Long-Term Care Insurance In Canada: Do I Need It?

TL;DR: You probably should not buy long-term care insurance in Canada.

For many Canadians who are entering retirement, one of the big fears is that in their final years they will not be able to live on their own – and that because they can’t afford private long-term care, their lives will become miserable.

This fear button can be a powerful motivator when someone sitting across from you is trying to sell long-term care insurance, even if you’re still a relatively young retiree. The promise of long-term care insurance sounds good in theory: “Just like we insure against a house fire or a car crash, we can insure against the event that you will need to spend ten years in a high-end long-term care facility. Just sign here, and then come see us when you need a little help.”

The problem, according to experts such as Fred Vettese, is that long-term care insurance doesn’t actually offer very good value, and the coverage involved can be complicated to the point of incoherence. We’ll explain what some of the problems are with long-term care insurance in Canada, and alternative planning strategies for your later years.

What is Long-Term Care

The phrase “long-term care” is going to mean different things to different people. Broadly defined, we can say that long-term care is any service that provides for the essential needs of people who are no longer able to live independently.

Long-term care insurance plans generally state that at least two of the following daily activities cannot be performed independently in order to qualify for long-term care in Canada:

- Dressing

- Toileting

- Bathing

- Transferring (moving from room to room)

- Continence

- Eating

What your long-term care in Canada accommodation options will actually look like in practice, can be divided into five main categories according to Vettese:

1) Private home care provided round-the-clock by a team of personal support workers – and may include private nursing.

2) A high-quality, private run assisted living retirement home where care is supplemented by outside personal support workers.

3) Government-run and/or government-subsidized nursing homes where residents can pay for better (private) accommodations and services.

4) Remaining at home with care provided by family.

5) Government-run nursing homes that involve basic accommodations.

My sister-in-law works in a support role for many in long-term care, and she likes to say, “Getting old isn’t for sissies”. After diving into the realities of long-term care, I have to say that I couldn’t agree more.

But while cognitive and physical decline is a scary possibility, that doesn’t necessarily mean that insuring against the need for long-term care is a good idea.

Long-Term Care Insurance in Canada

Before you decide whether or not you need long-term care insurance, you should be aware of a few statistics:

- About 17% of us are likely to need long-term care according the Canadian Life and Health Insurance Association (CLHIA)

- Less than 1% of Canadians hold long-term care policies and across the OECD, less than 2% of the population has purchased coverage.

- The average long-term care stay is about 18 months.

- Don’t forget, if you’re in long-term care, many of your other budget items such as travel, housing, food, and entertainment will be significantly reduced. So while the price tags on the options we’re about to discuss look quite high, they need to be looked at in the context of your entire retirement financial plan.

The costs of long-term care in Canada vary significantly by province and city. Of course, the costs involved with caring for someone with dementia can be quite different than someone with severe physical ailments. Because of these variables (and the fact there is no way to predict the length of time that you will be using long-term care) it’s difficult to predict what long-term care costs will be for you (if any at all).

If we take Vettese’s calculations from back in 2016 and apply a conservative 20% inflation rate to bring the numbers up to 2023 levels, we get the following estimates:

- Private 24-hour at home care: $120,000 to $240,000

- Privately-run assisted living w/ PSWs: $90,000

- Upgraded nursing home accommodations: Up to $42,000

- Family Care: Minimal

- Basic government accommodation: $0

Alternatively, Financial Planner Jason Heath quotes data from the Canada Mortgage and Housing Corporation (CMHC) that shows private-run assisted living facilities might be a little cheaper than my modified Vettese estimates above.

I personally have very little experience with nursing homes or high-end assisted living facilities. From my personal visits to elderly friends and family, as well as from anecdotal conversations, I think it’s safe to say that the quality of each specific long-term care accommodation can vary widely – even within specific budget ranges.

For what it’s worth, Vettese volunteers that his third option is, “a middle-of-the-road solution that can be quite comfortable and generally affordable. I have visited people in such facilities and found nothing wrong with the surroundings or the quality of care.” It’s also one that can be quickly adapted through the purchase of increasing upgrades as needed.

It’s worth noting that contrary to what some people believe, the government does not pay for every Canadian’s long-term care, nor do they cover all the costs for the people who do qualify for government-aided care.

For basic care in government-run accommodations, each province sets their own minimum income threshold (below which all care is paid for by the government). For example, in Ontario, in 2022 if your annual income was below $24,049 then you qualify for a rate reduction. If you have above that level of income you will be charged a co-payment.

The Ontario government stipulates, “long-term care homes are regulated and funded by the provincial government. Government agencies determine who is eligible to be admitted to long-term care, and manage the wait lists. Each home is granted a license to operate by the provincial government. Homes are required to follow the requirements of the Long-Term Care Homes Act, one of the most stringent pieces of nursing home legislation in the world.

The provincial government provides funding for all the staff and supplies related to nursing and personal care, resident social and recreational programs and support services, and raw food (used to make meals). In addition, long-term care homes receive other government funding for specific needs, such as falls prevention equipment. Residents pay an accommodation fee to the long-term care home that is used to pay for expenses such as non-care staff, utilities, and mortgages, as well as building maintenance and major capital repairs (like a new roof). The government sets the rate for resident fees and provides subsidies for residents as needed.”

When considering insurance products, it’s always essential to understand that there is an opportunity cost to preparing for a worst-case scenario. In this case, in order to protect against a 2+ year long-term care stay, one needs to consider that the cost of their monthly insurance premiums could significantly impact their ability to enjoy their early retirement years. That is a difficult tradeoff for a lot of us to make, and one that insurance sales people often overlook.

Long Term Care Insurance in Canada: Pros

- It can set your mind at ease if you are really terrified of needing long-term care for an extended number of years.

- It can (in specific circumstances) ensure a high-level of care in your final years.

- Payouts are generally tax-free.

Long-Term Care Insurance in Canada: Cons

- There are only a few companies offering long-term care insurance in Canada. This has resulted in very high costs and little competition.

- Most long-term care insurance policies need to be purchased as early as 45 to be remotely affordable. The likelihood you’ll need your policy until 80+ is quite low.

- According to Michael Wolfson, a professor and holder of the Canada Research Chair in Population Health Modelling at the University of Ottawa: “It’s difficult to know just what you’re buying because the boundaries of what is a long-term-care need, and what isn’t, is pretty subjective.”

- Conditions for underwriting of long-term care insurance are quite exclusionary. For example, Asthma would preclude coverage for many. By the time we’re 55 or 65, many of us will likely be dealing with these conditions.

- Coverage is often limited to 2-5 years or capped at a relatively modest amount of money. Consequently, you might not even be fully protected for that substantial long-term care stay that was your biggest fear in the first place!

- You often have to wait 90 days before the insurance benefits will start paying out. That’s about 20% of the total time the average person spends in long-term care!

- Premiums are often only guaranteed for 5 years – and then they can be raised quickly (right when you’re more likely to need them).

Long-Term Care Insurance Costs

Most insurance policies (such as your car insurance or house insurance policies) come with the following setup:

You pay a relatively small amount each month (called a premium).

If the negative event that you’re insured against occurs, you will sometimes also pay a deductible. For example, if you’re in a car crash, your bill to fix your vehicle might come to $15,000. You could be asked to pay $500, and your insurance company will pay the other $14,500. The specifics may vary based on your plan.

Long-term care insurance is set up a bit differently. You still pay a monthly premium, but there is not usually a deductible. Long-term care insurance benefits in Canada are usually set up in one of two ways.

1) A simple plan that says that if you qualify for long-term care, you will receive a specific amount of money each month that you are in care. Usually you are to receive this amount of money for a period of two years, but alternative lengths of time can sometimes be used.

2) A somewhat complex plan that will reimburse you for specific costs provided that you qualify for long-term care. There is a massive range of services that can be included or excluded in these types of plans, so be careful to read the fine print.

Inflation options can also be baked into many long-term care insurance policies – at a cost of increased monthly premiums, of course.

Obviously, given all of the different variables that we just talked about, the range of long-term care insurance monthly premium costs are massive. As a really vague ball park number, you might be looking at $120 per month if you’re a healthy 45-year old female, $250+ as you start to age into that 55-60 age bracket when many Canadians first start looking at long-term care costs.

Again, these are very rudimentary long-term care premium cost numbers – you really have to get a personalized quote to see what it would cost you.

If you try to get a long-term care policy after you turn 60, the monthly premium costs go up dramatically.

Building Your Own Long Term Care Solution

Just because the Canadian long-term care insurance market leaves a lot to be desired, that doesn’t mean that Canadians shouldn’t prepare for the eventuality that they may need help in their advanced age.

Vettese recommends using housing equity as a ‘buffer’ that can be used to pay for long-term care if needed. After all, the vast majority of people who go into long-term care don’t make the journey in the other direction. Either through a housing sale or a reverse mortgage, a person should fairly easily be able to pay for 3-5 years of long term care (and substantially more than that if a middle-of-the-road accommodation plan is pursued.)

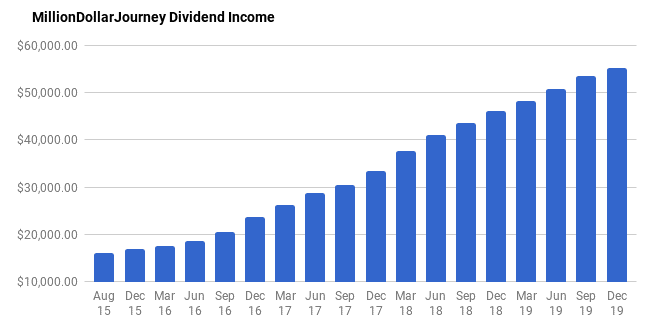

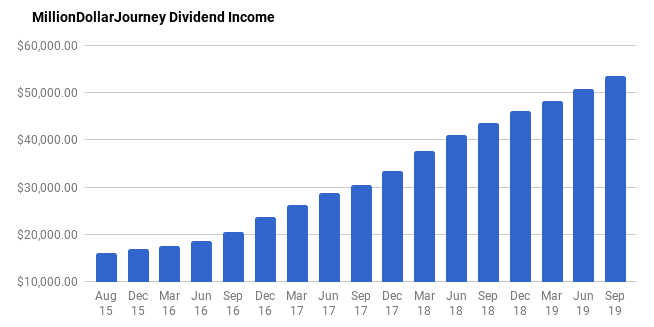

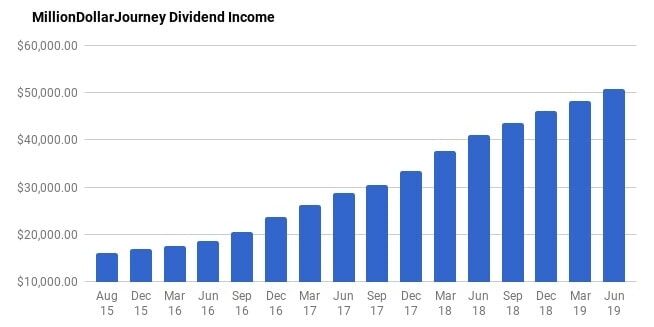

Here’s the other option – which is my personal favorite: Create a personal savings/investment account that you can call “old age emergency or inheritance”. Vettese explained this in an appearance on the Rational Reminder podcast saying:

So when I looked at the typical situation for long-term care, i.e. where you start receiving at age 87, 88, and you need it for three years. I found that somebody simply saved the same amount as the premiums from age 55 and on, that they actually were better off than if they bought the insurance.

So you can see it is self-insured. So it didn’t make any sense. I can’t say I made any friends with that insurance company, and to their credit, they were actually very helpful in opening up their books and explaining to me as to how it worked. But once I saw how it would work, I said, “This doesn’t make any sense.”

In other words, if you decide at age 50 or so to start putting away $50-$75 in an account each month (be it a high interest savings account, GICs, or perhaps something with a little more risk such as dividend stocks), then by the time you are roughly likely to need long-term care (80+ years-old) you should have a nice little “emergency asset” sitting there. Certainly enough to get you through all scenarios barring the very worst 5% of the time when you would need 3+ years of long-term care.

In those negative highly improbable circumstances, spending your first few years in a more middle-of-the-road option before gently transitioning into more basic government-provided accommodation doesn’t sound all that awful in terms of a worst case scenario to me.

Indeed, you’re much more likely to pass away without needing the money at all – and in that case you’ll be fondly remembered by someone – and you’d have had the peace of mind of being able to access that money with no questions asked – exactly when you needed it. Self-insuring is a much simpler and more flexible way to achieve that same peace of mind that many try to get through long-term care insurance.

FAQ About Long Term Care Insurance In Canada

Do I Ultimately Need to Buy Long-Term Care Insurance in Canada?

While you might very well need long-term care at some point, you probably should not purchase long-term care insurance. Without knowing you, your specific fears, and the financial tradeoffs that you would need to make in order to pay long-term care insurance premiums, there is no way to answer this question for sure.

What we do know for sure is that Canadian long-term care insurance policies suffer from:

- Being very complex

- Massively expensive

- Capped benefits in worst-case scenarios

- Having long waiting periods to get access to the benefits you have paid for

Some people will argue that the peace of mind is worth it and that you should start paying long-term care insurance premiums when you are young – but I just do not see the evidence supporting that position. There is a massive opportunity cost to paying so much of your after-tax money over to an insurance company each month.

Most financial planners that I know say that when you look at the difference in costs between the target monthly budget that you set up for yourself – and the costs of a middle-of-the-road long-term care option – the difference is not massive. If one has either a mortgage-free residence, or a decent nest egg of $150,000 or so, then they will likely be just fine when it comes to funding their own long-term care needs (if they need it at all).

Many long-term care insurance plans won’t cover you for more than $150,000 anyway – so they’re not any help in protecting against the worst case scenario of spending 5+ years in long-term care.

There is no way to mathematically determine if the opportunity cost of not getting to spend thousands of dollars from the age of 45 to 70+ is worth the promise of some financial help (after 90 days) if you need long-term healthcare. Some people will crave that peace of mind, but for me, given all the negative aspects of the current policies, I won’t be recommending long-term care insurance to any Canadian.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Biggest plus of insurance…

One can get into a 100% private pay facility at a younger age if needed.

Key stress reducer is not having to run the Ontario Government bureaucratic gantlet of need evaluation and nearby facility availability.

(Of course, if the money had been saved as suggested it would also be possible).

I was 63 when my wife needed full time care so might not have saved sufficient funds.

We decided home care was insufficient. 2.5 hours later she was in her bed in a private pay facility!

Hi Dave. First – I’m very sorry that living circumstances for your wife (and yourself) changed so dramatically at a relatively young age. I hope that you both continue to live very fulfilling lives to this day.

In the scenairo you describe, it would indeed be beneficial to have had long-term care insurance. Here would be my follow up questions though…

1) How long ago did you purchase the policy? I ask because long-term care policies used to be considerably more generous with payouts and caps on benefits.

2) Was there any caps as part of your policy? The vast majority of today’s plans have a cap on the number of years or total dollars that will be paid out.

3) You mentioned that within 2.5 hours your wife was in a private pay facility. Did your policy pay for the first 2-3 months of that care? Most policies only kick in after 60-90 days.

1 Policy bought 10 years ago.. Premiums to 85, then no cost for coverage. $699/month/individual.

2 $8,500 per month benefit. No lifetime max from selected provider. Most did have caps.

3 Chose a 6 month deductible to keep monthly rate down.

Dave

PS I dropped my life insurance policy shortly after she passed, and am considering dropping the LTC policy as my assets are now sufficient to cover many years of private pay. Maybe not yet however, as for those who are self employed the cost in their PHP is 100% deductible from business income.

Thanks for sharing your story and letting us benefit from that unfortunate experience Dave. Very sorry to hear that your loved one is no longer with us.

Ten years was right around when things were changing from what Ben Felix and Cameron Passmore were saying on the podcast I listened to (I couldn’t find a better discussion or article anywhere). I do like the simplicty of that plan you signed up for – it’s easy to understand and there is no worries about reimbursement. The 6-month deductible is an interesting feature. It would make it much more affordable, but on the other hand that’s the total stay for a lot of folks in LTC. There is so little concrete info online, but from what I can see, I think you’d pay a lot more for that coverage these days if you started paying at 55 or 60.

Assuming you signed up for the same policy, I might consider hanging on to the policy at this point in terms of value for the premiums you already paid. One would have to look at any surrender values, your own longevity expectations, etc.

Interestingly, even when an applicant is physically healthy, there was still a 45 minute approval phone call with an RN. Apparently (according to my insurance broker), the major risk for insurers is dementia as such people may need care for over a decade. The purpose of the call was to evaluate an applicant’s mental state and deny a policy if there were indications of early cognitive decline.

As someone with a grandfather who has suffered from dementia for the better part of a decade, I can actually see where they’re coming from in terms of a risk/actuarial perspective.

Just to be clear – that 45-min approval phone call, that was when you started the insurance plan, or that happens periodically for you in order to keep the plan going? Because, if you have to pass a continual cognitive test as you age, that would lower the value of the plan consinderable I would think?

Not a bad gig for an RN compared to some of the other stuff they often get tasked with eh?