Scotia iTRADE Review 2025

Scotia Review Summary:

-

Scotiabank’s Online Fees and Commissions

-

Account Options

-

ETF Trading Fees

-

Customer Service

-

User-Friendly Platform and Mobile App

-

Overall Banking Convenience

Scotia iTRADE Review Summary:

Scotia iTRADE serves as the online brokerage platform of The Bank of Nova Scotia (Scotiabank). If you’re already a customer of Scotiabank and prioritize the convenience of consolidating your investments alongside your mortgage and chequing account, then Scotia iTRADE may justify its higher cost.

Compared to other major Canadian banks, Scotia iTRADE distinguishes itself with its robust tools tailored for active traders and an extensive array of educational, and practice resources.

However, when pitted against the best Canadian online brokers Scotia iTRADE falls short. Its shortcomings include an underperforming app and subpar customer service.

Our review of Scotia iTRADE delves into its offerings, fees, commissions (spoiler alert: they’re steep!), active trader features, and more, to provide insight into whether it aligns with your investment needs.

Pros

- Well known and trusted company

- Good for day traders and large portfolios (active trader discount)

- Excellent desktop platform

- 100+ commission-free ETFs

- Some fees waived for investors 26 and under

- Practice accounts available

Cons

- Fees are on the high side even for a big bank

- Fractional share trading not available

- Bad reviews for their mobile app

- Terrible customer service reviews

What is Scotia iTRADE?

In 2008, Scotia iTRADE was launched when Scotiabank acquired E*Trade Canada and promptly rebranded it. This purchase was a smart move as it essentially doubled the online client base of Scotiabank overnight.

Scotia iTRADE initially gained popularity among active day traders because of its discounted flat rate commissions for active traders. However, while they still offer discounted rates, these have increased from $1.25+ per trade to $4.99+ per trade, aligning them with, or even surpassing, the fees of other major banks.

Despite its merits, Scotia iTRADE falls short of being among our top recommendations for DIY brokers. For investors seeking affordability and superior customer support we would recommend online trading platforms such as Qtrade and Questrade, which are known for their array of free and low-cost trading options and exceptional customer service.

Scotia iTRADE: Safe and Trusted?

Scotiabank was founded in 1832. It’s one of Canada’s Big Five Banks and is used and trusted by tens of millions of clients worldwide. Scotia iTRADE has been in operation since 2008 – and its original parent company, E*Trade, is about as old as the internet (it began operations in 1982).

Scotiabank is Canadian Investment Protection Fund (CIPF) insured and regulated by the Investment Industry Regulatory Organization of Canada (IIROC).

When it comes to data security, Scotia iTRADE is on par with the other big banks – meaning that it’s as secure as you can get when it comes to online transactions. Scotiabank requires 128-bit encryption, uses firewalls and system monitors, and offers its users free security software.

Which is a long way of saying yes, Scotia iTRADE is both safe and trusted. The only risk you incur by investing with them is the risk you incur when you make any investment decisions.

Scotia iTRADE Review: 100+ Commission-free ETFs

Scotia iTRADE offers investors commission-free trading on over 100 ETFs from a range of companies including:

- Vanguard

- Horizon

- iShares

- Emerge

- Scotiabank

Free ETF trading is increasingly common – and so is the catch: like other big bank investment platforms, including BMO Investorline, Scotia iTRADE will only waive the commission if you hold onto the ETF for at least 24 hours.

That means that regular investors can take advantage of the savings with this free ETF trading, but day traders are better off looking elsewhere.

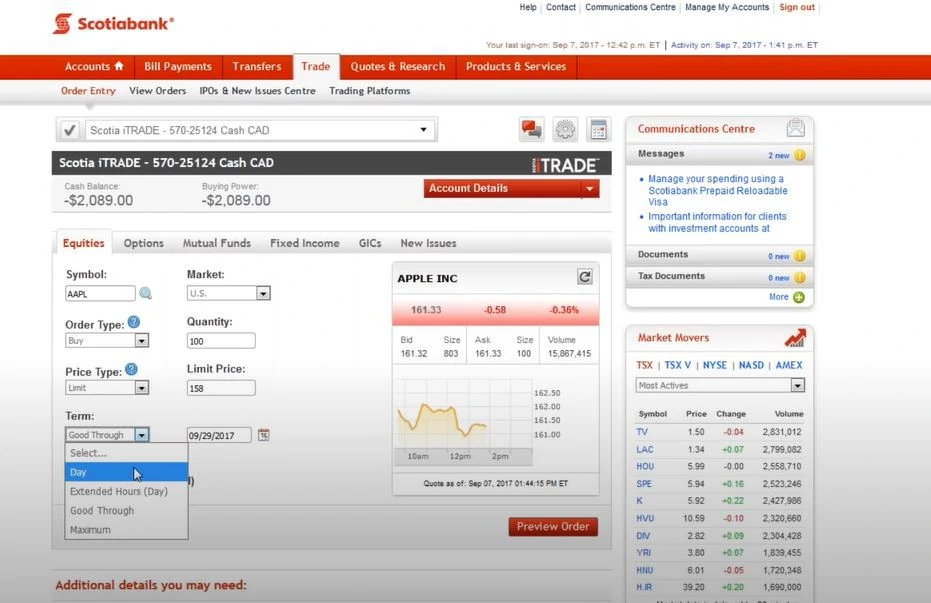

Trading Fees and Commissions

Aside from their commission-free ETFs, Scotia iTRADE’s trading fees are higher than we’d like to see. Stocks and non-exempt ETFs cost $9.99 for average traders to buy or sell (active traders can qualify for discounts- see more below).

Scotiabank’s trading fees and commissions are in line with their main competitors’ at RBC, TD, and BMO. The $9.99 per trade fee is standard across most of the Big Banks’ discount brokerages.

This is obviously a higher price than Questrade, Qtrade and other low cost online brokers. That said, there is something that Canadians love about the safety and convenience of using our well-known banks. Certainly there is a long track record of excellence and trust at Scotiabank, and to a lot of people, that’s worth paying more for.

Additionally, some Canadians value keeping all their money in one place, so if they’re already banking with Scotiabank they may feel some pull to utilize their trading service as well.

Account and Transaction Fees

Scotia iTRADE’s account fees are a bit nuanced. While the Scotia iTRADE TFSA and FHSA are free to open at any price point, the RRSP, RRIF, LIRA, or LIF will cost you $100 per year unless you meet one of the following conditions:

- $25,000 in combined assets across all of your Scotia iTRADE accounts.

- 12 commissionable trades per year.

The Scotia iTRADE RESP account fee is $25, but that fee is waived if your combined accounts add up to more than $15,000.

It’s also worth noting that if you don’t make one commissionable trade each quarter, Scotia iTRADE is going to hit you with a $25.00 inactivity fee!

For investors 26 and under, the RSP account administration fee waived, as well as the quarterly inactivity fee. However, once they reach 27 years old they’ll have to pay as many fees as everyone else. Is it just a ploy to get them started with Scotia iTRADE and then hope they don’t switch? Possibly.

Scotiabank also has a “StartRight Program” offering new residents and international students free banking for 1 year, free international money transfers, and 10 free equity trades with a minimum $1000 investment in an iTRADE account.

Below is a quick chart of the more common Scotia iTRADE account fees that you might run into.

| Canadian Controlled Corporation Setup | $300 |

| Canadian Controlled Corp. Annually | $100 |

| RRSP Withdrawals | $50 |

| TFSA Withdrawals | $0 |

| FHSA Withdrawals | $50 |

| Home Buyers Plan & Life Long Plan Withdrawals | $50 |

| Confirmation Replacement | $2 |

| Copies of Statements, Confirms, Cheques and Tax Receipts | $5 |

| Research Account Inquiries | $50 per hour |

| Certificate Registration | $100 |

| Wire fee (out) | $25 + Clearing Fee |

| Wire fee (in) | Free |

| Estate Account Processing | $200 per account |

Options Trading Fees

If options trading is what you’re after, the Scotia iTRADE options trading fee is $9.99 plus a $1.25 contract fee. However, if you make more than 150 options trades per quarter, the fee is $4.99 plus the $1.25 contract fee.

Much like their general trading fees, when it comes to trading options contracts, Scotia’s online trading commissions match up closely with the other Canadian big banks.

Scotia iTRADE iClub: Benefits for Active Traders or High Balances

Like some other big banks including BMO, Scotiabank offers reduced fees and special benefits to active traders and investors who have high balances. Here’s a look at the requirements and rewards for the Scotia iTRADE iClub Gold, Platinum , and Platinum+ membership tiers.

| Scotia iTRADE iClub | Gold Membership | Platinum Membership | Platinum+ Membership |

| Eligibility Requirements | 30+ trades per quarter or $250,000 in assets | $150+ trades per quarter or $1,000,000 in assets | $5,000,000 in assets |

| Special Pricing/Fees | Annual administration fees waived on registered accounts | Special $4.99/trade fees, annual administration fees waived on registered accounts | $4.99 commission Canadian & US stock & ETF trades regardless of number of trades per quarter |

| Other Benefits | -Dedicated client service line for Gold Members -Free access to Trade Pro active trading platform with complete customization options -Priority registration to iClub members only webinars and educational events | – Personalized service with dedicated relationship managers – Free access to Trade Pro active trading platform with complete customization options and additional free data entitlement (up to $30/month) – Priority registration to iClub members only webinars and educational events -Exclusive invitations to member appreciation events | -Priority access to iTRADE’s most experienced associates -Free Agent assisted trades by phone (typically $65 per trade) -Free transfer of accounts from other brokerages |

Scotia iTRADE Review: Account Types (TFSA, RRSP, Non-Registered)

While iTRADE isn’t going to outcompete the rest of Canada’s online brokers on price, they aren’t going to be beat when it comes to account offerings. They offer every account type you can think of, including:

- Non-registered accounts (both CAD and USD)

- Margin Accounts

- RRSP (both CAD and USD)

- TFSA

- FHSA

- RESP (both CAD and USD)

- RRIF

- LIF

- LIRA

- GICs

- Business Accounts (Sole proprietorship, corporate, partnership)

- Canadian Controlled Private Corporation (CCPC)

- Informal Trust

- Investment Club

- Trust or Estate

- Charity or Unincorporated Organization

Scotia iTRADE Review: Practice Account

One of Scotia iTRADE’s features that does stand out is their practice account. The Scotia iTRADE Practice Account is an online trading simulator that gives you (an entirely fictional) $100,000 CAD and $100,000 USD to invest.

The practice account is a risk-free way for new investors to get used to the platform and process—and a way for more experienced investors to test out new investment strategies. We don’t see a lot of practice accounts in the DIY investing space, and we’d be happy to see them catch on.

Scotia iTRADE Review: Cash Optimizer Account

The unique Scotia iTRADE Cash Optimizer account is a holdover from iTRADE’s origins as E*Trade. Basically, it’s a non-registered account within iTRADE that allows investors to get high-interest savings account-level returns on the investment funds they have sitting in cash.

To be honest, we’re not big fans of having a lot of cash sitting in your investing account. Either put your money to work in an investment portfolio or toss it in an actual high interest savings account to get the best interest rate possible. See our EQ Bank Review for more details on that decision.

Scotia iTRADE Review: Mobile App

While the Scotia iTRADE app looks fine to me, (I wouldn’t recommend doing any serious trading on a phone anyway – and it looks like it could handle basic transactions just fine) the 2K reviews in the Google Play Store are mixed.

While it is curently rated at 4.0 stars, it is still in need of improvement. Users continue to report many app crashes and long-term inability to log in as being the main issues. Many users mention trouble with the two-step verification.

Meanwhile, the rating on the Apple App Store (with 9K reviews) has dropped down to 4.2 stars from 4.4 stars since our last analysis of iTRADE. Clearly, the Scotia iTRADE Mobile App needs to be an area of improvement for the overall platform going forward. For better rated apps, read our comparison of the best stock trading apps in Canada.

Scotia iTRADE Customer Service

Every time we update our Scotia iTRADE review we get new comments complaining about the customer service. And it’s not just our readers, either: 87% of Scotia iTRADE’s reviews on Trustpilot are 1-star. Most complaints centre around wait times and app usability.

Though many of their features are robust and helpful, if you can’t use the app for basic transactions and you can’t get help when you need it, everything else fades in comparison.

Response times and mobile app functionality should be high on Scotiabank’s list of things to improve.

Scotia iTRADE vs Qtrade

Now that we’ve explored Scotia iTRADE in depth, it’s time for a quick comparison to our top online broker in Canada – Qtrade.

Scotia iTrade | Qtrade | |

ETF Fees | $0-$9.99 | $0-$8.75 |

Mutual Fund Trade Fee | $0 | $0 |

Account Fees | $300 set up fee + $100 annual fee for investment accounts | $25 per quarter, can be waived if certain requirements are met |

Inctivity/Low Activity Fee | $25 per quarter | $0 (as long as certain requirements are met *see above) |

Tradable Assets | Bonds, Equities, ETFs, GICs, New Issues, Mutual Funds, Options | ETFs, Equities, Exchange-traded debentures, Fixed income, Mutual Funds, Options |

User Experience | Average mobile and online trading platform and poor app ratings | Easy to use mobile and online trading platform and moderate app ratings |

Customer Service | Many negative customer service reviews due to long wait times, no response to calls or emails, and inexperienced staff | Highly rated customer service |

From this comparison, we can understand the reason why some Scotia iTRADE customers have jumped ship to get better value and service elsewhere.

Scotia iTRADE Review – Frequently Asked Questions

So, Who Is Scotiabank’s Online Trading Broker Best For?

If you’re a regular visitor to our site, you’ll know that the big banks’ best offering is usually just convenience if you’re already a customer. They aren’t generally keeping up with the online banks and top discount DIY brokerages. With iTRADE you won’t find the lowest fees, best platforms, or the best customer service.

However, that’s not to say they aren’t doing anything right. Over the years, Scotia iTRADE has won a number of awards for good reason. For those who hold a high account balance, or do day trading, there are plentiful rewards of lower fees and a much better customer service experience.

The crux of the matter is, times have changed, and big banks like Scotiabank are just not keeping up with other top discount DIY brokerages. You can find lower fees, and better customer service and app interfaces with many of the DIY brokerages.

Our Scotia iTRADE Review showed its comparative short comings. For Canada’s best online brokerage, we recommend Qtrade. Find out why it beats out iTRADE and others in our full Qtrade review.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

I agree and now the switch to tradepro is a bomb so far IMO. Any suggestions on a good platform would be appreciated.

My bad, but I didn’t realize there was an inactivity fee per quarter. It almost went to collections, despite receiving no notification that I owed money. I know it’s my responsibility to pay applicable fees every quarter, but even a small notice in my iTrade account could have alleviated the stress of being sent to the collections department.

I have had it with iTrade moving my portfolios to another company. I waited 4 hours to get through on the phones and in the end I was given wrong information from some helpdesk in India. Goodbye iTrade you don’t care about customer service and giving misinformation I will move somewhere else.

Constantly have issues with i-trade. The people at customer service are generally nice and for the most part helpful but the web access to their services is a nightmare. More often than not I incur unwanted surprises, restrictions, problems, etc. Processes with illogical restrictions, poor explanations of steps, ambiguous descriptions, and a labyrinth to find anything. Between iTrade and Scotia bank it’s a wonder I don’t just put my money under a mattress.

scotia itrade is a horrible place to trade. hours of wait time for phone calls, backoffice errors, high fees, mystery charges to your account and no one to talk to when it happens. it actually took 2 months for me to get an email response once.. do NOT use this bank – find yourself anyone else to deal with on the planet…

Totally agree

same experience on the phone on wait time even they have given me the Gold Club access number

I used to have iTrade before Scotia took over and it was good now its horrible. Its amazing how a company can be so bad but continue to stay in business. I wouldn’t recommend them to anybody.