Is Suncor a Good Stock to Buy in 2024?

If you’re thinking about buying Suncor stock in 2024, it’s important to consider how the company has been performing, its dividend growth, and any recent changes in the energy industry. It’s also important to keep up with the company’s latest developments, all of which show that Suncor is a good buy right now.

If you’re looking to diversify your portfolio with more dividend stocks check out our article on Canadian Dividend Kings.

Want To Buy Suncor Shares? Price, Performance & Analysis

- Suncor Energy Stock Price: 38.82

- Dividend Yield: 5.47%

- Price-to-Earnings (P/E) Ratio: 6.37

- 5yr Earnings Per Share Growth: 34.06%

- 5yr Dividend Growth: 7.99%

- Payout Ratio: 28.60%

Outlook on the Oil Market in 2024

Market analysts are monitoring whether OPEC’s supply cuts will offset concerns of declining demand amid a potential global economic recession. Even though capital investments in the oil industry have reduced, fuel demand is increasing. While we expect ongoing volatility, there is a fair chance that oil prices reach around US$80 or $85 in the near term.

As an energy company engaged in oil extraction and processing, Suncor’s financial performance and profitability are closely tied to oil prices. If oil prices rise as anticipated, it can be advantageous for Suncor as it would likely lead to increased revenues, and an increased stock price to follow. However, if oil prices remain volatile or decline, Suncor may face challenges in maintaining profitability.

It’s crucial for investors and stakeholders to closely monitor the oil market dynamics and their potential implications on Suncor’s business performance.

Our Suncor Stock Analysis

- At $38.82 per share, Suncor seems like an underpriced stock to buy and hold

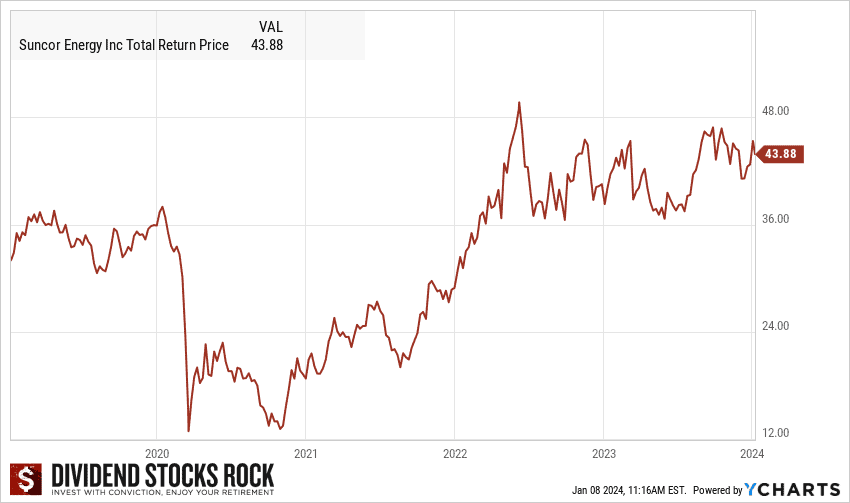

- It currently sits at the pre-covid price level, indicating recovery.

- Dividend yield is respectable at around 5%

- 3 year dividend CAGR sits high at 10%, with the sector growth rate being only 3%.

Our Suncor stock analysis shows that Suncor is currently underpriced and is in a great position for buying. We see that it presents a compelling opportunity for long-term investment as it is strongly positioned in the Canadian oil sector.

While some developments have not been swayed in Suncor’s way, such as losing out on the Surmont deal, I believe that the new CEO’s strategy to cut down costs and simplify operations will allow the company to refocus and recover in the upcoming years.

For more in-depth information on long-term investment opportunities, I suggest consulting our comprehensive guide on the Best Long-Term Investments in Canada.

Should I Buy Suncor Energy Stocks in 2024?

When considering buying Suncor stocks, you can be confident that you’re investing in a company deeply involved in the oil industry. Suncor plays a significant role in extracting and processing oil from Canada’s oil sands, making it a key player in the market. With such a substantial presence, holding Suncor stock can be a beneficial addition to your investment portfolio.

During its June meeting, OPEC made the strategic decision to implement additional oil production cuts while the United States opted to replenish its Strategic Petroleum Reserve (SPR). These actions have the potential to bolster oil prices once again. However, there remains a risk of oil price decline if China, the largest consumer of oil globally, enforces another lockdown. Amidst this ongoing tug-of-war between supply and demand, Canadian energy stocks like Suncor are poised to benefit.

As a key player in the energy sector, Suncor Energy is well-positioned to leverage this growth. However, it’s crucial to consider that Suncor Energy won’t be the sole contender for market expansion. This dynamic landscape underscores the need for Suncor Energy to navigate the competitive environment strategically and capitalize on emerging opportunities while balancing cost considerations.

If you’re seeking energy stocks that are less dependent on oil prices, we recommend checking out our list of the Best Renewable Energy Stocks.

Overall, I’m confident Suncor will provide investors with favorable returns, even in challenging market conditions. The company has a track record of delivering results, and while past performance doesn’t guarantee future outcomes, I believe Suncor’s management will effectively navigate upcoming obstacles and capitalize on opportunities in the energy industry.

How Do I Buy Suncor Stock?

You can use any one of the available Canadian online brokerage services to buy Suncor Energy shares.

At MDJ, we prioritize highlighting discount brokerages to our readers, helping them navigate choosing a broker to use. We ensure to keep our list of top online brokerages in Canada regularly updated. We also make sure we offer readers the finest overall recommendations as well as some of the best offer codes currently available in the market.

Once you have registered for an online brokerage account, it becomes a simple process to buy Suncor shares, as well as any other stocks for that matter. Simply use the search bar to search for the ticker symbol, in this case “SU”, and determine the number of shares you want to buy.

For example, let’s say you want to invest $4,000 in SU shares, and the current price of Suncor stock is $40. You would enter “100” and select “market limit,” and then your online broker will present you with a prompt stating, “Do you want to buy 100 shares of ENB at $40 each, totaling $4000?”

Once you confirm the order, the online broker will take care of Congratulations, you now own a portion of Canada’s largest integrated oil company! An investment that we recommend holding onto for quite a while.

If you’re looking for more guidance on investing in the Canadian stock market, check out our guide on How to buy stocks in Canada.

Suncor Stock Historical Dividend Performance

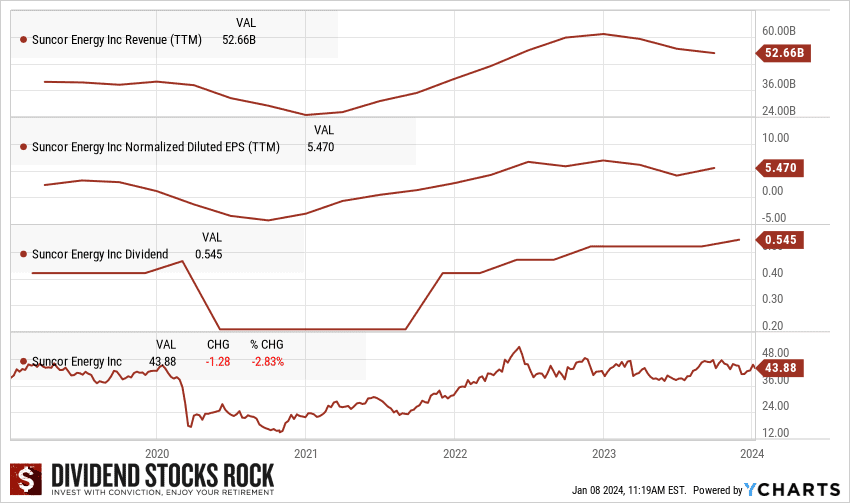

In recent years, Suncor Energy has had a pattern of consistent dividend growth, as shown in the graph above. We see that the revenues have fallen in 2020 and 2021, with a 55% dividend cut between mid-2020 and mid-2021.

This was during the Saudi-Russian price war, and since then prices have recovered along with Suncor’s revenues. Suncor has also recovered its dividends to pre-Covid levels, and is expected to grow in the coming years.

As an investor, this upward trajectory in dividends, coupled with the company’s robust revenue figures, instills confidence that Suncor’s management team and its prominent position within the Canadian energy sector are poised for enduring stability and growth in the long term.

I am highly optimistic about Suncor’s ability to consistently generate substantial dividend returns. I also believe that the current energy crisis will last for quite a few more years, which would benefit Suncor energy and other Canadian energy companies.

For more comparable investments to Suncor energy, take a look at our guide on Canada’s Best Energy Dividend Stocks. But if you’re looking for more information on dividend investing as a whole, then look no further than our updated list of Best Canadian Dividend Stocks.

As someone who likes to buy long term positions and hold them for years, I prioritize steady growth, consistent dividends and underpriced stocks to buy for the long run. In Suncor’s case, it has delivered a quite high 7% dividend growth rate over the past five years.

In comparison to the sector median growth rate which only sits around 3%, Suncor outperforms its peers when it comes to dividend growth. For me, buying Suncor right now is perfect as its stock price has come down recently, but with new changes and a consistent dividend growth, I believe it has great potential.

When I want to dive deep into analyzing dividend stocks, exploring advanced statistics and a wide range of stock options, I consistently turn to the Dividend Stocks Rock (DSR) guide for my dividend investing needs. It provides me with a comprehensive analysis that helps me make informed decisions and navigate the world of dividend investing with confidence.

Suncor Stock Forecast

Suncor released its financial results for the first quarter of 2023 on May 8, revealing net earnings of $2.05 billion, which is lower than the earnings for the same period in 2022.

Despite this decline, Suncor shows potential for future growth. Being recognized as one of the dependable dividend stocks listed on the TSX, Suncor continues its commitment to providing reliable dividend payments to its shareholders.

To gain further insights into the Toronto Stock Exchange, explore our comprehensive guide on the Dogs of the TSX.

Suncor is at its core, dependent on the price of oil. Most of its assets are high-cost oil sand developments that are only profitable if oil is $20 per barrel. That said, it’s good to see that Suncor is trying to remain lean when it comes to its workforce, and is focused on rewarding shareholders with dividends. Just last week the company announced they plan on cutting 1,500 jobs by year end in a bid to save costs.

Under their newly appointed CEO, the company has restructured their finances and have reversed their dividend cut decision in 2020. No one knows for sure what the price of oil will do going forward, but I think the recent turmoil in Russia shows that we will be dependent on ethical oil produced in countries with strong rule of law for a while yet.

If you’re looking towards a passive investing approach and prefer investing in ETFs rather than selecting individual stocks, I recommend checking out our comprehensive list of the Best ETFs in Canada. This resource provides valuable insights into top-performing ETFs that can help you achieve your investment goals.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?