Dogs of the TSX Dividend Stock Picks

The “Dogs of the TSX” dividend investing strategy for Canadian stocks has been a focus of mine for the past 13 years. I don’t follow the “Dogs” strategy with 100% of my portfolio, but it is a key factor when I look at my relative weighting of Canadian stocks at the end of each year.

I want to make it clear that the Dogs of the TSX is not something that I created. In fact, it’s actually an American idea. Michael B. O’Higgins wrote a book called the Dogs of the Dow back in 1991, and the idea was later adapted to the Canadian market. I first came across the “Dogs” method of stock picking when MoneySaver magazine started a column titled BTTSX – short for Beating the TSX – dividend stock strategy.(Click here to skip directly to my 2025 picks).

The theory behind the Dogs of the TSX strategy is to look for solid cash-flow positive stocks that have fallen out of favour for one reason or another. In other words, you’re looking to take advantage of short-term market inefficiency when it comes to the pricing of blue-chip Canadian stocks.

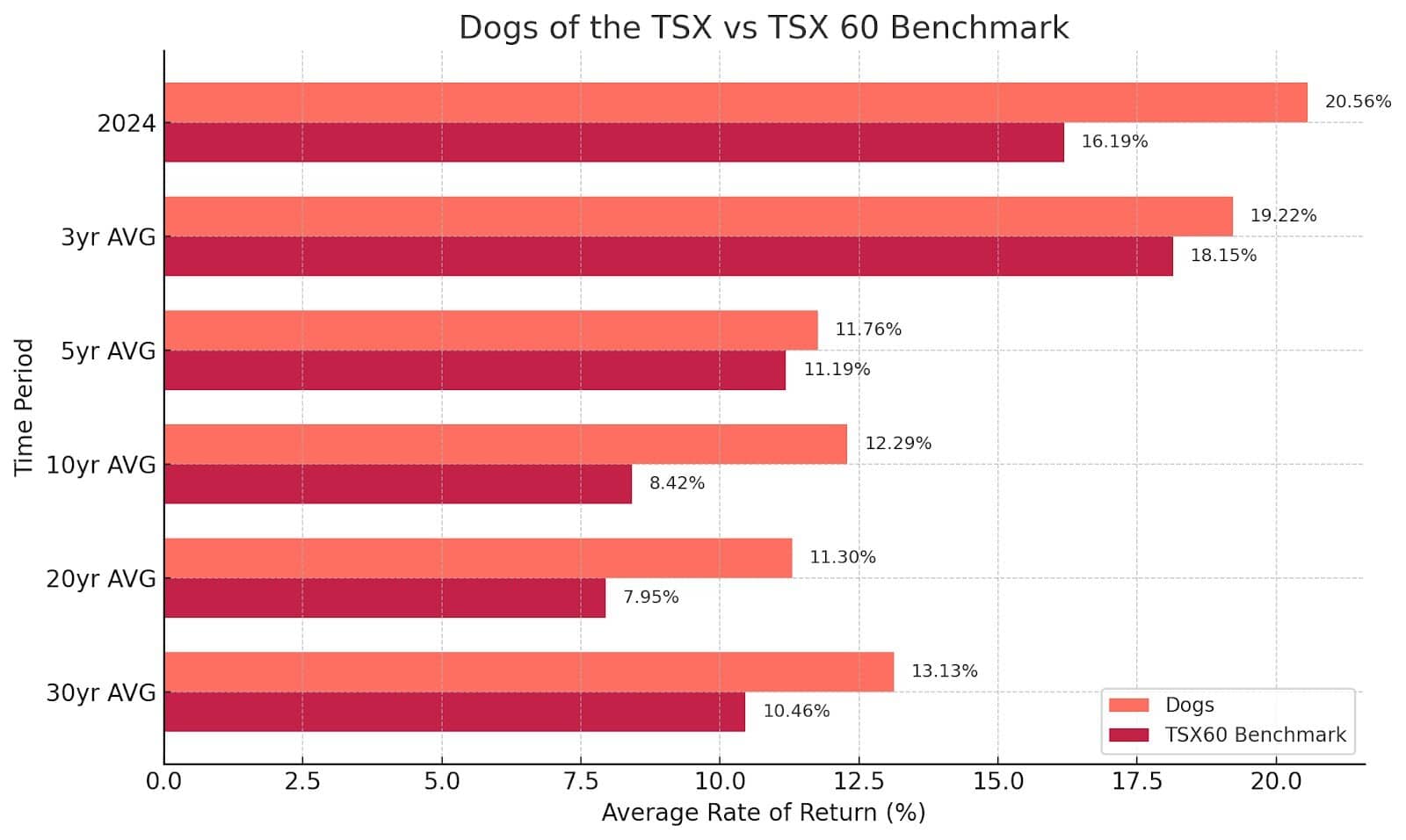

While the Dogs of the TSX investments finished 2024 a little over 3% behind the overall TSX 60 index, if we go back to 2022, the 3-yr performance favours the BTTSX stocks. If we go back even further, we can see that over the last three decades, the Dogs of the TSX stock picking strategy has outperformed the average of the TSX 60 once by about 2.6% annually. All numbers include dividends in overall returns.

If you had $100,000 invested 30 years ago, the constant difference in compounding would have left you about $2 million richer today had you followed the Dogs of the TSX BTTSX strategy.

The highlights for “Dogs 2024” included pipelines being much more profitable than many feared, with Enbridge and TC Energy having excellent years up about 28% and 42% respectively. The other big winner was unloved bank CIBC – which had been a perennial underperformer for quite a long time (exactly the type of company that the Dogs strategy is meant to systematically select).

The laggards included Algonquin (which continued its freefall), Bell, and Telus, which all saw substantial losses in a real bull market of a year.

In its pure original form, the Dogs the TSX strategy simply involved ranking the companies in the Toronto Stock Exchange 60 index (aka: TSX 60) by their dividend yield. The highest yield gets the top spot. Then you simply choose to invest equal amounts in all ten stocks.

The idea is that investing in companies that have relatively high free cash flow – but relatively low share prices – is an excellent way to systemically outperform the broader market. No need to pick stock winners with any sort of fancy algorithm – just choose dividend stocks that are out of favour and consequently have high yields.

The average yield for the stocks making the 2025 Dogs of the TSX is about 6.5%.

In my own implementation of the BTTSX strategy I eliminate Real Estate Investment Trusts (REITs), and any stocks that have cut dividends OR have insanely high payout ratios (foreshadowing a future dividend cut). Those rules helped me avoid the Algonquin disaster last year.

You’ll notice that my Dividend Dogs of the TSX list has a lot in common with my Best Canadian Dividend Stocks list that I update monthly. There’s obviously a lot of overlap in selecting value-driven, stable, Canadian company stocks.

Top Canadian Dogs of the TSX Pick for 2025: Power Corp (POW)

My favourite stock of the 2025 Dogs of the TSX is the same one as it was in 2024: Power Corp (POW) – an old standby for Canadian dividend investors.

The stock didn’t do badly in 2024, but it didn’t break out enough to make me feel like it has fully realized its value. I’m cautious heading into 2025, and I don’t see a ton of stocks screaming “buy” right now, so I’m doubling down a cautious operator. By the way, when I say it didn’t do badly, Power Corp still returned over 23% – beating our TSX 60 benchmark.

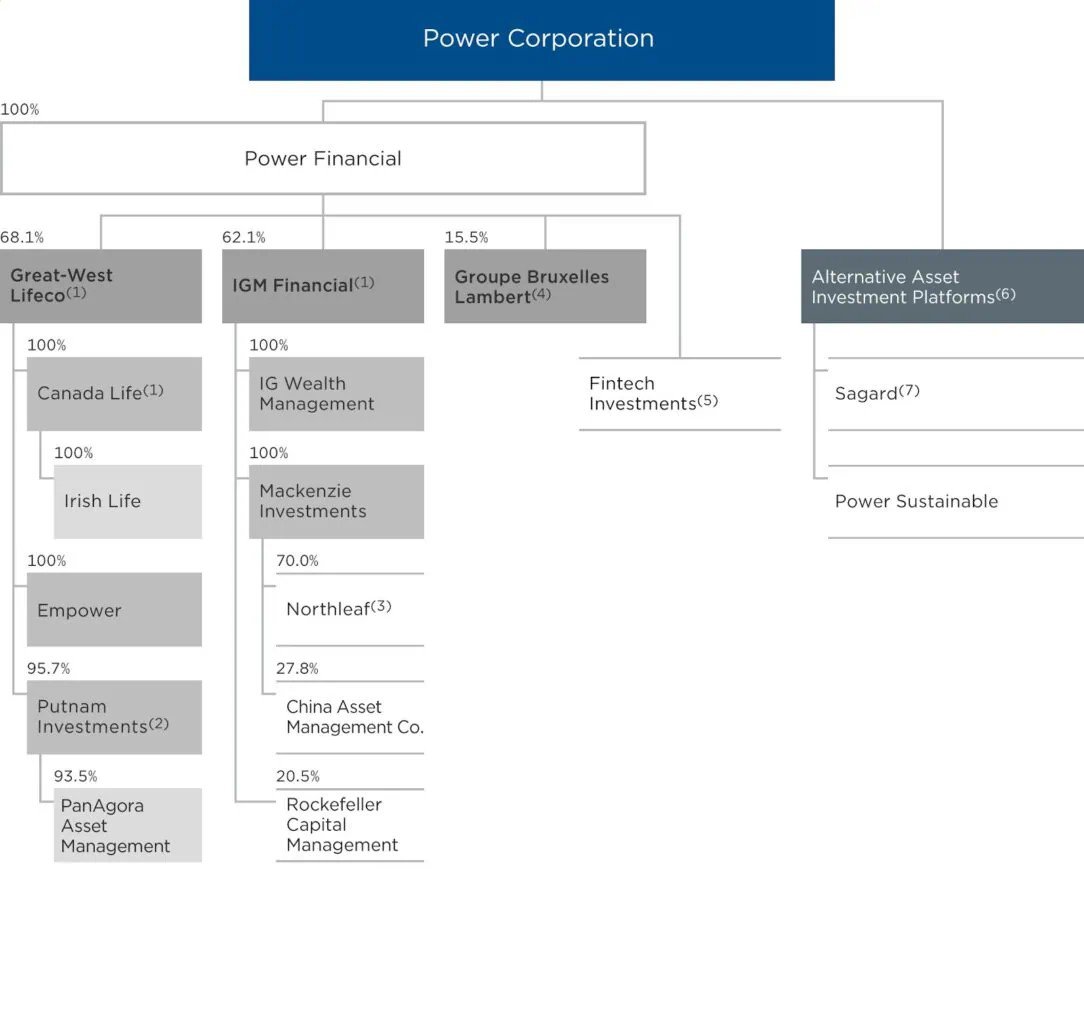

For those that aren’t familiar with the company, Power Corp is basically a holding company for Great-West Life Insurance, IGM Financial (previously “Investor’s Group” and “Mackenzie Investments”) and a holding company full of European diversification that goes by Groupe Bruxelles Lambert. You can see their entire business structure below:

Of these companies, Great West Life is by far the biggest chunk of the overall Power Corp portfolio (making up nearly 70% of the holding company). Insurance companies should do better than vanilla bank stocks if interest rates don’t get back to the lows of three years ago. I think we’re going to see some inflationary pressure from the Trump presidency, and interest rates are going to stay higher than we thought a few months back.

While I am less of a fan of the various mutual-fund-dependent companies under the IGM banner, I think Power has made a smart investment in the Wealthsimple robo advisor, which should help to offset the losses they see in their traditional wealth management models. Wealtsimple could make big news if its bid to become a Schedule 1 Bank goes through. Essentially Power is disrupting their own business model before someone else does!

Last year saw a really solid Earnings-per-Share jump for Power Corp, and their Great West Life crown jewel looks significantly undervalued to me – especially if interest rates begin to decrease. With a very reasonable P/E ratio of about 13x, and a juicy 5.2% dividend yield, I think it’s tough to go too far wrong. Power Corp had an excellent return on equity last year of 11%, and I see no reason that shouldn’t continue. Both Great West Life and IGM increased their assets under management by 12% for the year. Perhaps most importantly, POW saw a 7.1% dividend increase in 2024, and I assume 2025 will be more of the same. (I’d be very surprised if it was under 5%.)

Bottom line – I think Power Corp is worth more than the sum of its parts, and I love the dividend I’m going to get paid (not to mention the stock buybacks) while investors come to realize the underlying value of the companies in the Power portfolio.

Sure, it’s not the flashiest stock. I have to admit my mouth waters a bit when I see the returns that CIBC and the pipelines put up last year. I also think that TD’s share price has been beat up far past what is reasonable considering their strong position within Canada.

All that said, I already have significant positions in those companies, so it’s not like I’m saying dump all of your pipeline stocks and buy only Power Corp! I’m simply saying that I plan to overweight purchases of Power Corp in the short term.

September 2025 Dogs of TSX Update: I’m happy to report that my confidence in Power Corp wasn’t misplaced. POW is up nearly 30% year-to-date, and that doesn’t even count the 5%+ dividend yield that we started the year with! The combination of steady dividend income, strong insurance performance, and a market finally starting to recognize the undervaluation story has really paid off.

The biggest driver has been Great-West Life’s robust earnings, which have benefited from persistently higher interest rates and better-than-expected insurance margins. On top of that, IGM has quietly stabilized its asset base, and Wealthsimple continues to expand its footprint, with more rumours swirling about that Schedule 1 bank licence approval. Investors are finally pricing in the fact that Power Corp isn’t just a stodgy old financial holding company. It’s a well-run, diversified business with growth levers in both traditional finance and the fintech space.

And with another dividend increase likely on the horizon, I’m happy to keep holding and collecting those cheques.

Adjusted net earnings are up 19% year-over-year, and the company is currently sitting on $1.3 billion in cash (that it can reward shareholders with through increased dividends or stock buybacks).

Also, I’d be remiss if I didn’t point out that I was also a big proponent of TD Bank stock to start the year. That share price is up even more than Power Corp’s Year-to-Date!

Given that I had a swing and a miss with my Sunlife dividend pick to start the year, I’m happy to point out that on average, I’m still crushing the broader TSX and S&P 500 markets (without the volatility).

Dogs of the TSX Dividend Stock Strategy Implementation

Here is the step by step procedure of how this strategy is implemented:

1. Sort the TSX60 by dividend yield.

2. Purchase the top 10 positions with equal dollar amounts but remove former income trusts (maybe some exceptions) and stocks that have a shaky dividend history (ie. dividend cuts, cyclical companies, pausing dividends etc).

3. Hold your positions until the new year at which point you check the list of top 10 yielding blue chips on the TSX again. If there are any differences, you swap out positions until they match.

4. Repeat annually going forward.

While it may sound like a lot of portfolio churn, since the TSX is fairly small, the top 10 list doesn’t vary much from year to year.

It also turns out that a number of the largest dividend stocks in Canada are also dividend growth stocks. While the traditional method of picking these positions is to buy the top 10 while removing former income trust and companies that have cut their dividends in the past, I prefer to pick stocks that also have a history of dividend increases (most of them do).

Performance of the BTTSX Strategy

As magical as it may seem, this strategy has been outperforming the TSX over the long term. Mind you, the strategy does not outperform every single year, but it has outperformed over the long term (however, note that past results do not guarantee future returns).

According to the Beating the TSX Wiki page, between 1987 and 2017, the BTTSX had an average return of 12.4% vs the TSX which has returned about 9.6%.

As you know, small improvements in portfolio performance can lead to a significant difference in portfolio size over the long term. Note my article on improving your portfolio performance by 1.7% through reducing your portfolio MER can lead to a 60% difference in portfolio size over 30 years. It also helps to use a low-cost online broker.

I like this strategy in that investors are getting the highest possible yield out of the largest blue-chip stocks in Canada with the possibility of dividend increases.

The downsides are that there is annual turnover (usually minimal) which can result in a tax hit in non-registered accounts and potential lack of diversification depending on the year. For example, one year, it could be a high concentration of financial stocks in the portfolio, and the next could be utilities.

Beating the TSX Dividend Stock Picks For 2025

Now, for what you’ve all been waiting for, the 2025 BTTSX stock picks (with a juicy average dividend yield of about 6.5%!)

- Enbridge (ENB)

- BCE (BCE)

- TC Energy Corp (TRP)

- Canadian Natural Resources (CNQ)

- Bank of Nova Scotia (BNS)

- Telus (T)

- Pembina Pipeline (PPL)

- Emera (EMA)

- TD Bank (TD)

- Power Corp (POW)

If you’re curious, here’s what the Beating the TSX strategy looked like for me in 2024:

- Enbridge (ENB)

- BCE (BCE)

- TC Energy Corp (TRP)

- Algonquin Power and Utilities Corp (AQN)

- Bank of Nova Scotia (BNS)

- Telus (T)

- Pembina Pipeline (PPL)

- Emera (EMA)

- CIBC (CM)

- Power Corp (POW)

And here’s what I chose in 2023:

- Algonquin Power and Utilities Corp (AQN)

- Enbridge (ENB)

- TC Energy Corp (TRP)

- Bank of Nova Scotia (BNS)

- BCE (BCE)

- CIBC (CM)

- Power Corp (POW)

- Pembina Pipeline (PPL)

- Manulife (MFC)

- Telus (T)

Finally, here’s what my implementations of TSX Dogs has for me in 2022:

- Enbridge (ENB)

- Pembina Pipeline (PPL)

- BCE (BCE)

- TC Energy Corp (TRP)

- Manulife (MFC)

- Algonquin Power and Utilities Corp (AQN)

- Power Corp (POW)

- Suncor (SU)

- Bank of Nova Scotia (BNS)

- Telus (T)

The 2025 Dogs of the TSX group contains 2 telcos, 3 financials, 1 pure utility, 1 utility + renewable hybrid, and 3 pipeline utilities (or “mid-stream” energy companies). For a complete portfolio, we would also need materials/resources, real estate, technology, and consumer stocks. If you want to round out your dividend portfolio, check our top dividend stocks for 2025.

If you are considering this strategy, I would recommend using it as part of your Canadian exposure and using index ETFs for global diversification.

My top 10 holdings after 13 years of doing the BTTSX stock strategy are:

- Enbridge (ENB)

- BCE (BCE)

- TC Energy Corp (TRP)

- Telus (T)

- Manulife (MFC)

- Bank of Nova Scotia (BNS)

- TC Energy Corp (TRP)

- Power Corp (POW)

- Pembina Pipeline (PPL)

- CIBC (CM)

The 2025 Dogs of the TSX group contains 2 telcos, 3 financials, 1 pure utility, 1 oil stock, and 3 pipeline utilities (or “mid-stream” energy companies). For a complete portfolio, we would also need materials/resources, real estate, technology, and consumer stocks. If you want to round out your dividend portfolio, check our top dividend stocks for 2025.

I decided to continue to eliminate Algonquin from consideration considering the dividend cuts and the fact they probably should’ve been dropped from the TSX 60 index this past year. In its place, the next highest yield was Canadian Natural Resources, which is also one of my top Canadian dividend stock selections for the year. It was also a great way to diversify this list – so it made sense on several levels.

If you are considering this strategy, I would recommend using it as part of your Canadian exposure and using index ETFs for global diversification.

My Own Implementation of Beating the TSX

I mentioned in an earlier financial freedom update that my spouse had some cash saved up, and we were looking to deploy into dividend stocks using the Dogs of the TSX strategy. We ended up opening yet another account at Qtrade.

My net worth update from the end of the 2023 shows that I’m now generating $78,800 in dividend cash flow each year. That’s a figure that I logically thought I would see one day when I did the math, but it’s still somehow a surprise when I typed it out.

Being a dividend growth investor, we decided to utilize a hybrid approach to this strategy. We essentially sorted the TSX60 by yield, but only picked stocks with a history of dividend increases. We also added a couple of positions for diversification. So it’s not a pure Dogs of the TSX investing strategy.

While going through this process for 5 years now, I’ve noticed that I’m good at picking and buying the stocks, but terrible at selling! I’d much prefer to add to existing or new positions with new money rather than selling to gain capital. As of this post, I have not sold any of my original positions.

Since inception in September 2017 to January 2022, using XIRR the portfolio has returned about 12% while the index (XIC.TO) has returned about 8%. Not a bad result, but in reality, I’m more focused on the dividends that the portfolio produces.

My Overall Top 2025 Dividend Picks After Adjusting for Dividend Growth

Ticker | Sector | Div Streak | Dividend Yield | 5yr Revenue Growth | 5yr EPS Growth | 5yr Dividend Growth | Payout Ratio | P/E | |

Fortis | FTS.TO | Utilities | 51 | 3.51% | 5.90% | 5.03% | 4.89% | 74.53% | 20.62 |

Canadian National Railway | CNR.TO | Industrials | 28 | 2.64% | 4.51% | 9.61% | 9.16% | 48.07% | 18.54 |

Canadian National Resources | CNQ.TO | Energy | 23 | 5.29% | 16.41% | 4.76% | 23.03% | 74.30% | 11.28 |

Telus | T.TO | Communications | 20 | 7.61% | 6.22% | -9.43% | 7.04% | 233.03% | 34.49 |

Emera | EMA.TO | Utilities | 18 | 4.34% | 8.06% | -3.33% | 3.22% | 167.81% | 22.64 |

National Bank | NA.TO | Finance | 14 | 3.12% | 10.01% | 12.99% | 9.93% | 40.08% | 14.85 |

Alimentation Couche-Tard | ATD.TO | Business | 14 | 1.04% | 9.32% | 1.83% | 22.77% | 19.58% | 19.75 |

TD Bank | TD.TO | Finance | 13 | 3.71% | 8.84% | 8.53% | 6.04% | 86.14% | 9.70 |

Brookfield Corp | BN.TO | Finance | 12 | 0.52% | 3.69% | -28.67% | -5.59% | 104.65% | 163.00 |

Sun Life | SLF.TO | Finance | 8 | 4.18% | -0.96% | 6.73% | 9.35% | 61.50% | 14.97 |

?????? (Hidden, click for access) | (Hidden, click for access) | ?????? (Hidden, click for access) | ?? | ?.??% | ?.??% | ?.??% | ?.??% | ???.??% | ??.?? |

Taking Dividend Investing to The Next Level

Most of my picks are based on the information I get from Dividend Stocks Rock (DSR). They offer a free newsletter full of excellent advice that will help you maximize your yields.

On top of that, the optional paid subscription gives you access to a bunch of excellent tools, as well as expert advice tailor-made for your specific portfolio!

DSR is managed by fellow blogger Mike from the Dividend Guy Blog since 2013, and his results during that time have been nothing short of amazing. Read our detailed DSR review, or sign up now by clicking the button below to get 33% off.

Dogs of the TSX FAQ

Final Thoughts

As you can see, the BTTSX strategy has been outperforming the TSX over the long term. Mind you, the strategy does not outperform every single year, but it has outperformed over the long term (however, note that past results do not guarantee future returns).

Perhaps it’s the fact that large-cap stocks on the TSX tend to beat Canadian small caps, which at times can act as a drag on the overall index (Canadians love their oligopolies with large barriers to entry after all). Another reason may be that as yields rise for blue chips, it may mean that their stock price is relatively low which can equate to a form of value investing.

If you are considering the Dogs of the TSX strategy, I would recommend using it as part of your Canadian exposure and using all-in-one ETFs for added diversification.

Using an all-in-one ETF can give you instant international exposure, and is especially key for getting some of your money into areas like tech and healthcare where Canada doesn’t have many champions.

Canadian dividend stocks have historically been an excellent value (and I honestly believe they represent one of the best places to build your nest egg) but a responsible investor knows that diversifying risk is essential to long-term success. See my Canadian dividend stocks list for more information on what I’m putting new money into these days.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Thoughts on AQN with its recent cuts? Does this one get dropped going forward? Probably doesn’t even make the list anymore with its yield. Are you going to sell it off?

FT updates the list annually Vic. For now, it stays. It’s a “Dog” – but maybe the valuation is good at the current point?

Article could use some clarity ; which is final list for building starting now a dogs of the tsx prtfl and which is his personal, seems quite a diff and some of title work does not clearly differentiate if he is talking exclusively about the beating the tsx ie dogs of the dow and his pure dividend pritfolio = left scratching my head…..

last should day “dogs of the tsx”

nice one will all the ROGERS + SHAW drama do you think Shaw can be a good choice at this point? or should it be swap with something different ?thanks

If any one is interested, there is a Canadian site dedicated to Beating the TSX:

DividendStrategy.ca

It has the annual list, plus updates to the portfolio monthly for those needing up to date information. There is also a complete list of the TSX 60 stocks organized by dividend yield.

BTSX has a long history of generating returns in excess of the benchmark. Interestingly, a recent post shows how Beating the TSX has out-performed the index over various time periods after recent market crashes, which is especially helpful given the current situation. If you’re not sure how to implement the strategy in a practical way, there is information on that too. All of the information is free.

I have some of these. The yields are great and these companies have been paying divs for decades.

My big worry right now is the Canadian ecomy is in trouble, 6 million jobs have been lost. I don’t think the full ramification of this is yet know, let alone priced in.

In a conservative approach, which of this would be the most secure to

1- continue paying divs?

2- not depreciate in price substantially?

Hello MDJ, I have ~120k of room between me and my wife’s TFSA account.

Do you think investing the 120k in the TFSA or RRSP account is a better choice right now?

We have the cash sitting in Questrade and I am trying to decide what to do.

Thanks

I will go for TFSA when market is down and RRSP when is up.