Instantly Minimize Charges and Bank Fees in Canada

No one likes to pay fees – but when it comes to the incredibly high bank fees in Canada, it becomes even more important to take action.

Here are some quick and easy ways we can minimize our charges and bank fees or eliminate them altogether.

Best No-Fee Bank Account in Canada

The simplest way to minimize charges and bank fees is to start with a no-fee bank account.

EQ Bank is a Million Dollar Journey favourite. See Kornel’s updated EQ Bank review for our in-depth thoughts.

EQ is truly an online no-fee bank account. There are no monthly account service fees, unlimited free Interac e-Transfers, no fees for bill payments, no overdraft fees, and no dormant account fees. No minimum balance required either.

Do keep in mind that the EQ Bank Savings Plus Account – as its name implies – is structured as a high-interest savings account and therefore does not give you a debit card. But, Kornel suggests using a credit card for everyday purchases and then paying off the credit card from the EQ account. This way, you enjoy the benefit of paying absolutely no fees and still meet your everyday banking needs (plus maxing out your credit card travel/money back points).

If that’s not enough, your money will also earn you one of the highest interest rates currently offered by any Canadian bank. At the time of this writing, the EQ Bank Savings Plus Account will give you 1.25% interest on your balance. Other banks may occasionally offer higher short term promotional rates, but EQ Bank’s consistent high interest rate usually beats the boost from any promotional rate.

Second Best No-Fee Bank Account in Canada

If you can’t live without a debit card, then Tangerine is another great no-fee banking option. Kornel also has a review for Tangerine Bank. Tangerine, under its old name ING Direct, was the first free online bank account in Canada. It is the trail blazer that spurred other online banks to join the low fee banking landscape.

Granted, Tangerine is now owned by Scotiabank and has strayed somewhat from its simplistic, no-frills roots. But we think it is still one of the best all-in-one online banks.

The Tangerine chequing account gives you unlimited transactions, free Interac e-Transfers, and a free first cheque book, all without charging a monthly service fee. If you sign up during their frequent bonus interest rate promotions, you can even earn a high interest rate on your deposits for the first few months in your new account.

Besides Tangerine, there are a number of online banks that offer no-fee accounts. MillionDollarJourney has you covered, checkout our Motus Bank, Motive Financial, and Simplii Financial reviews.

As you can see, there are quite a few options for banks that don’t charge fees.

How to Save on Bank Fees

If you already have your chequing account with a big brick and mortar bank and don’t want the hassle of moving all your banking to a different institution, then there are still ways to minimize your bank account fees.

Many banks are willing to rebate the monthly service fee in exchange for maintaining a minimum balance. The required minimum balance varies from bank to bank and varies across different account tiers. For example, TD will rebate the $10.95 monthly fee on its Everyday Chequing Account if a $3,000 minimum balance is maintained throughout the month. The minimum balance for the higher tier, higher fee All-Inclusive Banking Plan is $5,000. In the past, maintaining a minimum balance would have saved you the monthly fee on TD’s lowest tier Minimum Chequing Account but that is no longer an option. At this time, there isn’t a good way to rebate the $3.95 monthly service fee from the Minimum Chequing Account.

Check with your bank if your account qualifies for service fee rebate and what minimum balance you need to maintain in order to avoid chequing account fees.

Some banks also offer multi-product discounts. For example, RBC offers a $6 discount on your monthly account fee if you also have two other categories of RBC products. Those categories are credit cards, investment accounts, lines of credit, mortgages, and small business accounts. So, for example, if you have an RBC credit card and have your mortgage through RBC, you can save $6 off of your RBC chequing account monthly fee.

If you’re a student or are over the age of 60, you can qualify for student or senior discounts on your monthly service fee. See my articles Best Student Bank Accounts in Canada and Best Bank Accounts for Seniors in Canada for advice on how to enjoy those discounts.

Avoid Chequing Account Fees

Everything we’ve talked about up to now assumes simple use of accounts that do not exceed the available balance and are within the limits of the account’s features. I.e. simple transactions and disciplined use of the accounts. But if you try to do things that push the boundaries of the account, be prepared to pay extra fees.

Typical extra fees are Insufficient Funds fee, non-bank ATM withdrawal fee, currency conversion fee, and overdraft fee.

Overdraft fees are charged when the account holder tries to withdraw money or make a debit transaction that puts their account balance below zero. Basically, if an account holder tries to spend money they don’t have, they are charged an overdraft fee.

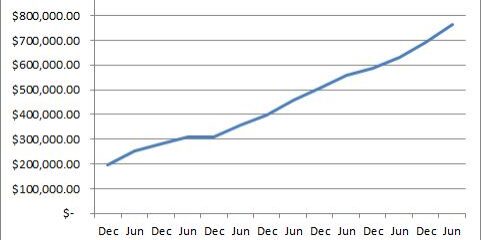

Such fees made the news recently when it was revealed that leading U.S. banks JP Morgan Chase, Citibank, Bank of America, and Wells Fargo collectively raked in $4 Billion dollars (Billion, with a ‘B’) in overdraft fees during the 2020 pandemic. That is a mind boggling dollar amount that hints at the vast number of Americans living with close to zero bank balance, and reveals just how profitable overdraft fees are for the big banks.

We here in Canada are not immune to overdraft fees. TD, for example, would charge $48 per transaction that takes the account balance below zero. TD does offer overdraft protection at $5 per month or $5 per day any time the balance is below zero. The overdraft protection is actually a short-term loan from TD to the account holder. And it being a loan, there is a 21% interest on top of the protection fee. As you can imagine, the overdraft penalties can really add up, even while under “overdraft protection.” All the big banks have similar policies, fees, and interest rates.

Please be careful. Don’t become a statistic. Avoid overdrawing your account to avoid those overdraft fees.

Even the Tangerine Chequing Account, a so-called “no-fee” account, has fees attached to transactions beyond the simple, day-to-day banking tasks. Here is a sampling of “fine print” service fees and penalties on the Tangerine Chequing Account:

- Insufficient funds (or bounced cheque) fee: $45

- Overdraft protection fee: $5 per month

- Overdraft interest: 19.00% (per annum) on the overdrawn balance

- Withdrawals from non-Tangerine or non-Scotiabank ATM: $1.50

- 1 year inactivity fee: $10

Please avoid these fees and penalties by avoiding writing cheques bigger than your balance, by avoiding overdrawing on your balance, by always using your bank’s ATMs, and by keeping your account active.

These are just a small taste of penalty fees that nearly all bank accounts charge. Please check the fee schedule for your account so you know how to avoid penalties.

The only exception seems to be EQ Bank. Their Savings Plus Account fee schedule shows a lot of “Free” in the “Fee” column. In terms of overdraft, EQ Bank simply would simply deny the transaction and not charge you a penalty for it.

Don’t Settle for Paying Banking Fees in Canada

Fees and penalties are big business for big banks, don’t help feed their profits at the expense of your own financial wellbeing. Be careful and avoid Canadian bank account fees. The best option is to start with a truly no-fee account. The EQ Bank Savings Plus Account is the best option at this time.

The next best thing is to use an online, low-fee bank account like the Tangerine Chequing Account or similar offerings from Motus Bank, Motive Financial, and Simplii Financial.

And always check your account’s fee schedule to understand potential fees and penalties. If you know what fees could be charged, you’ll know how to avoid them.

It may seem petty to fuss over a few dollars here and there, but a few dollars can quickly add up. It’s the small details that can have major impacts on your financial wellbeing. One of those small details that’s easy to get right is to avoid unnecessarily paying bank fees in Canada.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Just an update to the article – RBC now has done away with the multi-product rebate and created a ‘value’ program.

Now you need 2 products AND

“For each enrolled account, you must also complete at least 2 out of 3 regular account activities (pre-authorized payment, direct deposit or bill payment) each month to receive the monthly fee rebate.”

https://www.rbcroyalbank.com/accounts/value-program.html