Investing in Canadian Bank Stocks 2025

Last year (2024) was a very solid year for Canadian bank stocks. Most of us invest in bank stocks for peace of mind, solid dividend increases, and overall stability characteristics. But it’s always nice when you can add a 26% capital gain on top of that as well!

Looking ahead, there are several good reasons why several Canadian banks made it on to our Best Canadian Dividend Stocks in 2025 list.

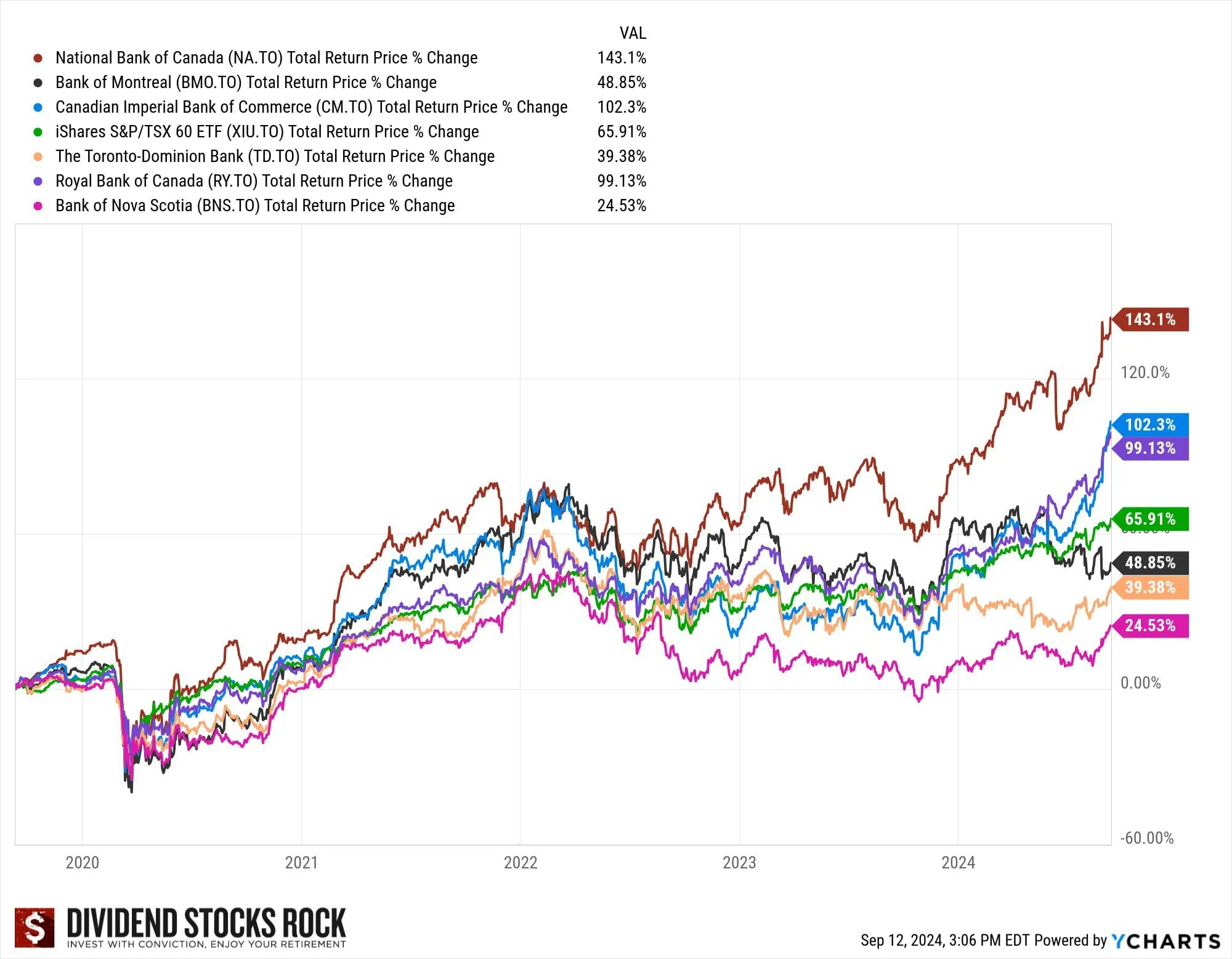

Mike Heroux created the chart above, and his newsletter is one that is personally at the top of my “must read” list. Click below to get on Mike’s free newsletter list and find out more about his exclusive Dividend Stocks Rock platform.

In 2024 we went two for three with our Canadian bank stock recommendations. National Bank and RBC have been my two most recommended stocks in this sector for the past five years, and both did excellent. RBC finished the year up 38%, with National Bank not far behind at 35%. Both banks significantly outperformed the TSX60 index on the year. Plus, one has to account for the juicy 3.5% dividend yield when considering total return. In fact, I liked National Bank so much (and continue to do so) that they are my 2025 Canadian Dividend King pick for the year.

Yes, that’s an excellent return despite both banks ear-marking hundreds of millions of dollars to cover bad loans. In other words, despite more Canadians defaulting on their debts, the best bank stocks in Canada are still making money hand over fist!

I will admit that I feel a bit burned by missing out on CIBC’s scorching 53% gain in 2024 – but to be honest, I didn’t see that one coming. After years of underperformance, and just generally feeling like the least-loved of the big bank brands, CIBC clearly did something right. A lot that earnings momentum though came from PCLs not being as bad as they had expected – and that’s a trick that can only be done once, as there is no underlying business growth behind that number.

Now… I’m not quite as proud of my third pick – but I still think the long-term investment thesis makes sense when it comes to TD Bank. In case you weren’t aware, TD’s earnings report got overshadowed by the massive amount of money that they had to set aside to pay a penalty in the US. Long story short, TD is being investigated for laundering hundreds of millions of dollars for drug cartels.

Not a great look.

TD sold some of the Charles Schwab shares they had in the pantry from their TD Ameritrade brokerage merger back in 2020 in order to come up with the $4 billion they figure they will need to pay the penalty. (The 2nd biggest penalty ever levied in North American banking.)

Now – all of that said – do you know any Canadians who have stopped banking with TD because of this activity?

I don’t. Not one. Nobody has talked about moving their mortgage or switching lines of credit. Heck, other than investors, I don’t know a single Canadian that’s even aware of this news story.

Consequently, I think TD’s Canadian operations will remain quite profitable. I have downgraded my long-term sky-high expectations, as there are now many complications to overcome if their US-led growth strategy is going to continue. That said, their share price is crazy-low valuation right now (basically flat for the year so far). So I’m not selling shares yet.

Looking at 2025, I think RBC and National Bank continue to be best in class. While I think TD is an excellent value at the current price, it’s probable that investors aren’t going to get real excited about buying the stock in 2025. I think it’s a great buy for the long-term, but probably won’t produce eye-popping one-year results.

Owners of Canadian bank stocks know that the big banks operate in a very protective oligopoly here in Canada, and consequently, their wide moat allows them to pass along price increases very efficiently – thus protecting profit margins.

Canadian Banks vs. The Best Dividend Stocks in Canada

Here’s a snapshot of how Canadian bank stocks compare to big companies in other sectors. For more information, read our best Canadian dividend stocks article, or our list of dividend kings in Canada.

Name | Dividend Yield | 5yr Revenue Growth | 5yr EPS Growth | 5yr Dividend Growth | Payout Ratio |

Scotiabank | 5.72% | 2.04% | -2.25% | 3.97% | 71.34% |

CIBC | 4.34% | 6.69% | 5.41% | 5.15% | 49.63% |

TD Bank | 5.30% | 6.67% | -5.46% | 7.14% | 86.14% |

Bank of Montreal | 4.48% | 4.81% | 1.89% | 8.55% | 64.31% |

Royal Bank | 3.45% | 4.67% | 5.15% | 6.59% | 49.76% |

National Bank | 3.44% | 9.34% | 10.99% | 10.18% | 40.08% |

?????? (Hidden, click for access) | ??????? (Hidden, click for access) | ?.??% | ?.??% | ?.??% | ???.??% |

2025 Canadian Bank Stock Earnings

The most recent quarter was mostly good news for bank stock earnings.

Earnings per share were up big time for CIBC, National Bank, RBC, and Scotiabank. TD was basically flat, and BMO appears to be in real trouble with a 35% reduction in EPS due to having to increase their provision for credit losses (PCLs).

There was also some great year-end dividend growth news for the Canadian bank stocks. National Bank and RBC kept up their excellent page of 7-8% annual dividend growth. BMO lagged slightly behind, raising its dividend 2.6% (for the second time in 2024). CIBC only raises their dividend once per year as a general rule, so they crushed it with a 7.8% dividend increase. Finally, we have TD with only a 2.9% dividend increase in 2024, and Scotiabank with no increase at all (keeping their dividend at $1.06). It’s pretty obvious to see why investors were fans of certain banks over others as we look at 2025!

Overall, the Canadian banks look to continue their stable growth in 2025, but obviously if the Trump tariffs cripple the entire Canadian economy, it will trickle down to reduced lending and reduced long-term profits for the banking sector.

If you want to dive into the nitty-gritty details of the most recent bank stock earnings reports, you should check out Mike Heroux’s video below. You can also snag an automatic promo offer code for Mike’s Dividend Stocks Rock platform (exclusive to Million Dollar Journey readers) by clicking the link underneath the video.

National Bank and Canada Western Bank Merger

The other big news in the Canadian banking sector this past quarter was the major expansion by National Bank via an acquisition of Canadian Western Bank (CWB) the eighth-largest bank in Canada. The TLDR is that National Bank is going to buy CWB’s assets for $4.7 billion.

Most notably, that means that National Banks gained 65,000 clients overnight, and 39 branches in a part of the country that NB didn’t have any footprint in. The goal will of course be to market some of National Bank’s existing services to CWB’s client list.

While gaining more market share in the Canadian banking oligopoly is nearly always a winning proposition, National Bank did have to pay a pretty penny for the deal. Before the acquisition was announced CWB’s shares were valued at just under $25 each, and they will be “purchased” at $52.24. Any time you can make a 110% gain on your investment, that’s a pretty good deal!

As a result of the high price tag (which was mostly financed by issuing new shares, as well as securing financing from the Quebec pension fund) National Banks share values did take a brief hit before heading higher and setting new all-time highs this past quarter. In the big picture, National Bank appears to be firmly planting their flag in the “we are going to become a full-fledged cross-country competitor to the other big banks” as opposed to their previous Quebec-centric business model.

Canadian Banks are Not SVB or Credit Suisse

Investing can be scary sometimes.

When investing involves banks, there is often an exponentially greater emotional response because often it’s not only your stock exposure at risk – but your chequing account, maybe business account, etc.

Consequently, when phrases like “bank runs” start to be uttered, it can be tempting to run for the exits. Of course, if companies are fundamentally sound, buying in at low valuations is exactly how you beat the market. Anyone can invest with conviction when all the news is good, but it’s the ability to separate the noise from the reality when things aren’t so rosy that generally determines long-term outperformance.

If you Google “Credit Suisse” you’ll see that the bank has had a lot of problems over the last ten years. Frankly, it has been involved with a lot of really bad people/entities – one might even say “shady” endeavors – and it doesn’t shock me that they look the most shaky out of the large “world systemic banks”. But even Credit Suisse appears “to big to fail” now with the Swiss Government stepping in and back-stopping liquidity worries.

When it comes to SVB, it’s a really interesting case study from a geeky economics/business point of view, but what it really boils down to is a ridiculous risk management decision for that particular bank. It was an awful decision to have essentially put all of their “safe assets” – or “tier one liquidity” as we like to say in Canada – in long-term US Treasuries when we were about to enter a raising interest rate environment. When you consider a huge percentage of their depositors (startups and tech companies) are also very sensitive to interest rate hikes, you have the makings of a perfect storm.

Neither of these two banks has much to do with the Canadian banks we’re discussing here. You might say that on the fringes, BMO and TD investors might have some small worries when it comes to recent American acquisitions, but given the strength of the US labour market, as well as the new guarantee by both the Fed and the Biden Government, I wouldn’t worry all that much.

BMO’s Bank of the West acquisition would be the closest connection to the recent headlines, just due to geographical proximity to SVB, as well as having slightly elevated numbers of non-insured deposits vs the major US banks. That said, the US government just implicitly guaranteed all bank deposits, so I’d say that systemic risk is now off the table.

As a major TD investor (added to my position amidst the chaos on Monday – so didn’t get it at the bottom, but I’m happy with my discount) it certainly wouldn’t break my heart to see the $13.4 billion acquisition of First Horizon Corp go quietly into the night. Perhaps at the very least, TD can use this regional banking weakness to renegotiate more advantageous acquisition terms.

On a purely fundamental level, I think it’s worth pointing out that quarterly earnings results from a few weeks revealed that the Canadian banks continue to make a lot of money, and that the major reason that earnings per share numbers weren’t through the roof was something called “PCL”.

PCL is actually pretty important as it stands for Provision for Credit Loss. That money the Canadian banks are setting aside is the exact reason that I’m not nervous about them in terms of their long-term sustainability. A little pain in the short term due to decreased quarterly earnings, is more than worth the heartburn some American bank investors felt this week.

To recap, RBC, CIBC, TD, and National Bank, all substantially beat their quarterly consensus earnings predictions. BMO and Scotiabank both had solid-if-unspectacular quarters as well. The Big 6 all remain very liquid and very well capitalized.

I haven’t noticed any rush within Canada to pull money out – and with FDIC insurance, why would you? That being the case, I don’t see any reason to believe that investing in Canadian bank stocks is any more risky in the long-term than it was a month ago.

Canadian Bank Stocks Performance in 2023

For more context on where Canadian bank stocks are coming from over the last couple of years, let’s take a look back at 2023.

Remember, 2023 was coming off an awful year across all stock markets in 2022. Here were the main takeaways from two years ago:

- Our top bank stock pick of National Bank had a great year with over 10% in capital gains and about 5% in dividend yield, for an excellent total return. (Some things haven’t changed much!)

- The spring banking crisis in the USA never really materialized for Canadian banks – once again highlighting the strengths of the more conservative Canadian banking system.

- RBC continued to show why they are the premier name amongst Canadian banks, and justified their relatively high P/E ratio.

- I was wrong on CIBC. It’s not that it’s a fantastic bank, it’s simply that the stock had gotten so beaten up that it finally offered solid value, and actually led the total returns for Canadian bank stocks in 2023.

- Scotiabank has some real structural issues and investors just aren’t willing to trust it right now. I’m staying away until there is more stability there.

Given the very reasonable valuations for the banks as a group at the end of 2023, I predicted upcoming growth – and was proved correct.

Investing in The Big Canadian Banks – Overview

Royal Bank of Canada (RBC)

RBC is the reigning king of Canadian banking. Royal Bank of Canada is a Canadian multinational financial services company and the largest bank in Canada by market capitalization. The bank serves over 16 million clients in Canada, the U.S. and 27 other countries.

They are one of North America’s most diversified financial services companies, and provide personal and commercial banking, wealth management, insurance, investor services and capital markets products and services on a global basis.

In summary, they are a dividend/earnings beast with so many ways to make money.

TD Bank (TD)

TD is also a very well-diversified bank that concentrates on Canadian and U.S. retail banking and wealth management. In fact, TD has more branches in the U.S., compared to Canada. That said, they generate more revenue and earnings in Canada. That speaks to the very profitable oligopoly situation in Canada.

TD Bank Group offers a full range of financial products and services to more than 26 million customers worldwide. TD also ranks among the world’s leading online financial services firms, with more than 15 million active online and mobile customers.

U.S. financial giant Charles Scwab (SCHW) purchased TD Ameritrade in 2019, giving TD a 13.5% stake in Schwab. Consequently, with TD you’re getting some very nice U.S. exposure.

Scotiabank (BNS)

Scotiabank is the most International of the Canadian banks. Scotiabank serves more than 26 million clients in Canada, and offers a range of products and services in the U.S., Latin America (excluding Mexico), and in select markets in Europe, Asia and Australia. They have a very robust global and capital markets division that includes lending, deposit, cash management and trade finance solutions and retail automotive financing operations.

While there is great potential in developing markets, they have not always executed with precision in these foreign markets and have generally lagged behind the leaders in recent years.

Scotiabank also owns Tangerine, Canada’s leading online bank.

Bank of Montreal (BMO)

BMO might be considered the most forward-thinking of Canada’s big banks when it comes to introducing cost-cutting options in recent years.

BMO serves more than 12 million customers, with 8 million via Canada operations. They operate in three divisions – personal and commercial banking, capital markets and BMO wealth management. BMO has been aggressively expanding its U.S. footprint through a series of operations.

In Canada they are well positioned as the leading bank with respect to ETF assets under management. They are in second place in Canada, only behind BlackRock, but BMO is gaining ground and closing that gap. They also offer advice-Direct, a digital investment advice and portfolio management platform.

Canadian Imperial Bank of Commerce (CM)

CIBC can often be classified as the also-ran among the big 5 Canadian banks. They have made some missteps and have lagged the other banks with respect to diversifying outside of Canada.

In 2019, Barry Schwartz, chief investment officer of Baskin Wealth Management, offered “They seem to be swinging past the fastballs and missing the easy layups that the other banks get right.” That said, analysts appear to be warming to CIBC’s recent efforts.

CIBC serves 10 million customers and operates Canadian personal and commercial banking, plus wealth management. In the U.S. they offer commercial banking and wealth management. They also have a capital markets division.

Dividend investors love CIBC’s commitment to paying shareholders consistently and just because they aren’t the leading name, doesn’t mean they can’t hold leading value at a certain price point!

National Bank of Canada (NA)

National Bank is a regional bank (Quebec) that has been successfully diversifying. National is a very well-run bank, and has been the top-performing big Canadian bank for 20 years or more. It is the favourite value of Dividend Stocks Rock – our most trusted source for dividend growth information.

National generates 50% of its revenues in Quebec, which it then uses to fund additional growth projects outside of Quebec’s borders. Wealth management is growing at 15% annual over the last 10 years. The bank is also active in the U.S. and emerging markets.

The fact is that National Bank is a bit smaller and more nimble (compared to the big 5) and more responsive as they seek acquisitions. This could lead to outsized gains versus its large market cap banking brethren.

Where to Buy Canadian Bank Stocks

This stocks can be bought through any broker – all you have to do is open an account, add funds and pick the specific stock you want to buy. For more information you read our comparison of the best online brokers in Canada.

Best 2025 Broker Promo

Up to $150 Sign Up Bonus!

Open an account with Qtrade and get the best broker promo in Canada: $150 in cash back when you fund a new account.

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by October 31, 2025. Qtrade promo 2025: CLICK FOR MORE DETAILS.

Canadian Bank Stocks: Cheap or Overvalued

A recent Globe and Mail article put it best when they stated:

“Though they have rebounded over the past month, stock prices are down 14 per cent since November. Relatively low valuations, in terms of price-to-book and price-to-earnings ratios, also appear to suggest that stocks are priced for trouble ahead, if not an outright economic contraction.”

The same article went on to reveal:

“At this point, we are wondering if too much negativity has been reflected,” Gabriel Dechaine, an analyst at National Bank Financial, said in a note.

Given the strength of the Canadian labour market, I think the calls for a dramatic long-term recession are overblown. The Canadian banks are doing what they always do and setting aside reserves for a rainy day. This is the kind of cautious move that has generated such strong confidence amongst investors.

I’m also of the opinion that the idea of a complete housing meltdown have been exaggerated. People forget that the vast majority of Canadian homeowners either have fully paid off their mortgage, or locked into a long-term deal over the last couple of historically-low interest years.

Yes, higher interest rates will affect new homeowners, but let’s now blow things out of proportion here. Most middle class Canadians would rather sell an organ than foreclose on the house that they have tied up so much of their identity in.

It’s worth noting that the most current Canadian insolvency numbers are lower than they were in 2019 (pre-pandemic).

With forward P/E ratios 10%+ below their historical averages, and their P/B metrics looking quite attractive as well, now may very well be the time to scoop up these stocks at excellent valuations.

Investing in Canadian Banks: FAQ

Canadian Bank Stock Dividends For the Government?

The federal Liberal government is looking to hit the financials coming and going. First off, they are looking to increase the corporate income tax rate from 15% to 18% on all earnings above $1 billion. It is estimated that collectively it will cost the big banks about $1billion in profits each year.

Also, the big Canadian banks and insurers will be paying a Canada Recovery Dividend. The two programs are slated to begin in 2022-2023 and will run over a four-year period. The rate or amount of the Canada Recovery Dividend will be negotiated over the coming months.

Analysts do not see this as a major hit to the very profitable banks and insurance companies. The taxes are likely already priced into the stocks, as bank analysts already know what’s coming down to the pipe.

It may be best to focus more on the long term growth prospects and those growing dividends that will end up in your pocket.

Investing in Canadian Banks for 2025 – Ignore the Noise

As you can see from the chart above, there are great reasons to love and trust Canadian bank stocks for the long term.

The stability of Canadian bank dividends helps all investors moderate their “animal spirits” when it comes to panic selling, and their track record when it comes to allocating capital for expenditures is second-to-none. This moderate tone will serve bank investors well 2025, as news headlines declare that the sky is falling due to tariffs, recessions, etc.

With all the negative news in 2024 (and I think it will get worse in 2025), the current entry prices for Canadian bank stocks seem pretty fair compared to most.

The unique regional background of National Bank, combined with its smaller market cap relative to its “Big 6” bank cousins, gives the company the most solid prospects for growth out of the Canadian banks.

RBC has simply proven year in and year out to be worthy of their “best in class” status. The sheer scale and diversity of their revenues continue to make them one of the safest stocks in the world from my point of view.

Small online-only EQ Bank might also be worthy of consideration, as it has seen substantial growth over the last few years. It’s now on our radar from an investment perspective (it has long been on my personal radar as a longtime customer).

At the end of the day, nothing that has happened in the last ten years has done anything to shake my faith in Canadian bank stocks. They operate in a protected oligopical environment, benefit from massive barriers to entry, are well run, and profit off of Canadians’ collective indifference to fees and costs.

With Canada’s working population being juiced by aggressive immigration policies, the only real question is which Canadian bank stocks will reward their shareholders with outsized returns (instead of merely solid earnings growth). For other investment options, read our best Canadian dividend stocks page, or our list of Canada’s dividend kings and aristocrats.

Best 2025 Broker Promo

Up to $150 Sign Up Bonus!

Open an account with Qtrade and get the best broker promo in Canada: $150 in cash back when you fund a new account.

The offer is time limited - get it by clicking below.

Must deposit/transfer at least $1,000 in assets within 60 days. Applies to new clients who open a new Qtrade account by October 31, 2025. Qtrade promo 2025: CLICK FOR MORE DETAILS.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Refresh my memory please, did MDJ have a link to an article where the investor was 100% dividend driven, investing only in the banks, insurance, communications & energy?

Was just checking in on this post. It was suggested that banks deliver 17% from that yield level historically. We’re above 14% already. Wow.

More to come if the fears of inflation and rising rates hang around.

Dale

Banking stocks (not just Canadian) seem like a great bet due to their depressed prices and just the heady rise in tech stocks making them out of favour.

A 4% divi yield? what isn’t to love about that.

Thanks for the OSFI tip restricting dividend increases for the banks. I did not know that.