Smith Manoeuvre Portfolio – 2022 Update

For those of you just joining us, this is an update (it’s been a while!) on my portfolio that is leveraged with money borrowed from my home equity line of credit (HELOC) – otherwise known as the Smith Manoeuvre.

What is the Smith Manoeuvre?

The Smith Manoeuvre, in its simplest form, is a leverage investment strategy that uses your home as collateral. It’s popular because borrowing to invest makes the interest eligible for a tax deduction. So to frame it in an enticing way, Canadians, it enables Canadians to convert their regular mortgage into a tax-deductible mortgage.

How does it work?

If you have a home with some equity, the simplest way is to obtain a Home Equity Line of Credit (HELOC) and invest in the stock market with the balance. To make it the true Smith Manoeuvre, you would need to obtain a readvanceable mortgage that increases your HELOC balance as you pay down your instalment mortgage. Using your HELOC balance to invest within a taxable investment account, over time, your regular mortgage shrinks while your HELOC balance (and hopefully your taxable investment account) grows. In the end, you have a fully tax-deductible HELOC that has replaced your regular mortgage.

Sounds risky right? Well, leveraged investing is definitely risky so you’ll definitely need to have a high-risk tolerance to implement this strategy. You can read much more detail about the nuts and bolts of the Smith Manoeuvre Strategy here.

How I’m Using the Smith Manoeuvre

As many readers know, I implemented the Smith Manoeuvre many moons ago in 2007/2008. I obtained a readvanceable mortgage from BMO, withdrew $50,000 and invested in Canadian Dividend stocks. Yes, right before the financial crisis! While the timing wasn’t great, I knew that I was in it for the long haul, with the goal to generate dividend income to one day fund early retirement.

We eliminated the regular installment mortgage in our early 30’s but never really maxed out the HELOC. In total, we borrowed over $100k, and used the HELOC to pay for itself (we capitalized the interest) and let the balance and tax-deductible interest grow.

Fast forward to today, the strategy is still alive and well, but it looks a little bit different than in 2007/2008. While we capitalized the interest (used the HELOC available credit to cover the monthly payment) for many years, the balance also grew over time. That is until now – we are currently using the dividends to slowly pay down the HELOC balance.

Why the shift from capitalizing the interest to paying down the HELOC? Basically, we are reducing some risk/liability since we are in semi/early retirement! After hitting the million dollar net worth milestone in 2014, we turned our focus on building our passive income to the point where it would cover our recurring expenses. We basically doubled down and put pure focus on building our dividend and indexed portfolios.

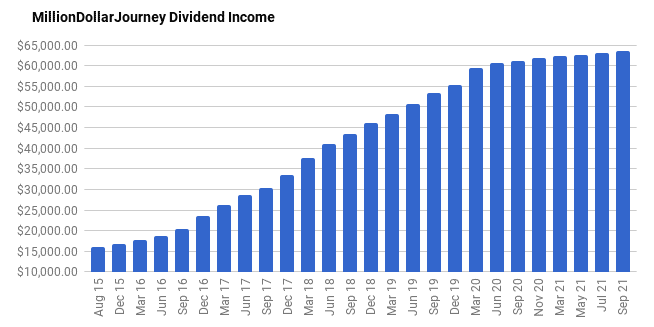

By mid-2020, we managed to hit a big financial milestone – we reached financial independence by growing our dividend income enough to cover our family’s expenses. At the time, it just felt like another day. What I didn’t realize was that it started a subtle shift in the way I thought about my day-to-day life. It might have been partly because of the COVID pandemic restrictions, or partly due to working from home full-time – my underlying desire for more freedom grew stronger.

So I have taken the leap of moving on from professional full-time work and into a phase of working on new projects and hobbies. While these projects and hobbies aren’t very lucrative, we have made the shift from accumulation of assets, to finally spending some of those dividends that have been growing over the past 15+ years.

Portfolio Update

In the most recent financial freedom update, our total dividend income is in the $73k/year range. How much comes from our Smith Manoeuvre portfolio? About $8.8k/year with a yield of about 3.54%!

The big question now is the impact of rising interest rates and my strategy. For a while, we were paying about $3,600/year in interest. With rates rising aggressively, annual interest has risen to about $6,500/year. While there is still a spread between dividend income and interest expense, this just means that it will take a bit longer to pay off the HELOC balance. On the bright side, it also means a larger tax deduction during tax season.

As we have not “needed” to spend the dividends from this account yet, we continue to use the dividends to pay down the investment loan/HELOC balance.

New/Added positions:

Very little has been added to this portfolio over the years as we haven’t been interested in growing our HELOC balance. Occasionally, however, there are some opportunities to add that we cannot pass up. In 2022, we have added:

- BCE (BCE.TO)

- Telus (T.TO)

- Algonquin Utilities (AQN.TO)

Dividend growth:

Since this portfolio is focused on dividend growth stocks, the portfolio did not disappoint where a significant number of dividend-paying positions increased their distributions. The increases to this portfolio include:

- CU.TO (1% increase)

- BCE.TO (5.1% increase)

- TRP.TO (3.4% increase)

- TRI.TO (10% increase)

- T.TO (7% increase)

- SU.TO (12% increase)

- WN.TO (10% increase)

- AQN.TO (6% increase)

- FTT.TO (4.9% increase)

- BNS.TO (3% increase)

- BMO.TO (4.5% increase)

- CM.TO (3.1% increase)

- RY.TO (6.7% increase)

- FTS.TO (5.6% increase)

- EMA.TO (4.1% increase)

Top 5 Positions

The top positions in this portfolio does vary a bit and all have a strong history of increasing dividends. My current top 5 positions include:

- Canadian Pacific Railway (CP.TO)

- Thompson Reuters Corp (TRI.TO)

- Royal Bank (RY.TO)

- TD Bank (TD.TO)

- Fortis Utilities (FTS.TO)

Common Questions:

Why the high concentration in financials and energy?

With regards to sector allocation, you may notice that this portfolio is fairly concentrated in financials and energy. Note though that this is one of my accounts where I treat all of my accounts as one big portfolio. In other words, I consider this account to be my Canadian exposure (which is mostly financials and energy) and my US, international and other sector equity exposure in other accounts.

Why don’t you use a dividend ETF instead?

Couple of reasons, first, most Canadian dividend ETFs hold stocks that distribute return of capital which can affect the tax deductibility of the investment loan. Second, the MER eats into the dividend. I keep the expenses in this portfolio very low through occasional buying but rarely selling.

Should I start the Smith Manoeuvre?

There have been a lot of readers who have mentioned that they are interested in a leveraged portfolio. Over the long term it may be lucrative. However, over the short term, equities are volatile and can put the portfolio deep in the red. My portfolio during 2008 is a prime example of what can happen. If you can’t stomach losing 20-30% in the portfolio in any given year, then your risk tolerance isn’t suited for leveraged investing.

Disclaimer: The securities mentioned in this post are not recommendations to buy or sell and should be used for informational purposes only.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Glad to see an update on your portfolio. I’ve been following your Smith Maneuver journey for quite some time, and your articles on the topic are my go-to.

Suprised to see you add some Algonquin Utilities given they had some major declines this year. I suppose you believe the dividend is safe going foward?

All the best, and happy new year!