Truly Active Managers Outperform The Index – Being Different is Key

The popular opinion among investors supported by many studies claims that most fund managers underperform their index, so you are better off just investing in an index fund or ETF (our list of best Canadian ETFs). However, truly “active” fund managers have significantly outperformed their indexes after all fees over the long term, based on a very comprehensive study by 2 Yale academics (Cremers & Petajisto).

We have seen many studies of investing, but this is the most comprehensive and the most informative in analyzing fund manager skill. It identifies one category of fund managers that do beat their index.

There have been many studies comparing mutual funds to indexes, most of which are actually unfair to both sides:

Unfair to mutual funds:

- Include index funds among the mutual funds – 100% of index funds and ETFs underperform their index. They are about 10% of funds. But believe it or not, every study we have seen that shows mutual funds underperform actually include all the index funds among the underperforming mutual funds!

- Include “closet indexers” – About 30% of mutual funds try to be similar to the market, since this tends to make investors in those funds comfortable, increases the sales of the fund and tends to preserve the fund manager’s job. Most are trying to be close to the index and are arguably not really trying to beat it. How can you expect to beat the index if you have costs of managing your fund (MER of 2-2.5%) and similar holdings to the index?

- Include conservative funds – Many mutual funds don’t even try to beat the index. Because many investors cannot tolerate index level risk, a lot of mutual funds try to be less volatile than the index. For example, of the pure Canadian equity funds, 232 are less volatile than the TSX, while only 76 are more volatile. Leaving a margin for error, 23% of funds (74 funds) are between 10-40% less volatile than the TSX. Are these funds even trying to beat the index?

- Include the cost of advice – Most mutual funds pay your financial advisor for comprehensive planning advice (whether you get it or not). With index funds or ETFs, you would have to pay extra if you would benefit from advice or a financial plan. A fair comparison should exclude the cost of advice that is built into the cost of mutual funds.

Unfair to index funds:

- Exclude closed funds – Using today’s data has a “survivorship bias” because this excludes funds that closed down. Funds are closed for a variety of reasons, but the most common reason is that the fund was unpopular, so closed funds were more likely underperformers.

I recall a night playing cards with several couples when I realized that all the guys were playing to win, but all the women were really just playing haphazardly and enjoying the company. The game is very different when half the players are not really even trying to win!

That is what the comparison of mutual funds to index funds is like. Depending on what you include, only about 40-60% of mutual funds are actually even trying to beat their index.

Our view is that any study trying to meaningfully measure the skill of fund managers should exclude at least the 40% of equity funds that are index funds or closet indexers, and possibly those that are much more conservative. These studies should only include funds that actually try to beat the index!

Active Share

The Yale study introduced the concept of “Active Share” – the degree to which a fund’s holdings differ from the index. It is a scale from 0-100%, where 0% means it is a passive index fund identical to the index, and 100% means the holdings have no overlap from the index.

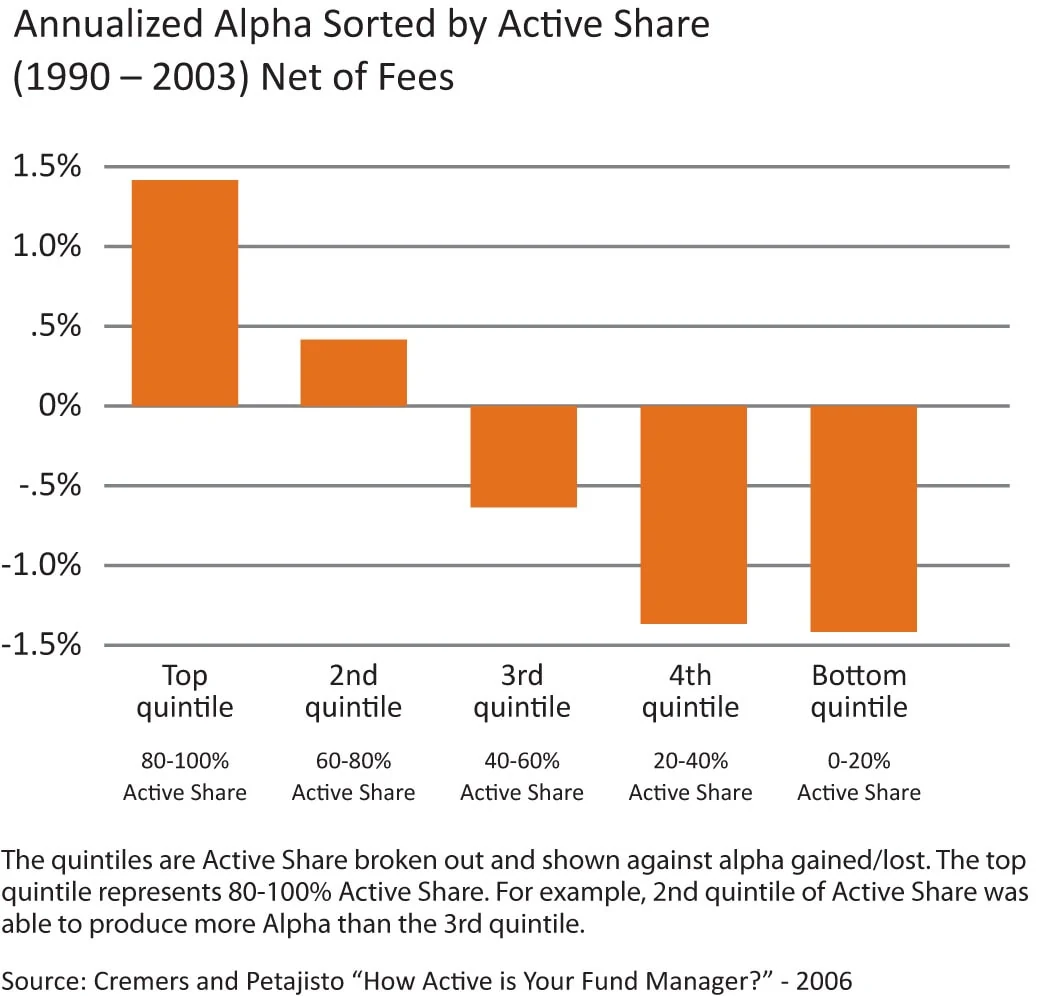

They found that among “stock pickers” – funds with an Active Share of 80-100% – the average fund beat the index by 1.5%/year after all fees for the entire 13-year period of the study. Meanwhile, funds with an active share of 0-20% underperformed the index by nearly 1.5%/year.

This is an important point. The conclusion of this very in-depth study was that, once you filter out the index funds and closet indexers, the average mutual fund beat the index by 1.5%/year for 13 years after all fees!

The graph of the results shows clearly a surprising fact – the more different a fund is from the index, the better it tends to perform!

We think that the reason for this is that only a smart, skilled fund manager has the confidence to be completely different from the index.

Looking for funds very different from the index is a great filter to help identify the most skilled fund managers. Those unlikely to outperform will identify themselves by having holdings similar to the index.

Fund managers that are focused on keeping their job by being similar to the index, that have bosses telling them what to do, that make their top 10 holdings look good for investors especially at month-ends (“window dressing”), that want to own popular stocks, and generally are focused on having a fund that people will buy – will want to own companies with big, recognized names. They will want to avoid losing money when others are doing well by having similar holdings and sectors to the index.

We call this the “business of investing”. Fund managers from the “business of investing” will filter themselves out. By focusing on making their fund popular, they will have a low Active Share and little chance to outperform.

However, fund managers that are focused on getting the best possible return with a given risk level, the true, skilled stock pickers that are passionate about researching companies, that are confident in their methods, and that have most or all of their own money in their fund – will want to invest in the undiscovered gems they find and the companies they believe are the most undervalued or the fastest growing.

We call this the “profession of investing”. Fund managers from the “profession of investing” invest like they would invest their own money. By focusing on being the best possible investor, they have the best chance to outperform. The Yale study shows that the average fund in this high Active Share group does outperform – after all fees.

Being very different from the index means there will obviously be times when they will lag while others are doing well, but, and this is the key point – it is necessary to be different from the index if you want to beat it.

In our search to find “All Star Fund Managers”, there are many important factors, but one important criterion is that they must be quite different from the index – which means they will have a high Active Share. It is not easy to identify the truly skilled fund managers, but Active Share is one objective measure that is a good start.

Conclusion

What can we learn from this study?

- Be Different – The more different your fund is from the index, the more likely it will outperform.

- Avoid “closet indexers” – If the top 10 holdings of your fund include more than 1 or 2 of the top 10 holdings in the index, you may have a closet indexer. You would need to look at the holdings more closely to be sure. With a closet indexer, you are paying the full cost of a skilled fund manager, but you have little chance to outperform. Most closet indexers are from the “business of investing”, which means they are focused on having a fund that will sell, instead of focusing on good performance. Our view is that nobody should buy a closet index fund.

- You can get comprehensive advice for free – Even if your fund doesn’t beat the index, but just has similar returns, you may be way ahead. If you would benefit from comprehensive financial advice (and almost everyone would), your mutual funds already pay your advisor. If you own “No advice investments”, such as stocks, ETFs or low cost index funds, you would have to pay extra for advice. If you are paying for advice, you should insist on getting it. Admittedly, the advice from many financial advisors may not be worth paying for, but the #1 reason given by advisors for NOT doing a comprehensive, written financial plan for clients is that “they don’t ask for it”. If you own mutual funds, insist on getting the comprehensive advice you are paying for!

- “All-Star Fund Managers” do exist – Most are from the “profession of investing” by focusing on being the best possible investor. They have the confidence in their discipline to be completely different from the index or from currently popular stocks. Active Share gives us one objective measure to help identify them.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Hi JFG,

I’m with you on having faith in the market. We think it is essential for all stock market investors, no matter what strategy you choose.

In general, we have found that investors that have faith in the market tend to do well, and those that are fearful do not.

It can be difficult to have faith in the market in big bear markets, like 2008, but the market has always bounced back. People forget that it is made up of a bunch of big, solid companies, that generally can adjust their operations to increase their profits, which is why the stock market goes up long term.

Perhaps it is a result of experience, but we have found it easier to be confident in a human being, like a fund manager. Once we have done our research and are confident in a fund manager and his methods, experience integrity, track record, etc., we get a more confident feeling from confidence in the fund manager than an impersonal market.

Many investors seem to have almost all their information from impersonal sources, like the internet, without seeing the importance of knowing the people behind it. We have avoided some major catastrophes by not investing with fund managers with exceptional track records, but where we were not comfortable with the person.

When the market crashes, there is a major comfort level from knowing that there is a really good fund manager hard at work making sure that anything that needs to be done is being done.

We still have faith in the market generally, but find a greater confidence from also having faith in a human being.

By the way, Michael Lee-Chin’s fund was a financial services sector fund. It is aggressive, since it is all in one sector.

Ed

Actually, Michael Lee Chin was anything but aggressive. Buy, Hold & Prosper was his motto.

Having said that, I just don’t like to be at the mercy of a manager. And yes, I prefer to have faith in the market. Weird, I know, but the market is many factors, the mutual funds are one factor, the manager.

Hi Houska,

Of course they took risk level into account. The 2 figures showing the amount by which the high Active Share fund managers beat their index are not a range. They are 2 different methods. The second figure (1.15% outperformance) is based on Alpha, which is “manager value added” taking into account risk level.

The study found that adjusting for risk did not change the results.

There is a follow-up article to come shortly that explains more details from the study. It lists a bunch of the factors that they all adjusted for, such as risk, size of holding, size of fund, etc. My first thought was that perhaps they were buying small caps, but they allowed for that as well.

The study clearly shows that these are superior stock pickers. They beat the market without more risk.

Ed

Hi JFG,

In our opinion, most of the managers you mentioned were just the aggressive manager in a hot sector. They were temporarily industry darlings (as you put it), but that is completely different from being an All Star.

What is so scary about a manager leaving? It’s like having Sidney Crosby on your team. What if he leaves? Just find someone else.

There is a deeper point here, though. The most skilled fund managers almost never leave their company. The reason for this is that top fund managers are rarely employees of someone else’s company. It is far more lucrative to have your own investment firm and get contracts managing certain funds, or have a fund company create a fund for you.

All Star Fund Managers, in our opinion, nearly always own their own firm, so they never leave it. Even when the retire, in some cases they have a good succession plan and the firm continues to outperform the same way.

Having a manager leave has almost never happened to us and is not something we worry about.

Ed

@JFG (#25) – tautologically true. If you’re buying active management, you’re betting on the manager. If the manager leaves, you’re either making a bet on his/her (are there many hers?) successors or you should move on.

@Ed (#24) – I’ll read your #15 in more detail in the morning. In the meanwhile, your #24 and Canadian Capitalist’s blog entry today on Legg Mason make me wonder: did the study correct for level of market risk (beta) and level of volatility overall? One of the ways institutional investors sometimes claim to generate alpha (which is effectively what this study is saying about the active retail market) is by actually taking on more risk. You would expect more risk to mean more return, so if the High Active Share funds are also on average more volatile than their benchmarks, one could presumably duplicate the effect by biasing ones’ asset allocation and yet staying a passive (index) investor.

JFG: Very true, I’ll keep to ETFs too.

It’s all about the manager.

Remember the Altamira Equity fund of years passed? The darling of wall street and it put Altamira on the map.

What about AIC? That fund was untouchable. Didn’t he sell his company?

PH&N. Now that RBC has them, will they still perform?

Sorry, but Mutual Funds are quite dependent on the Manager and if the Manager leaves, then what?

I’ll stick to my ETF’s, thank you.

Hi Houska & Multiple Baskets,

Thanks for the support!

I’m just trying to provide some general education. Too many people believe all the index propaganda that nobody can predictably beat the market and too many people buy closet indexers!

Your question about whether this will hold long term is interesting. We think so.

The study did show that fund managers with high Active Share tended to continue to have it in the future. This makes sense. A good stock picker that has holdings very different from the index is unlikely to suddenly have very similar holdings in a future year, except for possibly the odd year.

Our experience with what we call “All-Star Fund Managers” is that the all-stars tend to remain all-stars. In fact, our experience agrees with the study that experience makes a big difference.

Wisdom (for lack of a better word) makes a big difference. Young fund managers usually get into heavy computer analysis of public information, graphs, and many ideas that sound logical, while the more experience fund managers learned years ago that most of these don’t work.

Having said that, all top fund managers also have significant periods of underperformance. I saw one article that listed the top fund managers since 1950 and the percent of the time they underperformed. Most underperformed about 30% of the time and still beat their index by wide margins over the long term.

One striking example is Rick Guerin who managed a fund from 1965-83. This was a very unfortunate time – the period of time many people wrongly claim the index had no growth at all.

He beat the index by 32.9%/year compounded during his career! And yet, he underperformed the index in 7 of 19 years (37% of the time).

Having a high Active Share means you are very different from the index, so it inevitably means there will be periods of underperformance. This is part of why All Star Fund Managers are not that easy to identify.

Our big question is whether this fact will result in periods of time when an updated Active Share article would not confirm outperformance. The updates from the existing study already show the degree to which the top fund managers beat the market goes up and down.

In general, though, we would be surprised if future studies would not continue to show that top Active Share fund managers generally would beat their index.

Ed

Hi Thicken,

This study actually proves the top funds do outperform indexes, not just “benchmarks”. It compared every fund to 19 different indexes and used the one that it was most similar to. So, it did not accept the fund’s category or benchmark.

This study compares every fund to a specific index – whichever index of 19 the fund most closely resembles.

The benchmark for a mutual fund is always an index or a combination of indexes, but this study was far more in-depth than to just accept their benchmark.

This is just one example of how in-depth the study is.

Ed

Hi Aolis,

We just added the article to our web site so that we could make sure we had a reliable link from this blog for anyone that wanted to read the original study. But we did find it very useful.

Active Share does not by itself identify a top fund manager, but it can help you rule out those that are not.

Think of it like being a great skater in hockey. An all-star hockey player will most likely be a great skater, so you can rule out most of those that are not great skaters, but just because someone is a great skater does not make him a all star.

This study was very comprehensive and clear shows that some fund managers CAN predict which companies will do well.

The belief that nobody can beat the market is rampant, but makes not sense to us and does not fit with what we observe in studying fund managers. I can also identify the top people in many other fields, especially areas that publish a lot of stats – like sports.

Granted the markets are much more complex than hockey, but I can tell you who most of the most talented hockey players in the world are. There are people with superior talent, intellect, and work ethic in every field.

Why do people think that would not also apply to investing???

For example, the market is very manic with most investors, including most professionals, being sheep – essentially following the herd. This creates large systematic mispricings, which is why the majority of the all-time best fund managers are value style. There are many styles of investing, but one style has most of the top investors.

The top investors, not surprisingly, are not sheep, and are not following the herd. This study just confirms what makes intuitive sense to us – the top investors have holdings very different from the index.

Ed