Is National Bank Stock a Good Buy Right Now?

National Bank of Canada has demonstrated its resilience in the face of market challenges, standing out as a great investment opportunity in the coming years. Its historical performance reflects a commitment to stability and growth, with recent advancements reflecting its proactive approach to evolving market dynamics. However, it’s essential to consider the broader context of the Canadian banking sector and the global financial services industry when making investment decisions.

As we delve into this comprehensive analysis, you will gain valuable insights into National Bank’s past performance, its strategic moves in response to market trends, and the potential impact of economic factors on its future growth. By understanding the bank’s position within the Canadian banking oligopoly and its unique strengths, you can make a more informed decision about whether to invest in National Bank of Canada stock in 2024.

For further insights into alternative investment opportunities, you can delve into our article highlighting the Top Canadian Bank Stocks.

Want To Buy National Bank Shares? Price, Performance & Analysis

- T.TO Stock Price: 103.89

- Dividend Yield: 4.06%

- Price-to-Earnings (P/E) Ratio: 11.14

- 5yr Earnings Per Share Growth: 9.57%

- 5yr Dividend Growth: 10.28%

- Payout Ratio: 42.05%

Our National Bank Stock Analysis

- At a valuation of $103 per share, NA emerges as an attractive investment prospect.

- Having observed a 2023 uptick of 13.6%, it has been recovering to its peak in 2022.

- Smallest market cap among Canada’s Big 6 banks.

- Showcasing an impressive dividend yield of 4%.

- Foresees a trajectory of measured growth potential.

Our National Bank of Canada (NA) stock analysis indicates that NA is appropriately valued, rendering it an appealing choice for long-term investment. While it maintains a robust standing within the Canadian banking sector, NA’s growth prospects in the foreseeable future are anticipated to be limited. Given the prevailing trajectory of the industry, growth is projected to remain modest at best. However, the stock’s notable dividend yield provides an enticing opportunity for a consistent income stream.

Bank Sector Outlook

Over the past year, the majority of banks have witnessed a decline in their stock prices. This initial downturn can be attributed to the proactive approach taken by the Bank of Canada and the U.S. Federal Reserve, who raised interest rates as a measure against the inflationary pressures impacting both economies.

While higher interest rates can potentially bolster banks through increased net interest margins, the rapid and substantial rate hikes within a condensed time frame are making it much more difficult to borrow. Households and businesses with variable-rate loans have been immediately affected by rate hike announcements, while those with fixed-rate mortgages encounter obstacles during loan renewals. Prolonged elevated rates could amplify the risk of defaults.

Central banks are striving to temper economic growth and restore equilibrium to job markets. Investor concerns arise from the possibility that central banks might push the economy to an extreme, potentially triggering a significant recession. Such a scenario could lead to an unexpectedly high surge in loan defaults, placing banks in a challenging predicament.

The collapses of select regional banks in the United States are further contributing to a cautious sentiment among bank investors. Many are eagerly awaiting developments to assess whether additional challenges are on the horizon. An imminent catalyst could emerge from loans associated with office buildings grappling with high vacancy rates.

Should I Buy National Bank Stock?

From a long-term perspective, National Bank appears to be a compelling investment choice, as we highlighted in our in-depth analysis featured in the Canadian Dividend Kings article. The Canadian banking sector operates within an oligopoly, creating a stable environment for the key players. Within this landscape, National Bank stands out due to its noteworthy growth potential.

As a primary player in Quebec, it benefits from the region’s robust economic growth, which has been particularly pronounced recently. This advantageous market positioning positions National Bank to leverage the positive economic trends in Quebec and potentially contribute to its sustained growth over the long run.

One distinct advantage that sets National Bank apart is its unique mortgage risk profile. Unlike some of its Canadian counterparts, National Bank is exposed to a lower mortgage risk profile. This is due to the fact that home prices in Quebec, its primary market, are relatively more affordable compared to other regions in Canada. This aspect offers a level of resilience to potential housing market fluctuations, which can be a significant factor in providing stability to the bank’s operations and overall financial performance.

However, it’s important to acknowledge that short-term market dynamics can introduce volatility and unpredictability to any investment. Factors such as market sentiments, economic indicators, and global events can influence the short-term performance of National Bank stock, as they do for any company in the stock market. These short-term fluctuations should be considered as part of the investment landscape.

In conclusion, National Bank appears to have a promising outlook for long-term growth, buoyed by its strategic market positioning in a thriving Quebec economy and its unique mortgage risk profile. While short-term market fluctuations are inevitable, a careful consideration of these factors can guide your investment decision.

How Can I Buy NA.TO Shares?

To acquire National Bank stock, you have the option to leverage any of the numerous Canadian online brokerage services available. At MDJ, our primary focus is on offering our readers guidance in selecting discount brokerages that align with their specific requirements. Our regularly updated compilation of the Best Online Brokers in Canada not only furnishes readers with top-tier recommendations but also facilitates access to advantageous promotional offer codes prevalent in the market.

Upon successfully completing the registration process for a brokerage account, the process of buying NB shares, along with other stocks, is very simple. Begin by searching for the ticker symbol “NA” and determining the desired quantity of shares you wish to purchase.

If you are contemplating an investment of $1000 in NA shares, with the current stock price standing at $100. Input the desired quantity as “10” and choose the “market limit” option. Subsequently, your online brokerage will present a prompt inquiring, “Do you wish to acquire 10 shares of NA at $100 each, summing up to $1000?”. Upon confirming the order, your online brokerage will oversee the subsequent steps.

National Bank Stock Past Performance

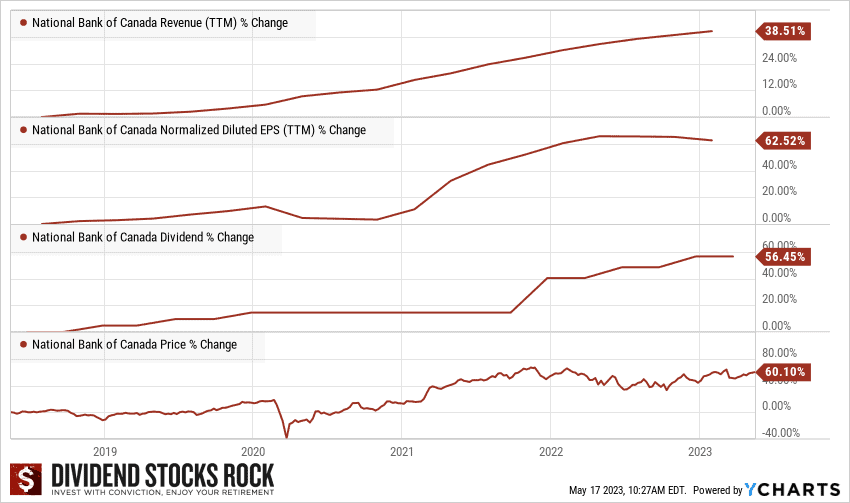

Over the course of the last three years, National Bank of Canada (NA) has exhibited a consistent increase in its dividend payouts, a trend mirrored by its growing revenues, as illustrated in the graph provided below. This steady trajectory instils confidence in me as an investor, signifying the robustness of National Bank’s management and its firm standing within the Canadian banking sector.

I am optimistic that these factors will contribute to the bank’s enduring strength over the long term which I believe will consistently generate returns for its investors.

For more comprehensive insights into the realm of dividend investing, I encourage you to explore our recently updated compilation of the Best Canadian Dividend Stocks.

As a dedicated long-term investor, my central focus rests on opportunities that provide not only a progressively increasing dividend but also exhibit unwavering capital gains. Within the context of National Bank of Canada, its dividend growth rate exceeding 10% over the past five years positions it above its industry counterparts. It is worth highlighting that the bank’s dividend growth rate surpasses both TD Bank’s stock 8% and RBC’s 7%, further enhancing its appeal within the market.

For a comprehensive and detailed analysis, along with an extensive comparison of dividend stocks encompassing advanced statistical insights and a broader array of stock possibilities, I wholeheartedly recommend consulting Dividend Stocks Rock (DSR). This comprehensive resource empowers investors with valuable insights and information, assisting them in making well-informed decisions within the realm of dividend-oriented investing.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?