CIBC Investor’s Edge Broker Review 2025

CIBC Investor's Edge Review

-

Fees and Commissions

-

Account Options

-

ETF Trading Fees

-

Customer Service

-

User-Friendly Platform and Mobile App

-

Overall Banking Convenience

CIBC Investor's Edge Review Summary:

Our CIBC Investor’s Edge review describes why even though the big bank brokerage offers a well regulated investing option, it’s probably not the best choice for you. If you currently bank with CIBC and want the convenience of keeping all of your financial dealings under the same roof, then Investor’s Edge might be worth the tradeoffs.

That said, you can see how the CIBC brokerage stacks up by checking out my best Canadian online broker comparison for 2025. While Investor’s Edge compares favourably with several of its big bank competitors, we think there is room for improvement when it comes to customer service, ETF trading fees, and maintenance fees.

Pros

- All account options available

- Lower trading fees than other big banks

- Easy access from mobile and desktop devices

- Commitment to updates and innovation

- Possible to purchase fractional shares

Cons

- More expensive than the best non-bank brokers

- High fees on ETFs trading

- Mediocre user interface for main platform and app

- Most negatively mentioned customer service of all MDJ brokerage reviews

- Still charging a $100 annual maintenance fee

What Is CIBC Investor’s Edge?

If you are already a CIBC customer, you might already know that it has been around for a long time, over 100 years in fact. As a result, it offers an array of choices when it comes to how you save and invest your money. It offers the basics, such as cash accounts, TFSA, RRSP, and RESP. It also offers you access to other attractive investment options like stocks, ETFs, mutual funds and bonds.

Something that makes CIBC stand out is that it was the first to launch Canada’s first depository receipts (CDRs). This means that customers can use the Neo Exchange platform to purchase fractional shares of the US’s top performing stocks, such as Amazon and Tesla.

The benefit of using the CDR is that you won’t need to convert your currency to USD to make the purchase, as CIBC uses an automated currency hedge to mitigate the currency exchange risks.

With the launch of CIBC Investor’s Edge, it became easy for CIBC customers to also become DIY investors. Investor’s Edge has multiple options for both long-term and short-term investment needs.

That said, in many areas they have fallen behind their more well-known peers at BMO, TD, RBC, and Scotiabank over the years. In terms of trading commissions, they simply cannot compete with other options that offer low-fee or even free commissions.

CIBC Investor’s Edge Trading Fees and Commissions

CIBC Investor’s Edge trading platform is not only competitive with the other big bank brokerages in Canada, they are significantly cheaper when it comes to daily trading fees. If you meet the active trader threshold of 150 trades per quarter, you’ll pay only $4.95 per trade.

In May this year CIBC Investor’s Edge made a big move by slashing their stock and ETF trading fees to $0 for young investors aged 18-24. This is for both Canadian and US stock trades. To make it even more attractive for young investors, they have also waived their annual account maintenance fee.

For traders above 24, CIBC Investor’s Edge doesn’t quite match low-cost leaders (non-brank brokerage firms) like Questrade, Qtrade and Wealthsimple Trade, CIBC’s online discount brokerage beats all the other big bank brokerages when it comes to trading fees.

Account and Transaction Fees

Like the other major banks CIBC Investor’s Edge has no account minimum in place; however, they will not hesitate to charge a fairly substantial fee if you do not meet their account minimum threshold.

If your RRSP account has a balance under $25,000, you’ll pay $100 annually. However, you won’t pay any fees if the market balance of your account is greater than $25,000.

If your basic non-registered account is below $10,000, then you’ll owe an annual $100 fee as well. Again, this fee is waived if your balance is greater than $10,000 or if you also have a retirement account with CIBC.

The good news is that the TFSA and RESP are completely free to open and trade in, no matter what your balance is. Additionally, the CIBC Smart™ Account for students is free, and might be the best deal out there for students who want to get started with investing.

Below is a quick chart of the more common CIBC Investor’s Edge account fees that you might run into.

| Transfer Out | $135 |

| RRSP Withdrawals | $50 |

| TFSA Withdrawals | $0 |

| Home Buyers Plan & Life Long Plan Withdrawals | $50 |

| Copies of Statements, Confirms, Cheques and Tax Receipts | $5 |

| Certificate Registration | $50 |

| Wire fee (out) | $40 |

| Wire fee (in) | Free |

| Estate Account Processing | $100 per account |

CIBC Investor’s Edge ETF Fees

One of the major reasons that Qtrade is our #1 most recommended brokerage is that they combine the elite level information and platforms that the big bank brokerages like Investor’s Edge bring to the table – but combine it with free ETF trading (as well as some other unique features).

These free ETF transactions can keep a substantial amount of your money in your account – ready to compound – instead of getting siphoned away.

When you think that you might be using your discount brokerage account for 50 years, if you make 4 ETF trades every three months – and that takes away from your nest egg that is growing at 8% per year – then you will be sacrificing close to $55,000 in ETF trading fees over the course of your portfolio’s lifetime!

| Online Discount Broker | Per Transaction Cost to Buy ETFs | Per Transaction Cost to Sell ETFs |

| CIBC Investor’s Edge | $6.95 | $6.95 |

| Qtrade | $0 | $0 |

| RBC Direct Investing | $9.95 | $9.95 |

| Questrade | $0 | $5 |

| TD Direct Investing | $9.95 | $9.95 |

| Scotia iTrade | $9.95 | $9.95 |

| Wealthsimple Trade | $0 | $0 |

Options Trading Fees

If options trading is your thing, Investor’s Edge is definitely competitive in this arena. Their $6.95 rate continues to shine vs leading competitors at TD and RBC. There is also the standard $1.25 per contract fee added on. The rate goes down to $4.95 (matching the Scotia iTrade rate) if you hit active trader status.

CIBC Investor’s Edge Account Types: TFSA, RRSP, Non-Registered

The wide variety of both registered and non-registered accounts available with Investor’s Edge, stacks up well against what any other discount broker brings to the table. You should expect no less from such a large-scale Canadian corporation!

- Non-registered accounts

- Margin Accounts

- RRSP

- TFSA

- RESP

- RRIF

- LIF

- LIRA

- Informal Trust

- Investment Club

- Trust or Estate

CIBC Investor’s Edge Mobile App Review

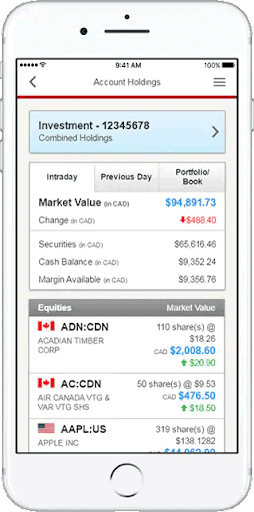

The Investor’s Edge mobile app is called the CIBC Mobile Wealth app on both the Google Play and Apple App stores.

The CIBC Investor’s Edge mobile app provides users with a convenient way to monitor account balances and trade stocks, ETFs and options anytime, from anywhere. Users can also stay updated on important investment news, such as new IPOs, so they can jump on new opportunities as they happen.

Users will also have access to graphs and charts to help them analyze their entire portfolio in one easy to read view, or look at different investment accounts separately. By taking the time to check on your portfolio regularly, investors always know how their investments are doing, and make a change if needed. With CIBC’s stock app, investors can conveniently buy and sell whenever they wish.

In the past, the app had a bit of a bad reputation due to poor user experience and slow speed. However, CIBC addressed the issues and continues to update and improve the app. This has led to higher customer satisfaction, with an overall 3.6 star rating from over 5.5K reviews on the App Store and a 3.5 on the Google Play store.

The app has over 100,000 downloads, which is another sign that it’s growing in popularity and trust. Want to find out more about other mobile trading apps? Head over to our best stock trading app page to find out more about other options that allow you to trade easily from your mobile device.

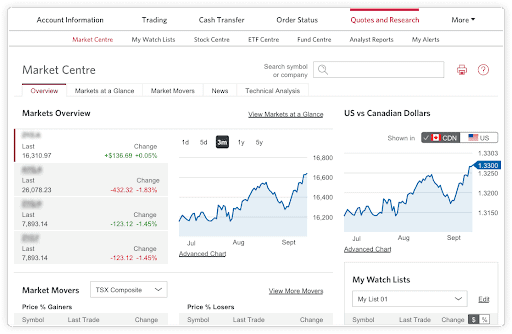

CIBC Platform and Tools

CIBC Investor’s Edge has recently updated its mobile and desktop platforms, with its website getting a much needed refresh as well. The enhanced design allows users to more easily access tools, make trades, or do a bit of research. They have also added enhanced accessibility features for those who need it.

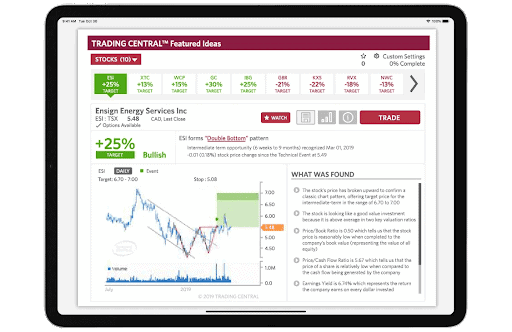

Like most online platforms, CIBC Investor’s Edge provides tools to help investors research, strategize, and execute, helping them make well-informed decisions for their financial futures.

Some of the tools include insights from CIBC World Markets Inc., access to Trading Central, which offers technical analysis resources, and advanced charting tools to help you predict when the best time for a future trade might be.

Users will also have access to a wide range of other research tools, as well as the ability to build their own watch lists and alerts.

CIBC Investor’s Edge Customer Service

Unfortunately, judging by the comments on our articles, as well as the emails we receive each month, it appears that CIBC Investor’s Edge has taken a bit of a hit over the years. This reality is backed up by third party broker ratings as well.

Notably, Investor’s Edge does offer Mandarin and Cantonese customer support through its Asian trading desk.

CIBC really has to up its game when it comes to the usability of its platform and customer service responses if it wants to compete with the top online brokers in Canada.

Comparing CIBC Investor’s Edge With Canada’s Best Broker

Our readers often ask us how CIBC Investor’s Edge compares to Qtrade. Yes, Qtrade is one of Canada’s most popular brokers, but CIBC also has its perks. Check out the table for a side by side comparison of the two, which can help you decide which broker is right for you.

| ||

|---|---|---|

| Canadian ETFs | Free to buy and sell | $6.95 per trade |

| User Experience | Excellent - consistently ranked #1 in Canada. Built for Canadian users exclusively. | Average. Customer service can be difficult to reach, and there have been complaints about order processing times. |

| Stocks | 100% FREE to trade |

|

| Safety | CIPF Member | CIPF and IIROC Member |

| RESP Accounts | Available | Available |

| Research Tools | Has been at the top of Canadian brokerage ranking in this category for over a decade. | Wide range of tools as well as education platform CIBC Learn. |

| promotion | 5% Cash Back + Unlimited Free Trades | None |

| Sign Up | Visit Qtrade | Visit CIBC Investor's Edge |

CIBC Investors Edge Review Frequently Asked Questions

CIBC Investor’s Edge Review – Final Thoughts

CIBC Investor’s Edge does have some definite advantages over some of the other Big Bank self-directed brokerage options. This can save you a good amount of money on commissions and fees in the long run. Another way it stands out among the other large banks is that it offers fractional shares.

Even with those benefits in mind, unless you already bank with CIBC, it doesn’t make sense to use their brokerage services. With our top rated brokerages, Qtrade and Questrade, you will save even more on fees, all while having access to customer service. With this much value for your money available elsewhere, why pay a Big Bank more – for less?

To see why we recommend these brokerages over CIBC Investor’s Edge, check out our full Qtrade review, as well as our Questrade review. Want to compare this brokerage to other popular Canadian brokerages? Check out our full feature write up on the best Canadian online brokers.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

CIBC IE is one of the worst options out there. stay away. The couple dollars you may save is outweighed by all the headaches and lost opportunities.

The English language does not have sufficient negative words to describe CIBC Investor’s Edge. I feel like I am standing on the Edge!!!! Brutal sign-up required two visits to a CIBC branch. Unstable platform. Mine was displaying English and French on various pages frequently! Long waits on the phone. Chat is often unavailable. The embattled CRSs seem to be undertrained and often unhelpful, probably due to high turnover. I have been given the wrong information many times. Contrary to the information provided when I signed up I cannot complete US/CDN currency conversions, although I have connected US and Canadian LIF accounts. I called on April 2, 2024, and a gentleman explained this should not be the case, promised to look into it and call be back by 12:30 pm on April 2, 2024. I am still waiting for the call. Today I was greeted with a flashing red question mark (think DEFCON 1)! I have experienced 5 online brokers in 18 years of trading. Nothing compares to CIBC Investor’s Edge. And I don’t mean that in a good way! Avoid at all costs.

Absolute worst. The service is from the stone ages, and if you need to call in (you will need to, trust me), expect to wait hours on the phone. I don’t know how they are still in business.

i totally agree, and they rob you of what little stocks you have

It’s very dangerous with CIBC investor edge trader. I lost thousands US$ after I purchased few options (call and put both) in the CIBC investor edge account. Even if there are deep-in money when there are expired, no proper excise have been done as they said on their website. There are all end with nothing.

CIBC is the most unreliable trading company I have ever seen, stay away from this company. they charge you their fee no matter what but make you lose money for their shortfall like their own tech problems.

I have placed an order last night and I wanted to check and make a necessary change to my order. But I couldn’t log in for 10-15 min, from 6am Pacific time my password was not working.

I finally call and the service rap said they are having tech problem and suggested to try to log in again in 3hrs. When I complain she transferred me over to other department and hung up on me.

I am sure my order has gone through at a price I don’t want to buy at but can’t do anything. I called again and been on hold for more than 30 min.

Complete disaster!

The problem is this isn’t the 1st time they are having tech problem and not taking responsible.

I want everyone to know to stay away from CIBC Investor’s edge at all cost!

The system is slow, sometimes it takes 2-3 seconds to refresh a page. What more ridiculous part is they could put your buy order on pending for manual “review”, and results a 25 seconds of delay ! I lost hundreds of dollar in one trade just because of this. Their system is absolutely unacceptable, stay away, guys.

Erroneous stock quotes: as I have complained many times, many of your supposedly up-to-date stock quotes are grievously wrong. This is especially true for triple-leveraged US ETFs, such as FNGU, URTY, TQQQ and others, but also for other ETFs, such as GRN.

In the morning, before markets open, often your quotes are terribly wrong and show drops of 10-30 per cent, where CNBC.COM shows no change. I have learned not to trust your quotes until 9:50, and even then they’re often still wrong.

I am an active investor and I would like to trust your information, but unfortunately I often cannot and have to double-check with other sources, quite time- consuming.

Cibc edge is a joke. Do not waste your time and money. Just retarded unbelievable how uncomfortable n slow all the process is.

I tried to call them to resolve some login issues but instead spent an hour on hold yesterday and another hour and a half on hold today. Still haven’t gotten through to them. By far the worst customer service ever.

Yes, it’s becoming horrible… I tried to contact them and the estimate waiting time was three hours…

It used to be few minutes (usually no more than 5 mins) I do not know if they have cut on agents but the excuse of COVID should not apply here

Don’t let the lower trade fees suck you in. Investors Edge had The worst customer service. Chat is always closed and you will often get “Internal error, please contact us” when you try to place a trade. Then you will wait forever on hold. On top of this, I have had market orders take over 40 minutes to get filled. If the only other option was a shifty broker running his server out of the back of his car, pick that one.