Best Mining Stocks in Canada For 2024

The Toronto Stock Exchange (TSX) or its cousin the Toronto Stock Venture Exchange (TSXV) is home to nearly half of the world’s public mining companies, so when we take a look at the best mining stocks in Canada, it’s all about separating the speculative junior mining companies from the steady profit generators.

As you might guess if you’ve read our best dividend stocks in Canada article, we’re pretty big fans of mature companies that have the free cash flow to reward patient investors. While Canada’s mining stocks are by their very nature going to be somewhat volatile (due to the market cycle of commodity prices) some companies have withstood the test of time a lot better than others.

The other really pertinent detail given our current market environment, is that Canadian mining stocks (along with Canadian energy dividend stocks) are often looked at as some of the best Canadian inflation stocks for hedging investments.

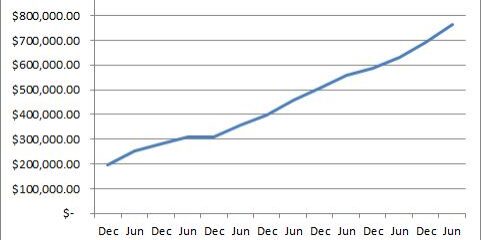

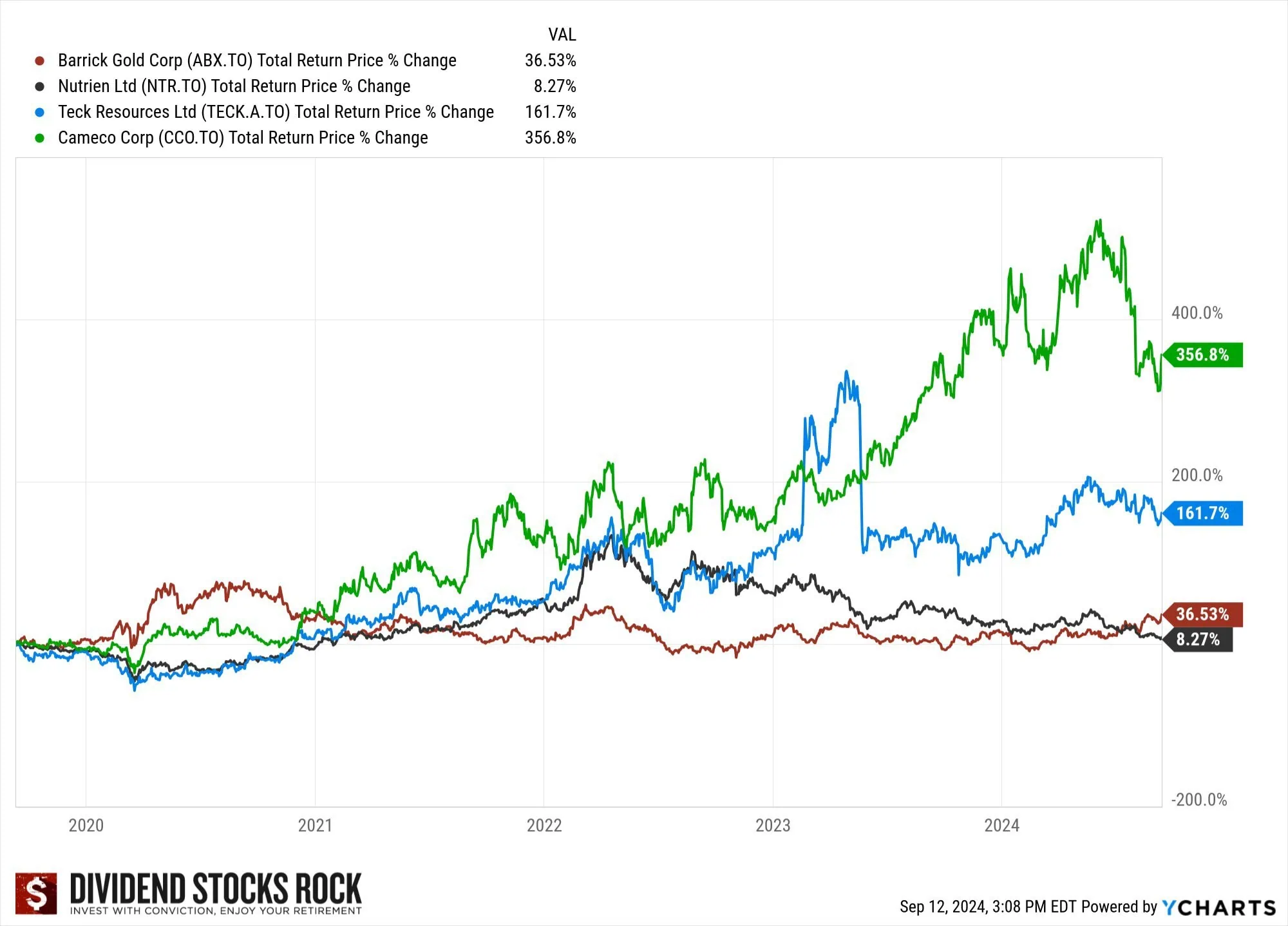

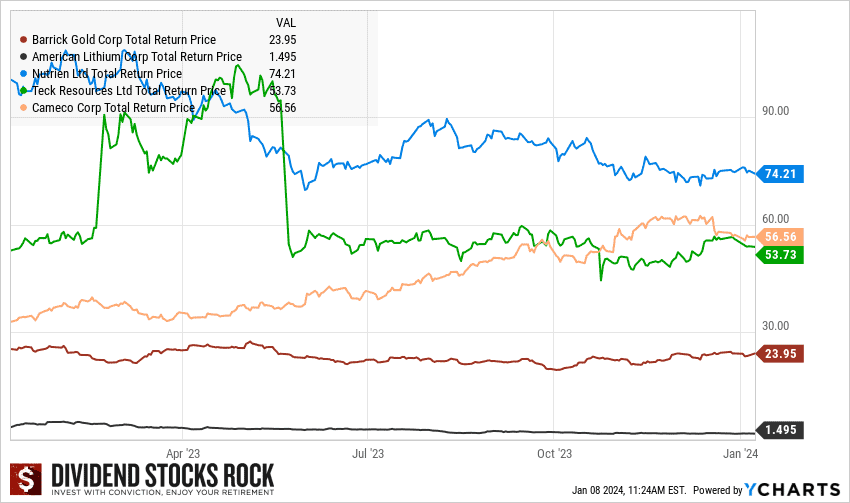

Canadian Mining Stocks Performance

This chart was created by Mike Heroux at Dividend Stocks Rock – our go-to source for Canadian investing information.

Top 5 Canadian Mining Stocks

Below you’ll find my top contenders for the Best Mining Stock in Canada title.

Name | Ticker | Price | Market Cap | P/E | Dividend Yield |

Cameco | CCO.TO | 29.55 | 11.774B | 197.00 | 0.41% |

Nutrien | NTR.TO | 117.91 | 63.545B | 7.47 | 2.09% |

Teck Resources | TECK-B.TO | 43.86 | 23.238B | 4.30 | 1.18% |

Barrick Gold | ABX.TO | 21.37 | 37.845B | 14.84 | 4.85% |

American Lithium | LI | 2.92 | 605.589M | N/A | N/A |

?????? (Hidden, click for access) | (Hidden, click for access) | ?.??% | ?.??% | ?.??% | ?.??% |

1) Cameco (CCO)

Sometimes making the case for a company is really simple. For me, deciding to buy Cameco shares comes down to this:

- The world needs all kinds of energy immediately.

- The world especially needs green energy as extreme weather patterns begin to increase the awareness of climate change.

- Nuclear energy is the most efficient clean energy we have – and it’s not even close.

- There are very few places around the world where the uranium needed for clean energy can be found. There are even fewer of those places where stable government and infrastructure are in place.

An investment in Cameco is simply a bet on Canadian uranium production. There is simply no better way to fight climate change than with nuclear energy, and with Canadian companies at the forefront of that engineering technology, Cameco is in a great spot.

Clearly a lot of investors agree with me, as the company is up massively over the last couple of years, and has even held up well in the recent market sell off.

Of course the downside to this is that Cameco isn’t exactly a well kept secret. With a stratospheric P/E ratio of 200+, investors are clearly expecting big long-term growth. Count me in.

2) Nutrien (NTR)

Nutrien is another Canadian mining stock where the investing thesis is pretty straightforward. In much the same way that the recent conflict in Ukraine has made nuclear energy (and Cameco shares) much more appealing, it has also driven the need for sources of fertilizer outside of the conflict zone. Saskatchewan-based potash giant Nutrien fits that bill nicely.

With soaring revenues, the stock currently has a P/E ratio of only 7.5 – despite being up nearly 30% YTD! The 2% dividend is a nice little insurance policy. Net income is up over 200% year-over-year and the company’s balance sheet is rock solid.

Even if the war were to stop tomorrow, the long-term prospects of a company whose product helps the world grow more food will always be pretty solid.

3) Teck Resources (TECK)

One of Canada’s most diversified mining stocks is Teck Resources. It’s a great way to get exposure to a wide variety of industrial metals including:

- Copper

- Zinc

- Steelmaking Quality Coal

- Bitumen (oil)

- Germanium

- Cadmium

- Silver

- Small amount of fertilizers and germanium

In addition to production diversification, it’s a great way to get geographical exposure as well, as Teck has properties all over Canada, Peru, Chile and the USA.

At the moment the stock is clearly pricing in a recession and a drop in demand for industrial metals since its P/E ratio is about 4.3! When you can get that kind of value (not to mention a nice little 1.15% dividend kicker) then you have to take a hard look at future prospects.

So far, Teck has been a great inflation fighter and is up nearly 7% year to date. It has a market cap approaching $24 million, and has a very clean balance sheet (giving it excellent options in terms of acquisitions vs rewarding shareholders with dividends or stock buybacks). Teck’s net income was up over 500% on a year over year basis last quarter.

4) Barrick Gold (ABX)

I’m not a huge fan of gold mining companies simply because I always find it hard to value a corporation when its value relies so heavily on a precious metal. With demand for that metal fluctuating so heavily, revenues and profits can be difficult to predict.

That said, you can tell from reading our how to invest in gold in Canada article, that I’d rather invest in Canada’s gold companies (like Barrick, Agnico Eagle, Kirkland, and Kinross) than I would in Gold ETFs or physical gold. At least with gold companies like Barrick you can say conclusively that if the price stays above $1,200 USD – then profits will accumulate.

As you might expect given gold’s lofty price levels the last few years, Barrick has made investors quite happy. Barrick is our pick out of the Canadian gold mining stocks because of its economies of scale, its substantial 2.4% dividend, and its commitment to paying down debt and keeping a relatively cautious balance sheet.

While the stock is down 2.44% year to date, that’s still pretty solid relative to the rest of world’s stock markets, and the company has had pretty solid success controlling costs in an inflationary environment.

If you think that Bitcoin is going to replace gold in the near future, then obviously a gold mining stock isn’t going to be where you put your cash. But if you think Bitcoin is about to replace gold… well, you probably quit reading Million Dollar Journey a long time ago!

5) American Lithium (LI)

Despite the American name, American Lithium is a Canadian mining stock as it is headquartered in Vancouver and listed on the Canadian Venture Exchange (CVE).

Full disclosure: This is a fairly volatile and somewhat risky stock pick. American Lithium is a small cap mining stock ($600 million) and doesn’t pay a dividend. That said, I had to toss it on our best mining stocks in Canada list simply for its growth potential.

Much like the single-producer case that can be made for Nutrien and Cameco, American Lithium is simply a bet on where the world is going. Don’t take my word for it – here’s what Elon Musk had to say recently:

“You can’t lose, it’s a license to print money.”

With electric vehicles truly taking off over the next few years and batter demand in all industries going off the charts, the companies in the lithium supply chain are assured the demand will be there. The race for efficiency is on, and even if American Lithium were to lose that race to bigger rivals, it would make a very attractive takeover target.

The company is expanding rapidly throughout Latin American and its incredibly 5-year growth rate illustrates just how lucrative the stock could be. Of course, as with any small-cap mining stock, there are major risks as well. The company lost money last quarter and is essentially a bet on the price of lithium at this point. That said, for a speculative stock it’s nice to see a company that carries such little debt.

Best Canadian Mining Stock ETFs

While you can check out the our picks for best Canadian gold miner ETFs in the aforementioned article, if you’re looking for broader exposure to “base metals” (non-precious metals) then our top two picks available on the Toronto Stock Exchange (TSX) would be the iShares S&P/TSX Global Base Metals Index ETF (XBM) and BMO Equal Weight Global Base Metals Hedged to CAD Index ETF (ZMT).

Both of these ETFs are very geographically diversified. As you might guess, the BMO offering is a little more Canada-heavy with substantial exposure to Teck and Hudbay. Whereas the iShares mining ETF is much heavier on international mining companies like Alcoa, BHP, and Rio Tinto.

Both options will give your instant diversification to mining stocks inside and outside of Canada.

Final Word on Canadian Mining Stocks

Mining stocks are notoriously volatile relative to the rather smooth sailing sectors. If you want dependable dividend growth I’d check our articles on Investing in Canadian Telco Dividend Stocks and/or Investing in Canadian Bank Stocks.

If on the other hand you’re looking for stocks to fight inflation with, then mining stocks make a lot more sense. While Canada has a real lack of stocks in sectors like healthcare and pharmaceuticals, and our tech stocks are limited as well, we are blessed with a pretty solid variety of publicly traded mining stocks.

At the end of the stock mining stocks tend to move in tandem with the prices for the underlying product that they are taking out of the ground (duh). Consequently, learning a bit more about the commodity markets behind lithium, potash, uranium, precious metals, and base metals makes a lot of sense if you’re going to build your own watchlist of best Canadian mining stocks.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?