Is Shopify Stock a Good Buy in 2024?

If you’re considering investing in Shopify stock in 2024, it’s important to assess the company’s performance and the latest developments in the e-commerce industry. Staying informed about Shopify’s latest financial and innovation updates are essential in determining whether it is a favorable investment choice.

If you are looking to diversify your tech investment dollars, we recommend exploring our article on Best Canadian Tech Stocks. This valuable resource provides insights into reputable Canadian technology companies known for their high growth potential.

Our Shopify Stock Analysis

- Shopify’s stock has surged over 80% year-to-date through early June.

- In comparison, the S&P 500 has only seen a 13% increase while the TSX Composite has only grown by around 4% year-to-date.

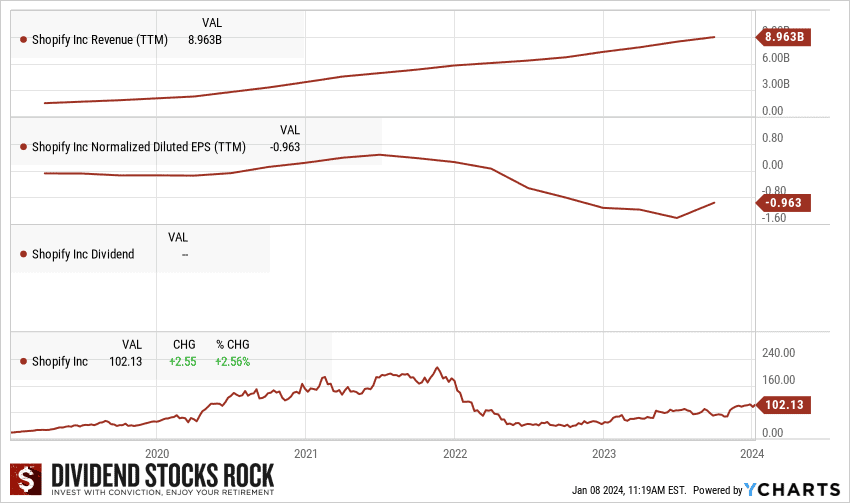

- 22.30% YOY revenue growth is quite high, but not uncommon for the e-commerce industry.

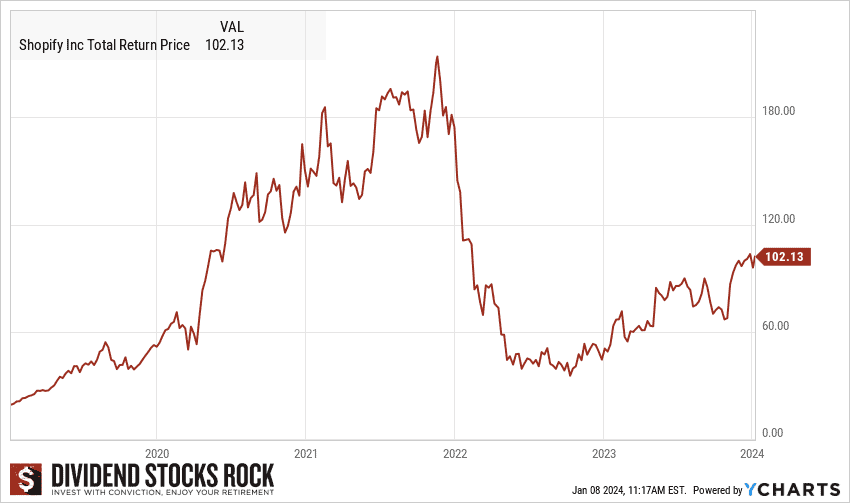

- It currently sits just above the pre-covid price level, recovering from a huge decrease in 2022.

- Higher merchant fees and sale of logistics business is expected to increase profitability.

Our Shopify stock analysis indicates that Shopify is currently valued correctly but still presents an excellent buying opportunity. It holds a strong position in the e-commerce industry, making it a compelling option for long-term investment.

Despite facing some tough decisions, such as the sale of its logistics business, we believe that Shopify’s focus on cost reduction and streamlining operations will enable the company to refocus and achieve more recovery in the coming years.

For detailed information on long-term investment opportunities in Canada, we recommend checking out our comprehensive guide on the Best Long-Term Investments in Canada.

Should You Buy Shopify Stocks Now?

Investing in Shopify stock offers the potential for a reliable asset in your portfolio. With a track record of consistent growth and innovation in the e-commerce industry, owning shares in Shopify can provide advantageous opportunities for investors.

The company’s strong market position and continuous efforts to enhance its platform make it a compelling choice for those seeking long-term growth in the digital commerce sector.

One of the key strengths of Shopify lies in its huge addressable market. With a 10% share of the e-commerce market in the U.S. alone, the company is well-positioned for solid long-term growth. As more merchants adopt Shopify’s solutions, there is room for further market penetration and increased market share.

Shopify offers a diverse range of shopping solutions, including point-of-sale payment systems, online payment solutions, digital marketing initiatives, and tools to help merchants drive sales and achieve better returns on investment. These offerings position the company to capitalize on the growing e-commerce penetration both in the U.S. and worldwide.

Furthermore, despite its current success, Shopify estimates that it has only captured a fraction of its total addressable market, which is valued at an impressive $160 billion. This untapped market opportunity suggests significant growth potential for the company as it continues to expand its market share.

Investing in Shopify stock is an excellent way for Canadians to diversify the systemic risk from banking and resource extraction industries. While we love our Top Canadian Dividend Stocks, a balanced portfolio should include exposure to high growth companies has well.

Considering Shopify’s attractive valuation, strong guidance, massive addressable market, and diverse shopping solutions, investing in Shopify in 2024 appears to be a favorable option for those seeking long-term growth in the e-commerce sector. Shopify allows you to diversify your portfolio and you can buy it in Canadian Dollars on the Toronto Stock Exchange.

How Do I Buy Shopify Stock?

To buy Shopify shares, you can utilize any of the available Canadian online brokerage services. At MDJ, we prioritize guiding our readers in selecting discount brokerages that meet their needs. We consistently update our list of Top Online Brokerages in Canada, and provide our readers with the best recommendations and current promotional offer codes.

Once you have registered for an online brokerage account, buying Shopify shares is quite a simple and straightforward process. Simply use the search bar to look up the ticker symbol “SHOP” and decide on the number of shares you wish to purchase.

For instance, if you plan to invest $850 in Shopify shares and the current stock price is $85, you would enter “10” and select the “market limit” option. The online brokerage website will then present you with a prompt stating, “Do you want to buy 10 shares of SHOP at $85 each, totaling $85?”

Once you confirm the order, the online broker will handle the rest. Congratulations! You are now a proud shareholder of one of the leading e-commerce companies in Canada.

If you require further guidance on investing in the Canadian stock market, we invite you to explore our comprehensive guide on How to Buy Stocks in Canada.

Shopify Stock Historical Performance

In recent years, Shopify has demonstrated a remarkable pattern of revenue growth, as depicted in the graph above. The company did really well when all the tech stocks surged during Covid, especially between mid 2020 and late 2021. This all came down in early 2022, but has since been recovering and looks to be on an upward trajectory.

Although Shopify does not offer a dividend, its strong financial performance and upward trajectory in revenues are indicative of its potential for long-term stability and expansion.

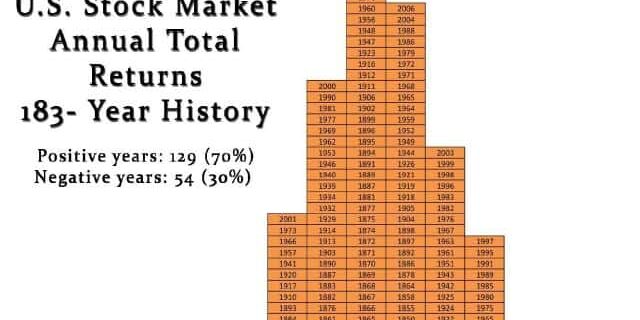

Despite the absence of dividend returns, Shopify’s innovative position within the e-commerce industry and its ability to adapt to changing market demands make it an attractive investment choice. It is always important to diversify your portfolio with technology stocks, as they tend to do very well at times and cashing in the capital gains at the right time can serve you well.

As an investor seeking long-term positions, I prioritize companies that exhibit steady growth, consistent dividends, and undervalued stocks. While Shopify does not fit the traditional dividend investing criteria, its impressive revenue growth and market performance make it an intriguing option for investors looking for capital appreciation and future opportunities. Moreover, Shopify’s stock price has recently experienced a decline, presenting the perfect time to consider investing in a company with strong growth prospects.

For additional investment opportunities in technology I recommend checking our guide on the Best Telecommunications Stocks in Canada. Although Shopify is not in the telecoms sector, if you’re looking at shopify you are going to want to look through a few of the telecoms giants we have in Canada.

When it comes to thoroughly analyzing stocks and exploring a diverse range of investment options, I consistently rely on the Dividend Stocks Rock (DSR) platform for comprehensive research and guidance. While Shopify may not offer dividends, the DSR guide provides valuable insights into various investment strategies, helping investors make informed decisions in their pursuit of long-term success.

Shopify Stock Forecast

Shopify released its financial results for the first quarter of 2023 on May 4, revealing net sales of $2.04 billion, which is quite promising to investors as we finally see the company reversing its recent past of revenue losses. This substantial increase in net sales indicates a strong performance for Shopify in the first quarter of 2023. It’s an encouraging sign for investors who have been eagerly awaiting a turnaround in the company’s financial performance.

For investors looking to capitalize on the opportunities presented by the e-commerce industry, Shopify remains an attractive choice. Its strong financial performance, coupled with its market dominance and ongoing efforts to enhance its platform, make it a compelling investment option for those seeking long-term growth in the digital commerce sector.

To explore other potential investment opportunities on the Toronto Stock Exchange, we invite you to delve into our comprehensive guide on Dogs of the TSX. This resource provides valuable analysis and information on top-performing stocks within the Toronto Stock Exchange, including companies like Shopify.

Shopify operates in the e-commerce industry, and as such, is influenced by various market factors. As an innovative technology company, Shopify’s success is tied to the growth and evolution of the digital commerce sector. However, it’s worth noting that Shopify is not immune to economic fluctuations and competitive pressures in the market.

Recently, Shopify’s CEO announced workforce reductions affecting over 2,000 employees and a divestment of its logistics business to streamline operations. Despite these changes, Shopify’s commitment to innovation and strategic decision-making positions it as a resilient player in the e-commerce landscape, offering potential investment opportunities for those interested in the digital commerce sector.

If you’re looking to reduce risk and prefer a passive investing approach in ETFs rather than selecting individual stocks, I recommend checking out our comprehensive list of the Best ETFs in Canada for 2024. This resource provides valuable insights into top-performing ETFs that can help you achieve your investment goals.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

It’s been a great year for Shopify.

Holding for the long term.