Best Finance and Investing Books

Whenever readers ask me for finance book recommendations, my mental response is always “how much time do you have?” A list of the best personal finance books of all time would take hours to go through, even if you limit it to financial books written specifically for Canadians.

That’s why I’ve put together this list of the 16 best finance and investing books for 2023. They’re not ranked, but they are split into 3 categories so you can skip right to what interests you most (or read through all 16 reviews and pick the ones that stand out to you!).

Are you excited yet? Ready for some nerdy fun and/or a book-buying spree? Let’s get to the list!

Top 5 Investing Books 2023

The Value of Simple: Taking the Complexity out of Investing by John A. Robertson (2018)

DON’T PANIC, John Robertson quotes in the introduction of The Value of Simple, and the classic Douglas Adams line has never felt more relevant.

Robertson understands that investing can be scary and overwhelming for the complete beginner. In this book, he gives readers all the information they need to understand investing basics, from mutual funds to passive investing to RESPs, RRSPs, and TFSAs. Then he shows you 4 great choices for simple investing without outrageous fees.

The Value of Simple gives you step-by-step instructions (with screenshots!) on how to make your first investment using each of these methods. Robertson also gives readers plenty of links to resources, worksheets, and additional information, making it the most beginner-friendly book if you want to learn the ropes of investing in Canada.

If you’ve been around the investing block a few times, then this isn’t the book for you. But if you’re currently feeling lost and paralyzed by all the choices out there and want someone to take you through the best options, The Value of Simple is an excellent choice.

Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School by Andrew Hallam (2017)

English teacher turned debt-free millionaire, Andrew Hallam, followed a few simple rules on his journey to retiring rich.

Along the way, he realized that these fundamental principles of good money management weren’t being taught in schools – and should be. So, he set out to write the lessons that his students (and you) should have learned before graduation.

Hallam’s rules are mostly straightforward (save more than you spend, invest wisely in the stock market, slash fees, be aware of your mindset) but sometimes you just need someone to say the thing. Plus, his chapters on investing cover the basics and then some.

Millionaire Teacher defines wealth as earning double the median household income in your area…without having to work. If that sounds like exactly where you want to be and you have no idea how to get there, give this book a read.

Beat the Bank: The Canadian Guide to Simply Successful Investing by Larry Bates (2018)

When 35-year finance veteran Larry Bates got a call from his sister asking about why her mutual funds were performing so poorly, he didn’t expect it to change his life.

After checking her financials, he quickly realized that the fees she was paying for her mutual funds had eaten up 30-40% of her possible gains over the years. When he dug deeper, he was horrified to learn that many Canadians were faring even worse!

Big banks capitalize on the typical investor’s sense of overwhelm, trust in institutions, and fear of asking stupid questions. Bates shows reader how they do this and then presents an alternative: Simply Successful Investing.

This approach combines a knowledge of investment basics with long-term thinking and slashing bank fees, allowing you to maximize your gains – without spending more than a few hours annually.

Part exposé, part passive investment primer, Beat the Bank is a fascinating (if occasionally infuriating) read that’s perfect for anyone considering jumping out of the mutual fund market and finding a better way.

The Rule of 30: A Better Way to Save for Retirement by Frederick Vettese (2021)

If you’re worried less about the mechanics of how to save for retirement and more about how much to save, The Rule of 30 could be the book you’re looking for. In fact, it’s one of the best Canadian books about retirement, period

Frederick Vettese uses the narrative framework of a young couple chatting with their retired actuary neighbour to break down past stock market performance and propose a flexible, easy to follow, and surprisingly achievable savings framework for young Canadians to adopt.

Vettese was inspired to write his book when he began looking for a rule of thumb about how much of their salary Canadians should save for retirement – and found basically nothing. The question seemed like it should have an easy answer, but no one could agree (or even really wanted to talk about it).

The Rule of 30 digs into the topic the experts tried to avoid—and does it in a way that’s entertaining and easy to understand. It’s worth a read for anyone, but especially for Canadians in their 30s or younger.

The Intelligent Investor by Benjamin Graham with updates by Jason Zweig (originally published in 1949, updated in 2006)

If you’re a reasonably experienced investor looking to expand your knowledge base, then The Intelligent Investor is required reading. This is our pick for the best (and classic) advanced investing book.

Called “the stock market Bible” and dubbed “the best book on investing ever written” by Warren Buffett (who should know), The Intelligent Investor was the first book ever to describe the financial mindset and practical tools that are the keys to stock market success.

Graham built on decades of studying market psychology plus his experience as a successful investor and defined core principles that still hold true today. This edition was revised and annotated to provide a modern perspective on the classic investment book. Co-author Jason Zweig also demonstrates just how correct Graham was with more contemporary examples.

The Intelligent Investor states, “This is not a ‘how to make a million’ book. There are no sure and easy paths to riches on Wall Street, or anywhere else.” And that’s still true. But an in-depth understanding of how the market works sure helps.

Top 5 Personal Finance Books 2023

Stop Over-Thinking Your Money!: The Five Simple Rules of Financial Success by Preet Banerjee (2014)

Well-known Canadian personal finance expert Preet Banerjee is the straight-shooting advisor we all need but few of us usually listen to, and he’s written the best personal finance book for beginners in Canada.

Instead of treating investing like the be-all and end-all of financial well-being, Banerjee digs deeper. How can you invest anything without having money to invest?

You can’t, and that’s why he treats saving, not investing, as the Prime Directive.

Banerjee is like the best personal trainers – he gives it to you straight, in a style that’s easy to understand, with some room for flexibility (or, in this case, fancy coffee). Like a push-up, his rules are simple to understand – but often tough to do.

If you find financial planning needlessly complicated (or if you avoid thinking about it altogether), Stop Over-Thinking Your Money will give you the push you need.

Wealthing Like Rabbits: An Original and Occasionally Hilarious Introduction to the World of Personal Finance by Robert Brown (2014)

I don’t know about you, but I’m here for pretty much any personal finance book that can work cultural references from Super Mario to Star Trek into it. “Original and occasionally hilarious” really does sum it up for this book, which is an entertaining and informative read from start to finish.

Wealthing Like Rabbits doesn’t feature the most innovative or advanced personal finance tactics, but it does a good job of making the basics entertaining and showing why classic advice like “spend less, save more” is still accurate (although always challenging).

If you want a quick, easy read to help get you acquainted with the principles of smart financial management in a friendly and, yes, “occasionally hilarious,” way Wealthing Like Rabbits is a solid choice.

The Money Master: Inside Secrets on How to Make Your Money Grow and Stay Safe (What They Don’t Teach You About Wealth and Investing) by Sandy Yong (2020)

Self-proclaimed financial nerd Sandy Yong is dedicated to helping her readers get comfortable talking about money.

That’s why the first section of The Money Master looks at why people feel overwhelmed and intimidated by money – and why so many of us spend our lives living paycheque to paycheque.

This book is part investment guide, but it’s about so much more than the stock market. Yong starts by laying out crucial mindset changes and habits that will help you build wealth. Then she digs into a range of financial topics from DIY investing to real estate to owning your own business.

It’s a friendly and encouraging book, perfect for people who have been avoiding their finances or feeling vaguely stressed out by them.

$2 from the purchase of each book goes to the CAMH (Centre for Addiction and Mental Health). If you want to support TWO good causes (mental health resources and the health of your own finances), The Money Master is a perfect choice.

Money Like You Mean It: Personal Finance Tactics for the Real World by Erica Alini (2021)

Personal finance reporter for Global News, Erica Alini has written the personal finance book she desperately needed when she started working full time…right before the financial crisis of 2007-8.

When Alini looked for advice to help her sort out her finances, she realized that the traditional financial wisdom and goals we’re usually given have become nearly impossible. Millennials, older Gen Zs, and anyone of any age who’s struggling to get their finances figured out need a new collection of financial tools.

That’s what you’ll find in Money Like You Mean It. Alini looks at everything from mindset to credit scores, from housing to side hustles, from pay negotiations to DIY investing. She covers all the concerns that post-Gen-X adults have, while also digging into the big Whys behind the dire financial headlines.

If you’re frustrated with typical financial advice and want a book that meets you where you actually are, gives you advice that applies to your situation, and does it in a readable but informative style, give Money Like You Mean It a try.

Worry-Free Money: The Guilt-Free Approach to Managing Your Money and Your Life by Shannon Lee Simmons (2017)

Certified life coach and financial planner Shannon Lee Simmons works with members of “the financially frustrated middle class” every day. These clients have a massive range of income, but they all have something in common: they all feel broke.

You might know the feeling: the constant, low-level feeling of guilt and anxiety. That’s the feeling that keeps you stressed and makes you want to overspend.

Simmons argues that financial wellness is more complicated than “stop spending, start saving.” We make hundreds of small financial decisions every single day – and how we feel about money shapes every one of them.

So why do we feel broke? Why do we overspend? Why doesn’t budgeting work? And how can we avoid “financial F*ck It Moments”? Worry-Free Money looks at all of it in an encouraging, hopeful way that anyone who has ever had an anxiety attack in Ikea will relate to.

6 More Money Books We Recommend

Moolala: Why Smart People Do Dumb Things With Their Money—And What You Can Do About It by Bruce Sellery (2015)

Bruce Sellery understands that you may not love finances (or, if you’re reading this site, maybe you do…) but he insists that Moolala isn’t just about money- it’s about what you love. Yes, really.

That’s because how well you manage your money affects how much you can experience the things you love.

Moolala is designed to help you find clarity about your priorities and your finances, and then use that clarity to help you find peace of mind.

His five-step Moolala Method starts by teaching you why smart people do dumb things with their money. Then it guides you through creating and acting on a plan to help you avoid those mistakes and get what you really want.

A mix of personal stories, financial wisdom, and workbook exercises (book and worksheets are available on Sellery’s website), Moolala’s advice is practical, actionable, and personalized.

No matter what your income or financial situation, Moolala is worth a read. A little more clarity never hurt anyone.

Happy Go Money: Spend Smart, Save Right and Enjoy Life by Melissa Leong (2019)

Part financial planning guide, part self-help book, part book club masterpiece, Happy Go Money is less a book about getting rich and more a book about living a rich life. Melissa Leong guides you to take control of your happiness – which includes (but is not in any way limited to) improving your relationship with money.

Leong challenges you to focus on gratitude, experiences, and growth, as well as reframing budgeting in a way that helps you focus on what you’re saving for, not what you’re giving up.

Each chapter ends with “Your Happy Money To-Do List” (a list of practical tasks that will help you increase your overall happiness as well as improve your relationship with money) and “Money Talks” (a list of questions to discuss with friends or an accountability group).

If you’re looking for a no-nonsense guide to saving and investing, this book isn’t the one. But if you want a book that will make you more aware of yourself, your money, and your life while also teaching you basic financial wellness, it’s well worth a read.

Balance: How to Invest and Spend for Happiness, Health, and Wealth by Andrew Hallam (2022)

Millionaire Teacher author Andrew Hallam returns to our list with his brand-new book, Balance. It’s one of the best new Canadian finance books – which is impressive considering it’s not only about finance, but about so much more.

Unlike Millionaire Teacher, which focuses solely on building wealth, Balance takes a broader look at life and at what’s important for happiness.

Hallam describes life as a table with 4 legs: money, strong relationships, physical and mental health, and a sense of purpose. Each leg is equally important for a happy life. If you neglect any of the legs too much, they’ll crack or break, and your table won’t be sturdy.

Balance invites you to consider what truly makes you happy. That means spending your money on things (or experiences) that will improve your life in long-lasting, important ways. It also means thinking twice about saying yes to something (say a new job or a longer commute) that will negatively affect other areas of your life (or legs on your table).

For more details, check out our full review of Balance: How to Invest and Spend for Happiness, Health, and Wealth by Andrew Hallam.

House Poor No More: 9 Steps to Grow the Value of Your Home and Net Worth by Romana King (2021)

Romana King understands that a house is more than just a financial investment, it’s an emotional one. Homes are (ideally) safe spaces where we can become more ourselves. And that kind of investment needs to be nurtured and protected.

House Poor No More draws on King’s decades of finance and real estate experience and gives readers practical advice on how to maintain (and improve) their home’s value.

This book is a homeowner’s bible, packed with tips from what home maintenance tasks to tackle annually to what kinds of insurance claims to make and when to take care of things yourself.

We appreciate King’s friendly, “you do you” approach, especially when it comes to the rent vs buy question. This is not a book to fuel that debate. Renting isn’t inherently bad any more than homeownership is inherently foolish, King argues. Just do what feels right to you and don’t worry about defending your decision.

This is the kind of book you want to keep on hand and refer to regularly. Mark your favourite sections. Write notes in the margins. For more details, check out our detailed House Poor No More review.

More Money for Beer and Textbooks: A Financial Guide for Today’s Canadian Student by Kyle Prevost and Justin Bouchard (2014)

Setting aside the fact that this book was written by MDJ’s own Kyle Prevost and Justin Bouchard, any finance book that has an introduction entitled “Why This Isn’t a Waste of Your Time” is going to earn bonus points from me.

And, it turns out, they’re right. If you’re a Canadian student (or the parent of one), this book will not be a waste of your time. More Money for Beer and Textbooks was written to fill a much-needed niche: a guide to getting through university without throwing money away or getting sunk under a (bigger than necessary) pile of debt.

More Money for Beer and Textbooks is one of the older picks on this list, but it’s still the best finance book for young adults who are heading off to university. You’ll get honest information about tuition, housing, student loans, textbooks, and partying without going broke. You’ll also get Canadian student-specific advice about all the big financial topics: jobs, student taxes, budgeting, and credit cards.

These guys really know what they’re talking about (as you would expect), and they’ve written a book that’s straightforward, helpful, and easy to read. My oldest kid is already a teenager (how did that happen?!) and I expect to be buying a copy of this book for him (and me) in a few more years.

The Year of Less: How I Stopped Shopping, Gave Away My Belongings, and Discovered Life is Worth More Than Anything You Can Buy in a Store by Cait Flanders (2018)

When Cait Flanders turned 29, she set herself a challenge: no shopping for a year. There were some exceptions (like gifts for others), but clothes, books, home décor, and takeout coffee, to name a few, were all banned.

Flanders didn’t expect that the challenge would change her life.

The Year of Less is more of a memoir than a how-to book – but reading it will make you look at your consumption habits differently. Why do you buy the things you do? What are you holding onto or avoiding? These are questions worth asking.

If you’ve ever considered minimalism, or if you’re just tired of wondering where your money goes every month, spending some time with The Year of Less can help you get a new perspective.

It won’t give you universally applicable strategies, but that’s what the other books on this list are for. Read this one for fun and inspiration and then pick up another book from the list to get your practical financial advice.

The Best Finance and Investing Books in Canada for 2023

From investment basics to fixing your relationship with money, from a plan for a balanced life to targeted advice for students and homeowners, you can find it all on our list of the best financial books in Canada. I hope it’s inspired you to build your reading list.

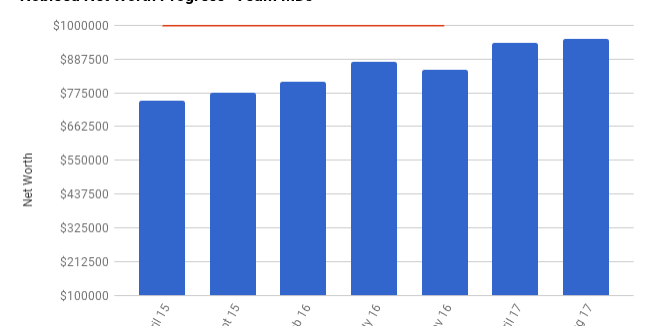

But if you want to start learning for free and are looking to get a handle on preparing for retirement, you don’t have to go any further than MDJ.

Our free eBook, Can I Retire Yet? is available to download now. It’s packed with useful information and advice, and it will cost you precisely zero dollars. Interested? Head here to get your hands on a copy of Can I Retire Yet?

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

May I also suggest “Poor Dad Rich Dad” by Robert Kiyosaki, and his later books, which give a unique perspective on investing, entrepreneurship and wealth. Since reading it (several times) I then purchased an investment property with a plan to expand my portfolio with purchase of one property each year. I have been in the stock market for decades and have invested wisely, yet my largest gains have been through real estate investment, and by a significant margin, and has proven safer over both the short and long term. I enjoy your advice on dividend and stock investing and do believe that one should have a diverse portfolio. I applaud your passion and commitment to your journey and your inspiration to others to educate themselves on investment.

Thanks for the advice, Mike. I’ll look for that book.

I have no experience in real estate investment, and only started investing in the stock market this year; however, I’d love to know more about your success in real estate investment.