Financial Freedom Update – December 2016 (+15.5%)

Welcome to the Million Dollar Journey December 2016 Financial Freedom Update – the final update for the year. For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. All within the next 5 years. If you would like to follow my newest financial journey, you can get my updates sent directly to your email, via twitter (where I have been more active lately) and/or you can sign up for the monthly Million Dollar Journey Newsletter.

In my first few Financial Freedom updates, I talked about what life has been like since becoming a millionaire, why I like passive income, and our family financial goals going forward.

Here is a summary:

Financial Goals

Our current annual recurring expenses are in the $50-$52k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money became tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family could live comfortably without relying on full time salaries. I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and capitalistic pursuits.

Financial Numbers

So now that I’ve declared my financial goal, where do I stand now? Here are the annual dividends generated by account (Sept 2016):

September 2016 Dividend Income Update

Account Dividends/year Yield on Cost SM Portfolio $5,380 4.11% TFSA 1 $1,776 4.64% TFSA 2 $2,190 4.88% Non-Registered $240 1.57% Corporate Portfolio $6,600 3.74% RRSP 1 $3,900 3.54% RRSP 2 $375 1.82%

- Total Invested: $536,667

- Total Yield on Cost: 3.81%

- Total Dividends: $20,461/year (+9.7%)

Since September, there has been little change to our financial situation. In fact, it has been more go-with-the-flow type mentality. In the last update, I announced that my spouse took the leap and resigned from her professional healthcare career. Since she was on a leave of absence for the previous two years anyways, there was very little financial pain with the move.

There has actually been some financial benefit to leaving her position, namely her pensions. One pension has already been transferred to a LIRA with Questrade, but there is a larger pension to deal with in the new year. We have the option to leave the pension in place until the age of 60, but we are leaning towards taking the inflated commuted value (due to the low interest rate environment) lump sum and investing it ourselves.

We still live off my government salary, and we still pay close attention to our spending (here is a breakdown of our expenses in 2015). Since we do not have any large debt servicing requirements (mortgage, rent, car payments etc), my salary allows us to live comfortably, but far from extravagantly.

Now, lets talk a bit about my passive income strategy – generating dividend income. As dividends are the main focus of my passive income pursuit, there is a large dependence on the market. While there are merits to this investment strategy, there are also substantial risks – particularly dividend cuts. The goal of the strategy is to pick strong companies with a long track record of dividend increases.

My leveraged Smith Manoeuvre dividend income has increased since the last update due to adding to my Fortis (FTS), Canadian Utilities (CU), Emera (EMA), and Bell Canada (BCE) positions. However, this was slightly offset by selling off my long term Mullen Group (MTL), and half of my TECK holdings.

I’m in the process of cleaning up my portfolios, and if a position has cut its dividend, then I will likely cut it from the portfolio. The overall goal is to hold onto equities that will pay increasing dividends going forward in a predictable manner. If we do eventually live on dividends, I would prefer to hold onto companies with a solid dividend track record.

As it has been the trend for this year, I’ve continued to deploy corporate cash into dividend stocks which has resulted in the biggest contributor to dividend income growth ($6,600 annually -> $8,300 annually). Since this is currently my largest investment account, it also adds the most weight to my overall holdings.

In my overall portfolio, here are my current top 10 largest holdings (besides cash):

- Bank of Nova Scotia (BNS);

- TransCanada Corp (TRP);

- Fortis (FTS);

- iShares Core MSCI All Country World ex Canada Index ETF (XAW) (mostly from my wife’s RRSP);

- Emera (EMA);

- Bell Canada (BCE);

- Royal Bank of Canada (RY);

- Canadian Utilities (CU);

- Manulife (MFC); and.

- Enbridge (ENB).

December 2016 Dividend Income Update

| Account | Dividends/year | Yield on Cost |

| SM Portfolio | $5,600 | 4.04% |

| TFSA 1 | $1,956 | 4.53% |

| TFSA 2 | $2,250 | 4.67% |

| Non-Registered | $210 | 1.37% |

| Corporate Portfolio | $8,300 | 3.54% |

| RRSP 1 | $4,800 | 3.55% |

| RRSP 2 | $520 | 2.68% |

- Total Invested: $631,439

- Total Yield on Cost: 3.74%

- Total Dividends: $23,636/year (+15.5%)

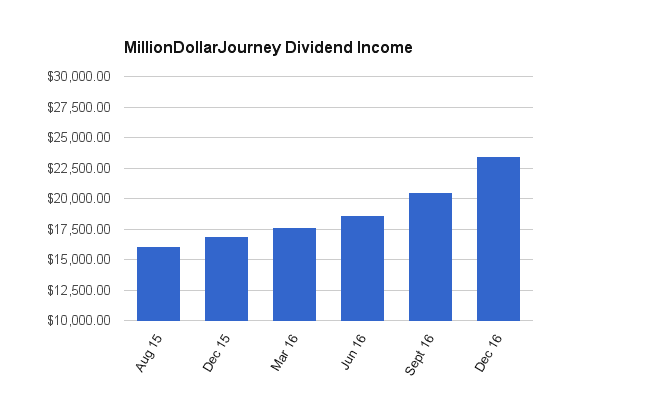

I’m happy to see progress throughout the year in building our dividend portfolio. I had a mental goal of hitting $25,000 in dividends this year and it looks like it may be close providing that I continue buying this month. In the December 2015 update, we had $16,873/year in dividends. With $23,636 this December, it represents a 40% increase year/year. Perhaps $35,000/year is a reasonable stretch goal for December 2017 which would represent a 48% year/year increase.

We still have a long way to go, but for the most part we are moving in the right direction. There is cash available to deploy in most of our accounts. That’s in addition to the dividends that are constantly being churned out which gets deposited as cash and reinvested again (the power of compounding). You may notice that RRSP 2 is also fairly minimal in dividends, that’s because that is my wife’s RRSP, and it is 100% indexed.

If you are also interested in the dividend growth strategy, here are the Canadian dividend stocks with the longest history of dividend increases. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

Let me know if you have any questions by leaving a comment.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

First of all I want to thank you for sharing valuable info. I have few questions and I’m just starting out with investing:

1. What is your asset allocation mix for your portfolio?

2. By doing both index investing and dividend investing, is it not too risky to put all money in one basket – stocks?

Thanks.

Hi Prem, for my accounts, I’m about 95% equities. For my spouse, probably closer to 85% equities. Having a high percentage in equities is a variable of how much volatility you can handle without giving up on your strategy. If market volatility causes you to lose sleep at night, it might be time to increase bond %. This article may help:

https://milliondollarjourney.com/a-simple-low-cost-diversified-etf-portfolio.htm

Are you holding any bonds, bond funds or Bond ETFs? If so what percentage of your total portfolio do they make up? What bond funds/ETFs do you hold?

Bonds index funds are about 25% of my childrens RESP. Perhaps 5% of my spouses RRSP, and maybe 1% of my own portfolio.

XAW in an RRSP? I thought that was not tax efficient due to withholding taxes.

Hi Ian, that is a very good point. Upon looking into this further XAW’s MER accounting for withholding tax is 0.56% (http://www.canadianportfoliomanagerblog.com/war-of-the-worlds-ex-canada/). Not terrible, but definitely could be improved by holding US ETFs instead (but would need an efficient way of converting CAD to USD).

If holding CAD ETFs:

VUN Mer: 0.16% + 0.246% (withholding tax) = 0.406% [alternatively use: XUU Mer: 0.10% + 0.313 (withholding tax) = 0.413%]

XEF Mer: 0.22% + 0.26% (withholding tax) = 0.48%

Holding equal parts will equal 0.455% MER vs 0.56% (for XAW) – not a huge difference.

If holding US ETFS:

VTI Mer: 0.05% (but need do FX cad to USD which can be pricey depending on strategy)

VXUS Mer: 0.13%

I’m in my peak earning years and am in a high tax bracket so I’ve been told to max out my RRSP, but at 52 it is getting close to 400k. I’m concerned that I may squirrel away too much there and then take a big tax hit when I’m forced to withdraw it. In a cash account you are only taxed on half of the capital gain, but in an RRSP you are taxed on the full amount when you take it out. I’m wondering if I’m better investing the money in a cash account, even though I won’t get the tax break from an RRSP contribution. Thoughts?

Hi Timmy, if I was in the top tax bracket, I would personally max out RRSPs for the deduction, then use the tax refund to max out TFSAs (or debt if you have any).

Hi! We seem to be on quite parallel paths, except that I’m in Australia. I’m also working towards the goal of financial independence through passive dividend income, and am about to breach the $1 million mark as you faced.

I’m really intrigued and inspired by your blog, and am also blogging my own journey down under.

I just had a question, what’s you’re thinking on yield on cost? An alternative would be yield on current valuation, have you selected your approach for specific reasons?

The FI Explorer

Hi FT,

I am a newcomer and I’ve learn a lot by going through your posts. Maybe I haven’t read enough of your posts (I’ll definitely do that in the coming months), but I don’t see you mention anything about real estate. I just want to know what’s your view on real estate passive incomes? Do you only consider dividend as passive income and not real estate?

Happy holiday.

Cheers,

– Leo

“With $23,636 this December, it represents a 40% increase year/year. ”

That’s deploying lots of capital….and some dividend increases. Very well done FT and continued success in 2017. I’ll be watching and reading as always. :)

Happy Holidays to you and family,

Mark

How is the Index account doing vs the Dividend Growth Stock Accounts? In total return?

Great question. I usually run the return numbers after year end, but I just ran them to give you some numbers. Via Excel XIRR, XIC (Canadian index) has returned about 23.23%. This is assuming that it closes Dec 31 with yesterdays price, and assuming that it pays a 0.16 dividend later this month. The XIRR of my Smith Manoeuvre dividend portfolio (with same assumptions as XIC) is about 25.5%. Note that the recovery of oil this year has made a big impact on the portfolio as there are a number of smaller cap oil plays in there. On the reverse, the SM portfolio did worse than the index in 2015 due to the same reason – diving oil impacted small caps the most.

had to edit my XIRR numbers, I believe I was using it incorrectly before

Hi FT,

What is the purpose of the “Corporate account”? Why not just put the money in non-registered account? Is there any tax benefit to it?

Thanks!

Hi JZ, the corporate account are the accounts relating to my online business. I basically save the cash generated from the online biz, and currently investing the proceeds in dividend stocks. Technically, it is a non-registered account held within my corporation. I wouldn’t say there is any tax benefit to investing in a corp, but there’s tax benefit to keeping earnings within the corp vs withdrawing it all which would impact personal income tax.

A 40% increase in dividends from last year is amazing! How much additional money did you add to the portfolio over the year in order to make that happen?

Thanks for stopping by. It’s difficult to quantify how much we added to the portfolio as we typically save money, then add to portfolios as I see fit. This year, we maxed out our TFSA’s ($11k), maxed out our RESP ($5k – not counted here), converted my bank managed account to self-directed ($20k), transferred Mrs. FT’s pension to a LIRA (~$20k), and the rest was just cash that was sitting around within the a brokerage account.