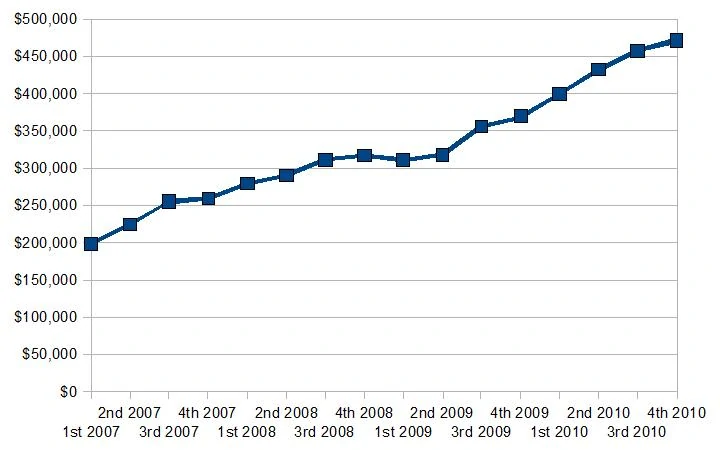

Net Worth Update Dec 2010 (+1.87%) – Year End Summary

Welcome to the Million Dollar Journey December 2010 Net Worth Update – The Year End Summary Edition. For those of you new to Million Dollar Journey, a monthly net worth update is typically posted near the end of the month (or beginning of the next) to track the progress of my journey to one million in net worth. If you would like to follow my journey, you can get updates sent directly to your email.

The second half of 2010 brought a bull market that has propped portfolios all around the world. My portfolios showed some gains this year, although in hindsight, I should have invested more of my cash. Overall though, I’m very happy with the net worth result in 2010 finishing the year with a 26% overall gain and surpassing the $500,000 psychological milestone.

A reader suggested to post a graph of my net worth over the years. As I’ve been tracking my net worth since late 2006, there are quite a few data points to go by, so I took some quarterly numbers and compiled them into a graph. The data points are slightly off, but ignoring that, it’s all in the trend! Our net worth has been trending upwards with the exception of when it plateaued a bit during the market crash of 2008/early 2009. Although the trend correlates with the market direction, I would say that most of our net worth growth has been due to cash savings thus the reason why our net worth wasn’t affected too much by the market correction in 2008.

For those of you who track your net worth, how did you do in 2010?

On to the numbers:

Assets: $ 561,200.00 (-0.20%)

- Cash: $4,500 (+0.00%)

- Savings: $45,000 (+15.38%)

- Registered/Retirement Investment Accounts (RRSP): $103,000(+1.48%)

- Tax Free Savings Accounts (TFSA): $20,950 (+1.45%)

- Defined Benefit Pension: $32,400 (+1.25%)

- Non-Registered Investment Accounts: $12,800 (+0.00%)

- Smith Manoeuvre Investment Account: $59,300 (+2.24%)

- Principal Residence: $283,250 (+0.00%) (purchase price adjusted for inflation)

Liabilities: $55,400 (0.36%)

- Principal Residence Mortgage (readvanceable): $0 (0.00%) (Paid off this year!)

- Investment LOC balance: $55,400 (+0.36%)

Total Net Worth: ~$505,800 (+1.87%)

- Started 2010 with Net Worth: $399,600

- Year to Date Gain/Loss: +26.58%

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker can prove useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Real Estate

Our real estate holdings consist of a primary residence and REITs plus a rental property. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of both of our defined benefit pension plans. I basically take the semi annual statement and add the contribution amounts (not including employer matching) on a monthly basis.

Stock Broker Accounts

Another common question is which discount broker do I use? We actually have accounts with multiple institutions. I’m hoping to reduce the number of accounts that we hold in the near future. Here is a review of some of the more popular online stock brokers.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

@canon, congrats on the big gains in your leveraged portfolio! Perhaps the readers would be interested in hearing about your SM success. Interested?

@Emily, I think using an inflation number between 2-3% is fair. If you want to be really conservative, you can use your tax assessment amount.

I am wondering when/how you account for inflation in your house price. I am doing my NW for Jan 2011 and I calculated a 2% increase…which brings me up by around 5500….so that now brings me to the positive NW. I want to be conservative as well so I’d appreciate any input. I also decreased the values of the cars…..it can’t be this easy!

FT,

Nice accomplishment…. But that’s nothing new for you. ;-)

I stopped tracking monthly NW and was surprised when I did a YOY comparison. We were up over 40% in 2010 which was at least double what I would have guessed. The biggest contributor was our Smith Man portfolio. The $300k we started with in late 2008 is now worth more than $800k. And we are mortgage free with all payments now going to pay down the $375k HELOC.

I think a 20% increase for 2011 would be very satisfactory considering how well we did in 2010 and that in absolute terms it’s harder to increase a growIng NW.

Good luck in 2011 and I hope to pop in a lot more.

I have a question about how you’re valuing some assets. With stocks & other financial instruments, we value them at current market price, not original purchase price (it helps that current market prices are so easily available). But you value your home at the original purchase price+inflation. Why not try to use a value might better approximates the current market price of the home?

I understand that getting a true market price for a particular home (short of actually putting in on the market for bids) involves a lot of estimates & guesswork and won’t be reliable as a result, but perhaps a suitable proxy could be used? Like maybe the municipal tax valuation (which is typically below the market value of a well-maintained home)?

That being said, your approach is more conservative & I suppose could be preferable for this purpose.

Nice increase in net worth. Another tool you might want to try is networthiq. An online site owned by Mint. You create a profit and can track your networth – comparing to others.

Got our update done, up 31.5% for the year. Would love to share it, just click on my name :)

This is definitely an inspiration. Congratulations on your continuous growth. I’m hoping to reach your level one day.

Nice Work.

1.93% for the month, approx 16% on the year, representing about $61k in growth. Getting close to my age 35/$500k goal. 1.5 years to go. Still shooting for $1 million by age 40.

The “FU” factor is progressing nicely for me!

Whoa! Look at that graph! Congrats Frugal Trader.