PolicyMe Review (Term & Critical Illness Insurance Online)

Solid term life insurance and critical illness insurance are essential parts of disaster-proofing your life.

This PolicyMe review shows how to get the best deal when it comes to comparing these types of insurance policies in Canada.

While PolicyMe began as an insurance comparison and brokerage site, its core mission to focus people on getting the most important types of insurance – at the lowest price possible – hasn’t changed.

In a Canadian context, PolicyMe has teamed up with a longtime Canadian insurance stalwart in order to offer excellent term insurance and critical illness options. Personally, I’m a big fan of saving money with term life insurance and investing the savings vs the complicated insurance plans put out there under the permanent life insurance umbrella. So it should come to no surprise that I’m a big fan of what PolicyMe brings to the table.

My Personal PolicyMe Review Highlights

- PolicyMe was created for a generation who grew up researching and buying things online. It’s an excellent platform that offers a superb user experience for buying insurance online.

- PolicyMe specializes in simple term life insurance, as well as critical illness insurance. I like that the company isn’t incentivized to sell you other types of complicated insurance that you probably don’t need.

- There are a wide variety of 10- to 30-year life insurance policies to choose from.

- Policy prices are generally 10-20% cheaper than comparable insurance policies from large Canadian insurance companies.

- PolicyMe is no longer an online insurance comparison site (or “insurance broker”) it is in fact an insurance provider.

- The sign-up process is as easy as possible, with many reviewers confirming that it only takes about 20 minutes and does not include medical exams.

- There is a 30-day money-back guarantee whenever you purchase an insurance policy from PolicyMe.

What Is PolicyMe Anyway?

PolicyMe is a Canadian company that was started in 2018. Originally, it was a comparison company that featured life insurance quotes from around Canada, and operated under a brokerage business model.

Then, in 2021, the company pivoted to directly selling its own term life insurance and critical illness insurance products.

PolicyMe has helped over 10,000 Canadians get insurance coverage, and has an exceptional 4.9-star rating on Google Reviews. Their policies are backed up by corporate giant Securian Canada, and they also have Assuris coverage (re: they’re really safe to use, even if you haven’t seen the name in too many places).

PolicyMe obviously has online usability built deep into its DNA given that the company started out as an online brokerage. That has continued, and one look at their site will tell you all you need to know about how easy they are to use.

On the insurance side of things, it’s important to note that PolicyMe teamed up with Canadian Premier Life Insurance Company in 2021 in order to directly offer insurance products to Canadians. Canadian Premier is one of the most highly-rated insurance carriers in Canada and has been around for 60+ years. Canadian Premier is a subsidiary of Securian Financial (a company that had over USD $8 billion revenues in 2023).

While PolicyMe is clearly trying to capitalize on a no-frill online business model in order to provide a low-cost alternative to expensive “in person” companies, they do provide access to advisors who can hop on a phone call or answer an email in a timely fashion. I think there is great value in the efficiency + help if you need it (without any sales pressure) model of doing business!

Is PolicyMe Legit in Canada and Is It Safe?

Whenever you’re dealing with super important adult stuff like life insurance, it’s important to know if it is safe to use a specific company.

From everything that I can see, PolicyMe is safe for Canadians to use and is a fully legitimate insurance option to compare vs other leading term life and critical illness insurance providers.

Securian Financial (the parent company of Canadian Premier Life Insurance Company – PolicyMe’s partner) is a federally-regulated insurance provider in Canada. That means that it is a member of the Assuris organization. All Canadian insurance providers must belong to Assuris, and it protects Canadian life insurance policy payouts in even the absolutely worst-case scenarios.

While critics of PolicyMe (mostly insurance salespeople trying to sell more expensive products) used to point out that PolicyMe term life insurance coverage was not “renewable” – that sales talking point has now been addressed.

As of 2023, PolicyMe insurance customers can renew their coverage until age 85 without having to reapply or undergo any medical exams. This addressed the one major concern that I had around the company’s term life insurance offerings.

PolicyMe Insurance Offerings

What type of insurance does PolicyMe offer, anyway?

The company specializes in two main areas of insurance that every Canadian should think about:

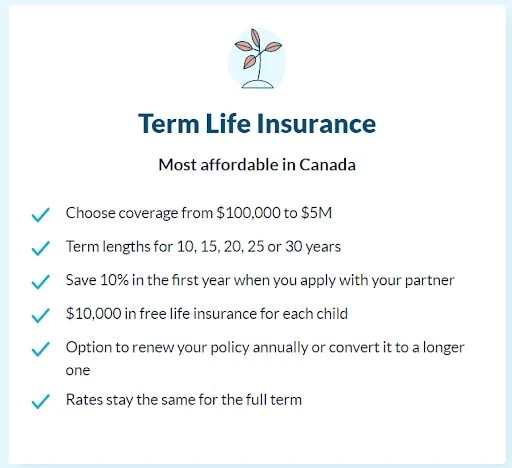

1) Term Life Insurance.

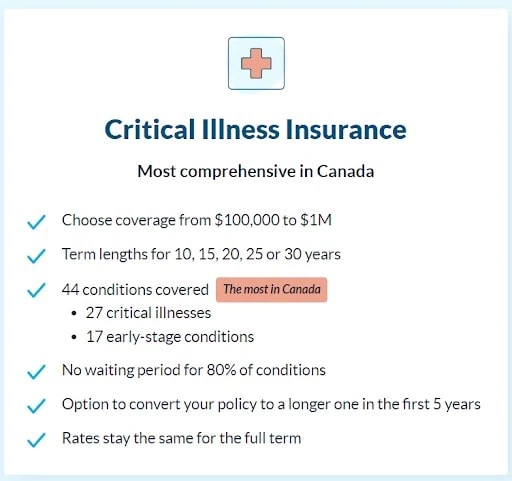

2) Critical Illness Insurance.

For those not familiar, term life insurance is the most basic type of life insurance that you can purchase. It’s the simple idea that you pay a certain amount of premiums each month in exchange for a lump sum of money if you pass away. It’s absolutely essential for young families and anyone else who has people depending on their income to meet life’s daily needs.

Term life insurance has very little in common with permanent life insurance and all the salesy bells and whistles that those types of insurance bring to the table. Check out our article on life insurance for seniors in Canada to get a better understanding of why I’m not a fan of whole life or universal life insurance.

Critical illness insurance (along with disability insurance) is one of the most important parts of the most under-reported aspects of Canadian personal finance. The chances that you will experience a long-term illness that takes away from your ability to earn a living are much greater than the chances you will pass away. Obviously, if you have long-term disability coverage through your job (and it includes critical illness) then you are set to go.

A lot of Canadians don’t have this coverage, though, and are going with the tried-and-not-so-true insurance strategy of burying their head in the sand. Don’t be one of these people! Protecting your ability to earn an income is an essential part of personal finance.

I personally love that PolicyMe is focused exclusively on these two fundamental areas of Canadian insurance, and that they don’t try to sell you a whole bunch of stuff that you don’t need. Here’s a quick look at their two fundamental policy areas.

PolicyMe Comparison to Other Insurance Companies

*(critical Illness price quote based on a 45 year old non-smoking woman, with 50k coverage over a 10-year term)

| Feature | Other Canadian Insurance Companies | PolicyMe |

| Application Process | Call or meeting with an advisor, paper application. | Fully online, instant decision in 20 mins. |

| Cost per Month | $37.71 to $41.76 | $37.67 |

| Coverage Amounts | $25,000 to $2.5M | $10,000 to $1M |

| Term Lengths | Usually 10 or 20 years, or until age 70 or 75 | 10, 15, 20, 25, or 30 years |

| Number of Conditions Covered | 24-26 severe conditions, 0-8 early-stage conditions | 27 severe conditions, 17 early-stage conditions |

| Payout Details | Lump-sum tax-free payout | Lump-sum tax-free payout |

| Locked-In Rate? | Yes | Yes |

| Convertible? | Yes | Yes |

| Joint Application | No, separate applications required | Yes, one online application for both partners |

PolicyMe Review: Pros and Cons

Overall, there is far more to like than dislike about PolicyMe. Let’s start with the PolicyMe Pros:

- Excellent price points on the two key insurance products most Canadians need to consider

- Perhaps the most usable online platform in the Canadian insurance marketplace

- Very safe insurance protection

- A medical exam isn’t always needed

- Phone or email access to licensed advisors

- 30-Day money back guarantee

- Fully-renewable life insurance policies offer long-term stability

- Broadest critical illness insurance coverage in Canada

- Instant approval (or lack thereof) upon completion of online application

- An instant quiz provided for a quick and easy way to determine if you even need insurance in the first place!

When it comes to PolicyMe cons, there are really only one that I can see (previously, they were not available nation-wide but they have recently rolled out in every province across the country!)

As of right now, only term life insurance and critical illness insurance is available. That said, if PolicyMe was able to offer a full-size long-term disability package alongside their excellent critical illness offering, then I don’t see a big need to expand beyond what is currently being offered. To be honest, I think the focus on essential insurance products (as opposed to just selling as much unneeded insurance as possible) is a feature and not a bug!

Is PolicyMe Worth It for You?

Without a doubt, if you’re in the market for a Canadian life insurance or critical illness insurance policy, then PolicyMe is worth your consideration.

Look, if you are fortunate enough to have a government job, or you work for a really incredible employer, then it is likely you already have life insurance and/or critical illness insurance. In that case you probably don’t need PolicyMe (and to their credit, PolicyMe’s quiz will tell you as much).

Also, if you happen to be an independently wealthy individual, and/or you can provide financial support for any loved ones who might need it were you to pass away (or be unable to work for an extended period in the case of a critical illness).

In a perfect world, I’d love to see PolicyMe introduce a disability insurance policy to go alongside their critical illness. That would cover off the three most important types of insurance that most people need to consider (but usually don’t).

That said, I love what PolicyMe is bringing to the market:

A super easy, super simple, super budget-friendly alternative to other insurance options in the Canadian market.

I really applaud the company for focusing on low-margin term life insurance, and foregoing the thick profit margins that come with selling over-complicated permanent life insurance policies. The online application process is very user-friendly, and sky-high user ratings are indicative of the high level of customer service that PolicyMe brings to the table.

If you want to buy excellent, cost-efficient insurance, without scheduling the annoying meetings and medical checks, then PolicyMe is certainly worth your consideration!

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?