moomoo Canada Review

What is moomoo Canada?

Moomoo is an online brokerage created with the goal of providing a platform for investors of all experience levels to engage with the market. Moomoo is an independent brand of Hong Kong-based FUTU Holdings, which is a NASDAQ Listed global financial institution.

While moomoo was founded in Silicon Valley in 2018 it quickly expanded across the globe. In 2021 they earned the top spot for online brokerage apps in Singapore, and it is utilized for international trading in Australia. In Japan, moomoo has become the top choice for US stocks trading.

Moomoo officially launched in Canada in September 2023. Then on March 26, 2024, they rang the opening bell at the Toronto Stock Exchange to celebrate their approval as a TSX and TSXV non-trading member.

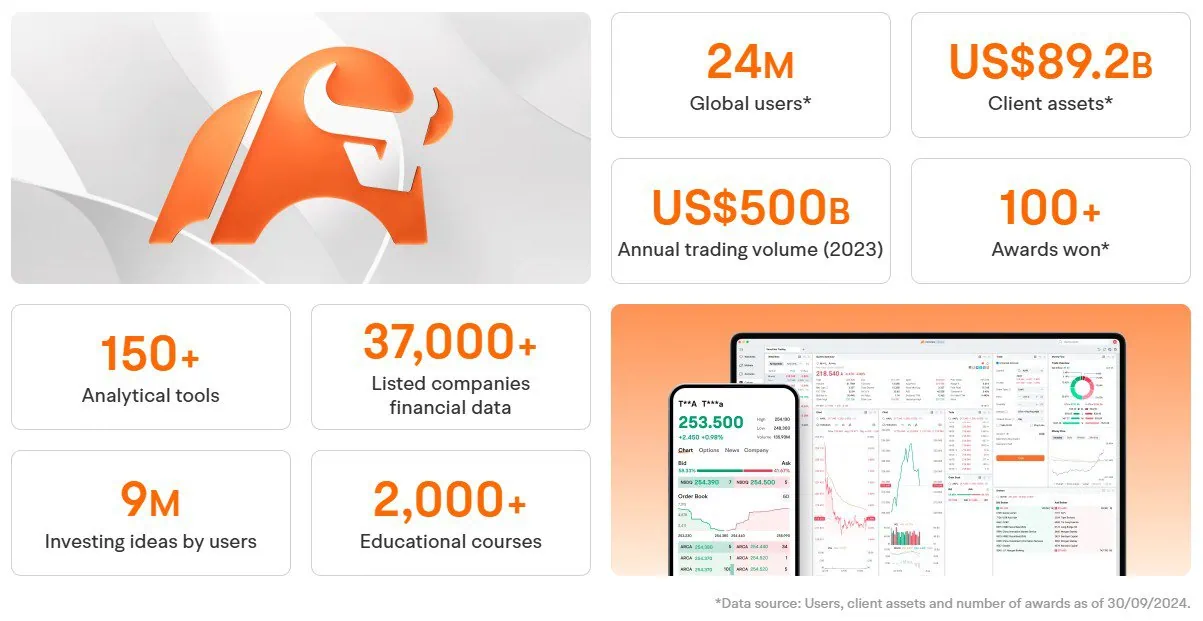

The following infographic taken from their website gives you an idea of their global presence.

Is it Safe and Trusted?

While moomoo is a newer brokerage available to Canadians, and has a name that some find silly despite the intended connection to a bull market, it is indeed a legitimate brokerage.

Moomoo Financial Canada Inc., a brand of FUTU Holdings listed on the NASDAQ, is also a member of the Canadian Investor Protection Fund (CIPF) and is regulated by the Canadian Investment Regulatory Organisation (CIRO).

This protects the securities of clients up to $1 million for each general account. It’s important to note, however, that while the CIPF protects eligible customers in the event of a CIRO dealer member’s insolvency, it does not cover losses incurred due to fluctuations in market values.

Moomoo Canada Fees

With online brokerages, fees need to be low in order to be a top contender in the Canada discount brokerage scene. When it comes to fees with moomoo you won’t be paying much! This is one of the stand-out features of this new-to-Canada online brokerage.

| Canadian Stocks and ETFs | CAD $0.0149/share, Minimum CAD $1.49 per trade |

| US Stocks and ETFs | US $0.0099/share, Minimum US $1.99 per trade |

| US Options (stock options and index options) | $0.90/contract, Minimum $1.50 per orderExercise/assignments fee: $0 |

| Margin Rate (in USD) | Under $100,000: 8.83%$100,000 – $1 million: 8.33%$1 million – $50 million: 8.08%$50 million – $200 million: 7.83%Over $200 million: 7.83% |

| FX Fees | 0.09% plus USD $2 per transaction |

| Account Fees (Opening and Closing) | $0 |

| Account Minimum | $0 |

| Deposits via Bank Transfer (EFT) | $0 |

| Electronic Statements and Trade Confirmations | $0 |

| Withdrawal Fees | From cash, margin, and TFSA accounts the first withdrawal per month is free, then cost $2-$12 each. The first withdrawal per month from RRSP accounts cost $50; subsequent withdrawals are $52-$62 each. |

| Inactive Account | $0 |

As you can see in the table above, moomoo offers stocks, ETFs, and options at a very affordable cost. We also love to see that there are no account fees and no withdrawal fees. All this on top of a $0 account minimum so you can get started investing at any point!

However, there are no caps on trading fees, so for investors trading large blocks of shares, they will pay a high cost. In contrast, many other brokers have a maximum trading fee.

Account Options

Moomoo Canada offers a limited selection of accounts, offering just 4 different account types. This is a downfall as other top Canadian online brokers offer a much more diverse variety of account options and holdings. Moomoo Canada’s current account offerings are:

Registered Retirement Savings Plans (RRSP): Within a moomoo RRSP account, you can invest in stocks, ETFs, and options, with taxes deferred until you make a withdrawal, typically during retirement. RRSP accounts are available for individuals, as well as for spouses.

Tax Free Savings Accounts (TFSA): TFSAs are a highly beneficial account option for Canadian investors. They allow you to invest in stocks, ETFs, and options, with the added advantage of tax-free earnings and withdrawals.

Cash accounts: Cash accounts are simple and versatile, allowing you to buy and sell stocks, ETFs, and options. They typically come in various forms, including individual, joint, corporate, and group accounts, but moomoo only offers individual accounts at this point in time.

Margin accounts: Margin accounts enable you to borrow money against your securities to trade at competitive rates. However, it’s important to note that this is the only account type where you’ll be required to pay interest.

Unfortunately, they do not offer First Home Savings Accounts (FHSA), Registered Education Savings Plans (RESP), RIFs, LIRAs, corporate and joint accounts – all of which are very popular accounts with Canadians, for good reason. They also don’t have certain popular asset classes such as bonds or mutual funds. So, for clients who like to open many account types and asset classes, and then keep all of their investments with one brokerage, moomoo will not be a good fit.

Furthermore, for some reason, if you wish to open a TFSA account with moomoo, you must open it as your first account with them. This is likely important to note because it means you have to plan the order in which you open accounts.

Additionally, when it comes to setting up your account, transfers in kind (of cash or securities) from a cash or margin account to an RRSP or TFSA are not supported.

As you have probably gathered, the account options and ease of opening them have not been an impressive feature of moomoo!

Investment Options

Moomoo Canada has fairly limited asset classes. Unfortunately, they are only open to US and Canadian markets. Here are the investment choices that moomoo Canada does offer:

Stocks: Stocks, or shares/equities, represent ownership in a company. Investing in stocks offers the potential for higher returns over time, as they have historically outperformed other investment options such as cash equivalents, GICs, or bonds. However, this comes with a higher level of risk. Moomoo has over 7000 US stocks, and all the stocks listed on the major Canadian trading platforms.

ETFs: ETFs contain a diversified mix of assets, including stocks, bonds, or commodities, helping to spread risk across various asset classes. With moomoo, you can choose from over 5000 US-listed and Canadian-listed ETFs. These include Index ETFs, Bond ETFs, All-In-One ETFs, Sector-Specific ETFs, Commodity ETFs, Dividend ETFs, Factor-Based ETFs, Inverse ETFs, and Leveraged ETFs.

Options: An option grants the buyer the right, but not the obligation, to buy or sell an underlying asset or security at a predetermined price, on or before a specified date. Options trading can be complex and involves inherent risks, so it may not be suitable for novice investors. To learn more about Options trading and our top picks for options brokers, check out our Options Trading Guide in Canada article. Moomoo offers options that can be held in your cash, margin, TFSA, and RRSP accounts. They currently only offer US stock options.

Cash Plus: This earns you 2% p.a. cash rebates that are automatically redistributed each week. It can only be held in your margin and cash accounts.

Extra Features

Moomoo’s online trading platform is widely recognized for its advanced trading tools and global market access. They offer real-time alerts with free access to updated market data every 0.03 seconds.

Moomoo also offers the option to customize your trading charts with many different features:

- Multi-Monitor Setups

- Technical Indicators

- Drawing Tools

- Custom Indicators

There are also many features for stock analysis when trading stocks. These include information on:

- Short Sale Volume

- Institutional Holdings

- Company Valuation

- Financial Reports.

Moomoo also offers a demo paper trading account. This gives you a chance to see how moomoo’s trading platform works, without investing your own money. The paper trading demo gives you $1 million in virtual money and access to more than 10,000 stocks and options. This demo also includes educational resources and the opportunity to take part in paper trade competitions.

Moomoo Mobile App Review

At this point, we expect all online brokers, banks, etc. to offer clients functional, easy-to-navigate stock trading apps so that they can perform actions anytime, anywhere, with their mobile device or tablet.

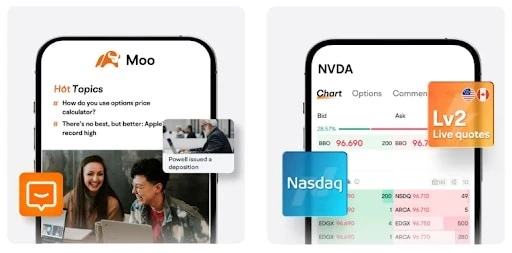

The moomoo Trading & Investing mobile app is an easy-to-use app with many functions. The app can be used to trade US stocks from 4am to 8pm ET, and Canadian stocks from 8am to 5pm ET. It can be used to analyze stocks, and you can engage with experts and other users to view live streaming and trending discussions. Furthermore, the app can also be used to access financial news from credible sources such as Bloomberg, Dow Jones, Benzinga, and Investorplace, all for free!

Here is a screenshot from their website showing some of their app features:

Android users and Apple users alike rate it highly: 4.5 stars from over 31,000 reviews on the Google Play Store, and 4.6 stars from 1000 reviews on the Apple App Store. Users commonly comment on the ease of use and the straightforward layout and organization of the app.

The app is also linked to 24/7 customer care: professional support from licensed professionals by live chat, phone, or email.

For a more in-depth look at their mobile app, check out their App Features page in their online Help Center.

Moomoo can also be downloaded for desktop trading for those who prefer to use their computer when making trades but they do not offer web-based trading.

How to Open an Account

The process of opening an account with moomoo Canada is pretty simple. According to their website’s Help Center, it is a simple 5 step process:

- Submit an application via either the app or on the website

- Your account will be approved within 2 business days if all the provided information is verified

- If additional documents are required, the instructions will be sent via email

- An email will be sent containing your account details once approved

- Lastly, access the Client Portal to update your temporary password

For all accounts, you need to have Canadian citizenship or tax residency. The following table outlines what you need specifically for each account type:

| Individual Margin Account | Tax-Free Savings Account | Registered Retirement Savings Plan | Individual Cash Account |

| A Canadian Social Insurance Number (SIN) A valid residential address in Canada A valid mobile phone number A valid personal email addressTo be 21 years old or older | A Canadian Social Insurance Number (SIN) A valid residential address in Canada A valid mobile phone number A valid personal email addressTo be 18 years old or older | A Canadian Social Insurance Number (SIN) A valid residential address in Canada A valid mobile phone number A valid personal email address$7,000 CAD or more in net assets To meet the minimum age requirement: 19 years old in BC, NB, NS, and NL, and 18 years old in AB, SASK, MAN, ON, QC, and PEI To be younger than 71 years old | A Canadian Social Insurance Number (SIN) A valid residential address in Canada A valid mobile phone number A valid personal email address To be 18 years old or older |

From our experience, account opening takes 1-3 days.

Once you have opened an account you can use the moomoo app to add another account type. But please note, that if you wish to open a TFSA with moomoo, it must be opened as your first account.

Moomoo vs Qtrade – Canada’s Top Brokerage

| ||

|---|---|---|

| Account Options |

|

|

| ETF Fees | Free buying AND selling of 100+ ETFs | $1.49 - $1.99 per purchase. |

| Trading Fees | $6.95/trade for Investor Plus Program members, $7.75 for investors aged 18-30, $8.75 for everyone else |

|

| Safety | CIPF Member, IIROC regulated | CIPF Member, CIRO regulated |

| User Experience | Consistently ranking #1, high availability and friendly to customers. Built exclusively for Canadian users. | Overall positive reports and highly rated app. |

| Research Tools | Has been at the top of Canadian brokerage rankings in this category for over a decade. | Free demo paper trading ($1 million virtual money). Standout access to educational resources including 60-depth level 2 quotes, advanced market tools & market data, 24/7 global market news |

| promotion | Instant Sign Up Bonus: $150-$2,150 | $2,000 commission rebate card and 6% cash rebate for 60 days upon sign up. Up to $200 Cash Bonus. |

| Sign Up | Visit Qtrade | Visit Moomoo |

Moomoo Canada Review FAQ

Is moomoo right for you?

As an online Canadian brokerage, moomoo is good, but not the best. It has some stand-out features, but falls short in many areas when compared to other options such as Qtrade and Questrade. However, despite the downfalls, they still come out above the big bank brokers.

While we love the low fees and in-depth online trading interface, it is lacking in account options and asset classes, and has an absence of global market options. This causes it to drop down in our rankings. If you are most focused on US and Canadian stocks and ETFs and are happy with the limited account offerings, then moomoo may be a good choice for you.

Otherwise, we recommend you check out our list of the Top Online Brokers in Canada, where you’ll see that Qtrade is ranked at the top. To learn why, visit our complete Qtrade review.

As usual, we’re always keen to hear from our readers. If you’ve had any experiences with moomoo Canada, whether positive or negative, let me know. Your input helps keep our 2024 moomoo Canada review relevant to readers.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?