Ultimate Guide to Peer-to-Peer Lending in Canada

Peer-to-peer lending in Canada is a unique niche for Canadian investors looking for higher returns on fixed income. If you want to act as the bank (instead of just investing in them), this is your chance.

So, what is peer-to-peer lending?

How does it work?

And is Peer-to-peer lending a safe way for Canadians to invest?

| Platform | Types of Loans | Loan Amounts | Interest Rates | Annual Servicing Fee |

| goPeer | Personal Loans | $1,000-$25,000 | 7.5%-31.5% | 1.5% |

| Lending Loop | Business Loans | $1,000-$500,000 | 4.96%-24.93% | 1.5% |

What is Peer to Peer Lending?

Peer-to-peer lending (also known as P2P), crowd-lending, or social-lending allows one person to obtain a loan directly from another person rather than a bank or financial institution. With peer-to-peer lending, you are cutting out the middleman.

Since you are effectively cutting out the bank, lenders can get a better return on their cash savings and borrowers can get lower rates on the loans. Peer-to-peer lending has only been around since 2005, however, peer-to-peer lending in Canada has started to gain a bit more popularity and there are now a few peer-to-peer lending online platforms for Canadians to use.

Types of P2P Loans

So, what kind of loans can you get with peer-to-peer lending?

Pretty much everything:

- Personal loans

- Business loans

- Car loans

- Loans for debt consolidation

Since peer-to-peer lending in Canada is still pretty new, there are fewer platform options available to Canadians at this time though, no doubt, we will see more in the future. Right now, Canada has two main peer-to-peer platforms. One for business loans and another for personal loans.

Pros and Cons of Peer-to-Peer Lending in Canada

P2P loans, like everything else, have their pros and cons. Here’s the good and the bad on peer-to-peer lending.

Pros

- Quick and easy to apply online

- Easier to qualify for a loan than traditional banks and credit unions

- Lower rates for borrowers

- Higher rates for lenders

- Strict vetting process for would-be borrowers

Cons

- Fewer regulations compared to other financial institutions

- Fees

- Low loan amounts (maximum $25,000 for a personal loan)

- Not ideal for those with poor credit- you may not qualify

How Does Peer-to-Peer Lending Work?

You might be asking how it’s possible for there to be better returns for lenders and at the same time lower rates for borrowers.

The fact is that both statements can be true due to the fact Canada’s banks use very healthy margins when they lend money. If borrowers and lenders split this healthy margin, it’s possible for both to get ahead.

This is where the peer-to-peer lending online comes in. These peer-to-peer platforms make the process straightforward and easy for borrowers to get loans.

1) Choose a peer-to-peer lending online platform and complete the assessment as directed.

2) The platform will assess your risk and then assign you an interest rate.

3) Once you have been approved, you have access to the lenders that use the platform. Browse through the options and choose what works best for your needs.

4) Choose the loan that best suits you and receive the money (it might be all or some of the total loan amount needed. You can have multiple lenders.)

5) Make your payments as directed and repay the full loan in the agreed-upon term.

The interest rate you are assigned will depend on your credit rating and history, but since you’ve knocked out the bank or financial institution, the rates offered by peer-to-peer platforms are generally lower than what you would be offered by a bank or credit union.

Keep in mind, there are a few eligibility requirements for those who want to borrow on peer-to-peer platforms. These include:

- Being the age of majority in your home province or territory

- Being a Canadian citizen or permanent resident

- A valid Canadian address

- 2 valid pieces of identification

- Proof that you can pay off your loan (bank statements, pay stubs etc.)

- A credit score of 600 or better

- You must be willing to submit to a credit check.

Can You Make Money With Peer-to-Peer Lending?

Lower interest rates are great for the borrower, but what about the lender. Can you make money with peer-to-peer lending?

Yes!

Even when you hold your money in a bank account like a HISA or GIC, the interest rate you are receiving is a thank-you to you for putting your money there as the bank is essentially lending your money for profit. In this case, you are cutting the bank out, so you’ll notice that peer-to-peer lending investment returns are higher than the interest rates offered by banks.

And, who doesn’t want to see higher investment returns?

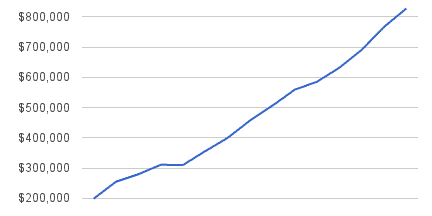

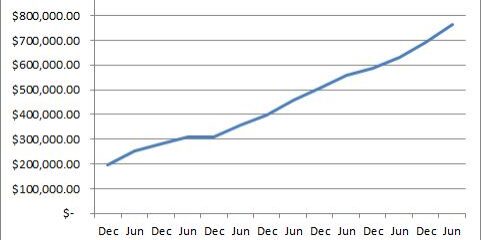

So, what can you expect from peer-to-peer lending investment returns? According to Lending Loop, the estimated net return for a balanced plan is 7.9%; however, there are quite a few peer-to-peer investors who report returns of 10% or higher.

Now, keep in mind that there are some fees involved. After all, the platforms need to make their money too. You will likely have to pay a lending service fee and, should the loan go into default, a collection fee.

It’s also important to note that like any other type of investing, there is no return model without risk involved. If you want to act as the bank, you have to be ready to accept that some people won’t pay you back – just like the bank is.

How Do I Invest in Peer-to-Peer Lending?

Investing in peer-to-peer lending is pretty easy. To start with, choose a platform you want to lend on. Right now, Canada has 2 main P2P lending platforms which I will discuss more below. Both are Canadian businesses aimed at helping your fellow Canadians, but one leans more towards personal loans while the other is for business loans.

Keep in mind each platform has its own requirements for borrowers AND lenders. Read through these to ensure that you do qualify. Also note that there are minimum lending requirements for the platforms as well as lender categories within the platforms.

When you have chosen your platform and checked to make sure you do qualify as a lender, you can apply for an account. Once you are in, you can then browse individuals or businesses who are looking to borrow. As the lender, you’ll be able to see the risk rating given to them by the peer-to-peer lending platform. For the two platforms discussed in this article, those ratings range from A+ which means the business or individual is extremely reliable to E which means they are at risk of not paying back their loan.

On top of allowing you to actively invest as you like, some P2P platforms also have Auto Invest options which means you don’t have to do the work. This feature will look for opportunities based on your preferred risk grade and automatically invest your funds for you.

Best Peer-to-Peer Investing Platforms

Thinking about giving peer-to-peer lending a try and wondering where you can lend money online? Canadians don’t have as many online P2P platform options as they do in the USA, but we still have a couple of choices. Here are the best peer-to-peer lending platforms for investors in 2021.

goPeer

goPeer is a Toronto-based P2P platform for those looking for personal loans. They have a rigorous application process and will only accept borrowers with a credit score of 600+ which means it may not be ideal for borrowers with poor credit history. But, from a lender perspective, this makes it a more attractive bet.

Loan amounts range from $1,000 to $25,000 and interest rates range from 7.5%-31.5% with terms of either 36 or 60 months. In terms of fees, goPeer charges a 1.5% annual servicing fee (0.125% monthly) on the unpaid principal balance of outstanding loans. They also charge a collection fee of up to 35% on delinquent loans.

Lending Loop

Lending Loop is another well-known Canadian P2P platform and is also Toronto-based. Lending Loop, however, is specifically meant for business loans. Loan amounts range from $1,000-$500,000 and interest rates range from 4.96%-24.93%. In order to qualify, businesses must earn $100,000 in revenue per year and have a credit score of 600+. Lenders are charged a 1.5% lender serving fee that is collected when payments are received.

How Safe is Peer-to-Peer Lending/Investing?

One very big question when it comes to peer-to-peer lending in Canada is: is it safe? Is P2P a good investment?

Well, like every other type of investment, peer-to-peer lending correlates risk with investment return.

The platforms themselves do their best to be safe and secure. Funds are held in chartered Canadian Banks and they are regulated under Canadian securities law. Both Lending Loop and goPeer use state of the art encryption to protect your information. They also both have fairly rigorous approval processes for would-be borrowers.

That being said, P2P platforms are still very new in Canada and not subject to the same regulatory oversight as big banks and other financial institutions.

The bottom line is that any investment or borrower that is going to pay you 20% is going to come with some risk. The real question is can you judge that risk better than the average bank, and pocket the difference in fees between this platform and what a bank would charge.

What if I Don’t Qualify for Peer-to-Peer Lending?

Since peer-to-peer lending is so new, the qualifications are pretty stringent. Especially when it comes to Canadians who are looking to borrow. Right now, P2P lending isn’t very compatible for those with low credit scores. As you saw in the platform summaries, both goPeer and Lending Loop require borrowers to have a credit score of at least 600.

I expect we will see more growth in these types of platforms over the next few years as they gain more traction and popularity; however, right now if you need a loan and don’t qualify for peer-to-peer lending then you will have to go the traditional route with a bank, credit union, or other financial institution.

P2P Lending for Canadians: Final Verdict

The concept behind peer-to-peer lending in Canada is an interesting one.

Canadians are tired of low returns and high interest rates on loans. P2P lending promises better deals for both sides which makes it incredibly attractive. Additionally, the community aspect of knowing that your money, as a lender, is going to support fellow Canadians in their business or just day-to-day life pursuits also provides a feel-good factor. That being said, peer-to-peer lending is still relatively new in Canada. Not everyone can qualify and it can be a bit risky. It will be interesting to see how this trend grows over time.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

This is a super interesting article and I agree with your final takeaway. I think that P2P lending has the potential to create a much more efficient lending system for both borrowers and lenders. However, it’s still so new and potentially risky. Will be interesting to see how it develops.

I have been using Lending Loop for two years. Unpaid loans bothered me at first. But, my average gross yield is 15%. You should know that the entire application and accounting processes are paperless-

even your tax slip. I have never had any issues and am very satisfied.