Best Strategies to Hedge Against Stock Market Downfall

Having a stock hedging strategy is like having insurance… sort of.

In general, it’s good to have a way to minimize damage when things go wrong. In a best-case scenario, that’s what hedging against stock market crashes does.

The Risks And Downsides of Hedging Strategies

When formulating a hedging strategy, it is good to clarify the specific risk you are hedging against. (Hedging against something generally means protecting yourself from that risk.) For example, car insurance hedges against potentially huge and unavoidable cost of property damage or injury. You spend a little money now on an insurance premium to hedge against a potentially large loss.

What about the risks involved with a stock market crash?

There are many examples of downturns in stock market history. The Canadian and U.S. markets fell after the tech bubble burst in 2000, declined after the financial crisis in 2008, dipped at the end of 2018, and most recently, the markets crashed in early 2020 in response to the Covid-19 pandemic. Through some of those crashes, the stock market value dropped 50% from its peak value.

That is certainly a scary scenario! Seeing one’s investment portfolio drop to half its value is devastating and has been compared to a serious car crash.

But I think that’s a tad dramatic…

After a serious car crash, the car needs to be repaired or replaced, property damage must be paid for, and personal injury must be rehabilitated. You have to pay those unavoidable costs, and you have to pay them immediately.

After a stock market crash, you don’t actually lose any money.

Contrary to what the headlines might have you believe, as long as you don’t sell, the loss in value stays unrealized. Given enough time, the stock markets have eventually turned around, recovered to previous highs, and continued to rise. Sometimes, the turn around takes years, sometimes the recovery happens over just a few months.

History has shown that stock markets in most developed countries rise over time and eventually recover from downturns. Just look at the S&P 500 index valuations over a long period: The early 2020 losses have already been erased, the 2018 downturn barely registers, the cataclysmic financial system meltdown in 2008 looks like a small dimple, and the bursting of the tech bubble is just a minor dip. The same goes for earlier crashes in history, the effect of the oil crisis in the 70s and even of the great depression in the 30s have all been erased by the flow of time.

Given enough time and discipline to hold on through a market downturn, the risk of losing money in the stock market over the long term is actually very low. For anyone with an investment horizon 10 years or more, there is really no need to have a hedging strategy.

Hedging strategies cost money (just like insurance), so it’s worth mentioning that historically speaking, if you simply hold on through the downturn you’ll likely turn out just fine.

If you happen to have a portion of your investments in lower volatility instruments like bonds or high interest savings accounts, you can even take advantage of market downturn and buy more stocks at a discount. This strategy won’t hedge against short term market downturn but would really boost your gains over the long term.

Disciplined investment into the stock market is actually a low risk activity.

Simple index investing is really the best strategy for most people and MillionDollarJourney has many resources on that topic. See FT’s Top 6 Indexing Options for Your Portfolio article, the latest update on the Best All-in-One ETFs in Canada, and Hannah’s article on the Best Robo Advisors in Canada.

Fine, But I Want Short Term Insurance Anyway

Okay okay, you came here to read about hedging strategies against short term market downturns. You still want to hedge your bets and minimize losses. There are many types of hedging strategies, I’ll talk about just three:

1) long assets that have low (or negative) correlation to the stock market;

2) invest in a volatility index; and

3) trade options.

A warning: all these strategies require accurate predictions for the future, accurate prediction for timing of significant events, and once implemented, require active management. Be honest, how well do you understand the stock market and the economy, how good are you at accurately predicting the future, and do you have the time to actively manage your hedging instruments?

I myself don’t fully understand the stock market or the economy. My crystal ball is always cloudy, and I don’t want to constantly check on my investments and make buy/sell decisions. So I don’t actively hedge against stock market downturns.

My long investment horizon is my best hedge.

As I get older and accumulate more assets, my stance may change, but at this time, in my late 30s, time-in-the-market is still my go-to hedging strategy.

With that Debbie Downer warning and disclaimer out of the way, let’s look at these hedging strategies.

Hedging Strategies for Stocks Using Low Correlation Alternatives

The first hedging strategy example is to long (i.e. buy) assets that don’t tend to follow movement in the overall stock market. Or even better, long assets that move in the opposite direction to the overall stock market. In other words, when they zig, you zag.

Stock market crashes indicate the shifting of overall investor sentiment balance towards fear and pessimism for the future. When that fear sets in, people tend to gravitate towards investments that feel safer. Government bonds, precious metals like gold, and consumer staple stocks like Walmart, Dollar Tree, Johnson and Johnson are some “safe havens” people tend to flock to when the broader stock market tumbles downward.

If you foresee a market downturn on the horizon, you can pull some of your investments out of stocks and redirect them into these so-called “safe havens.” When the market value declines, the redirected portion keeps its value or, better, even increases in value. Then as the markets recover, you can redirect your investments back into the stock market.

Aside: if you’re looking to keep up to date with what’s the best discount brokerage in Canada, we have you covered. See FT’s latest article: Canada’s Best Discount Brokerage Comparison.

This hedging strategy sounds insultingly simple. It’s almost too obvious. But in reality, it is very difficult to execute successfully. It is very difficult to predict the direction and timing of stock market movements and therefore hard to time the shift to “safe havens” and avoid a stock market drop. If you start the shift after significant market decline, you miss out on the protection of these “safe haven” investments.

Similarly, it’s also difficult to know when to shift your investments out of “safe havens” and back into the stock market. If an asset is negatively correlated to the stock market, its value would increase when the overall market value decreases. That’s helpful during market down turns but once the markets rebound, this asset would drop in value.

Just as it’s difficult to time market drops, it’s also difficult to time market booms. If you miss the rise in the overall stock market, you would miss out on the gains in the market and may even see your investments in the “safe havens” drop in value. A whole lot of luck is needed to consistently shift in and out of the stock market at just the right times.

Fair warning: “safe haven” assets do not have perfect negative correlation with the stock market. That is, they don’t always move in the opposite direction to the stock market. The magnitude of their price movement is not proportional to the price movement of the stock market. And they experience volatility in their prices as well. These variables make it even more difficult to consistently time the shifts into and out of these “safe havens.”

Aside: I hope I don’t have to say this but crypto currencies are not “safe havens.” The price of bitcoin, in its relatively short life, seems to move roughly in the same direction as the overall stock market. Not to mention, the extreme volatility and huge movements in bitcoin price would make it a very difficult hedging instrument to manage. You can use crypto currency as a separate investment vehicle if you’d like, but it won’t work well as a hedging strategy. You can read our brand new guide to investing in bitcoin here.

Prices of all assets are ultimately tied to human emotion and sentiment. And sentiment is one of the least predictable things in the world.

Use Fear as a Hedging Instrument Against Stock Market Crash

Warren Buffett famously says “Be fearful when others are greedy and be greedy when others are fearful.” I believe he means: buy more stocks when fear in the market drives prices down, but there is another way to capitalize on fear. That’s where our second hedging strategy example comes in.

The CBOE Volatility Index (ticker symbol VIX) is an index that predicts expected short term market volatility. Its nickname, The Fear Index, gives you an idea of what this index measures.

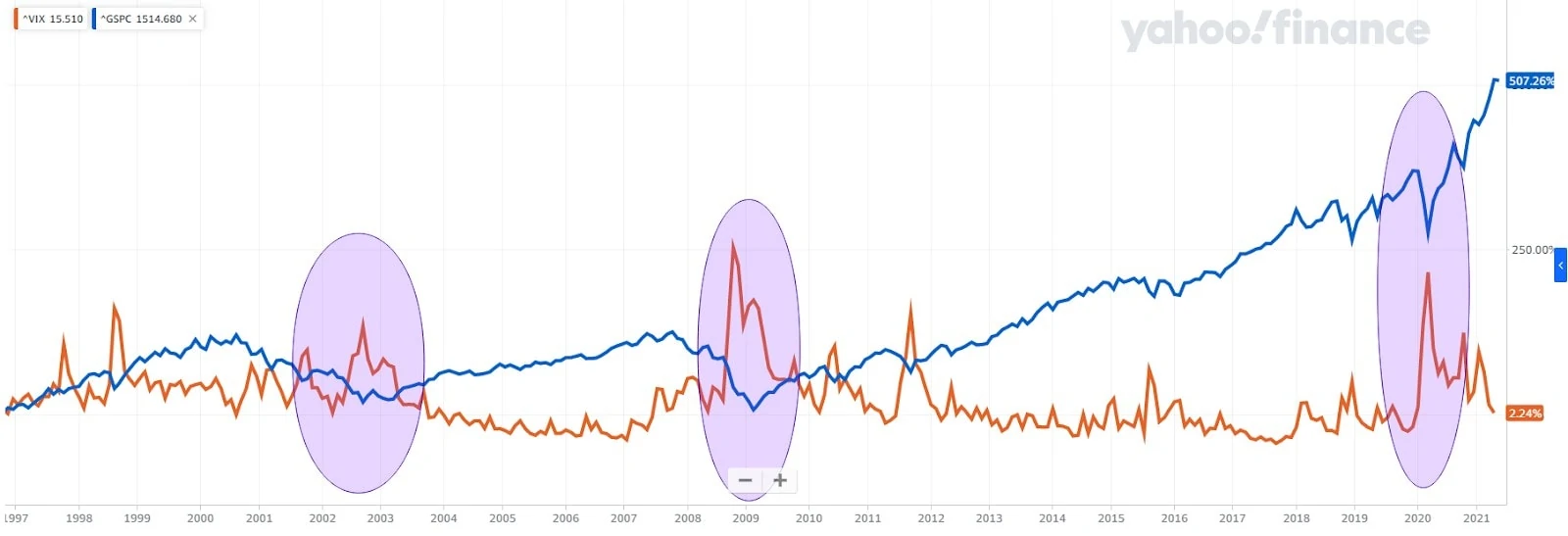

The price of VIX is derived from short term options against the S&P 500 index. It is often used as a proxy for market sentiment. When the S&P 500 index experiences high volatility during panic selling, the VIX index shoots up in price. The chart below compares VIX (orange line) price change with the S&P 500 (blue line) price change over the last 25 years. The circles highlight three examples of VIX rallying in response to S&P 500 selloffs in 2002, 2008, and most recently in 2020. See the full chart for yourself here.

VIX is a good indicator of when others are fearful; and you can be greedy when others are fearful by buying an ETF that tracks the VIX index, such as VIXY – the Proshares Trust II VIX Short Term Futures ETF.

If you foresee a market downturn in the near future, you can buy some VIXY as insurance. When the market crash occurs, the rally in VIXY will help offset some of the drop in the rest of your portfolio. Of course, this requires precise timing of the downturn. Buy VIXY too early, and you’d miss out on the continued rise of the overall stock market. Buy VIXY too late, and you’d have to pay a much higher price and diminish the protection that VIXY provides.

Notice that when the market volatility subsides, the price of VIX drops quickly, as will the corresponding VIXY price. Therefore, you have to sell your VIXY shares at the right time to capitalize on its rally. If you hold on too long, your VIXY shares can quickly fall back to pre-rally levels and you’d lose its hedging power against the overall market.

Keep in mind that VIXY is a synthetic instrument based on the VIX index, which is based on options instruments, which are themselves derivatives, that is, they derive their value from the value of other assets. There are many layers of abstraction between you and the real value of the underlying asset. Buying VIXY to hedge against stock market crash isn’t so different from betting at the casino.

All that’s to say there are many moving parts. To make this strategy work, you’d have to time the market drop just right, time the market rebound just right, and be comfortable using a complicated betting instrument to hedge your risks. Caution is advised.

For us Canadians, a similar instrument for hedging the TSX 60 index is HXD, the Horizons BetaPro S&P/TSX 2x Daily Bear ETF. It aims to return 200% the inverse of the TSX 60 performance every day. So theoretically, if the TSX 60 drops 5% in one day, HXD should increase by 10%. HXD does not work exactly the same as VIXY but both can be bought as insurance against short term market downturn.

Beware of the risk of getting the timing wrong, this ETF amplifies TSX 60 performance both ways. So if the TSX 60 has a good day and rallies 2%, HXD is going to drop 4%. This particular insurance policy can be pretty costly if the timing is off. Tread carefully. ETFs like VIXY and HXD can be traded in the discount brokerage you’re already using. But active hedging requires constant vigilance and the agility to make trades at a moment’s notice. You may need to use a trading app so you can make trades any time, anywhere. Check out our review of the Best Stock Trading Apps in Canada for 2024 if you need help choosing an app.

Hedging Strategies Using Options

The third hedging strategy example involves directly buying options.

FT discusses options contracts in detail in the article Options Trading: Buying and Selling Calls & Puts for Hedging & Profit. In short: an options contract gives its holder the right to buy or sell an asset at a guaranteed price within a set time period. The holder pays an upfront fee, called the premium, for this guaranteed price and for the freedom to choose whether or not to buy or sell.

A call option is the option to buy an asset, and a put option is the option to sell an asset. Options contracts are denominated in blocks of 100 shares of the underlying asset.

For example, say a buyer, Susan, buys one put option on ABC stock with a guaranteed strike price of $50, a three months expiry, and a $1.50 per share premium, here is what happens:

Susan pays $150 (100 shares block multiplied by $1.50/share) premium upfront to the contract seller, Morgan, in exchange for the option to sell 100 shares of ABC at $50/share to Morgan any time within the next three months. Susan can also choose not to sell the ABC shares and just let the contract expire.

Put options are often used to hedge against falling stock prices. Say ABC stock is trading at $54 per share now but Susan thinks the price will drop in the near future and buys a $50 put option on ABC exactly like the example above as insurance. She pays Morgan the $150 premium and watches the price of ABC. Two months later, ABC falls to $46 per share. Now, Suan can sell her ABC shares at $50/share rather than at $46/share. Susan just unloaded some falling assets at above market price.

If Susan bet wrong and ABC actually grows in price then she can just let her put option expire. Her hedging bet still cost her the $150 premium but the gain in ABC’s price could offset that cost.

This is a common hedging strategy for individual stocks but it can be applied to broader index linked ETFs too. If Susan feels pessimistic about the short term future of the whole S&P 500 index, she can buy a put option on the ETF that she owns, be it SPY, VOO, or IVV.

Aside: actually, Susan can even buy a put option on ETFs that she doesn’t own. If she chooses to exercise that option, she’ll just have to buy shares of that ETF at market price and then sell those shares to Morgan. And she would only choose to exercise the option if the strike price is sufficiently higher than market price. So buying at market price and selling at the higher strike price should be profitable.

So if you, like Susan, feel pessimistic about the short term future of the overall stock market, you can buy some put options on your holdings to hedge against the risk of a market downturn. Buy options on individual stocks to protect just those stocks or buy options on an index-linked ETF to hedge against overall market downturn.

Options contracts can be purchased through your existing brokerage account. Questrade, Wealthsimple Trade, Qtrade all make the options market available to you.

For example, Susan logs into her Questrade account and sees many options available for the SPY S&P 500 ETF at various expiration dates between 1 and 40 days. SPY’s current price is $416.58 at the time of this writing. Looking at put options expiring 30 days from now, here are some of Susan’s choices:

- $413 strike price at a $6.70/share premium

- $416 strike price at a $7.03/share premium

- $420 strike price at a $8.75/share premium

No surprise that higher strike prices cost higher premiums. Let’s say Susan chooses the lowest premium option, she would have to pay $670 up front for the right to sell 100 shares of SPY at $413 any time within the next 30 days. If SPY drops to $400 within 30 days, 100 shares would drop in value by $1,658). If Susan exercises her put option, the drop in value would be limited to $1,028 ($358 from the difference between current price and strike price times 100 shares plus the $670 premium).

Similarly for the Canadian stock market, options are available for TSX 60 linked ETFs like XIU. XIU’s current price is $29.40 at the time of this writing, and here are some put options available with a 33 day expiry:

- $28.50 strike price at a $0.27/share premium

- $29.00 strike price at a $0.44/share premium

- $30.00 strike price at a $1.22/share premium

Put options can be a way to establish insurance policies on your holdings. Like insurance, you have to pay a premium upfront for that protection. You have to decide if the premiums are worth the risk that you’re hedging against.

Extending the insurance analogy further, may I point out that there aren’t many struggling insurance companies. There is a reason Warren Buffett credits much of Berkshire Hathaway’s success to its foundation in the insurance business.

Insurance is a highly profitable business, for the insurer.

Companies like Geico, Dejardin, Manulife, and the like have teams of actuaries scrutinizing all aspects of their own risk profile. They then carefully set premiums to ensure profitability.

Options contracts are mainly offered by market makers, hedge funds, or other large players in the financial world. The contract sellers have teams of analysts scrutinizing all aspects of their own risk profile. They then carefully set premiums to ensure profitability, or at least significantly tilt the odds in their favour. So in our example, Susan is probably not buying an option contract from Morgan, she’s likely buying from JP Morgan Chase. And JP Morgan Chase would put a lot of effort into making sure it doesn’t lose money on any deal.

In this casino game of options trading, the house always has the edge.

Final Thoughts on Hedging Strategies for the Stock Market

The stock market consistently grows over the long term but in the short term, it can be wild and volatile. It is certainly wise to implement some sort of hedging strategy to protect your investments. I believe the best hedge is the discipline to maximize your time in the market. Hold on through short-term volatility, or even buy more through the dip, and you should come out ahead.

But I can appreciate the interest in more active hedging strategies. We talked about three such active strategies:

1) Buy assets that have low or negative correlation to the stock market. Look for assets that increase in price when the overall market drops.

2) Invest in a volatility index. Buy into the index that measures market volatility so you can profit from the fear and offset the downturn in the overall market.

3) Directly trade options. Buy put options on stocks or ETFs that you would like to hedge just like buying insurance policies.

Final warning, the active hedging strategies all require accurate and precise predictions of what the market is going to do. You have to predict both the direction and the timing of market movement. Otherwise, these strategies won’t offer any protection. So polish that crystal ball, you’re going to need it.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?