Transferring Money Back From Qatar and Using Currency Exchange as an Expat

The average expat looking to transfer money from Qatar to Canada, the UK, the Euro zone, New Zealand, or Australia is likely paying a voluntary tax of $1,000 every single year!

When I first started researching the options in Qatar for exchanging currency online or in-person, I was stunned by how few people even understood that there was more than one place to exchange their Qatari Riyals for their home currency. It seems that many of the folks from the Asian subcontinent who are living in Qatar understand the value of shopping for the best money transfer exchange rate, but very very few Westerners had any idea what I was talking about.

After talking to many teachers from around the world, it appears that most expats in Qatar (or anywhere really) simply login to their online banking or walk into one of the very large consumer banks in Doha, and are told that they can send money home either for free or for roughly $5 (15 QR).

What they fail to mention is the most important thing:

The markup that they are charging you on your currency exchange rate!

The Best Money Transfer Option from Qatar to Canada, the UK, Australia & the Rest

Compare Online Currency Exchange to Qatar’s Banks

When exchanging currency and then transferring it internationally, there are two key ways that money comes out of your pocket:

1) The upfront fee (aka “transaction fee” or “transfer fee”)

2) The markup on the currency exchange (or “currency rate spread”)

The upfront fee is easy to understand – which is why most companies choose to make it as low as possible!

The currency exchange markup is much sneakier.

Basically, when it comes to exchanging currency, there is the “spot rate” or “mid-market rate” – and then there is the amount that you will actually pay in order to “buy” the amount of currency on the other side of the transaction.

For example, let’s say my wife and I get paid in Qatari Riyals, and we want to send 18,000 Qatari Riyals of that income home, so that we can invest it on the Toronto Stock Exchange using our Questrade discount brokerage account (and Canadian Dollars).

If I were new to transferring money internationally I might Google “Qatari Riyals to Canadian Dollars” and Google would then pull up some search results that either revealed their own currency exchange calculator or the well-known currency site xe.com. Currency exchange rates change daily, but let’s say that today Xe and Google tell me that the current mid-market rate is 2.68. That should mean that when I transfer my 18,000 Qatari Riyals into Canadian Dollars, Google tells me I get $6,713 CAD to send to Canada.

The issue is that when I log into my bank account or visit the helpful customer service folks at my big bank, and hand them my 18,000 Riyals, I’m only likely to get somewhere in the neighborhood of $6,521 Canadian Dollars back. The difference is small enough that I might wonder if I made a math mistake with my earlier Google calculations – and hey, I’m getting a tax-free salary right, so who really cares right?

You should care! If you’re an expat couple like my wife and I are, you’re paying a lot of voluntary tax!

If you’ve seen our Canadian Expat Taxes and Budget post then you know that my wife and I are hoping to invest a significant amount of surplus salary while we are living overseas. It’s quite conceivable that if an expat couple are both earning a solid income tax-free salary – and staying away from “expatitis spending” – then they could be sending upwards of $100,000 CAD home to invest each year.

If you’re exchanging 268,000 Qatari Riyals for Canadian Dollars at an average mid-market rate of 2.68 over the course of a year, the difference between what a bank will charge you, and what our preferred online money transfer partner will charge you would be:

Over $2,200!

Here’s the quick math behind that number…

Our exclusive deal with Moneycorp (see our handy tool below) means that they are going to charge us roughly 2.70 Qatari Riyals for every Canadian Dollar (making about .75% profit on the deal) if the mid-market rate was 2.68.

The absolute lowest Canadian Dollar exchange rate I could find at a major Qatari Bank charged a 3% profit margin on the currency exchange – meaning that in our example, it would take 2.76 Qatari Riyals to buy a Canadian Dollar.

The difference between those two exchange rates is over $2,200 for our hypothetical expat couple’s annual savings!

Plus – the bank is going to charge you a transaction fee, whereas the only place that Moneycorp makes a profit is on that .75% currency exchange mark up.

If our hypothetical expat couple were to work overseas for 10 years, invest that $2,200 currency exchange savings each year that they were abroad (at an 8% investment return), and then retire 15 years after coming home – they’d be looking at well over $100,000 in “found money” sitting in their investment portfolio as a direct result of avoiding this voluntary tax!

Transferring Money from Qatar with Western Union

If you’ve only sent money within your home country before, you might be thinking what in the world is this guy talking about – I’ll just Interac eTransfer or PayPal the cash back to my home account.

The problem is that you can’t send money internationally like that – or at least not in most places. PayPal has teamed up with an online currency exchange transfer company, but they don’t yet deal in Qatari Riyals, and rarely have the best exchange rate even in the markets where they do compete.

The other popular option, due to their distinctive logo, longtime marketing advantage, and their sheer physical presence in so many countries, is Western Union. Transferring money with Western Union is quite convenient and it is available in Qatar.

Western Union actually charges more to route your money online than they do to complete a transaction in person (a major negative for me) and the key with their business model lies in their fine print:

“Western Union also makes money from currency exchange. When choosing a money transmitter, carefully compare both transfer fees and exchange rates. Fees, foreign exchange rates and taxes may vary by brand, channel, and location based on a number of factors. Fees and rates subject to change without notice.”

It turns out that Western Union charges you roughly 5% to transfer your money! Western Union can get money transferred quickly to parts of the world where speedy financial service is tough to come by.

If you’re in Qatar though, there are much better options available.

If our hypothetical $100,000-per-year couple used Western Union instead of our preferred online money transfer company, they’d be paying a “voluntary tax” of $4,200 each year!

Transferring Money with Currency Exchange Houses in Doha, Qatar

The Wild Wild West of currency exchange and transfers around the world are currency exchange houses. You’ll often see these businesses on high-traffic corners in cities, and Doha is no exception. It is very hard to show the specific math for one of these companies, because the rates that you actually have access to when you walk in and approach the window are not listed anywhere.

When it comes to the most common of currencies (such as the US Dollar and the Euro) these exchange houses might be able to beat your big bank’s rate. Occasionally, they might even be competitive with our preferred Moneycorp option. For lesser-traded currencies, the percentages generally don’t work in their favour, and they probably average close to that 3% figure we used at the best large-bank rate we could find. Exchange houses can also charge considerably more than that, it really just depends which exchange house you walk into on what day.

Again, it appears from all of my research that many of these companies in Doha are understandably focused on the very large expat community from the Asian subcontinent, as opposed to the relatively few expats from Canada, the UK, Australia, New Zealand, and the Eurozone. While there are some online options routed through these exchange houses for remitting money to countries like India, there are few online currency exchange or money transfer options run through these exchange houses for Western expats.

Between the much higher transaction costs wiring money from the exchange house to your Qatari Bank, then from the Qatari Bank to your Canadian bank, plus the non-online lack-of-convenience factor, I just can’t see the argument in favour of this foreign exchange transfer option.

Can I Use My IB Brokerage Account to Exchange Qatari Riyals for Dollars or Pounds?

If you’re a seasoned discount brokerage DIY investor you might have an account with Interactive Brokers that you often use to get the best foreign currency exchange rates out of any option on the market.

While this works great for exchanging the Canadian Dollar with the US Dollar or the Euro, the Qatari Riyal is not one of the two-dozen currencies that IB trades in.

It’s also worth noting that navigating the currency exchange platform on IB isn’t everyone’s cup of tea, and can be a bit confusing your first time through.

Why Do We Recommend Moneycorp for Qatar Money Transfers?

Moneycorp Group has been exchanging currencies and providing foreign exchange services around the world (now in 190 countries) for over 40 years, trading over $30 Billion Dollars annually. There are very very few companies in the online money transfer space that can lay claim to that long of a track record.

I also like that the company is headquartered in London and has worked with small retail customers like myself, as well as large commercial companies.

Moneycorp’s only business is exchanging one type of currency for another type of currency as cheaply and efficiently as possible! That mission statement shows you the key difference between online money transfer companies and big banks around the world.

When it comes to Moneycorp rates and fees, they charge a markup on their exchange rate. The more common the currency, the lower that “currency spread” or markup is. As an “exotic currency” that is not often traded on world markets, the Qatari Riyal doesn’t have a lot of demand, so Moneycorp charges a .75% fee when you use our exclusive promotional offer below. That’s roughly a quarter of what your bank will charge you!

They also never charge a transaction fee. The currency exchange markup is the only way they make a profit.

Moneycorp is rated quite highly on all of the usual review sites by 40 years’ worth of customers. Because they are one of the world’s largest foreign exchange businesses, they have excellent, user-friendly smartphone and website platforms.

In fact, Moneycorp is so well trusted around the world that media agencies such as CNN and The Guardian newspaper use it to provide their own money transfer services! When I clicked on the ad below, it took me right to the Moneycorp website.

The setup process took a half hour or so – but was comparatively much less of a pain than visiting an exchange house every time you want to send money home. Plus – it’s a one-time effort investment get the online process setup – as opposed to heading down to the exchange house monthly.

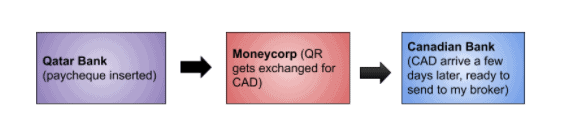

How I Exchange My Qatari Riyals to Canadian Dollars & Send to My Discount Brokerage

Here’s the basic path that my money takes on its way from my paycheque to my online discount brokerage account. I simply make sure that I keep enough Qatari Riyals in my account to pay for my local expenses, and the rest gets transferred back for investing purposes. I already had my Canadian bank connected to my discount brokerage before I left, so that cut down on the initial paperwork needed to create this chain.

Once the paycheque-to-investment chain is created, it only takes five minutes a month or so to process each new payment. It’s really just “rinse and repeat”.

Transferwise In UAE vs Moneycorp In Qatar

Before really researching the online money transfer market in preparation for going abroad, about the only brand name that I was familiar with was TransferWise.

TransferWise is a direct competitor to Moneycorp, and if I were changing Canadian Dollars for American Dollars (or vice versa) I’d probably choose them.

The problem is that they do not yet operate in Qatar. TransferWise does not currently allow you to exchange your Qatari Riyals for Canadian Dollars, American Dollars, British Pounds, Euros, or Australian Dollars.

Now – they have recently announced that they are opening up shop in the neighboring UAE with plans to expand into the rest of the GCC. Given the state of the world these days though, I’m not sure we should be holding our breath waiting for TransferWise to come in and compete with Moneycorp.

Will I Be Taxed When I Send Money Home from Qatar?

No! Well… probably not.

There is no additional taxation of any kind that you trigger by sending normal-people money home to Canada, and as far as I know, it’s the same in the USA, UK, Australia, New Zealand, and the Euro Zone.

Your tax status will likely depend on how your home country views your residency status. Taxes are based on residency – not on citizenship. (Unless of course you are an American – then it’s a whole different ball game, and you’ll be filing taxes at home when you live abroad anyway.)

Check out this in-depth piece on non resident status taxes in Canada for a detailed look at how the CRA will view your residency status. The general principles are similar in most countries around the world.

If you’re used to dealing exclusively with big banks in Canada or your home country, I can understand the initial reluctance that you might have to using a new online-based financial service. It will take a few minutes to get set up and to understand how the logistics work as far as sending-receiving money… but your retirement investment account told me that you have about 100,000 reasons to learn how to use our online currency exchange option, as opposed to the other money transfer options in Qatar.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Thanks for the useful information. I have just set up an account with Moneycorp in the hope of transferring my QAR to the UK after a failed attempt with another money transfer company based in the UK. Reason being, my bank in Qatar wouldn’t allow an international money transfer from a personal account to a company account. I’m trying to find out if this is the bank’s policy or if it’s Qataris law as it seems a bit odd. I am hoping it will be fine using Moneycorp.