Archive for May 2025

How Do RDSPs Work in Canada?

A Registered Disability Savings Plan (RDSP) is a special long-term savings plan designed by the Government of Canada to help people with severe disabilities (and their families) save for the future. In essence, an RDSP is similar to other registered plans like an RRSP or RESP – you contribute after-tax money and it grows tax-free…

Read MoreAI Investing in Canada: AI Stocks vs Tools

Canadian investors are increasingly faced with two related trends: investing in AI stocks (buying shares of companies benefitting from artificial intelligence boom) versus using AI to invest (leveraging AI-driven tools to make investment decisions). Personally, I’m instinctually suspicious of anything that gets this much press coverage and hype behind it. I should be clear –…

Read MoreShould You Buy VBAL ETF? My VBAL Review

The Vanguard Balanced ETF (VBAL) represents the fulfillment of the original promise behind ETFs when they first emerged three decades ago: a simple, low-cost way to achieve diversification across an entire investment portfolio. VBAL offers Canadian investors a convenient, all-in-one ETF solution that blends both stocks and bonds, making it an ideal choice for those…

Read MoreBuying Fractional Shares in Canada

Buying fractional shares is an excellent way to get exposure to Canadian All-Stars like Constellation Software without having to toss down more than $4,000 just to buy a single unit of stock! Even if you could afford that single share of CSU, tying up that much of your portfolio in one stock probably isn’t the…

Read MoreVGRO ETF 2025 Review

If you’re looking for a simple way to diversify your portfolio, ETFs are a great place to start. New to ETF investing? Check out our comprehensive guide to the Best All-in-One ETFs in Canada. Already familiar and just want our top recommendations? Head over to our list of the Best ETFs in Canada for 2025.…

Read MoreThe Best Mutual Funds in Canada (and why you should avoid them)

Despite the fact that they’re a pretty bad way to invest money, I still get a ton of questions about where to go to find the best mutual funds in Canada. Whether it’s in the comments section here on MDJ, or when I speak to audiences in person, there is always a group of folks…

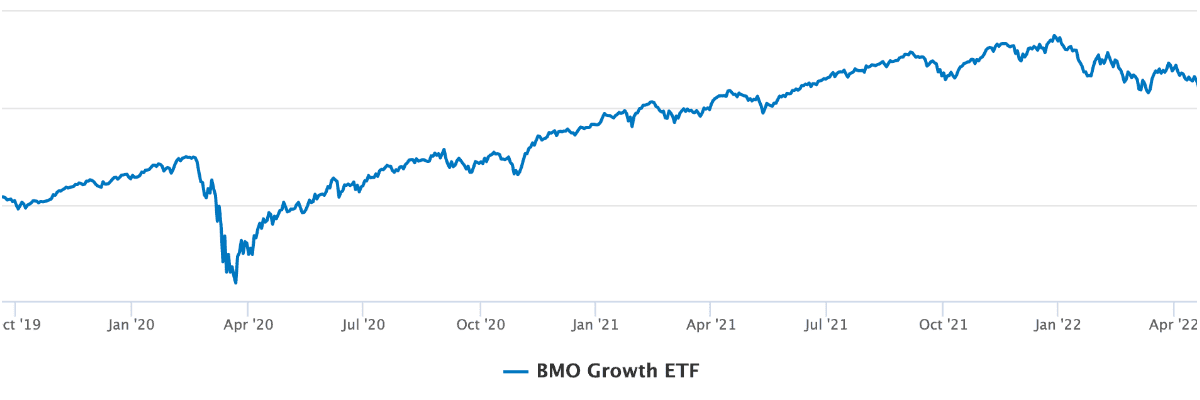

Read MoreZGRO ETF Review

All-in-One ETFs offer investors a simple and cost-effective way to buy stocks from thousands of companies through a single investment. Since their debut in Canada, these broadly diversified ETFs have soared in popularity. Naturally, brokerages have responded by launching a variety of all-in-one options to meet the growing demand. These ETF portfolios have become a…

Read MoreBest GIC Rates in Canada – October 2025

With the Bank of Canada hinting at possible rate cuts in 2025 – and with Trump’s tariffs lurking on the horizon – it’s looking more and more like the best GIC rates in Canada may have peaked for the time being. If you’re hoping to lock in a guaranteed return north of 3.5%, now might…

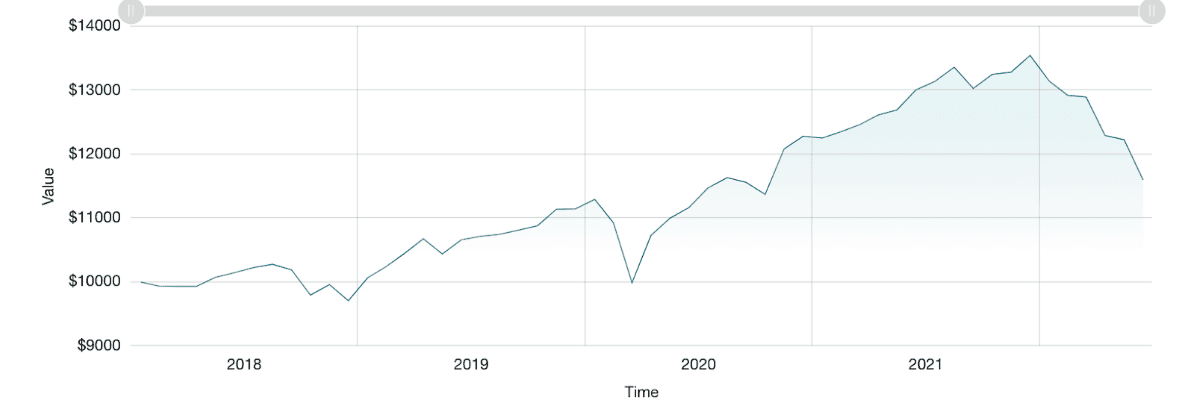

Read MorePassiv Review 2025 – Portfolio Management Tool

If you’re a Canadian DIY investor who prefers index ETFs – but prefers living life to dealing with rebalancing math and spreadsheets – then you might want to check out a tool called Passiv. The name is a play on the concept of passive investing (aka “index investing”). Passiv is most effective when used like…

Read MoreBest Short Term Investments in Canada Right Now (May 2025)

With interest set to fall, the best short term investments in Canada continue to evolve as we move toward the second half of 2025. As recently as 18 months ago, we were still seeing 5%+ GIC options, but now, I’d argue that high interest savings account options give you the best bang for your buck.…

Read More