Is TD Bank Stock a Good Buy in 2024?

If you’re considering buying Toronto Dominion (TD) Bank stock in 2024, then you need to be aware of the bank’s individual performance, its abandoned merger with First Horizon, and the long term prospects for Canadian and American banking as well.

For more insights on comparable investment options, check out our article on the Best Canadian Bank Stocks, and if you’re deciding on a passive investing strategy rather than picking individual stocks, check out our Best ETFs in Canada guide.

WANT TO BUY TD Bank SHARES? Price, Performance & Analysis

- TD Bank Stock Price: 78.89

- Dividend Yield: 4.97%

- Price-to-Earnings (P/E) Ratio: 9.77

- 5yr Earnings Per Share Growth: 12.05%

- 5yr Dividend Growth: 8.66%

- Payout Ratio: 37.52%

Our 2024 TD Bank Stock Analysis

- At $57.50 per share, TD seems like a solid investment to buy and hold.

- It’s down from all time highs in early 2022.

- Dividend yield is relatively high at 4.97%

- Canada’s second largest bank, in the top 1% of banks worldwide.

- Minor risk of Canadian economic downturn (housing market)

Our TD stock analysis indicates that TD shares are at a fair price, and are expected to grow as the economy recovers. The dividend yield is relatively high, and it is expected to stay that way for quite some time.

We believe that TD shares will be ones to hold for the long run as Canadian and American banking earnings have recently increased. If you’re looking at investing for your future, check out our guide on the best long term investments in Canada for more information.

Should I Buy TD Stock in 2024?

Investing in Toronto Dominion (TD) stock guarantees a reliable and well-established asset for your portfolio. With a longstanding history of stable and conservative growth spanning multiple centuries, owning shares in TD is always advantageous.

In 2023, despite a decline in GDP growth and increased taxes, the Canadian banking sector has performed relatively well. It is worth noting that TD Bank also possesses diverse American investments, making it akin to owning a Canadian-American bank stock and offering the best of both worlds.

TD Bank’s position as the second-largest player in the Canadian banking oligopoly has contributed to its stock price consistently increasing over time. The high profitability of the banking sector, coupled with limited competition, has been advantageous for TD and other Canadian banks. If you’re asking me, the Canadian banking sector protects TD Bank and its peers from opposing threats. For more moat stocks like TD Bank, check out our guide on Canadian Wide Moat Stocks.

Furthermore, it is important to highlight that TD Bank’s proposed merger with First Horizon has been called off. This development leaves the bank with increased cash reserves, enabling it to recover from losses stemming from defaulted loans. I’m confident that this strategic move by TD’s management demonstrates their long-term vision for the bank’s future, ensuring its resilience in a challenging economic climate.

How Can I Buy TD shares?

You can utilize Canadian online brokerage services to buy shares of TD. We regularly update our list of best online brokerages in Canada, providing readers not only with the best overall recommendations but also the most advantageous promotional offer codes available in the market.

Once you have successfully registered for a brokerage account, buying TD shares, as well as any other stocks, becomes a straightforward process. Simply search for the ticker symbol, in this case “TD”, and determine the number of shares you wish to purchase.

For instance, let’s say you intend to invest $580 in TD shares, and the current price of TD stock is $58. You would enter “10” and select “market limit,” and then your online broker will present you with a prompt stating, “Do you want to buy 10 shares of RBC at $58 each, totaling $580?”

Once you confirm the order, the online broker will handle the remaining steps. Congratulations, you now own a portion of Canada’s second largest bank! An investment that we recommend holding onto for quite a while.

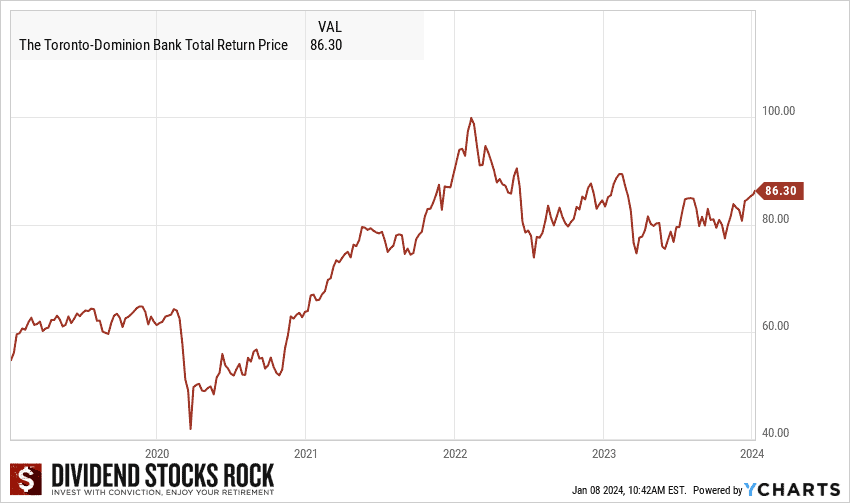

TD Bank Stock Past Performance

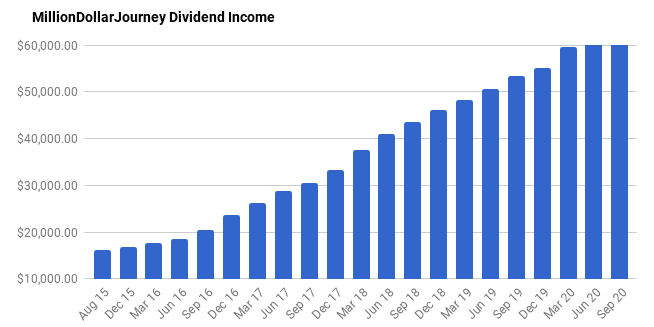

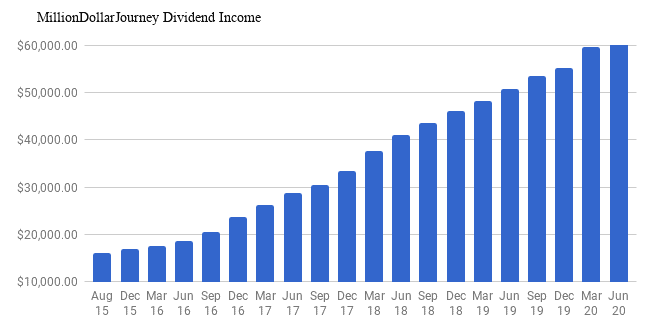

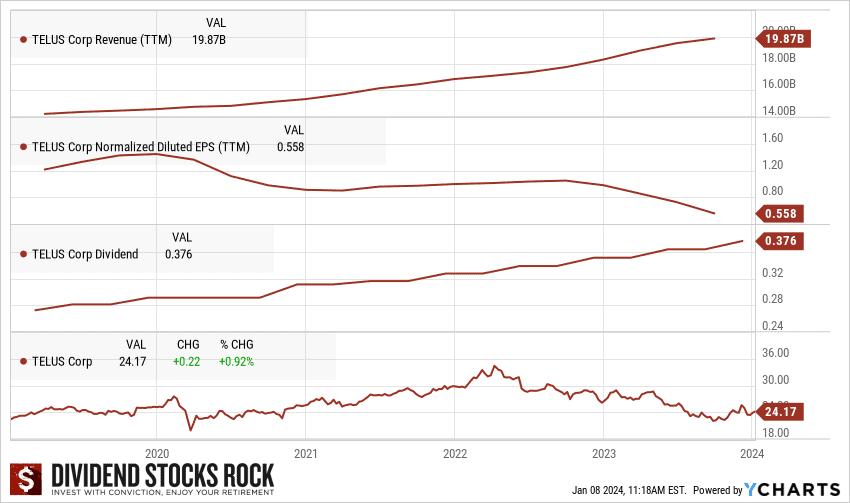

Over the past three years, TD Bank’s dividend has consistently increased alongside its revenues, as depicted in the graph above. This steady growth makes me confident as an investor that TD bank’s management and market position in the Canadian banking sector is expected to remain strong in the long run. I’m also confident that the Canadian banking sector will consistently deliver returns to its investors.

For more information on dividend investing, check out our updated list of Best Canadian Dividend Stocks.

As a long-term investor, I prioritize investments that not only provide a growing dividend but also exhibit steady capital gains. In the case of TD Bank, it has demonstrated a respectable 8% dividend growth rate over the past five years. TD sits between its peers as the National Bank of Canada has a 9% dividend growth rate and the Royal Bank of Canada stock has a similar 7% dividend growth rate.

For a comprehensive analysis and comparison of dividend stocks, including advanced statistics and a broader range of stock options, I highly recommend reading our Dividend Stocks Rock (DSR) review or visiting their site by clicking the button below.

TD Bank Stock Forecast

Even though TD Bank is the second largest bank in Canada, it is similar to its counterpart, RBC, as TD Bank has demonstrated consistent performance and remarkable stability. Based on this, it’s expected that as the economy recovers, TD shares are expected to go up. However, it’s important to note that past returns do not guarantee future outcomes.

It is no question that TD Bank is undeniably a remarkable company, poised to generate profits and create value for its shareholders. The key consideration lies in determining the extent to which the stock’s growth and value have already been reflected in its current price.

With a P/E ratio of 9.77, which is significantly lower than the historical average P/E ratio of 12.5 for Canadian banks, TD Bank is fairly valued. Considering its stability and established track record, I believe TD Bank is an intelligent choice for investors seeking a reliable Canadian bank stock to hold.

Check out our other picks for Best Canadian Bank Stocks if you’re searching for comparable Canadian investments.

Given the diversified nature of TD Bank’s earnings, it is reasonable to justify its position as a semi-Canadian/semi-American bank. This means that while it may benefit from the Canadian markets, it may struggle to compete with the large American banks.

However, as shown by the decision on the First Horizon acquisition, the company looks towards long term sustainability, making it a significant component of my investment portfolio.

Historically, TD Bank has consistently satisfied shareholders, instilling confidence in its future performance. As I evaluate TD Bank stock for 2024, it’s important to consider the company’s track record of success and anticipate its ability to navigate challenges.

If you’re asking whether TD Bank is a good buy right now, the outlook is positive. While this depends on the overall economic climate, with a strong foundation and efficient management, TD Bank is well-positioned for long-term growth and stability.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?