Archive for January 2025

Wealthsimple vs. RBC InvestEase – 2025 Comparison

Whether you’re looking at the cutting-edge fintech company Wealthsimple, or the long-established Royal Bank of Canada (RBC), both financial institutions are keeping pace with Canadians’ growing interest in index investing. Wealthsimple and RBC each have managed wealth platforms that have made the list in our Best Robo Advisors in Canada list. Both institutions also have…

Read MoreAlternative Investing in Rare Earth & Technology Metals

While on Million Dollar Journey we generally recommend straightforward investments like Canadian dividend stocks and index investing using Canadian ETFs, there is always some interest in people who want to try their hand and active management. We wrote about investing in gold before, as gold investing positions itself as one of the most popular ways…

Read MoreBest All-in-One ETFs in Canada 2025

Canada’s all-in-one ETFs (also called portfolio ETFs) have been the single most important investment product innovation since I’ve started writing about this stuff nearly two decades ago. The Vanguard, iShares, and BMO all-in-one ETFs are the perfect marriage of index investing strategy, convenience, asset allocation math, and behavioural safeguards. These ETFs – which are actually…

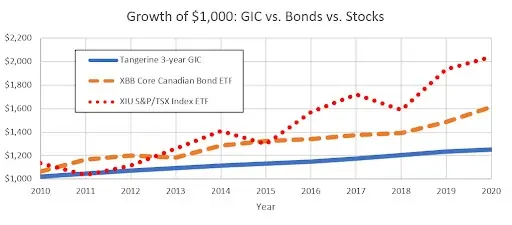

Read MoreBest Low Risk Investments in Canada Right Now (August 2025)

With so many threats to our economy in 2025 many Canadian investors are looking for low risk investments. Personally, I recommend that if you plan on using your cash within the next five years, it’s worth sticking to investments covered by the Canadian Deposit Insurance Corporation (CDIC). High-interest savings accounts and GICs (Guaranteed Investment Certificates)…

Read MoreWealth Management Companies in Canada 2025

When I first wrote about the best financial advisors in Canada it got some attention from Canada’s wealth management companies due to the news and social media attention it received. If you’re not sure what exactly the difference is between a wealth management firm and a financial planning company – don’t worry – there isn’t…

Read MoreMaxed out RRSP and TFSA – Now What?

I recently received an email from a reader with a bright financial future. They have a maxed out TFSA and has recently maxed out her RRSP as well. Here’s a snippet of the email below (edited for brevity). First of all, thank you for sharing your wisdom and financial journey. I love reading your blog and…

Read MoreWorking After Retirement in Canada

More and more Canadians are now working after retirement in some capacity. The idea of the traditional final office party, gold watch, and chair on the beach appears to be less and less fulfilling than many had hoped. That doesn’t mean a lot of us want to work the same job OR the same hours…

Read MoreCanadian Dividend Kings & Aristocrats – February 2025

Investing in Canadian Dividend Kings (sometimes known as Dividend Aristocrats) tends to come back into fashion when bond yields and GIC rates start to go down. With safer assets generating so little income, dependable dividend payers begin to look more and more attractive. So it’s no surprise that these solid blue chip stocks outperformed the…

Read MoreLaurentian Bank Review

What is Laurentian Bank? Laurentian Bank is an institution that has been around for over 175 years. Originally called the Montreal City and District Savings Bank, they changed their name in 1987. Laurentian Bank has a large presence in Quebec, with over 60 branches. However, their products are available to all Canadians through online banking.…

Read MoreEdward Jones Review (Canada)

After Kyle wrote about the best financial advisors in Canada a couple of weeks ago, we got several emails that asked some version of, “Should I use Edward Jones financial advisors?” or one of the other large financial advisory firms in Canada. Since I have had several friends use their services, and many of their…

Read Moremoomoo Canada Review

What is moomoo Canada? Moomoo is an online brokerage created with the goal of providing a platform for investors of all experience levels to engage with the market. Moomoo is an independent brand of Hong Kong-based FUTU Holdings, which is a NASDAQ Listed global financial institution. While moomoo was founded in Silicon Valley in 2018…

Read MoreWealthsimple Trade vs. TD Direct Investing

The Wealthsimple vs TD Direct Investing often boils down to a simple question: How much do you value price over user experience, full service, and physical location convenience? For a broader view of your brokerage options, you can check out my Best Online Brokers in Canada comparison. Wealthsimple Self Directed Investing (formerly called Wealthsimple Trade)…

Read MoreWealthsimple vs BMO in 2025

At first glance, a modern fintech company like Wealthsimple and an established financial giant like BMO couldn’t be more different. Yet, with the new push to index investing over the last decade, both financial institutions have managed wealth platforms that we ranked in my Best Robo Advisors in Canada list. Of course, they also include…

Read More