TFSA, RRSP, LIRA, RESP, RRIF, FHSA, LIF, Margin, Non-registered

- Current Promotion: Up To $150 Cash Back see the full details here with our Qtrade Promo Code.

- Full Review: Qtrade Review

Lowest Fees Mobile Investing App: Questrade

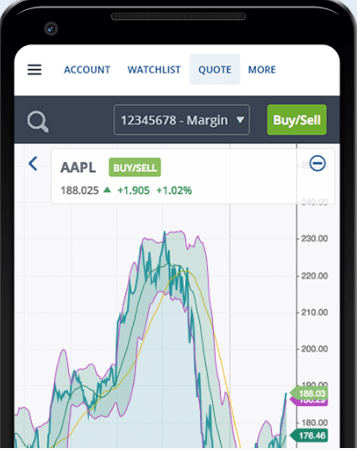

Questrade’s mobile app revamp in the fall of 2021 was a game changer for one of our top recommended DIY trading platforms.

Questmobile (their new and totally redesigned mobile app) features an intuitive interface, streamlined design, and biometric login. Questrade built the app with speed and ease of use in mind—and it shows!

Questrade’s stock trading app also features Learning Mode, which allows investors to access definitions, stock and ETF information, and real time snap quotes (a step up from the previous 15 minute wait).

Questrade recently lost out to Qtrade for our top recommended online trading platform. Their new online platform (redesigned to match the app) has caused more negative reactions than positive ones (it’s not our cup of tea either)—but as far as apps go we’ll be the first to admit that Questmobile is excellent.

- Minimum Balance: $0

- Trading Fees: $4.59-9.95 (ETFs free to buy)

- Account Options: TFSA, RRSP, RESP, LIRA, RIF, LIF, Non-registered, Corporate, Trust, Margin

- Current Promotion: $50 in free trades

- Full Review: Questrade Review

Best Big Bank Stock Trading App: TD Direct Invest

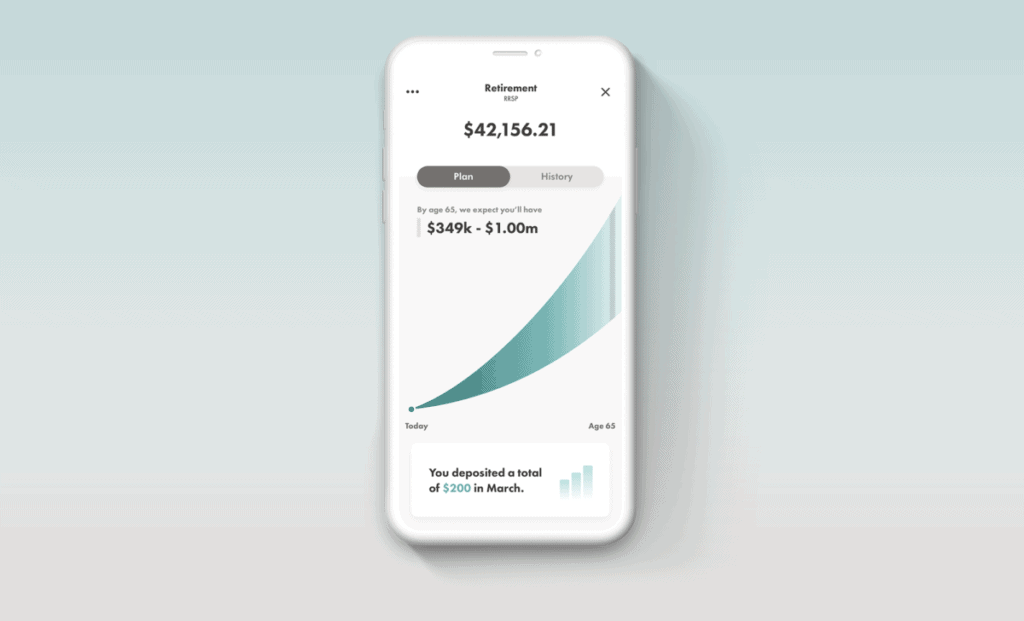

TD Direct Investing’s basic stock trading app (part of the main TD app) is nothing to write home about but they’ve been making interesting moves in 2022 with their TD Easy Trade app (formerly TD GoalAssist)

While TD’s usual stock trading rates are among the highest of all the DIY brokerages, at $9.99/trade, TD Easy Trade gives users 50 free stock trades a year before those fees kick in. They also offer unlimited TD ETF trades.

That means that if you’re just starting out and want to stick to a big bank stock trading platform, TD Easy Trade gives you the chance to get used to things without incurring any fees. There aren’t any account fees either, so it gives users a nice little grace period where they pay nothing at all.

There are a couple of catches, though:

- TD Easy Trade offers RESP, RRSP, and Non-registered accounts only

- TD Easy Trade users can only trade TD ETFs or stocks on Canadian and US markets

If you want to set up any other kinds of accounts or check out any other kinds of assets, this isn’t the app for you. But if you’re just getting started and don’t mind the comparative lack of options, TD Easy Trade is worth a look (did we mention the app is free?).

- Minimum Balance: $0

- Trading Fees: 50 free stock trades (then $9.99/trade), unlimited free TD ETF trades

- Account Options: RRSP, TFSA, Non-registered

- Current Promotion: $100 Cash Back

- Full Review: TD Direct Investing Review

Solid Selection of Free ETFs: BMO Investorline

BMO Investorline is our pick for best Canadian trading app if you want to stick to the major banks.

It’s not the cheapest option out there. However, many individuals are drawn to the convenience of keeping all of their financial and banking needs under one super-trustworthy roof.

The BMO Investorline mobile app emphasizes flexibility, simplicity, security, convenience, and comprehensive information. For our money, it delivers on these promises and gives the smooth user experience you’d expect from a world-leading brand.

Most reviews of the BMO Investorline app indicate that it is straightforward and easy to use – It’s a simple 5-second thumb tap to shift money from your BMO chequing account, to your discount brokerage account, and put it to work for you.

However, others note that it is not as detailed as the desktop platform. There are also several complaints from users experiencing technical difficulties on a semi-regular basis. And of course, the fly in the ointment is the higher trading fees relative to Qtrade or Questrade.

Minimum Balance: $0

Trading Fees: $9.95 (free to trade some ETFs)

Account Options: RRSP, TFSA, RESP, RRIF, LIF, LIRA, Non-registered, Corporate, Trust, Margin

Current Promotion: 50 free trades (up to $500 value)

Full Review: BMO Investorline Review

Lowest Fees for a Big Bank Stock Trading App: CIBC Investor’s Edge

Although CIBC Mobile Wealth, the mobile app for CIBC Investor’s Edge, started out clunky and unresponsive, it improved significantly after an update in late 2021.

CIBC Mobile Wealth connects users with a collection of tools that make it easy to monitor and understand your portfolio. They also have enhanced accessibility features for people who need them.

CIBC’s standout feature is relatively lower fees compared to other big bank platforms ($6.95/trade, or $5.95 for students, compared to $9.95 for most other big banks). They also have a special $4.95 price for active traders.

If you’re looking for rock bottom fees, this isn’t the app for you—but if you want to stick with a big bank and need more account or investment options than TD Easy Trade can give you, it’s worth a look. Just keep in mind that those trading fees do add up.

- Minimum Balance: $0

- Trading Fees: $6.95 ($5.95 for students)

- Account Options: TFSA, RRSP, LIRA, RESP, RIF, LIF, LIRA, Margin, Non-registered, Trust, Corporate

- Current Promotion: None

- Full Review: CIBC Investor’s Edge Review

Best Free Stock Trading App: Wealthsimple Trade

We can say with confidence that Wealthsimple Trade has the lowest fees of any stock trading app on this list. That’s because it offers commission-free trading for both stocks and ETFs. The pricing is, frankly, hard to beat.

That being said, when you get something for free you need to expect a trade-off. The Wealthsimple Trade app is clunky and confusing. It’s our least favourite mobile trading app by far.

However…if you’re looking for the cheapest platform, this would be it. And that’s why it’s on our list. If your priority is an easy-to-use, well-designed app, look elsewhere – but you WILL save on fees with Wealthsimple Trade. It’s just a trade-off you need to be willing to make.

Also, keep in mind that if they’re not getting their money from trading fees, they’re getting it from somewhere (usually from selling your data or trying to upsell you).

If you’re looking for a stock trading app that lets you play around with small sums without worrying about blowing your entire balance on fees that can cost up to $9.99 per trade, Wealthsimple Trade is a great choice.

Wealthsimple’s robo advisor, Wealthsimple Invest, is one of the best in Canada, and we appreciate everything Wealthsimple offers to Canadian investors. We just really don’t love the Wealthsimple Trade app or the platform in general.

- Minimum Balance: $0

- Trading Fees: $0

- Account Options: TFSA, RRSP, Non-registered personal

- Current Promotion: $50 Cash Bonus

- Full Review: Wealthsimple Trade Review

Newest Stock Trading App in Canada: National Bank Direct Brokerage (NBDB)

The National Bank stock trading app has long been touted as a project the company was pursuing, but we finally got to see the early final product at the end of 2022.

As we enter 2025 the NBDB mobile stock market app is still working the bugs out of its recently released Apple Store product, and hasn’t yet launched the Android version.

Initial reviews are that it is a fairly solid first effort. Some of the bugs and limitations mentioned by the first users include:

- No ability to transfer money from your bank account to brokerage account.

- No easy-to-see portfolio option such as those found on other leading Canadian broker apps.

- No mobile app alerts option.

- No current ability to track your portfolio using only the mobile app.

- Limitations in purchasing stocks priced below a dollar.

We’ll continue to update our National Bank Direct Brokerage review as more details become available.

Best Stock Trading App for Dedicated Royal Bank Customers: RBC Direct Investing

Look, if you were to press me, I’d have to admit that there is nothing game-changing about the RBC Direct Investing mobile experience. It does what it’s supposed to, has a solid user interface, and is generally quite sound.

Perhaps one feature that is unique to the RBC trading app is their practice accounts. Only a few Canadian brokerages have practice accounts, so if that is something you’re interested in, then it’s available and works smoothly to get your investing feet wet.

Other than the practice account, the only real reason I think you go with the RBC Direct Investing mobile app is simply because it is the most convenient way to keep all of your assets under one banking roof. There is nothing wrong with being willing to pay a little more in commissions and quarterly account fees for the sheer convenience of going with Canada’s largest bank.

Personally, I have several accounts with RBC due to corporate partnerships. That didn’t stop me from shopping around for the best deal on a mortgage, a GIC, or a stock trading platform.

- Minimum Balance: $0

- Trading Fees: $9.95

- Account Options: RRSP, TFSA, RESP, RRIF, LIF, LIRA, Non-registered, Corporate, Trust, Margin

- Current Promotion: None

- Full Review: RBC Direct Investing Review

The Stock Trading App for Scotiabank Customers

Scotiabank has had some problems keeping up to its big bank competitors over the last few years. This has not only impacted its stock price, but has resulted in a subpar performance for the Scotiabank iTrade app as well.

If you peruse the Google Play reviews for the iTrade stock trading app, you’ll see that after the big update in 2022, there has been a disproportionate amount of issues with bugs and overall user experience. In fact, so far in 2024, the app has only received one-star reviews (not exactly a glowing endorsement).

Basic functionality issues like not being able to complete the sign-up process from within the app are understandably an issue for younger clients used to the seamless usability of modern fintech companies. Interestingly, there has also been pushback from some of the older users (judging from how long ago they started using the iTrade app) in regards to how difficult the new app is to navigate. The prevailing wisdom appears to be, “the old app was boring, but at least you could find what you needed to and it didn’t have any bugs.”

While I personally don’t mind the desktop Scotia iTrade platform, the mobile app does leave something to be desired. When you combine that with the big bank fees, the only people I could really recommend it too would people who place a high premium on the convenience of keeping all of their banking assets under one roof – and have everything setup within the broader Scotiabank universe.

- Minimum Balance: $0

- Trading Fees: $10

- Account Options: RRSP, TFSA, RESP, RRIF, LIF, LIRA, Non-registered, Corporate, Trust, Margin

- Current Promotion: None

- Full Review: Scotia iTrade brokerage review

CI Direct Trading App

The CI Direct Trading App is still relatively new. Note that this is not the CI Direct Investing App – which is actually their old robo advisor product (the former Wealthbar). CI’s DIY trading app has a 2.2 rating in the Apple iStore, and 2.4 in the Google Play store.

You’ll notice more users voicing frustration, confusion, or straight-up disappointment with how the platform functions. Quite a few folks mention that they initially signed up expecting the same level of polish they’d seen with CI Direct’s other tools, only to discover an experience that often feels clunky.

A recurring theme among the negative reviews is usability. Many users comment that the interface looks outdated compared to other trading apps and that navigation can be unintuitive for someone wanting to place trades quickly or check on their positions. This has led to widespread calls for a more modern design and simpler onboarding process. People who frequently trade on the go say they’ve come across slow loading times or trouble finding certain basic functionalities, like up-to-date quotes, account balances, or transaction history.

There’s also been significant mention of technical bugs and errors. Some users report that the app crashes during key moments like submitting trades or attempting to update personal details. Others describe issues with logging in, occasional blank screens, and trouble linking external bank accounts.

On the plus side, a handful of reviewers share that, once they reached someone in the CI Direct Trading team, their questions were answered promptly, and solutions were provided in a straightforward manner. However, many others describe feeling stuck in a loop of automated emails and slower-than-expected response times, especially when it comes to resolving account-related or tech issues.

Ultimately, if you’re looking into the CI Direct Trading app, you may want to manage expectations: it doesn’t yet seem to live up to the bar set by other low-cost trading platforms on the Canadian market. If you’re a dedicated CI user and can handle some hiccups, it might be workable. But considering the relatively high costs involved with the CI platform (whether you use it on a desktop or a mobile device) it’s pretty clear there are better options out there.

- Minimum Balance: $1,000

- Trading Fees: $1.99 – $7.99

- Account Options: Non-registered accounts (both CAD and USD) , RRSP (both CAD and USD), TFSA, RESP, RRIF, LIF, LIRA

- Current Promotion: None

- Full Review: CI Direct Trading Review

Best Canadian Stock Trading App for iPhone and Android

Our top stock trading apps have largely positive online reviews. Questmobile has a 4 star rating on the Apple store and a decent 3.3 star rating on the Google Play (users seem universally pleased with the interface, but the biometrics gave them a little trouble back when the app launched).

My significant other and I use Qtrade, which is MDJ’s top pick for 2025. I’m a dedicated Google/Android user and she belongs to the “dark side” of the Apple universe. Neither of us have ever had any issues with the Qtrade app.

Generally speaking, I don’t see much difference when I look at any of the major stock trading apps on either my wife’s phone or my own. Obviously these companies understand just how important user experience is and are continuously working to refine their product.

Ten years ago it’s possible that you might have found bugs or glitches on the Android or Apple versions of specific trading apps, but those days are thankfully gone for the most part.

Nowadays the worst you’ll usually find is that the interface isn’t perfect, the load time is slow, or the customer service is iffy – and depending on your tolerance for those kinds of issues, you’ll be able to find an app that works for you.

It helps to check reviews on the app store of your choice before you make your decision—but it’s important to keep these two things in mind:

- Be sure to check the age of the review because these apps are continually being improved.

- Keep in mind that the quality of the app is only one factor you need to consider—if a trading platform has a killer app but doesn’t give you the accounts or investment options you want, then it’s not the right choice for you.

Best Canadian Stock Trading Apps for Beginners

As mentioned in our review section, we recommend Qtrade for beginner users. Their mobile app and trading platform have excellent consumer education resources and top-notch usability. Their simplicity and versatility makes them our top choice for best stock trading app for beginners.

Frankly, most of Canada’s big banks have user-friendly apps that will work for. RBC, TD, CIBC and Scotiabank have all created discount brokerage apps that most Canadians would find fairly intuitive after a little reading on how to buy stocks in Canada. What separates BMO from that group is the combination of a wide range of account options and free ETF trading.

Of course, Qtrade still gets my personal top vote due to its edge in consumer education and cool portfolio analysis tools that provide beginner traders with some unique investment insights. If you’re just learning how to buy stocks in Canada, it can help you get everything sorted out.

The other place where Qtrade really shines when it comes to beginner investors is in its customer service (where it has consistently ranked as the best in Canada for years). Customer service is never more important than when you’re just starting to get used to online investing and using the various platforms.

Best Free Stock Trading App For Canadians

It should be noted right off the bat that there is no such thing as a completely free stock trading app!

Sure, you might not pay anything upfront for a specific investing platform app, and you might even avoid per-trade fees. However, if you aren’t paying directly, then you can be sure that you’re paying in some other way.

Usually this payment comes from selling your data to the “big fish” further upstream and/or repeated ads that try to upsell you. If you’re familiar with the various controversies in regards to the “free” Robinhood stock trading app in the USA, then you know what I’m talking about.

Long story short, there’s a reason why we recommend tried-and-true discount brokerage apps such as Qtrade, Questrade, and BMO Investorline. They charge fees – but you get what you pay for.

If you want a very limited product that is free at the point of delivery, then your best bet for a free stock trading app in Canada is Wealthsimple Trade. You can also see other options on our free stocks trading page.

While this platform allows you to trade stocks for free, it has many usability issues (that it claims to be gradually fixing) and only offers a very limited number of account types to be opened. While Wealthsimple is our pick for the best free app, overall we believe that you’re better off avoiding free apps altogether and looking for quality instead

Best Stock Tracking Apps in Canada

I personally use my Qtrade account to do all of my tracking of apps (whether the are on my wishlist or already part of my portfolio).

That said, I know several people who prefer to use a designated stock tracking app alongside their actual stock trading app that their broker provides.

By far the two most popular Canadian stock tracking apps are Passiv and Wealthica.

Passiv is basically a no-brainer if you’re a Questrade user because you get it for free. The idea is that you’ll preset your risk tolerance, and the app will help you to rebalance your asset allocation when you’re no longer in the ideal zone for your designated risk level.

Wealthica currently works with the vast majority of stock trading apps and brokerage platforms in Canada, and is more of an overall personal finance app. It not only gives you a daily update of your portfolio, but also tracks your fees, net worth, and can even be used to create monthly budgets.

Canada’s Best Stock Trading Apps FAQ

Canada’s Stock Trading Apps: Final Thoughts

The short answer – YES!

Look, if you’ve read our comparison of Canada’s best online brokerages you’ll see why we think you should use this platform – regardless of the current promotion.

That said, getting paid to open a new account is some pretty great icing on an already-tasty cake!

The cool portfolio analyzer tools and useful investor information services are available to all users – and not just “elite traders” who make 200+ trades every month. When you combine the excellent user experience with best-in-class customer service, free ETF trades, and a flawless mobile app – then top it off with some free cash – it simply can’t be matched in the current broker landscape.

Regardless of if you’re just getting started with investing or if you have been dealing with another brokerage that you’re no longer satisfied with, there has never been a better time to choose the Qtrade stock investing app.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?