Questrade Review 2024

Our Opinion & Rating

-

User Experience

-

Account Opening

-

For ETF Trading

-

Annual Fees ($0)

-

For High Volume Traders

-

App Rating

-

Customer Service

Questrade Review Summary:

When I first created this site back in 2006, my Questrade Review was one of the first articles that I wrote. While it’s no longer my #1 choice, it’s still pretty amazing that Questrade has managed to stay ahead of all of Canada’s big bank brokerages.

And hey – there is no shame in getting ranked #2 in our ranking of best Canadian online brokers. Questrade still offers DIY investors a pretty fantastic value (especially when compared to where brokerages were twenty years ago).

If you want a breakdown of the two best brokerages in Canada, I recommend checking out our Questrade vs Qtrade comparison, as well as our in-depth Qtrade Review. See the below Questrade review for more information on Questrade’s fees, account options, user experience, customer services, and safety scores.

Pros

- No Fees To Build an ETF Portfolio!

- No Inactivity Fees

- Very Low Trade Costs (ideal for building a dividend-heavy portfolio)

- $0 Annual Account Fees (if you meet the balance requirement)

- 24-Hour Paperless Account Opening

- Globe and Mail “B+” Rating

- Good Promo Offer (see below)

- Solid USD Trading Options

- FHSA account

Cons

- Better options online for those interested in doing in-depth analysis research on stocks prior to purchase

- Only 2.1/5 app rating on Google Play – reviews mentioned delay in pricing on app vs desktop

- No free stock or mutual fund purchases

- Mediocre customer service

- New trading platform still has some kinks that need to be worked out

- Only a 1.7/5 rating on the Apple App Store

Is Questrade Safe & Secure?

One of the most common questions that I have gotten in the comments below is:

Is investing my money through a Questrade online brokerage account safe? Is Questrade as safe as RBC, TD, CIBC, ScotiaBank, and BMO?

– MDJ reader

The answer: Yes!

When it comes to online trading, safety and security are understandably among the top concerns for investors. So, just how safe is Questrade?

First, Questrade is a member of two critical regulatory organizations in Canada: the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF).

These memberships aren’t just checkboxes; they signify adherence to stringent rules designed to protect investors. IIROC oversees all investment dealers in Canada, ensuring compliance with high standards of financial operations and ethics. Meanwhile, the CIPF exists to protect investors in the event that a brokerage becomes insolvent.

The CIPF’s track record speaks volumes: since its founding in 1969, no eligible customer has ever lost property due to a member insolvency. In rare cases where member firms have gone bankrupt, the CIPF has paid out approximately $43 million (net of recoveries) to protect investors. This safety net covers up to $1 million per eligible account type, ensuring that even in worst-case scenarios, investors are safeguarded.

Questrade itself has been in business since 1999, giving it a 25-year track record of success as of 2024. With over $30 billion in assets under management, it’s not like it’s a “fly-by-night” operation!

On the technical side, Questrade has implemented robust safeguards to protect its clients. They offer an Online Security Guarantee, which promises 100% reimbursement for any unauthorized transactions in your account that result in a loss. This means they’re willing to put their money where their mouth is when it comes to security. Additionally, accounts are insured for up to $10 million through a combination of CIPF coverage and private insurance policies in the extremely rare event of Questrade becoming insolvent.

The company also uses state-of-the-art online security features, including two-factor authentication (2FA) to protect your accounts. 2FA adds an extra layer of security by requiring you to confirm your identity through a secondary device or app. Moreover, Questrade employs robust encryption protocols to keep your data safe from cyber threats.

“When I first wrote this Questrade review back in 2008, there were very few Canadian online discount brokerage accounts available to Canadians who wanted to open a DIY RRSP account, TFSA, or non-registered account, and trade their own stocks and ETFs.

Over the last 15 years, many Canadian online brokers have drastically improved their offerings, but Questrade remains one of the top low-cost brokers due to their focus on low fees and outstanding account options.

December 2024 Questrade Review updated by Frugal Trader. The MDJ editorial team collectively has several accounts with Questrade and benefits from daily firsthand experience.

Questrade Fees – Focused on Dividend Investing and ETFs

While Questrade has introduced some shiny new features (and excellent marketing) the last few years, the key reason that they are one of our top choices for best low cost discount online broker in Canada is their low overall fees, and especially their low or no cost trading fees with things like commission-free ETF purchases.

It’s worth noting that Questrade has zero fees on popular accounts such as RRSPs, TFSAs, RESPs, and non-registered accounts.

Questrade Fees Summary

- Free ETF Purchases (there are fees on ETF sales)

- Low Commission on Trades @$4.95/ trade

- ECN Fees Capped at $5.00 / trade

- No Account Fees on RRSPs, TFSAs, RESPs, and Non-Registered Accounts

- $25 Quarterly Account Fees on other account types (if certain conditions are met, the fee will be waived)

If you’re new to MDJ, you might want to have a look around for more information on why we recommend dividend investing and index-investing approaches for 99%+ of investors. Basically, if you’re trying to jump into day trading, time the market, or get rich on crypto, you had better be willing to risk it all, and committed to becoming educated on what it takes to be a professional trader.

We wouldn’t recommend this course, as far too many have lost far too much with these tactics.

If, on the other hand, you plan to make relatively safe and consistent investments with a high likelihood to earn a decent return over the years, then Questrade Canada is a place to DIY your nest egg and cut your costs to the bone.

Throughout the years, experts have echoed the idea that the average investor can’t control their returns, they can (and should) control their investment costs. By controlling your costs, you are adding more to the future of your money, and that’s never a bad thing.

Questrade ETF Fees

Some critics point out in their Questrade review articles that Questrade only covers free ETF purchases.

While this is technically true, what they fail to mention is that the vast majority of our transactions will be purchases if we are building a basic “couch potato” passive index investing portfolio.

With the excellent Canadian all in one ETFs available to investors today, many Canadians would do very well to just log into their Questrade RRSP or TFSA each month and purchase that same ETF over and over again for their entire working lives.

Alternatively, if you want to really cut costs to their absolute minimum, you can buy your bond ETF, domestic market ETF, and international ETF separately, and then rebalance each month simply by adding a little more to the asset class that has the worst over the preceding month, in order to keep your overall asset allocation where you want it.

The only selling you should really have to worry about is when your portfolio gets close to the $1 Million level and can’t be re-balanced by monthly additions, or when you are ready to start selling pieces of your portfolio to fund your retirement living.

Paying $5 to take your spending money out for the year is a small price to pay when you’ve had the benefit of investing for free over the last 30+ years!

Comparing Questrade’s Fees with Competitors in 2024

Here’s how the Questrade free ETF purchasing stacks up against some of the big names in Canada.

Broker | Stock Trades | ETF Purchases | Options Trades | Account Maintenance |

Questrade | $4.95 | $0 | $9.95 | $0 |

$9.99 | $9.99 | $11.24 | $25 per quarter unless certain requirements are met | |

$9.99 | $0 for 40 selected ETFs; $9.99 for others | $11.24 | $100 per year unless certain requirements are met | |

$9.95 | $9.95 | $11.20 | $25 per quarter unless certain requirements are met | |

$9.95 | $9.95 | $11.20 | $25 per quarter unless certain requirements are met | |

$6.95 | $6.95 | $8.20 | $100 per year unless certain requirements are met |

… How Does Questrade Compare with its #1 Competitor: Qtrade?

Qtrade | Questrade | |

Free ETFs | Yes! free buying AND selling of 100+ ETFs. | Free buying of ETFs, BUT does charge the normal trading fee to sell ETFs. |

User Experience | Consistently ranking #1, high availability and friendly to customers | Has made big gains over the last three years, rated just behind Qtrade by most publications |

Customer Service | Truly elite customer service, basically, the #1 reason to go with Qtrade | Have made some improvement over the last year, but still lacking |

Trading Fees | Very competitive, $6.95/trade for Investor Plus Program members, $7.75 for investors aged 18-30, $8.75 for everyone else | A rock bottom $4.95 for up to 500 shares, to a maximum of $9.95. |

ECN Fees (additional trading fees) | Free | Charged - often small amounts for most investors |

Account Fees | $25 per quarter - WAIVED IF you hold $25,000 in the account OR you make 2 trades per quarter or 8 in the last 12 months OR you add $100+ automatic recurring monthly contribution (our preferred option) | No inactivity fees |

Transfer Fees | Free Electronic Funds Transfer. Additional fee for transferring out. | Free Electronic Fund Transfers up to $50,000 CAD and $25,000 USD. Additional fees for wire transfers and transferring out. |

Research Tools and Education Materials | Has been at the top of Canadian brokerage rankings in this category for over a decade | Made excellent gains in the last few years |

Promo | Instant Sign Up Bonus: $150-$2,150 | $50 in Free Trades |

Full Review | ||

Sign Up |

For another low fee alternative in Canada, have a look at our Questrade vs Wealthsimple comparison. For more details on Questrade vs Qtrade view this comparison.

Globe and Mail’s 2024 Questrade Review

For two consecutive years now Rob Carrick over at the Globe and Mail (their longtime personal finance columnist for those who aren’t familiar) has given Questrade a solid-if-unspectacular grade of a B+. That compares to five years in a row of A rating for Qtrade.

He stated the following when it came to Questrade in 2024:

“If you plan to trade mainly on your smartphone, give Questrade a good look because its mobile app is one of the most user-friendly. There’s an easy simplicity to the way it guides investors through a trade that will appeal to new and even experienced investors. Pricing at Questrade is mid-market at a minimum $4.95, with electronic communications network [ECN] fees adding to the cost of some trades.”

By way of comparison, here’s what Carrick had to say about Qtrade:

“This consistently top-ranked broker gives you one of the better websites and apps for looking after your investments. More than many others, Qtrade has created a mini-me app that reflects the high level of utility in the website, including a quickie chart that shows portfolio results over the past year. Online, there’s a Portfolio Score tool that slices and dices your holdings to provide insights on returns, fees, downside risk, income and environmental, social and governance (ESG) factors. Unlike some brokers, Qtrade never coasts.”

What Can I Invest in With Questrade?

Questrade makes it easy to hold all of your baskets in one place, from your tax-advantaged accounts to your dividend earning investments. When it comes to choosing an online broker, this is an important feature to look for if you value simplicity and convenience.

When you open a Questrade account, you’ll be able to invest in:

- International and Canadian Stocks

- International and Canadian ETFs (purchases are free!)

- Mutual Funds

- Options

- Initial Public Offerings (IPOs)

- Currencies

- Guaranteed Investment Certificates

- Precious Metals

We’ll get into more detail about the trading fees and other information you will want to consider when planning your investment strategy below in this Questrade review.

Dividend Investing with Questrade

If you’re like many MDJ readers investors and are aiming to build a robust portfolio of dividend-paying stocks that generate cash flow, you likely purchase shares of your favourite Canadian dividend stocks quite regularly. This approach is especially effective if you’re using the Smith Maneuver or investing in a non-registered account (as opposed to an RRSP, TFSA, FHSA, or RESP).

Questrade offers competitive per-trade fees for buying basic shares as well as free ETF purchases. Here’s a breakdown of Questrade’s fee structure for purchasing company shares:

- Standard Trade Fee: $4.95 per trade

- ECN Fees: Up to a maximum of $5.00

For those unfamiliar with ECN fees, it stands for Electronic Communication Networks. Essentially, companies charge Questrade about $0.0035 per share when you make a purchase. While there are ways to reduce these fees further using limit orders and whole board lots, this often complicates things for the average investor.

Let’s look at a typical example for a monthly dividend investor targeting Canadian Dividend Kings:

Suppose I decide to allocate my $1,500 contribution equally among Canadian Utilities, Enbridge, and Canadian National Railway, which are favorites among dividend investors. Here’s how it might break down.

- Canadian Utilities (CU.TO) at $32 per share: 15 shares = $480

- Enbridge (ENB.TO) at $51 per share: 9 shares = $459

- Canadian National Railway (CNR.TO) at $160 per share: 3 shares = $480

If I wanted to maximize my contribution, I could buy another couple shares of Canadian Utilities with the leftover funds, but let’s stick with this for now.

Each trade would cost $4.95 + ECN fees of roughly ($0.0035 x 10 shares) $0.035, totaling less than $4.96 per trade. So, for all three trades, the total cost for the month would be ($4.96 x 3) = $14.88.

For larger purchases – such as buying $10,000 worth of Canadian Utilities stock (312 shares), the ECN fees would only amount to around $1.10. Personally, I don’t find this to be a massive difference maker, but it’s worth understanding why this extra little fee will show up on your transaction sheet.

That said, the ECN fees are somewhat unique to Questrade when it comes to comparing to Canada’s other top online brokerages. Right now, Qtrade has a promotion where they’ll let you trade completely for free until the end of the year (so no ECN fees – or any other kind of fees!) Plus, they’ll put a bunch of cash back in your pocket – so it’s pretty hard to ignore the massive difference there.

Questrade Promotional Offer

Questrade’s current top promotional offer is $50 in free trades.

Just click here or use the link below in order to take advantage of that offer and get started with Questrade.

While fifty bucks in free trades is better than nothing, it doesn’t really compare to this Qtrade promo offer. In short, Qtrade is combining a signing bonus of $150 with cash back (depending on how big your deposit is). If you open an account (RRSP, FHSA, TFSA, non-registered, etc) and put $5,000 into it, Qtrade is going to add $250 on top of your $150 sign-up bonus for a total of $400. That’s 8% cash back on a $5,000 new account!

Not only that, but to top it off Qtrade is going to offer free unlimited trades for a few months as you get your initial portfolio set up – PLUS, they’ll pay your fees for you to move an account over if you’re already at another brokerage.

Now I should note that if we’re properly comparing apples to apples, Qtrade does charge a quarterly inactivity fee of $25 that Questrade doesn’t hit you with. BUT – you can avoid this fee by making two trades every quarter OR by having at least $25,000 in your combined investment accounts. They also waive this fee if you make an automatic contribution of at least $100 per month (which is a good savings goal to hit anyway).

Questrade Active Trader Fees and Market Data Platforms

Questrade has recently shifted its active trader (sometimes called “professional trader”) pricing model from Questrade Enhanced and Questrade advanced, to more of an “ala carte” active trading fee menu.

This plan is accessible to clients who subscribe to one of Questrade’s advanced market data offerings. The advanced market data packages, available both for Canadian and U.S. markets, are priced at CAD $89.95 and USD $89.95 per month, respectively. These fees are fully rebatable, which means active traders can potentially offset these costs with $400+ of trading activity.

Questrade offers two main commission plans for active traders: fixed and variable. The fixed plan is straightforward and might appeal to traders who prefer predictability in their costs. For stock trades, it charges a flat rate of $4.95 per trade. Option trades are also simple, costing $4.95 plus $0.75 per contract.

On the flip side, the variable plan is designed for traders who might be purchasing smaller quantities of expensive shares. For stock trades, this plan charges 1 cent per share, with a minimum fee of $0.01 and a maximum of $6.95. Options trading under this plan costs $6.95 plus $0.75 per contract.

As for ETFs, buying is free under both plans. However, selling ETFs costs $4.95 per trade on the fixed plan and 1 cent per share on the variable plan, again with a minimum of $0.01 and a maximum of $6.95.

These pricing structures provide flexibility for different trading styles, catering to both high-volume traders and those dealing in smaller quantities.

Opening a Questrade TFSA, RRSP, RESP Account

Opening your Questrade RRSP, TFSA, or RESP accounts is easier than ever before. Given how complicated this process was in the past, the Questrade team has really upped their game.

Opening your Questrade Canada account can now be done completely online, and in as little as 24 hours.

Basically you click here and our $50 questrade promotional offer code will be automatically applied. Then you simply select which accounts you would like to open. The main options available are TFSA, RRSP, Margin (non-registered), and Forex. There are also options for “more” and then a Questrade Portfolios option which is similar to a robo advisor, and which I’ll talk about a little later.

The Questrade sign up process will guide you through the following three steps:

- Create a user ID

- Build Profile

- Setup Account

You’ll need a few documents and/or snippets of info including:

- Your preferred email address (used to create your User ID)

- Your name and home address as they appear on your Government ID

- After creating your User ID, you’ll need your new Questrade login and password

- Your Social Insurance Number (SIN)

- Employment information including your income, plus your income from other sources

- A Government-issued photo ID such as a driver’s license or passport (which can be uploaded via scanned document or picture)

Once you’ve completed the sign up with these documents, the final step to opening your Questrade RRSP or TFSA is to go to your normal “all-in-one” bank account or chequing account that your pay gets deposited into, and then to send your investing dollars over to your shiny new DIY Questrade account.

Once you have funded your Questrade account from your regular bank account, and you are ready to invest! You can set up seperate Questrade RRSP and TFSA accounts as recurring payees, significantly helping you save time in the future.

Technically – you can open a Questrade brokerage account without any actual money in it!

In order to actually purchase your first share of a stock or unit of an ETF though, you’ll need to have at least $1,000 in the account.

While most of our readers know that we recommend sticking to dividend-stock investing and basic index investing, Questrade offers a ton of choice when it comes to what you purchase within a TFSA or RRSP.

Questrade RRSP Account Details

Once you have set up your Questrade RRSP and have entered your deposit information into your online banking platform, it’s time to decide which account to open. For most Canadians, that means getting started with an RRSP or a TFSA.

If you’re a bit rusty on the details, the Registered Retirement Savings Plan (RRSP) is one of the most powerful tools in a Canadian’s financial arsenal. The idea behind the RRSP is to help you save for retirement but sheltering your investments from the tax man’s icy grasp.

Not only does your money grow sheltered from taxes, but it also allows you to defer paying taxes on your contributions until you withdraw the funds—ideally when you’re retired and in a lower tax bracket. This “tax arbitrage” is at the heart of the RRSP’s appeal and is a great to help to the vast majority of Canadians’ financial plans. Don’t listen to that “RRSPs are a scam” talk – it’s almost always a lie used to sell you things.

Your contribution limit for an RRSP is personalized and can be found on your Notice of Assessment from your last tax return. For 2024, the government allows Canadians to contribute up to 18% of their previous year’s income, with a maximum cap of $31,560. In 2025, that maximum increases to $32,490, reflecting the government’s annual adjustments for inflation.

If you participate in a workplace pension plan, however, your RRSP contribution room will be reduced by a figure called the Pension Adjustment (PA). For example, teachers and other public sector employees with defined benefit pension plans often have significantly less RRSP room. It’s a trade-off, as those pensions represent a valuable piece of retirement security.

One of the lesser-known features of RRSP room is that it’s cumulative—you can carry forward unused room indefinitely. Think of it like a fine wine: it improves with time! This means that if you’re just now opening a Questrade RRSP and have never contributed to one before, there’s a good chance you have years of unused contribution room waiting to be utilized. This can be a huge advantage for Canadians who start investing later in life or find themselves in a high-income situation where they can afford to “catch up” on contributions quickly.

If you just opened a Questrade RRSP account, and have never had other RRSP investments over the years, it’s quite possible that you have a significant amount of room that you can make use of over the next few years.

Questrade TFSA Account Details

Your new Questrade TFSA account will be the flip of the RRSP. You’ll get taxed when you put money into it, but there is no “postponement” of taxes to worry about paying on the back end when you take the money out. Just like the RRSP (and RESP for that matter), the TFSA is what’s known as a registered account, and consequently, the TFSA umbrella will prevent taxes from eroding away your investment returns over the years.

Just like the RRSP (and the RESP for education savings, as well as the FHSA for first home savings), the TFSA is a registered account, meaning it’s designed to shelter your investments from taxes. The TFSA’s tax-free umbrella ensures that over the years, taxes won’t erode the compounding growth of your investments. This is what makes the TFSA such a valuable tool for building wealth over time.

The other similarity the Questrade TFSA has with your Questrade RRSP is that it is extremely easy to open. When you first sign up for Questrade, you can select the accounts you want to open, and the TFSA is just a checkbox away. If you’ve already opened an RRSP or other account, adding a TFSA later is just as easy, and the process can be completed in minutes online.

One of the biggest misconceptions about the TFSA lies in its name. While the term Tax Free Savings Account might sound like it’s primarily for saving cash, the truth is that a TFSA can hold the same wide variety of investments as an RRSP. Stocks, bonds, exchange-traded funds (ETFs), mutual funds, GICs, and more – all of these can be housed within your TFSA.

For years, I’ve argued that the “S” in TFSA is misleading. It’s not just a savings account; it’s a full-fledged Tax Free Investing Account. Unfortunately, the name has led many Canadians to mistakenly think of it as a high-interest savings account with a bit of extra flexibility. In reality, the TFSA’s true power lies in its ability to grow wealth over decades, untouched by taxes.

In 2025, the annual TFSA contribution limit is set at $7,000, and the federal government plans to continue adjusting this amount for inflation in the future. What many people don’t realize is that unused TFSA contribution room doesn’t vanish if it goes unused – it carries forward indefinitely (like RRSP contribution room)If you were 18 or older when the TFSA was introduced in 2009, you’ve been accumulating contribution room every year since. As of 2025, you’d have a total of $102,000 in available contribution space (including 2025’s $7,000 limit). That’s an enormous amount of tax-free investment potential waiting to be tapped.

Holding USD In My Questrade RRSP and TFSA

Investing in USD can save you a ton of money in currency conversion fees when you think about how much it costs to convert dividend income and new stock purchases back and forth over your investing lifetime. Questrade RRSPs and TFSAs to allow you hold both USD and CAD in your portfolio – and they do this for no added fees. (Each account is still $0.)

Questrade was the first online discount brokerage to allow investors to hold USD in a registered account.

Questrade RESP and Family RESP Accounts

If you have children and you think they might one day attend post-secondary schooling of ANY KIND (it does NOT have to be university) then you are throwing away free money by not opening a Questrade RESP account. Given how quickly post-secondary education costs are rising (2.5x-3x the rate of general inflation) can you afford to throw away free money?

Here’s how to get $10,000 in free money from our government.

- Setup a FREE Questrade RESP account and deposit $208.34 into it every month.

- Collect the free $500 Canada Education Savings Grant (CESG) each year, up to a lifetime limit of $7,200.

- Invest the money in a conservative all-in-one ETF or even just a basic Canadian bond ETF.

- The interest/investment return you will make on your own money that you put it is nice – but you know what’s nicer? The $2,500-$3,000 return that you make on someone else’s money! (Especially when that someone else is the government!)

If your income is below $42,000 then there are some extra incentives for you.

The CESG cash, plus your investment returns within the Questrade RESP account will be taxed as income in the hands of the student. This means that it’s almost always tax-free because of the large amount of tax credits and deductions that students enjoy. Your original cash can be withdrawn tax-free as you already paid tax on it before investing it.

If you have more than one child, you can combine their contribution room into one big easy-to-manage Questrade Family RESP account (which is also free to open with no annual fees). The advantage to these accounts is that you can handle the withdrawals amongst your children in whatever way is convenient for you.

What If My Child Doesn’t Go to University? Do I Lose My Questrade RESP Money?

Here are the main points to think about if you’re worried about “wasting” RESP contributions:

1) The Questrade RESP account can be active for up to 35 years and you can use the RESP money for a HUGE variety of post-secondary studies. Everything from massage therapy to airplane mechanic courses can be covered. This combination means that it’s VERY likely your child will be able to use the RESP help at some point.

2) If you haven’t maxed out the CESG or contribution room for Child 2, you can simply take Child 1’s RESP money and use it for Child 2 within your Questrade Family RESP account.

3) If you have no children that ever attend any sort of post-secondary education, you can roll $50,000 into your RRSP (assuming you have the contribution room) and all you would lose is the free CESG money, and the investment earnings on the government’s cash.

4) You can withdraw the money you originally contributed tax-free without any penalties.

5) If you withdraw the investment returns that you made on your money, you will be taxed as if you earned the money as income, plus an additional 20% penalty. (This is a very unlikely scenario.)

Questrade Margin and Non-Registered Account

First of all – kudos to you for maxing out your Questrade RRSP and TFSA accounts! If you haven’t done that yet, you can probably keep life simple and skip this part of our Questrade review.

Once you have contributed the maximum amount to your RRSP and TFSA accounts, and (if you’ve got children) the Questrade Family RESP is on autopilot, your next step becomes a good news – bad news situation.

The good news is that you are in great financial shape, and there are options available for continued investing.

The bad news is that there is no more space under your tax-sheltered registered account umbrella. From here on out, you will be investing in the rain, and the tax man will get his chunk.

So, while there are semi-exotic accounts one could open if they want to exchange foreign currency or invest within a corporation, the option most people will opt for is a Questrade Margin Account.

The Questrade Margin Account is a fancy name for a basic non-registered account, with the added feature of being able to borrow money from Questrade and invest that money alongside your own. When you borrow money to invest it, this is called “investing on the margin”.

Now, I don’t recommend investing on the margin unless you really really know what you’re doing, and even then it often isn’t a good idea. The main takeaway from this though, should be that YOU DO NOT HAVE TO BORROW MONEY to invest within a Questrade Margin Account. Most everyday investors in Canada will be best served by using this account to invest in Canadian-dividend payers (my Smith Maneuver account for example) or other Canada-based ETFs.

You can however, put almost any kind of investment in a Questrade Margin account. Here’s a few more quick Questrade review facts about the non-registered option:

- You can invest in short-selling (watch the Big Short to have Margot Robbie in a bathtub telling you what this means)

- There are no contribution limits to worry about like there are with the Questrade RRSP, TFSA, and RESP accounts.

- Investment returns inside an unregistered account are still treated much nicer than income you make from a job. Capital gains and dividends are eligible for special tax treatment in Canada.

- There are no taxes to worry about upon withdrawal like there are in a RRSP.

- You can engage in complex options trading (not everyone’s thing).

- Questrade Margin accounts are governed by margin falls. This part is important: If you borrow money from Questrade, and the investment drops below the margin requirement, Questrade will essentially demand that you pay them their money back. If you don’t immediately pay them back, Questrade can sell your investments and take the money in lieu of your payment.

Overall, using the Questrade Margin Account as a basic non-registered account is a great option. Getting into the more exotic options like leveraged options trading is best left to the more experienced.

Questrade’s FHSA Account

Questrade was the first of Canada’s online brokers to come out of the gate with a First Home Savings Account (FHSA). You can read all about the FHSA and how to get the most out of it (as well as what investments we recommend) by checking out our ultimate guide to Canada’s FHSA.

There is no fee to open the account, and investors have a wide variety of investment options to choose from. Remember that to open a TFSA, you need to be a Canadian resident and not have owned a home for at least the past four calendar years.

By being the first broker to offer clients this supercharged path to a down payment, Questrade was able to offer its clients the ability to immediately start saving. All initial indications are that accounts were running smoothly. The ball is definitely now in the court of the rest of Canada’s brokerages to keep pace.

Questrade’s Trading Platforms – A Peek Inside

Questrade, like many other online brokers that have been around for a while, has done its best in trying to stay fresh and relevant in terms of providing a range of trading platforms to appeal to a wide range of investors.

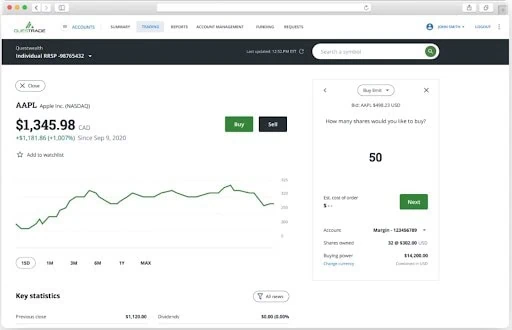

Questrade Trading

This is the platform most everyday investors will use. It’s simple interface allows users to view their holdings and earnings all in one spot, and trade with the click of a button.

It’s a secure, web-based platform, so you’ll be able to access it easily from anywhere without worrying about safety.

If you want access to more advanced tools, you can set up alerts, as well as access reports and data to help you make informed purchases.

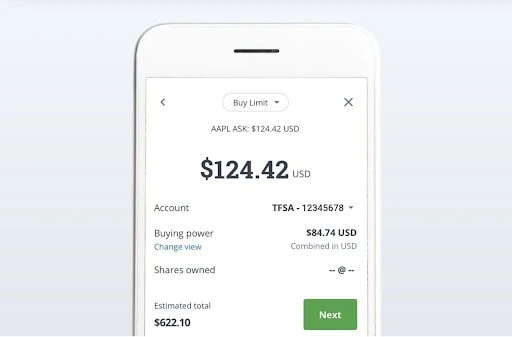

QuestMobile

We’ve got to hand it to Questrade for their effort in trying to create a user friendly app that actually works, but it looks like they are still on their quest to achieve this goal.

With a 2.1 star rating on the Google Play store, and a ton of negative reviews, it’s clear that while they are working on it, it’s not quite there yet. While they have tried to make it simple to use, they have taken away some of the key features liked by users. Others complain that the user experience isn’t great.

It does offer some interesting features like real-time info, an overview chart and customizable alerts. It also has a learning mode for those looking to learn the ropes before putting up the cash.

While that might not be enough for some investors, the app can be used for your basic trading needs, but likely not more than that can be done well.

Questrade Edge

For active traders, Questrade Edge offers a range of tools to help users maximize their results.

Some of the tools included are charting to help users analyze and map data, customizable alerts and workspace, advanced trading orders and a downloadable desktop version. One thing that Edge users will get that others won’t is access to research powered by TipRanks.

Questrade Global

If FOREX and CDFs are in your investment wheelhouse, Questrade Global makes it easy to trade currencies and commodities on international markets.

Not only will you be able to trade directly on the platform, but you will also have access to live charting, economic releases and alerts. It’s got both desktop and app versions, so you can access the platform from home and on the go.

Questrade Review: Market Data Streaming

Questrade’s market data feed is one of their strongest selling points. Like most brokerages, the data feed that you have access to depends on the platform you subscribe to.

Every account at Questrade gets “snap quote” updates on your usual stocks and ETFs, as well as options. What this means is that when you look up stocks or ETFs you get up-to-the-minute bid-ask prices, and can see the usual metrics including price highs and lows, market capitalization, dividend info, etc. You also get to see the TipRanks analysis and the Benzinga newsfeed.

Now, if you’re a professional day trader (not my cup of tea personally) you are likely interested in Questrade’s three premium data streaming options.

Streaming Package 1 ($19.95): Only for options traders. Give’s real-time pricing of all Canadian and US options.

Streaming Package 2 ($89.95): Gives you access to additional level 2 market streaming data for Canadian stocks, ETFs, and options.

Streaming Package 3 ($89.95): Give you access to additional level 2 market streaming data for American stocks, ETFs, and options.

By subscribing to market data streaming package 2 or 3 you also get slightly lower trading fees on stocks and ETFs.

QuestMortgage – Questrade’s BetterRate Mortgage Provider

In 2022 Questrade decided to branch out and include a mortgage platform. The President and CEO of Questrade, Edward Kholodenko, told new users that, “QuestMortgage will help thousands achieve their dream of homeownership in a simple, transparent and easy way, ultimately setting them on the path towards financial success and security.”

Here’s what QuestMortgage promises customers going forward:

- A simple user friendly platform.

- Mortgage advisor support through renewing or applying for a mortgage.

- Completely online interaction – no need to come in person to a physical location.

- A great low rate from the start with their trademarked BetterRate promise.

At the end of the day Quest Mortgage looks like a solid mortgage broker solution for folks that want to get things done online. I haven’t personally used this Questrade product (as I prefer to negotiate my own mortgage directly with my financial institution) but it’s interesting to see the DIY brokerage platform offer new products like this.

Questrade Uses CWB Trust Services

In the interest of full disclosure in regards to how safe Questrade is, the company announced in 2022 that CWB Trust Services would now handle the registered plans for Questrade as their official trustee.

The Trust company acts as trustee for over 1.5 million accounts with assets of over $90 billion.

Edward Kholodenko, the President and CEO of Questrade stated, “”CWB Trust Services is an industry-leader in registered plan trustee and custodial services,” and went on to add, “Their innovative and personalised solutions will help fulfil our service requirements, add value and ultimately ensure our clients become much more financially successful and secure.”

What this means to the average customer is that the parent company of CWB Trust Services (Canada Western Bank) stands behind the safety of your registered accounts. While the bank isn’t the largest in Canada, it’s still a pretty massive company with a $2.2 billion market cap and is fully regulated by the Canadian government as a Schedule One Bank.

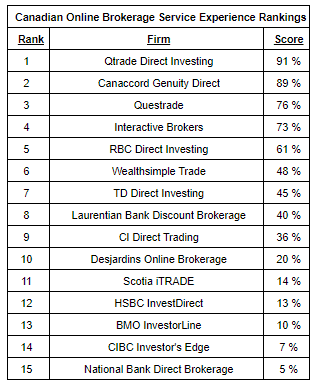

2023 Surviscor Questrade Broker Rankings

Over the last two decades Glenn LaCoste and his team at Surviscor have ranked Canada’s online brokers according to over 100,000 service interactions across 45 firms.

Questrade came in a very respectable 3rd place behind Qtrade and the very niche broker CG Direct. ETF commissions on ETF sell orders, mediocre service experience, and ECN fees were cited as areas for improvement. Much improved customer response times, chat services, and the ease of opening an account via mobile app were cited as strengths.

LaCoste summed up the report by saying, “Good news continued throughout 2022 as most firm response times improved for the second consecutive year after many years of neglect that was blamed on increased trading volumes. The glaring concern is the trend within the big bank owned firms as four of the six fall outside the top 10, a trend that is also mirrored in our digital banking reviews.”

Overall, I was happy to see Questrade continue to improve and be included amongst the leaders.

Questrade Customer Service in 2020 – 2023

While Questrade continued to lead the pack when it comes to per-trade fees in Canada the rush to DIY investing – combined with Covid-related logistics issues – led to customer frustration with Questrade throughout the last year. With many commenters reporting wait times of 3-5 hours whether they used the call-in feature or online messaging, there was a premium to be put on customer service.

Now that’s not to say that Questrade won’t adapt and adjust to these new market realities in 2023 (we think it’s likely they will), but for now, Canadians’ consistent expectation of solid customer service means that Qtrade has climbed to our #1 position when it comes to crowning the King of the Discount Brokerage mountain.

All of that said, if you’re an experienced investor that rarely requires help when using your discount brokerage platform, then the consistent commitment to low fees might mean that Questrade is still the best fit for you.

Questrade Review: FAQ

Questrade Review: Final Verdict

Opening a Questrade brokerage account was one the first concrete actions that I took as an investor nearly twenty years ago. While it’s no longer my preferred Canadian online broker, I still keep it active for the convenience of isolating a specific non-registered account and to stay updated with the platform’s latest features.

For the rest of my accounts I now use Qtrade. You can read the full details behind why I fully switched a few years back by checking out my Qtrade Review. If you aren’t using Qtrade yet, I recommend trying it out and doing a comparison for yourself. They’ve got a ridiculous deal on now to capitalize on RRSP season. You can grab:

- $400 instant money back with a $5,000 investment in a new Qtrade account

- $1% cash back for higher investment levels (up to $2,150) – whether you transfer from an old brokerage account or send cash from a bank account.

- Free Trades for a few months to get your new portfolio all set up.

- They pay your transfer costs from another brokerage.

It just doesn’t get better than that. That offer is tied with the best I’ve ever seen for accounts over $100,000 – and is far and away the brokerage promo offer I’ve ever seen for small- and medium-sized new accounts.

I want to be clear – I’m not here to devalue Questrade. They’re still a strong contender in the world of online brokerages and have come a long way since I started my DIY investing with them back in 2005. For many Canadian investors Questrade remains a solid and reliable choice.

That said, my shift to Qtrade (I’d always had a Qtrade account for information purposes, but I fully shifted over about five years ago) isn’t about Questrade faltering – it’s about Qtrade excelling in areas that have become increasingly important to me.

As an investor, my needs and priorities have evolved, and Qtrade’s strengths, like their exceptional customer service and well-designed interface, have just led to them topping my personal list.

Whether it’s their robust research tools, smoother trading experience, or the added polish in their customer interactions, Qtrade has simply raised the bar.

I’ve continued to update my 2024 Questrade Review throughout the year (and will continue to do so in 2025), as the platform continues to evolve. It’s worth noting that none of Canada’s top brokerages are static – they all adapt to new trends, feedback, and competition.

As always, I encourage you to share your recent experiences with Questrade in the comments below. Whether it’s a rave review or constructive criticism, your insights play a crucial role in keeping this discussion balanced and informed.

CNN I cannot find any mention of a $5 cap on ECN fees on their website yet you mention it a few times in this article. The ECN fees was one of the reasons I left Questrade but I am now thinking of coming back.

I have been with Questrade for many years and loved the product!

Unfortunately, over the past few weeks I have become very concerned with what is transpiring there.

I recently made an RRSP withdrawal for $80K. The team at Questrade made the withdrawal but forgot to withhold the taxes, so instead of contacting me, they made an unauthorized withdrawal for an extra $30K and withheld taxes as though I had originally requested to withdrawal $110K. When I noticed that $30K was missing I called and was told that they had only taken out $80K, then the story changed to $104K, then they asked me if I had withdrawn $110K???

It took a week and change to resolve and the whole time the team at Questrade treated me like it was my error, often hanging up on me. They wanted me to send back money, which I was fine with, but they would provide no calculations despite being asked multiple times for a clear breakdown. By continuously escalating the matter to senior managers, the matter finally got resolved.

The compensation they gave me was a joke for the amount of time I have spent listening to their annoying elevator music while on hold or arguing with people who cant organize amongst themselves to figure out what occurred and how it needs to be resolved.

The long and short of it is that they are able to make withdrawals from your account without authorization!!!

What is clear to me is that they have no processes in place to prevent their employees from making unauthorized withdrawals from your account, they have no processes in place to rectify the situation should one of their employees make an unauthorized withdrawal from your account, if they make an error they will try to cover it up by making am unauthorized withdrawal from your account, they will deny that the withdrawal was unauthorized, they will take no accountability for making an unauthorized withdrawal from your account, and they will fumble around with little to no remorse/expedition for making an unauthorized withdrawal from your account. And maybe, if you’re lucky, they will tell you that the compensation that they offered you was never offered to you, but will be honored anyways.

I mean, WTF??? Check your accounts folks.

I cannot stand questrade anymore. It’s been automatically logging me out of my account after 30 seconds for months now, so I am unable to trade and nobody has helped me. Please use any other platform

Never Again-Worst Customer Service I’ve ever experienced

I’ve had a horrible experience with Questrade transfers. In particular, an RSP transfer has so far taken 11 weeks and despite 35 emails, 5 phone calls and a few online chats is still “under investigation” which is their way of saying the transfer cheque was lost and their cooling their heels ‘investigating’ to stall re-sending it. Questrade really takes advantage of customer vulnerability. For weeks they would not give me any information regarding the transfer at all instead constantly deflecting blame to EQ bank (that is receiving the transfer) and having me call them multiple times. Personally, it seemed that they outright stole thousands of dollars from me – it took me so many messages and talking to so many people just to suss out that a cheque had been sent but never received by EQ. You’d think this would be a fairly simple thing to resolve but no the fight for the transfer is still ongoing almost 3 months in.

Questrade has made zero steps to compensate me, I’ve never been able to speak to a manager or superior and I have lost all faith in this company, all I can do is warn others.

Hello,

Quick question. What happens to your investments should questrade file for bankruptcy?

Hi Peter,

In all likliehood, what would happen is that one of the other brokerages would buy Questrade out before it got to that point. If that didn’t happen there would be some sort of mechanism available to switch over to another broker. Questrade doesn’t own your money.

I’m opening up a questrade account and i just have a question about the options. On the choosing an account page i can’t seem to find the RRSP option, the only thing there is RSP. Is that the same as an RRSP? I know when i look it up it shows RRSP for everyone else so im wondering if questrade just recently changed their naming for their accounts? Thanks

It’s the same Michael.

Where is the setting for turning off the ability to borrow in a margin account?

I asked Questrade support and here’s what they said: “There is no feature to turn off the borrowing on a margin account. The whole nature of this account is that it allows you to borrow funds if you don’t have. If you don’t wish to borrow then you can just ensure to trade with the funds you deposit. Whenever, it exceeds the amount you have then you will be borrowing.”

I apologize Francois, this was an old feature of their accounts that I never dreamt they’d change. I will update the review immediately.

I had the same initial impression, however this does not work for trades with accounts valued over $1M USD. SOOO many issues with account locks for “inquiries”or “risk reviews”, delayed transfers on amounts of $100K to my bank account…all while being a “platinum member”.

I left TD because of the fees, but now think it’s worth it…I’m moving back.

I did not know that they had issues with larger accounts. Can anyone else share their experiences?

WOW sooooo glad I read this. Was looking for a broker with good trading platform for my new trading experience. CIBC fees good but platform really lacking, Customer service VERY important to a newbie, On line reviews were good for Questrade but you have convinced me that i need to go else where THNX Now mt search for good trading platform continues frustrated this is soon difficult

Hey Don – haven’t been here for years, but saw a bunch of notifications in my email and figured I would check it out again. I see lots of complaints, but understand, its the people with complaints that will post to a forum, not those that are content. You are looking for platforms – since TDW killed their active trader, questrade IS the best canadian platform out there now IMH (IQ edge). I have been with them for about 15 years I think, rarely have issues and have withdrawn at least a dozen times (EFT) with no problems (note with USD to CAD – you have to exchange first, then withdraw once funds moved to Cad side). I see some complaints about exchange fees, well, it was the same as TD was from what I recall. Part of doing business. Also see complaints about orders being dropped – it COULD be the ‘aggressive bid’ rule where you can’t place an order greater than 20% above/below last price. This affects stop limits (ie, stoploss $1, with a limit of 0.79 – the order will go in, but will get rejected once triggered.

This is all brokers, so maybe the person just doesn’t understand and blames them.

One thing for sure, if you also want to trade OTC/PINK in US market, this is the place to be. Maybe its not for those with million $ accounts, but why are you using a discount broker if you have $million account?

Just curious, who would you go with if you had a $million account?

I’m more concerned with Suz story of having issues withdrawing from the account. I can say, like you, I have never had issues when withdrawing funds via EFT from my margin account over to my bank, however; in a few years time I am interested in buying a home and will be using the HBP, but I will be depositing $25K into my RRSP, hold it for 90 days to trigger a tax refund (from what I’ve read can be ~8-10k) then I will withdraw the money to be used with the HBP, but I don’t want to have issues when withdrawing the funds.

Hard to say which platform is the best, but I like what I get from the Interactive Brokers. I would also imagine they are used to the large transactions because they, supposedly, deal more with the wealthier investors and traders. Also, I believe, IBC has, by far, the best mobile and standalone application.

As for the issues…Since beginning of April I am trying to move a small (<$10K) RRSP account from RBC to my broker and the only word I would use to describe it is "sabotage". RBC has came up with several excused for refusing a simple and straightforward RRSP all in-cash account transfer. So…as usually, "your mileage may vary".

That’s interesting, because I just moved my RRSP from RBC to Questrade less than a month ago, with zero issues. And I didn’t speak with RBC at all. I filled the transfer form that Questrade provides and they dealt with it, pretty easy.

One thing, Questrade did say that it could take about 20 business days to finalize, but it took about one week, so much faster than anticipated. Cash still sitting in my RRSP account waiting for trade :)

Hard one to answer – one of the banks probably (TD), but to be honest, all the banks trading platforms suck, so if you want to self manage, not sure the best route. If you are fine with some one else managing, I would use a full service (locally have used Odlum Brown & Hollis Wealth and they have done fine).

Personally I don’t know if taking out large sums would be a common issue with Questrade. Max I have done at once was $10000, and no problem with that, but if it was $100000???

Hi Suz,

My name is David, and I work at Questrade.

We came across your comment, and we’re sorry to hear about your experience with us. We can only imagine how you must have felt at that moment.

We want to hear more from you and check what exactly happened there. Please send us an email with your contact information to feedback@questrade.com, and we’ll reach out to make things better.

Sorry for the trouble.

Thank you,

David – Team Questrade