Wealthsimple Tax Review (Formerly SimpleTax)

Wealthsimple Tax Review

-

Quality of Outcome

-

Ease of Use

-

Cost

-

Customer Service

Wealthsimmple Tax Review Summary:

Looking for a simple way to file your taxes? Wealthsimple Tax (formerly SimpleTax) could be just the thing you need. Filing taxes isn’t fun by any means, but this convenient and easy to use tax filing tool makes it as painless as possible.

With its web or mobile-based platform, Wealthsimple Tax allows you to file taxes with ease. Whether or not you have income to claim, filing taxes is the best way to make sure you receive the benefits you are entitled to as a Canadian citizen.

If you haven’t used Wealthsimple’s tax services in the past, don’t stress. All you will need is a few key numbers from your previous return and you’ll be able to get started. Each year you continue to use the service will be a piece of cake, as all previous information will be saved year to year.

In our Wealthsimple Tax review, we will be covering everything you need to know about the service, including how it works, how much it will cost, and who it might be best for.

Pros

- Easy to use on every device

- Great price and value for money

- Finish your taxes in 30 minutes or less!

Cons

- No real time support, only email

- Not ideal for complicated tax setups

What is Wealthsimple Tax?

If you enjoy doing taxes, you are likely an accountant, or you are one of a very select group who enjoys anything to do with numbers. Most of us would put completing our tax returns on the same level as going to the dentist.

What may be worse than doing your taxes is paying someone to do your taxes. In Canada, you can expect to pay $150 or more for an accountant to complete your taxes for you.

Luckily, the majority of Canadians have a simple tax situation and can forgo the expense of hiring an accountant.

Enter Wealthsimple Tax.

You may remember that Canadian Robo Advisor Wealthsimple purchased SimpleTax in the Fall of 2019.

Wealthsimple is a DIY investment platform that offers a range of investment products, and over the last several years has added products such as cash cards and tax preparation. Here’s our full Wealthsimple review if you would like to learn more.

Both teams are working on future integration measures that will link your investing and saving information with your Wealthsimple Tax account. As of now, crypto trading transactions are automatically added to your return once you like your crypto wallet to the platform. We’ll keep an eye out for new developments and will report on any progress.

With the additions of Wealthsimple Trade and the high interest savings accounts, and Wealthsimple Tax, Wealthsimple is certainly rounding out their offerings.

How Wealthsimple Tax Works

If you can fill out a form, you can file your own taxes.

Wealthsimple Tax asks the questions, you provide the answers. Before you know it, you’ve completed your taxes. Most users complete their taxes within 30 minutes.

It might sound too good to be true, but that’s the entire experience and it’s certainly not intimidating.

It can start on autopilot – Wealthsimple Tax can auto-fill part of your return with information directly from the CRA. It’s easy, accurate, and feels like magic. Before you can use auto-fill you will need an online CRA account in addition to the Wealthsimple Tax account.

Here’s a list of CRA information that’s available with auto-fill.

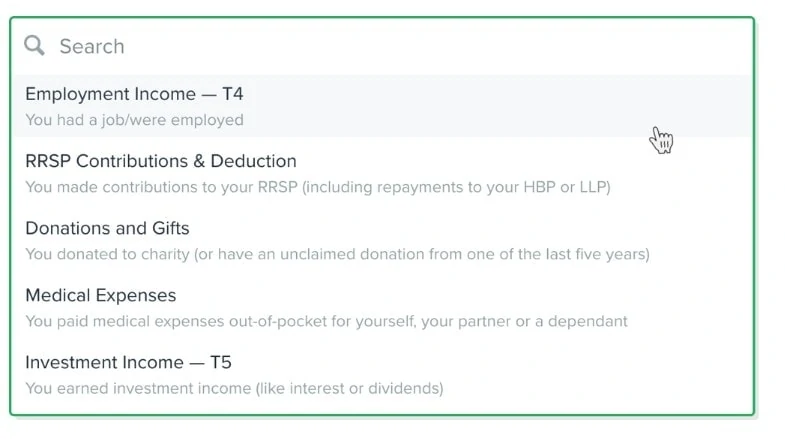

Wealthsimple Tax will also prompt you to enter what income you received, and whether or not you received any other income such as rental income. It will help you cross your T’s and check those boxes.

Looking for Opportunities to Optimize Your Taxes

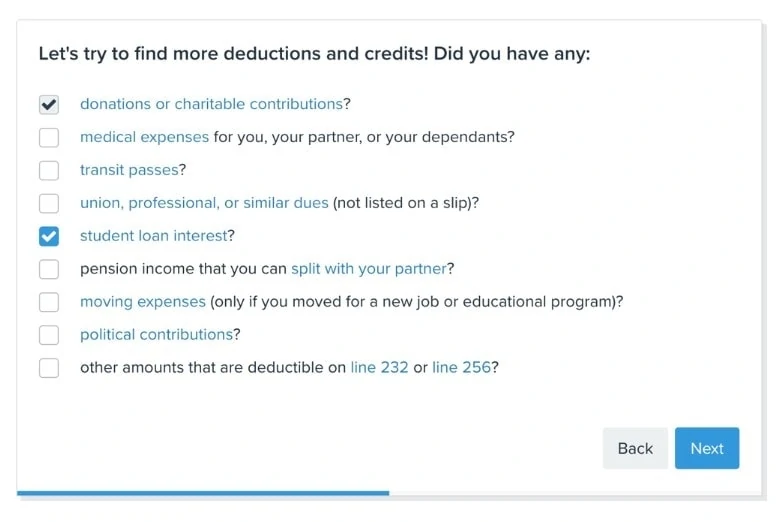

After you’ve auto-filled and entered all of your relevant information, you can click check and optimize. Wealthsimple Tax will look for mistakes and opportunities. For example, it may suggest that you defer some of your RRSP contribution to the next year.

That’s a good idea, if you think you’ll have higher income the following year or years. By doing so, you’ll eventually get a greater percentage of earnings back in your pocket, and you’ll pay less tax.

If you are married or have a common law partner, the optimizer will suggest the proper use of credits and even income splitting. Yes, Wealthsimple Tax works for joint filing.

When you hit Refund Optimizer it runs thousands of calculations to look for opportunities. After running the numbers, you’ll get a set of recommendations.

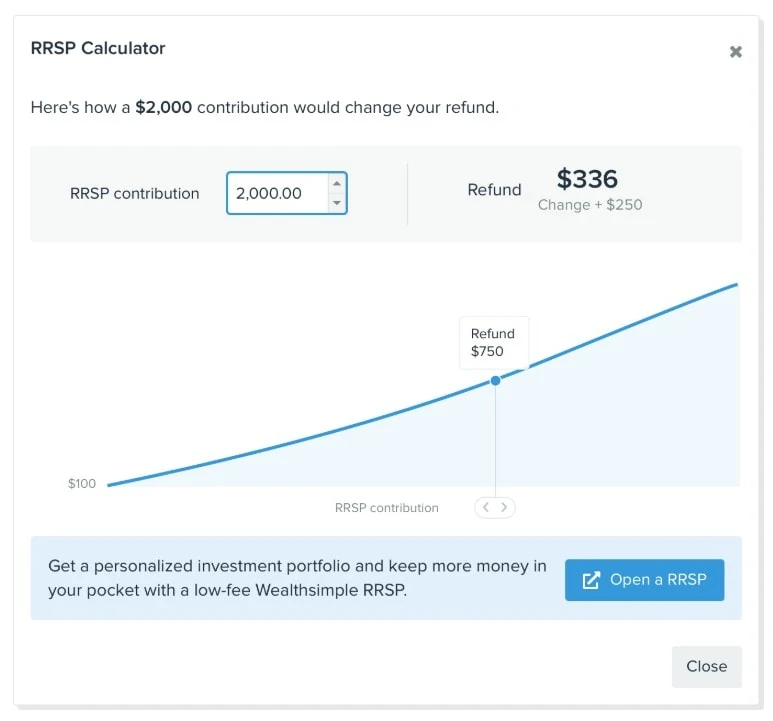

Wealthsimple Tax also includes an RRSP calculator, so that you can see the effect of greater contributions:

That may help you in your calculations and in the quest for optimal balance between RRSP or TFSA accounts.

The optimizing tools are what separates Wealthsimple Tax from some of the free online tax filing services out there. It’s adding a layer of simple but important tax advice or strategy.

When you hit submit, it will connect with CRA and submit your return via NETFILE. You don’t need to send your slips, receipts, or supporting documentation to the CRA when you submit your return through NETFILE. You are, however, required to keep these documents on file for six years in case the CRA asks to see them.

If you’ve set up direct deposit with CRA, you could see your return land in your account within several days.

I recommend saving a PDF version of your tax filing. Also, with Wealthsimple Tax, you can also make adjustments to returns that you’ve already filed.

How Much Does Wealthsimple Tax Cost?

That’s up to you. There is no requirement to pay. But most users do choose to pay. That suggests that the service delivers on the promise.

Does Wealthsimple Tax Integrate other Wealthsimple Services?

Besides automatically importing any crypto trading transactions (through Wealthsimple Crypto) you may have had during the tax year, Wealthsimple Tax automatically imports all investment data from your Wealthsimple Trade account.

As you know, all income, including earnings on investments, such as dividend income, must be claimed on your tax returns.

If you are a Wealthsimple customer, Wealthsimple Tax will automatically complete the following on your tax return:

- T4RSP-Statement of RRSP Income

- T3-Statement of Trust Income Allocations and Designations

- T5-Statement of Investment Income

- T5008-Statement of Securities Transactions

- RRSP Receipts-Contribution Receipts

If you have other income, such as pension, annuity, trust, or other, it can still be added to your Wealthsimple Tax form, but will need to be done manually.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?