The Best Joint Bank Accounts in Canada

Written by: FT

Not long ago, the Best Joint Bank Account in Canada lists were basically just the Big Five playing musical chairs. RBC, TD, BMO, Scotiabank, CIBC, and maybe Tangerine getting an honourable mention. But let’s be honest: not much separated them, and none of them were offering anything remotely exciting.

That all changed when EQ Bank came along and completely changed the game.

With automatic high interest rates, $0 account fees, and a refreshingly easy digital experience, EQ Bank has taken what used to be a bland banking product and turned it into something that actually delivers value. In my view, EQ now holds the clear title for Best Joint Bank Account in Canada – and frankly, it’s not even a close contest.

When EQ launched their joint account option, my wife and I jumped on board right away. It’s been the perfect solution for managing our shared expenses and saving for things like travel and home projects. The app is easy to use, the rates are market-leading, and it just works. It’s a simple & clean banking experience that helps us stay on the same page financially – while paying nothing in monthly fees!

Right now, their joint accounts pay an impressive 4% interest, which is miles ahead of the Big Bank alternatives. And if you’re heading abroad, the new prepaid EQ Bank Card is a serious bonus: it lets you withdraw money internationally with no foreign exchange fees. We’ve included a comparison of other Canadian joint accounts below so you can see how they stack up against our champ!

None

Elite customer service, top rated app, solid cashback credit card

4% (1.25% + 2.75% Bonus)

None

Unlimited transactions, free Scotiabank ATM access

1.00%

None

Lots of perks and benefits, annual fee waived for first year on Scotiabank cards

1.35%

None

Good no-fee joint chequing account for up to 2 people. Lacking in customer service but excellent $300 signup bonus

None

$30.95 (or none with a $5,000 balance)

Unlimited transactions, Fee rebates on certain accounts/credit cards, Enhanced interest rates

1.40%

How Do Joint Bank Accounts Work?

Joint accounts are perfect solutions in a surprising number of situations. These include:

- Couples (married or unmarried) who want to share finances and manage bills together.

- Young kids whose parents want to be able to give them an allowance but don’t have cash on hand each week (who has cash these days?).

- Older parents who need some help managing their money.

- Young adults who are heading out on their own for the first time.

- Business partners who need to share access to a business account.

Basically, if there’s ever a situation where more than one person needs to be able to manage funds, pay bills, or make withdrawals, a joint account can be a godsend.

How Do You Open a Joint Bank Account in Canada?

The requirements for opening a joint bank account can vary by bank and may also depend on whether both account holders are already clients.

Digital-only banks like Tangerine and EQ Bank allow you to open accounts online, but many traditional banks require an in-person branch visit. It’s a good idea to check the bank’s website and confirm their exact processes.

For a joint account, banks typically need both account holders to appear at a branch and show valid government ID. Some banks make exceptions for people who already have personal accounts with them – but again, be sure to check so you don’t waste your time!

You don’t have to be married to open a joint account – while couples are typically the first example of joint account holders that comes to mind, you can be married, unmarried, biologically related, business partners – you name it.

Best Joint Bank Account in Canada: EQ Bank

My personal choice for the best joint bank account in Canada is the EQ Bank Joint Savings account. Check out my in-depth EQ Bank Review for a thorough look at EQ brings to the table.

Given that they’re the only bank out there right now that offers unique Notice Accounts, and also leads in our recent comparison of Best High Interest Savings Accounts in Canada, it’s probably not a surprise that they’re joint account offering is elite as well.

With an automatic 4% interest, an excellent mobile app, and an EQ Bank Card that makes it easy to pay for things, it’s no wonder they’ve been Forbes’ choice as the #1 bank in Canada for several years in a row!

Pros:

- Top recommended bank in Canada

- CDIC insured

- High interest rates

- No fees

- Great mobile app

- Convenient cashback card

- New Notice Account

- New small business account

Cons:

Best Free Joint Chequing Account in Canada: Tangerine

If you need a joint chequing account, Tangerine Bank is an excellent free joint account option.

Tangerine is affiliated with Scotiabank and gives you free access to their ATM network, which means that this account functions just like any traditional chequing account, with ATM access and point-of-sale transactions.

Our one complaint about this account is the interest rate, which maxes out at 0.1%.

However, it’s not a deal breaker for us because a chequing account isn’t the place to be concerned about interest rates anyway. Chequing accounts allows you to receive and spend your money, and Tangerine allows you to do that easily, and for free, which is what matters.

Pros:

- Easy ATM access

- Savings accounts, GICs, credit cards, and lending available

- CDIC insured

- Great online platform and app

Cons:

- Low interest rates

- No business accounts

Best Joint Chequing Account Welcome Promo: Simplii Financial

Simplii Financial is CIBC’s low-fee online bank and it offers many similar features to Tangerine. No monthly fees, no balance requirements, and widespread ATM access make Simplii a great choice if you’re looking for a joint account at a bank that has many of a big bank’s options without a big bank’s pricetag.

Simplii offers personal bank accounts with up to 2 users, so if you’re looking for a business account or an account that a group needs to be able to access, you’ll have to look elsewhere. They’re a reliable bank, but we find their customer service to be less than stellar.

Pros:

- Easy ATM access

- Savings accounts, credit cards, and lending available

- CDIC insured

- Easy to obtain welcome promo

Cons:

- Only two users per account

- Customer service isn’t great

- No business banking

Best Premium Joint Chequing Account in Canada: Scotiabank Ultimate Package

When we say “premium,” we mean it. The Scotiabank Ultimate Package costs $30.95/month. But for what you get, it’s honestly worth it.

Scotiabank Ultimate Package holders receive:

- Unlimited debit transactions

- Unlimited international money transfers

- Unlimited Interac transactions

- Up to $139 ongoing annual fee waiver on a Scotiabank credit card

- A free small safety deposit box

- Your choice of SCENE or Scotia Rewards points

- Free personal cheques and drafts

- Improved rates on GICs and Scotia Momentum Savings Accounts

- Free Overdraft protection

- No monthly account fee on one Basic Plus Bank Account

- 10 free equity trades at Scotia iTrade in your first year.

Basically, there’s a reason why we named this account the Best Chequing Account in Canada.

When you open the Ultimate Package as a joint account, only one account holder receives some of the perks such as the fee rebates and free equity trades, but both account holders enjoy the unlimited transactions—and really, that’s what you want in a chequing account.

Scotiabank accounts must be opened in-branch by all account holders. Make sure you take a piece of valid government ID. As a big bank, Scotiabank has its own network of ATMs and, of course, allows point-of-sale transactions for its chequing accounts.

The $30.95/month fee can be waived if you maintain a balance of $5,000 in the account, or a total of $30,000 among your Scotiabank accounts—so if you have that kind of cash, this is a no-brainer.

For full details on this and other offerings, check out our Scotiabank Review.

Pros:

- A huge collection of perks

- Unlimited transactions

- Monthly fee waived with a balance of $5,000

- Near-universal ATM access

- CDIC insured

Cons:

- $30.95/month is pretty steep

- Not available as a business account

- Must be opened in-branch

Should Couples Have a Joint Bank Account?

Now that you know the best of what’s out there, the final question is whether you should have a joint bank account. Whether you’re married or not, it’s a question most couples consider at some point. Here are some pros and one major con to consider:

Benefits of Having a Joint Account with a Spouse or Partner

Fewer accounts to monitor: If you consolidate your accounts, you’ll have a centralized location for your transactions and fewer accounts to keep track of.

Can cooperate on savings and bill payments: This is one of the main advantages of having a joint account, especially for couples. Joint account holders can work together to make sure the bills get paid, and the savings goals get reached.

A hybrid approach can work well: Having a joint account doesn’t necessarily mean closing everything else and pooling all your cash. It’s perfectly fine (and sometimes ideal) for account holders to have their own personal accounts and then pay a set amount into a joint pot of money for bills etc.

Maintain access to finances in case of death: If your partner dies and you have a joint account, you’ll retain access to the balance. If they have personal accounts only, you’ll have to wade through red tape first.

Possible Drawback of Having a Joint Account with a Spouse or Partner

Requires trust and communication: This isn’t so much a drawback, as a fact to keep firmly in mind. If you’re going to open a joint account with someone, please, we beg you, make sure that they’re someone you trust completely. Especially if you’re planning to keep one central account for everything.

If a relationship goes south, or if the other person turns out to be someone you couldn’t trust after all, there’s nothing to stop them from draining the bank account and going on their way. Be sure that you trust the other person not to do that. That’s it. That’s the drawback.

Best Joint Bank Account for Students

Many parents find it reassuring to gently ease their little ducklings out of the nest when it comes to teaching them to financially fly on their own. A joint bank account for students is a great fit for this goal.

By using a joint account for their high school or university student, parents can get access to all of the transaction records at any time, and make sure “Little Johnny” didn’t spend his student loan before Halloween.

With EQ’s new EQ Bank Card allowing point-of-sale transactions and ATM access, it’s quickly becoming the obvious choice as the best joint bank account for Canadian students and their parents. The combination of high interest, along with the long-awaited ability to shop in stores and online makes a lot of sense.

For more information, you can also read our best student bank account article.

Canadian Joint Bank Accounts FAQ

Who Owns the Money In a Joint Bank Account?

Ownership of money in a joint bank account is completely shared equally by all owners of the account. In other words – anyone on the joint bank account can withdraw the money whenever they want to (or up the previously agreed-upon maximum).

There is no proportionality in terms of saying, “Well I deposited 70% of that money, so I own 70% of the money within the joint bank account.”

As far as who inherits the money if someone passes away, the nice thing about a joint bank account is that it doesn’t go through probate. The money and account ownership automatically passes to other joining account holders. In order to facilitate that transaction though, a deceased owner’s death certificate might have to be provided (which makes sense).

How to Close a Joint Bank Account

Closing a joint bank account is pretty straightforward. Just make sure you tie up all the loose ends such as:

- Cancel all of the automatic transfers both in and out of the account.

- Double check you have no more subscriptions from the account.

- Transfer the remaining funds (e-Transfer is probably the easiest way) so that the account balance is $0.

- Follow your bank’s specific procedures for closing the account permanently. (Usually this requires a signature or verified online action of some kind from all joint account holders.)

Non-Contenders for Best Joint Bank Account In Canada (Not Worth Considering)

While others recommend these accounts as a solid option, I feel these would be a mistake to even consider:

RBC Joint Bank Accounts

It’s nothing personal against RBC joint bank accounts specifically, it’s just that for the most part the Big 6 banks make a lot of money off of their fees on joining bank accounts – leaving less in your pocket.

RBC does have one unique option in that their USD-denominated high-interest savings account allows for you to have a joint account. So that might be one area to consider making an exception.

Otherwise the RBC Joint Bank Account fees just add up in a hurry versus our top contenders – plus the interest rates aren’t nearly the 3% that EQ is offering.

Scotiabank Joint Bank Accounts

Scotiabank doesn’t have any special promotion for joint bank accounts, it basically just allows two people to co-own any of their regular chequing and savings accounts.

What this results in is monthly fees somewhere in the neighborhood of $4.00 to $16.00 each month. That’s just too much when there are so many no-fee options available. You can see above all the bells and whistles that you get with the premium package from Scotiabank, but anything other than that one just isn’t worth the tradeoffs (and I personally, I don’t think it’s worth it even then).

The other major downside is that the interest rate for Scotiabank Joint Bank Accounts is only 0.10% right now (and can even be lower if you have a balance below $500). That’s simply a lot lower than the names at the top of our joint account comparison.

Bricks and mortar banks are just always going to have a hard time competing with the purely virtual online banks at the top of my most recommended list.

Koho Joint Bank Accounts

The Koho joint bank account is sort of like the EQ joint account’s little brother.

It’s a solid value in that you can earn ok interest rates (0.5%) and they have a pre-paid card that is similar to EQ’s.

The Koho joint accounts also include no fees on bill payments or Interac e-Transfers.

What they don’t have is EQ’s GIC options, the ability to open a TFSA or RRSP, their money transfer levels, and doesn’t try to upsell you a monthly fee plan like Koho does.

Plus the EQ interest rates are just substantially higher than those in a Koho joint bank account.

TD Joint Bank Accounts

Much like their big bank cousin RBC, there is nothing wrong with TD Bank’s joint chequing bank accounts. It’s just a simple matter of fees and value.

When you combine the relatively high fees with the need to be physically present at a branch bank (bringing two pieces of ID with you) it’s just not really a comparable product to the accounts at the top of this list.

It’s also relevant to point out that the interest rate for TD Bank joint bank accounts right now is around 0.10% (depending on the balance in the account). So that’s another comparison metric that doesn’t do the big green bank any favours.

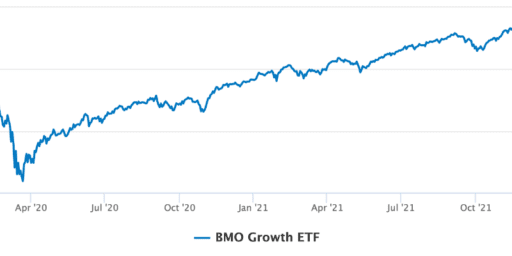

BMO Joint Bank Account

You’ll notice a bit of a pattern forming here when it comes to the joint bank accounts offered by Canada’s big banks. They’re fine, they work, they’re safe, etc.

But you’re going to pay for the privilege. The fees charged by BMO are part of the reason the bank is so profitable. In fact, they’ve made so much money, they’re busy buying up American banks these days!

BMO does have an interesting family bundle joint banking offer that might be worth looking into if you already do all of your other banking with BMO.

But when you consider just how much lower the interest rates are on their joint bank accounts vs our leaders, plus the long-term effects of paying so much in simple fees for your bank account each month, the math just isn’t mathing.

CIBC Joint Bank Account

Like several other banks that rely on brick-and-mortar locations, you have to actually visit a CIBC branch together to open a CIBC joint bank account.

The CIBC joint bank account rules and rates are barely even mentioned on their website. Clearly it is not a priority for Canada’s fifth largest bank.

From what I can tell, the personal chequing and savings account rates would apply to their joint accounts, and they’re about 0.10% on basic current account options, and up to 0.50% on e-savings account options. Not exactly world beating value considering the stiff monthly fees.

The Best Joint Bank Account in Canada: Our Verdict

For the fifth straight year, EQ Bank retains the title as Best Joint Bank Accounts in Canada champion. With consistently high interest rates, zero account fees, and a steady stream of new features, EQ keeps raising the bar and making it difficult for any of their competitors to catch up!

You can dig into the full details in our updated EQ Bank Review and our Best High-Interest Savings Accounts in Canada guide, but here’s the short version: EQ is still offering 4% on everyday savings, plus they’ve rolled new small business accounts AND Canada’s first Notice Account! For no-fee banking that actually puts money back in your pocket, EQ is tough to beat.

That said, the best joint bank account for you is the one that fits your wants and needs. Some couples or households might prioritize ATM access or cash-back perks, while others are laser-focused on maximizing interest. Whether you’re comparing EQ Bank, Tangerine, Simplii, or even one of the big banks, the key is to find something that checks your most important boxes.

My cautious nature forces me to repeat the important warning that it’s important to remember any co-holder on a joint account has full access to every dollar in it – there’s no such thing as “my half” and “your half” of the money. So before you open a joint account, make sure you’ve had the real conversations about financial goals, boundaries, and responsibilities!

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?