4 Steps for a Worry Free Retirement Course Review by Frugal Trader

It’s not every day that one of your co-writers pens the first online course for retirement in Canada.

Naturally, it only felt right that the first review of 4 Steps to a Worry Free Retirement was posted on Million Dollar Journey!

If you want to skip my review and see what the course is all about you can do that by clicking here.

As Kyle wrote about last week, he really deep-dived into several retirement topics over the past year – and even before that, he was writing articles on safe withdrawal rates in retirement that were so detailed, they were being quoted in Canadian Financial Planning journals.

As someone who has been writing about this stuff for over a decade-and-a-half now, I feel like I have some credibility in saying that this is simply the most complete resource you’re going to find when it comes to preparing for retirement in Canada.

If you check out Kyle’s bibliography in the course, you’re going to find every book that I’ve read on the topic (and several that I was not aware of before reading through the course).

The Difference Between a Teacher and an Adviser

I don’t want to belittle authors and financial advisers, but in general, I think it’s fair to say that when explaining concepts, they either struggle to go into enough depth to be useful to the average person, and/or they use so much industry-specific lingo that they lose people.

Often, the gist of most financial adviser-written material is, “Well, it depends. Each situation is different, so it’s best to seek out individualized advice.”

Roughly translated: “Please pay for my personalized services.”

Kyle really goes the extra mile to explain the tradeoffs involved when it comes to specific decisions such as:

- When to take your OAS and CPP payments?

- Is it a good idea to work part-time in early retirement?

- Should I move abroad to take advantage of lower cost of living?

- When is it best to withdraw from an RRSP and when does a TFSA make more sense?

- Do I have to turn my RRSP into a RRIF at age 65?

- What are the best investments for Canadian retirees?

- Is long-term care insurance a good idea?

These aren’t simple decisions, but when taken step-by-step, it becomes a lot easier to make an educated decision.

Kyle’s combination of original explainer videos, bite-sized content chunks, graphic organizers, case study examples, and full-length expert interviews, are a really effective way to communicate the pros/cons when it comes to each important decision. There is no financial advisor who has enough time to fully explain your financial plan to this degree.

If you want to check where the information came from, Kyle provides direct links to resources so that you can decide if they are trustworthy. I personally found all of his research to be based on the sound expertise of not only Canada’s leading experts, but also top-notch international sources as well.

Quick Reviews of 4 Steps to a Worry Free Retirement

I was also one of several folks who Kyle tapped on the shoulder to give him feedback on various aspects of the course. So, if it means anything, the information that is presented is as good and accurate as we could collectively make it.

Of course, he also had several other prominent personal finance bloggers, columnists, and Certified Financial Planners read through the content to get their takes as well. Consequently, I can vouch for the fact that it has been thoroughly fact-checked.

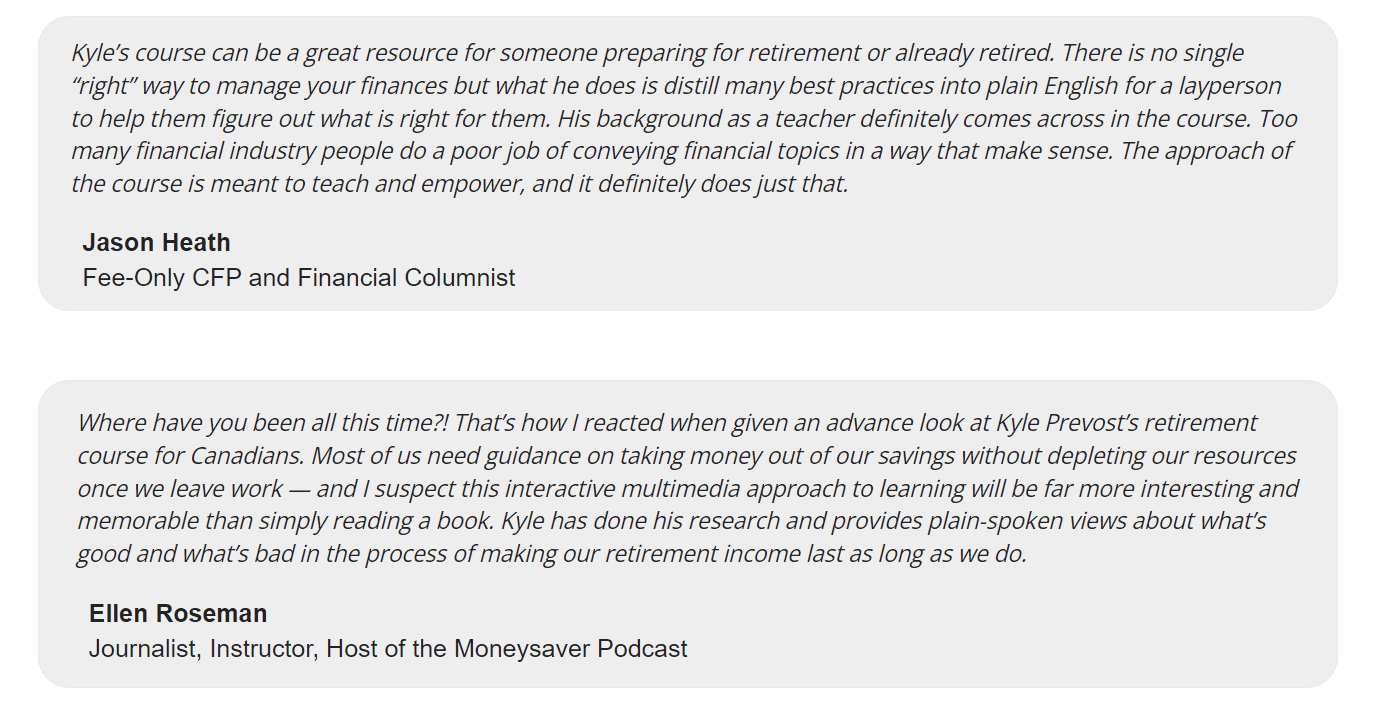

Don’t just take my word for it though – here’s what long-time personal finance journalist and university professor Ellen Roseman, as well as prominent writer and fee-only financial advisor Jason Heath had to say about the course.

4 Steps Worry-Free Retirement Online Course Cost

Projects that qualified people pour a year of their life into aren’t free.

That said, at $500, 4 Steps to a Worry-Free Retirement is an excellent value. I know Kyle has said that this is just an introductory rate, and while he will keep the price low enough that middle-class Canadians can afford it, similar online courses retail for $2,000+.

I’m not sure how long this introductory rate will stick around, so I wouldn’t delay.

After all, with a 100% money-back guarantee if you don’t find the information worth it, where is the risk?

Here’s the value proposition from my perspective:

- No more searching all over the internet for a little bit of info on CPP here, and RRIFs there, and maybe bookmarking 10+ articles on investing while in retirement, etc. It’s all here in one place, likely saving you hundreds of hours.

- The Thinkific platform that the course is on is ridiculously easy to use. Like a thousand times easier than what colleges and universities are using for online education these days.

- The course costs far less than what most Canadians are already paying for financial advice due to our high mutual fund fees in Canada.

- No pesky monthly subscription costs – just a one time fee.

- Unlimited updates. Kyle has promised me that he is going to keep this thing updated – after all, he wrote it with his own parents in mind, so I’d say he’s plenty motivated! No book is going to be able to do that.

- The money-back guarantee lets you see the course with absolutely no risk.

- Kyle blends whiteboard explainer videos, interviews, charts, and case studies, with the accessible writing that you read on this site. It’s simply one-of-a-kind in that regard, and makes the course feel a lot less like a book, and more of an interactive classroom.

- The sourcing of the information is easy to track via basic links all over the internet. If you want to find out where a statistic came from, it takes 2 seconds.

Ultimately… what are you waiting for?

Don’t endlessly procrastinate your retirement planning or depend on some salesperson in a suit. Quit thinking, “Well… maybe I have to go one or two more years… I just don’t know how much is enough.”

I honestly think this course is going to save most retirees tens of thousands of dollars.

More than that though, it’s going to give them confidence and peace of mind that is essential when headed into retirement.

I could make an easy case for Kyle to charge ten times what he’s selling this course for. At $500, it’s simply a fantastic value for a product that has no comparable rival in Canada.

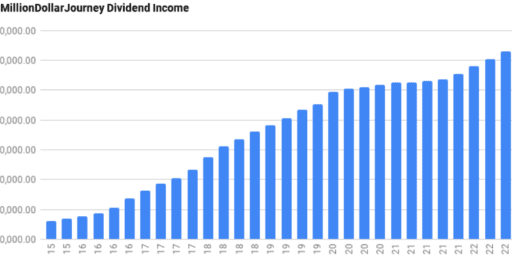

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?