Real Life Example of Norbert’s Gambit and Foreign Exchange w/ BMO Investorline

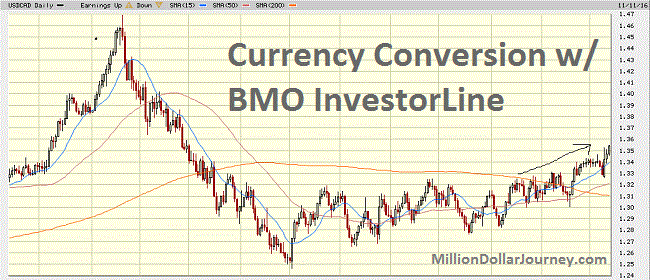

The continued strength of U.S Dollars (USD) has made it more expensive for Canadians to purchase US goods. As of this week, $1 CAD = 0.73856 USD, in other words, it would cost you $1.354 CAD to purchase $1 USD.

This is a great situation if you already own USD, and perhaps now is a good time to take advantage of the foreign exchange rate (FX). If you own some USD, converting to CAD to get a 35% premium is enticing – at least it is to me.

Financial institutions love it when you convert currency as they get a piece of the pie. If you go to a teller or even call your discount brokerage and ask to purchase a different currency, they will typically charge you up to 2.5% (possibly more) for the conversion. So if you are converting $10k, that’s an extra $250 plus the FX spot rate at the time.

What is Norbert’s Gambit?

As someone who is always looking for a better deal, I’ve found a number of ways to save money on FX fees. If you have USD sitting around to convert, one way is to use your discount broker to perform Norbert’s Gambit. I’ve written an article on Norbert’s efficient currency exchange gambit:

How do we use Norbert’s Gambit to cost effectively exchange USD to CAD with minimal risk? This strategy will allow FX at around spot rate and involves;

- Buying and selling highly liquid “inter-listed” stocks (ie. stocks listed on both the TSX and NYSE); and,

- Using a discount brokerage account that automatically journals (ie. moves) shares between CAD and USD (RBC Direct Investing or BMO InvestorLine). The automatic journaling of shares is an important feature as it reduces the risk and amount of FX movement while you are holding the shares.

The high level explanation is that you buy/sell stocks listed on both the Canadian and US exchanges. The pricing of the stock on each exchange should be close to equivalent after applying the exchange rate.

So as an example, using a non-registered account, you could buy a stock like TD on the US exchange (using US dollars), then immediately sell TD on the Canadian exchange (in Canadian dollars). With most discount brokerages, there is an intermediate step of phoning the broker (or live chatting with Questrade) to journal the shares from US to CAD. However, some brokers like BMO and RBC automatically journal the shares for you.

Real Life Norbert’s Gambit Trade with BMO InvestorLine

Having an account with BMO InvestorLine and USD cash on hand, I had the opportunity to play around with this strategy.

Step by step, this is what I did:

- Purchased 220 shares of TD:US (using USD currency – this is important!) @ $45.32 USD. The bid/ask was close to the real time quote on both TD:US and TD:CA. So when I purchased, I just simply placed a limit order on the ask price. The tight bid/ask spread and high volume (liquidity) was why I chose TD.

- Immediately sold 220 shares of TD:CA (using CAD currency) @ $60.53 CAD. Again the bid/ask spread was acceptable, so I placed a limit sell order at the bid price. In this case, speed of transaction is more important than waiting for a better price.

- At this point, my work was done and the foreign exchange was just about completed. My CAD is locked-in and cash already in my account. The last step was to wait for journaling to happen to clean up my account. My portfolio at this point showed 220 shares of TD:US and -220 shares of TD:CA (essentially a short position). It turns out that it takes a little less than a week for the shares to clear out of the account. Note that registered accounts will generally not allow for short positions. In this case, you would need to wait for the discount broker to journal the shares over before you can sell and lock in your FX rate. I’ve read that some investors phone the broker prior to making the trade and get the trading desk to journal and sell the shares while on the phone.

Result:

- This trade occurred on October 26, 2016 which had a noon spot rate of 1.336. My trade resulted in $60.53/$45.32 = 1.3356. In more concrete terms, converting $10k USD using spot rate would have been $13,360 CAD, using the results from my trade after the bid/ask spread: $13,356 CAD. This represents a $4 difference or 0.04%. Counting two trading commissions (buy and sell) of $20 and the $4 bid ask premium, the total cost of my trade was $24. This sure beats the typical $150-$250 that banks would charge you. I repeated this trade on November 7, 2016 and obtained the same 0.04% result (actually 0.037%).

- As you can see, the greater the amount that you exchange, the greater the dollar value in savings.

Final Thoughts

There you have it, I made two Norbert Gambit trades with BMO InvestorLine which had very good results. Both trades resulted in an implied fee of 0.04% plus buy/sell commissions. Compare that with a 1.5% – 2.5% fee charged by the brokerage to do the FX for you. While the portfolio showed both the long and short positions initially, the trades automatically settled (removed from portfolio) within a week.

You can also read about my experience trading DLR/DLR.U for currency conversion using Questrade.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

i just placed my first norbert gambit online through a non registered account converting 10,000 cad to usd. How do I figure out if they charge me interest rate of 21% at the end of the month?

I used the horizons etf and called the trader to sell it asap after placing an order on the cad side. he said that they charge $48 because I am making the trade through a live person rather than online? since I already purchased it and I was afraid of currency fluctuations, I just said yes. right now, i checked the holding positions and it just says..

HORIZONS U S DLR CURRENCY ETF – DLR 774 12.9155 C 12.90 C

– DLR.U -774 0.00 U 9.93 C

am at a total lost of how to see the total cost of the transaction including all fees.

If you purchased $10k worth of DLR with Questrades, there should be no interest providing that you used cash to purchase DLR. You purchased 774 units at $12.92 and sold for 9.93. This resulted in getting $7685.82 USD for an exchange rate of 0.7685.

Just a heads up that there is no need to rush to journal DLR to DLR.U. Once you purchase DLR you have locked in your foreign exchange rate. What I do is purchase DLR, then do online chat to journal DLR to DLR.U. Once it’s moved over to USD, I sell DLR.U at market. That will cost $4.95 online instead of the $48 phone trade.

I have requirements for US funds on a regular basis as I own property in the US and we spend considerable amounts of time down there. I opened an Interactive Brokers account which is linked to my RBC Canadian and RBC US accounts which are both in Canada. I can trade any amount on the IB site at the spot rate which is the lowest rate you can get. The fee I pay for 10K is less than $2.00. The account which I use for dirrivative trading costs me about $25.00 per month in fees. I make that up quite easily through option trading. I mainly use the account to sell premium on stock options.

I am a big believer in “small advantages” but…. to me, this sounds like a lot of messing around to make a few bucks when, if you want to convert currency, go to someone like Knightsbridge. I buy a lot of US goods on Amazon and I have a US bank credit card as well which I have to pay every month. I also bought my car in the US in 2008… saving $10,300) as I live close to the US border. Anyway, converting currency through a currency exchange to me, seems a lot simpler and efficient. I guess however, it depends on what your time is worth.

I am with Questrade. when I purchased shares of DLR.to and journaled to DLR.U.TO at my registered accounts, I was told that I cannot sell DLR.U.TO until the journal was settled. Is it true? I understood from the posts here that once I purchased DLR.TO, I locked the USD rat. So there should not have a big risk when converting CAD to USD. But how about converting USD to CAD? Except the DLR option. Is there any better option to convert USD to CAD at registered accounts? Does anyone know which bank has the USD account that can directly link with Questrade so I can transfer USD cash out? Thank you so much.

Hi! how did it work out for you? i want to try norbert gambit using my questrade account but not sure how it works over there.

Catherine, this is my post on trading DLR with Questrade. https://milliondollarjourney.com/low-cost-currency-conversion-with-dlrdlr-u-etf.htm

Thank you. I did read through both post. Just wondering if there is a waiting period before purchasing us stocks. I used NG on my non registered account at bmo yesterday and the person on the phone who transferred me to a trader told me I get charged an additional $48 for having someone sell the horizon us shares for me.

So i wanted to try it with questrade but the statement above … ”

I was told that I cannot sell DLR.U.TO until the journal was settled.”

Confuses me.

Catherine, you are right, when you buy DLR with Questrade you need to wait for the position to settle (3 business days) before you can journal the position over to the US side. You don’t need to worry about the delay though because once you buy DLR, you have locked in your FX rate. You can wait a year (or whatever time period) and you’ll still have the FX rate that you locked in when you purchased DLR.

Once DLR is journaled to the US side (now DLR.U), you can sell DLR.U in your US account and you’ll have US dollars.

thanks so much. i guess it is taking me some time to wrap my head around the concept. basically the us etf is stable and the canadian version is the one that fluctuates but once I have bought shares already I have locked in my fx rate and can sell anytime without much of a difference.

Hey guys great post. I’m actually looking to perform this on Monday. Quick question. If you use DLR/DLR.U to convert CDN to UD with BMO in an RRSP account, can you still do it automatically or do you need to call in and ask them to journal it? Justin Bender and Dan wrote a white paper a few years ago saying you still need to call in but it was from 2013 so I’m wondering if things changed?

I would also like to know the answer to this question. I’m reading in multiple places online that you don’t need to call, but I just came back from BMO branch 20 minutes ago where I asked this specific question and they said you still need to call and handed me a printed out copy of the PWL white paper you referred to… One of the reasons I’m considering moving everything from TD to BMO is because of the online NG capability…

I’d give BMO investorline a call. My understanding is that even in RRSP the journaling is automatic. However, I can’t say for sure as I have a non-reg account and can confirm that it’s automatic.

Hoping someone can chime in with real experience, as I don’t even particularly trust the information from BMO personnel. Seeing how many people have received varying information on the same subjects are various banks, I’d like to hear from someone who can confirm or deny first hand.

How about USD contributions to RRSP? I can’t do this at TD. I.e. transfer USD from my USD taxable cash account to my USD RRSP account. At TD you first have to transfer into CAD RRSP then exchange or NG into USD RRSP. There is no way to use the collecting dividends in my USD cash account to fund my USD RRSP without converting twice… which is a bit ridiculous.

Can this be done at BMO? Other banks? Thanks again.

@Ben: I’ve done NG with both DLR and RY at Investorline in both cash accounts and RRSPs. Every time they “flatten” the account (journaling) one day late and charge me one day’s interest (but the interest doesn’t appear until the end of the month). I set a reminder for the end of the month and then send a message asking for the interest to be reversed. So far they’ve reversed the interest every time.

I’ve never transferred U.S. dollars directly into an Investorline account, but I’d be shocked if they couldn’t do it. I tend not to take no for an answer if the answer makes no sense. I’ve transferred many different types of assets into my Investorline accounts.

I have TDW account and I have used Norbert’s Gambit in TFSA and RRSP in the past. I’ve never done so in taxable account. Are there any tax implications for buying and selling interlisted shares in a taxable account? Would you do Norbert’s Gambit on heavy or light volume days in a taxable account? With the new Webbroker at TD, anyone have any issues with doing the gambit? Is the process still the same?

Hi DL, here are the tax implications of FX: https://milliondollarjourney.com/capital-gains-tax-when-converting-currency.htm

Tax implications if using DLR: http://canadiancouchpotato.com/2015/02/26/taxable-consequences-of-norberts-gambit/

I like higher volume days so that the bid/ask spread is thinner.

I did the Norbert using regular stocks until I found DLR. Now I use DLR exclusively for it with RBC. DLR and DLR.U trade on the same exchange whereas the other US/CAD stocks trade across two separate exchanges and it may be part of the reason why an interest rate may occur. I have not seen it with the DLR transactions and have done large amounts.

I have used CanadianForex for my money transfers and found their exchange rates to be very competitive compared to big banks. There is a $15 flat fee for any transfer (Free for over $10,000). They perform a wire transfer so depending on your bank you may end up paying up to $25.

One question I have is how do you get US$ into your BMO account if you don’t already have any? Are you limited to wire transfer? For me, my company stock purchase plan is through e-trade in the states and when I sell, I get a US dollar cheque mailed to me. I normally deposit to a US dollar account I have with TD then transfer to tangerine US$ savings and convert there. I’m with Virtual Brokers, which doesn’t allow Norbert’s gambit, so curious about this.

For me, I have a USD chequing account with BMO that’s connected to the discount brokerage. I’m not certain if you can connect external bank accounts to their discount broker. A quick phone call should do the trick!

I do this periodically with DLR/DLR.U with National Bank Direct Brokerage. They now have $0 commissions on ETF’s traded on Canadian exchanges, so there are no commissions on either side of the trade. The only annoyance is that you have to call to get the shares journaled between accounts.

Thanks for the comment. I’m liking how National Bank removed commissions on ETFs. I wonder if any of the big boys will follow suit.