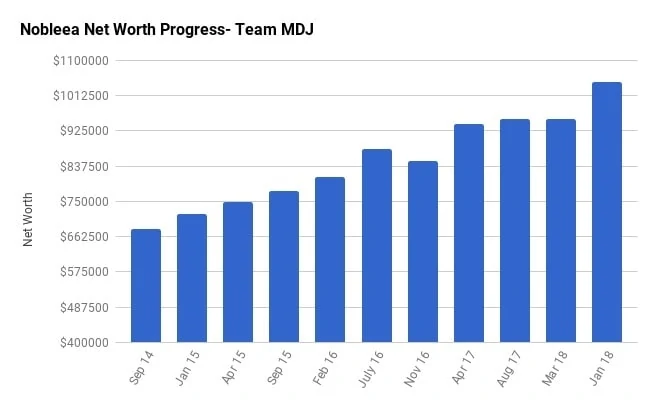

Net Worth Update January 2019 – Nobleea the Engineer and Millionaire!

- Name: Nobleea

- Age: 40

- Net Worth: $1,049,416

- Day Job: Engineering manager at oilfield services company, Teacher (wife)

- Family Income: $140,000 (main job), $20,000 (part-time job/rental income), $85,000 (wife main job)

- Goals: Million dollar family net worth before 40 (Complete), Retirement from the primary job at 50 (for me)

We live in Edmonton where incomes are decent and housing prices are fairly reasonable. Some may roll their eyes at the high family income and say that a million dollar journey is going to be pretty easy. I have a plan to retire at 50 and pursue other interests. My wife will likely continue working until it makes sense to retire with her DB pension as the penalties for early retirement are pretty severe.

The big news is that we’re now a family of 5 by welcoming our third child in October past. My wife is on maternity leave (the 100% for 12 months option) and will probably stay on this until January 2020. This would leave a couple months with no EI but it works better for her school’s calendar/semester schedule. With 3 kids, we had to get new vehicles as 3 large car seats only fit in certain vehicles. The old vehicles were sold privately for their ‘book’ value, the new ones are not included in the NW balance sheet.

We started an RESP for our kids as soon as we could. Combined, the three kids have a total RESP balance of about $30,000 although the value is not included below. It is invested in TD e-series. Our kids are 4.5y, 2y, and 2months. We will be moving it to a self-directed RESP at Questrade early in the new year to save on fees and add flexibility in investment options.

We rent out our garage suite to a great tenant. They’ve been with us for 18 months now and I could see at least that much more in the future. The suite and house are designed such that we never really see or hear each other, so there’s privacy for everyone. Garage suites are becoming more popular in the city with many completed now. Ours is still one of the nicer ones in terms of design, finish and location, so we expect to continue getting good rent.

Our first residential infill project wrapped up. This involved buying a teardown, splitting the lot, and building two detached homes on them for speculative sale. We were able to presell both houses during construction. We made money – nowhere near as much as I’d planned/hoped, but enough to want to try it again.

I learned a lot – what’s worth spending money on, what isn’t, where the hassle is worth it, etc. We have a second project that is to break ground just after New Years and should be on the market in early spring. The net worth numbers below include an amount for infill equity which includes the cash we have in the project and expenses already incurred.

We also started a small business selling products to homeowners and builders. It’s all online through the Shopify platform. It’s been open for a few months now and it looks like it’ll average $500-1000 profit per month, which is about what I thought would be reasonable. It requires a few hours a week to run.

We achieved our long-term goal of $1Mil net worth before I turned 40. The next major goal will be to grow the investable assets to a more respectable number. I am thinking something like $750K.

In May 2009, when we started tracking net worth in earnest, the value was $136,377.

Net worth numbers:

Assets: $1,764,411

- Cash: $1,673

- Registered/Retirement Investment Accounts (RRSP): $236,138

- Tax Free Savings Accounts (TFSA): $0

- Defined Benefit Pension: $220,000

- Principal Residence: $1,130,000 (N/C)

- Infill Project Equity: $145,600

- Small Business Account/Inventory: $15,000

- Vehicles/Other: $16,000

Liabilities: $714,995

- Mortgage: $709,610

- Credit Cards: $5,385

Total Net Worth: $1,049,416

Some quick notes and explanations to common questions:

The Cash

Cash includes bank account balances in two accounts, plus any gift card balances. We use cash flow modeling to predict the maximum amount we can put towards debt/investments today without having a negative balance in the future, taking all one time or non-regular bills into account.

Loans and Credit Cards

The credit cards are paid off in full every month with no interest due. We put all our expenses on credit cards for cash back. As this can be a substantial amount some months, I believe it needs to have a line item in your monthly net worth as it is a liability at that snapshot in time. I just started with the PC Financial World Elite card as we do 95% of our grocery/gas shopping there.

Savings

TFSA’s will need to be replenished over the next 5 years. We cleared out the non-registered and TFSA accounts for the downpayment on the teardown property. We are going to start putting $1,000 a month back into this in 2019.

Real Estate

We moved into our new build in July 2016 and have completed all the landscaping. We have a 1BR suite located above our detached garage that is rented out.

Any questions or comments, let me know in the comments!

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Hello! Thank you and I enjoyed reading this. How do you value your defined benefits pension? I have an excellent one as well, plan to stay with my current employer until retirement but I also have other investments and would like to do a net worth check for myself.

We get a quarterly update from the pension provider. It has what they cal the termination benefit, which is how much they would pay if my wife were to quit tomorrow. It’s usually made up of a transfer to an LIF and some other portion of cash which could be transferred to an RRSP if room was available. The combined amount will fluctuate over time as interest rates change, funds are added, and pension service is purchased.

One thing to remember when earning income from a primary residence is the capital gain implications. Whenever you claim home expenses linked to income gained, it sets you up for possible tax implications specifically capital gains, even though it is your primary residence. Rules may have changed, but it’s worth clarifying this with a reputable accountant so it does not come as a big surprise years later when you go to sell your home. Congrats on your net worth and starting early, we started in our 30s and are now in our 50s with a net worth of over 2. I would still like to own one more rental property before retiring.

Hey nobleea, congrats on the milestone! I live in Edmonton as well and have been curious of the garage suits income potential now that the regulations have loosened up considerably. 13% is a great return!

I do have a question concerning the taxation of the rental income as I similarly am coordinating multiple investment accounts and 2 buisiness incomes for my wife and I. I am finding taxation can’t be overlooked..How do you work that income on you tax returns? Do you write off cca on the structure? Interest on the loans? Do you have separate utility meters? Depreciation of sort? Other deductions? It seems that a favourable tax situation could make your return even better if your tax sheltered accounts are already maxed. I would guess that it could work out to be tax free at least for a time?

Not sure if you have calculated the tax drag on this investment, it would be great to hear from someone who has actually done this.

Hi Phil,

I thought our $1100/mo was good rent, but I have heard of rents in the 1200-1400/mo range and if you are ok with the hassle, double that on average if one were to keep it exclusively on Airbnb.

For taxes, the rent shows up as rental income on our personal taxes. We write off the expenses we can. Mortgage interest is based on the incremental purchase price of the suite. All principal repayments go exclusively to the deductible portion of the mortgage first. So the mortgage interest deduction drops fast and will disappear to $0 next year. Power/water, gas, internet is prorated to the number of adults living on the property. Property taxes I prorate based on the % of finished above grade square footage on the property (works out to 20%). Insurance has a specific rental rider, so that’s a known cost. And any maintenance expenses like furnace filters, etc. This added up to about $4700 last year in expenses.

We do have a submeter for the electricity, located after our primary meter. The same company offers gas and water meters if one was so inclined.

Wow, thanks for the info! It can be hard to find decent numbers to plan with. That will be a nice slice of income for years to come.

So if I can guess it seems like maybe 50-60% of the current rent can be written off? Does that seem close? And slightly less next year without the interest deductions.

It seems like a practical addition to a new build. Would you repeat if you were to do it again?

I’d say 35-40% could be written off. Keep in mind it’s sort of better than that since many expenses are fixed and you’d be paying the full amount anyways even if you didn’t have a suite (property taxes, mortgage interest).

The cleaner way would be to get a HELOC or something on the suite to keep the interest clean, but that’s near impossible especially since it’d always be dual use with your personal garage below.

For a new build home, I would absolutely do it. For an existing home, it becomes quite pricey since a lot of the construction costs would be required if you build a house and garage, or just a garage.

I might design it a bit different, but would definitely do it again. Just have to be clear on who your target renter is, then design/decorate the place in a way they’d find attractive (location too). We wanted a single, professional female, or mature student (we’re close to the university and to downtown). And that’s exactly what we got.

Congratulations, what a feat! Is a garage suite the same as a laneway house? That’s what we call them in Vancouver. They are around $200-250K to build.

Similar to a laneway house. A garage suite is a suite on top of a garage. It’s usually a full size garage like a 2 or 3 car garage and the garage is typically for the property owner, not the tenant.

We also have garden suites, which are probably similar to the laneway houses. May or may not include a garage that may or may not be accessible to the tenant. Can be 1 or 2 stories, at grade entrance.

Also from Edmonton, how much did it cost for you to build your garage suite?

Most forums I read say it’s around $200k which seems ridiculous.

We built it with a new house, so a lot of the utilities and mobilization costs were included. But I think ours came to 160-170K. But keep in mind that includes a 3 car garage for our personal use, so I think you have to back that out of the equation to get the true cost. The incremental cost of the suite was about 95K over what we would have paid for a plain 3 car garage. Since we rent it out for almost $1100/mo, I’d say that’s a good rental investment.

Great article! Thanks for sharing your financial progress! I wouldn’t apologise about your relatively high income. It is really easy to spend more as you make more and your peers do as well.

Great work saving and investing in real estate! I really want to finish our basement to do the same.