Market Predictions for 2025

I get a kick out of how every year the same news sources trot the same big names to make predictions about what the world’s various stocks, bond, and commodity markets will do. These predictions rarely come true – but no one appears to care, and then we repeat the cycle in the hopes that someone’s crystal ball will be right for the next twelve month cycle.

The truth is, there are just too many factors at play to predict financial markets with precision – especially over an arbitrary time frame such as 365 days. Whether it’s interest rates, investor sentiment, or global economic dynamics, it’s just too difficult to get it right.

All of that said, making predictions is kind of fun. I’ve done pretty well making predictions over at Moneysense the last couple of years (full disclosure – it was likely luck as much as skill) and so I figured I’d take a shot over here on MDJ this year.

I want to be upfront in saying that I am making no active investing decisions based on these perceived trends – but I think it helps to stay the course if a person thinks through various eventualities that could happen in the year to come. It also helps you keep a big picture view and ignore the day-to-day noise of 24/7 news channels.

So without further ado, here are my 2025 market predictions!

Trump’s Tariff Threats Become a Reality

One of the most pressing questions for Canadian businesses in 2025 is whether the newly elected U.S. president will follow through on his promises of large tariffs on Canadian imports.

Trump’s fixation on trade deficits could lead to a significant shake-up in the global economy. He appears intent on generating tariff income to support the legislative groundwork for corporate tax cuts. His “national security” justification may lack substance, but it could still trigger sweeping trade policies.

I don’t actually believe that Mr. Trump understands how trade wars actually work, and he hasn’t cared to learn anything new in several decades. So the hopes better angels will talk him out of this are perhaps misplaced.

I believe even more strongly that the President-elect doesn’t understand how trade balances work, and consequently, he does not understand that in buying goods from Canada with a strong US Dollar, his constituents (US consumers) are winning! There is no “subsidization” of Canadian business going on here.

While a blanket 25% tariff on all Canadian goods seems unlikely, a more targeted 10-15% tariff on non-energy products feels probable. If that happens, Canadian businesses would face a challenging environment, and retaliatory tariffs from Canada could escalate tensions further.

My guess is that we’ll see some major disruption in Canadian manufacturing, with supply chains snarled, and some factory commitments being delayed indefinitely as companies decide to move more operations within the USA for the next few years at the very least. I’d also be pretty worried if I was a farmer and/or worked in the dairy industry. Some of these tariffs might come off when the overall North American trade deal is finalized in a couple of years (and once a new government resets relations with the Trump administration), but for now, Trump will get two things he wants:

1) More money in his budget to offset corporate tax cuts.

2) Leverage in the upcoming larger overall trade negotiations.

Maybe I’m wrong and some positive news headlines and photoshoots will be enough to shift the Trump team’s focus to taking over South America or something like that. But I wouldn’t bet on it.

Inflation and Interest Rates Trickle Down

Inflation concerns dominated much of 2024, and they’re not going anywhere in 2025. A combination of tariff-driven price increases, corporate tax cuts, and a booming U.S. stock market could fuel spending, driving inflation higher once again.

If inflation climbs above 3%, mortgage rates will rise, and the U.S. dollar could continue strengthening – which is ironic, considering Trump’s tariffs are aimed at reducing trade deficits. The stronger dollar will partially offset those same tariffs Trump is so intent on. With inflation on the rise, the U.S. Federal Reserve is likely to hold off on the rate cuts some investors have been hoping for.

With the US keeping rates higher, that is going to pressure the BoC to not fall too far out of lockstep.

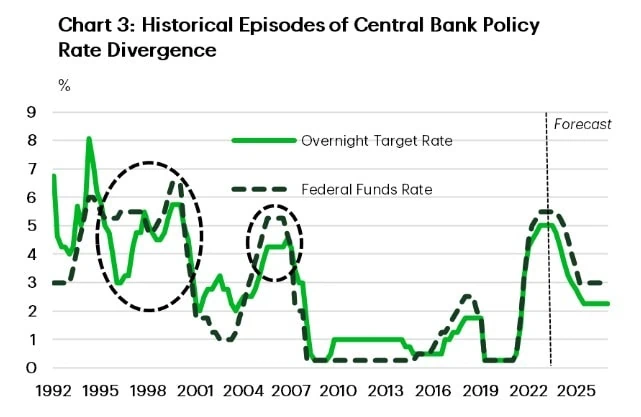

This chart from TD shows just how rare it is for the BoC and US Fed to diverge much on monetary policy. I don’t think high oil prices are going to save the loonie this time around – which means if the Canadian Dollar starts to free fall vs the USD there is going to be a ton of pressure on the BoC to lay off further interest cuts. That all could result in Canadian mortgages and interest rates staying higher for longer as well (but they would still be lower than down in the States).

A Split Year for Stock Markets?

The first half of 2025 could ride the momentum of post-election optimism. Both Canadian and U.S. markets might see gains as investors revel in the economic “sugar high” of a Republican sweep. Positive sentiment and AI-fueled enthusiasm could push valuations even higher, especially in the tech sector.

But the second half of the year might tell a different story. The combination of tariffs, a strong U.S. dollar, and stretched valuations could start to weigh on corporate earnings – particularly in the U.S. Tariff impacts could also ripple north of the border, dampening profits for Canadian companies reliant on exports.

Right now, large sections of the US stock market are priced for perfection. The valuations are high because expectations that earnings will grow are also quite high. If those earnings projections start to go south, investors could turn skeptical in a hurry. I think there is a pretty good chance this happens at some point in late 2025.

That said, you’d be right 65-75% of the time if you predict the stock market will go up every year (which is probably a much better shooting percentage than most prognosticators have)! So, if forced, I’d say that overall, the markets will be up in 2025. The more positive news we get on tariffs being a bluff, and US inflation coming down, the better it will be for stock markets and to a lesser degree, commodity markets as well.

The Return of Canadian Dividend Stocks

When anxiety creeps into the markets, cash-flowing companies such as Canadian moat stocks tend to shine. Canadian dividend stocks, like utilities and pipelines, could see renewed interest, especially if falling interest rates make their steady payouts look more attractive.

Investors may also turn to dividend-paying banks and insurance companies, which make up a significant portion of the Toronto Stock Exchange. Lower borrowing costs often translate into higher profitability for these sectors, offering reassurance to patient investors.

As Canadian GIC rates dip below the highs of 2024, yield-hungry Canadians may find it harder to replicate guaranteed returns, making dividend stocks an appealing alternative.

Canadian Housing Prices Under Pressure

Housing prices in Canada may face headwinds in 2025. While a 6.6% rise has been forecast by CREA, I’m skeptical. With bond rates not falling as quickly as the Bank of Canada’s rate cuts, fixed-rate mortgages may not drop to levels that entice buyers.

The CREA is always trying to come up with reasons why RIGHT NOW is the most advantageous time to buy a home. Unless rates keep falling, I don’t see why Canadians will feel a big rush to buy houses, or to sell homes that they have better mortgage rates on (or perhaps a completely paid off mortgage).

Add in decreased immigration targets and more negative consumer sentiment, and buyers will continue to hold the upper hand in major markets. The condo market, in particular, might feel the pressure as inventory levels remain elevated.

Oil Prices: Stuck Below $75 US

The global oil market isn’t showing signs of recovery anytime soon. With U.S. production continuing to rise and OPEC nations reluctant to slash supply further, a surplus could keep prices below USD $75 a barrel.

Meanwhile, sluggish demand from China means there’s little hope of soaking up the excess inventory. Unless there’s a major geopolitical disruption, we don’t foresee significant upward movement in oil prices.

As always, Saudi Arabia – and to a lesser degree, the rest of the OPEC+ nations – will largely control the price of oil. If they get sick of the US gobbling up their market share they could very easily decide to increase it.

Tesla Shares Will Collapse At Some Point

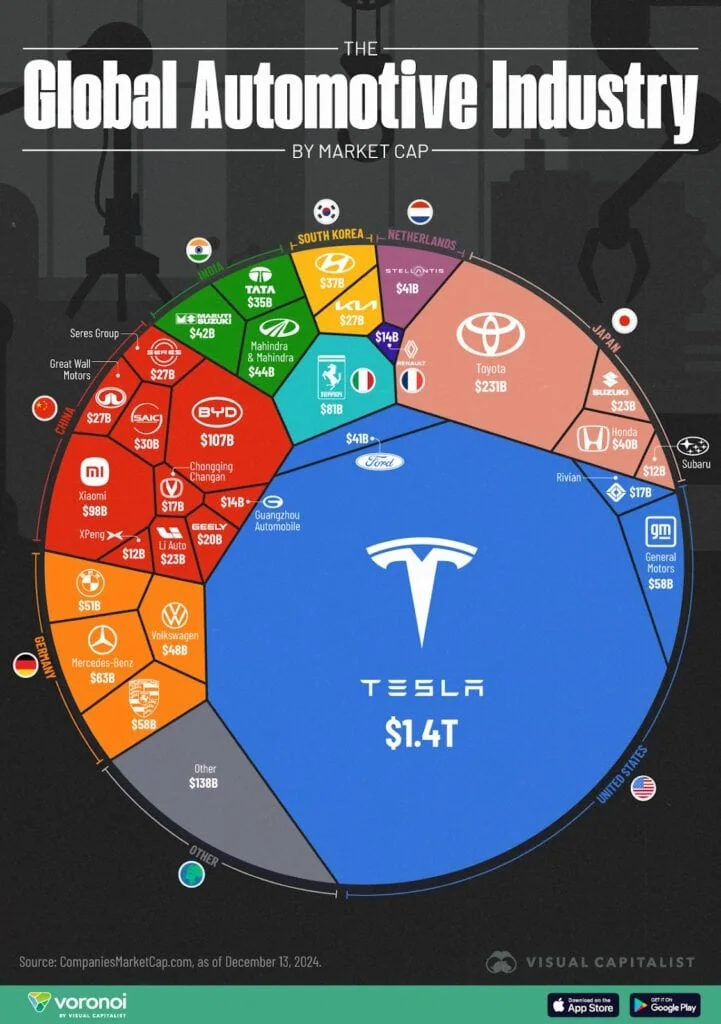

Look, I don’t know if investors will come to their senses in 2025 or another time in the next few years – but at some point, someone is going to ask if Tesla is worth more than all the other car companies combined. This is what the current map of vehicle manufacturers looks like when it comes to market capitalization.

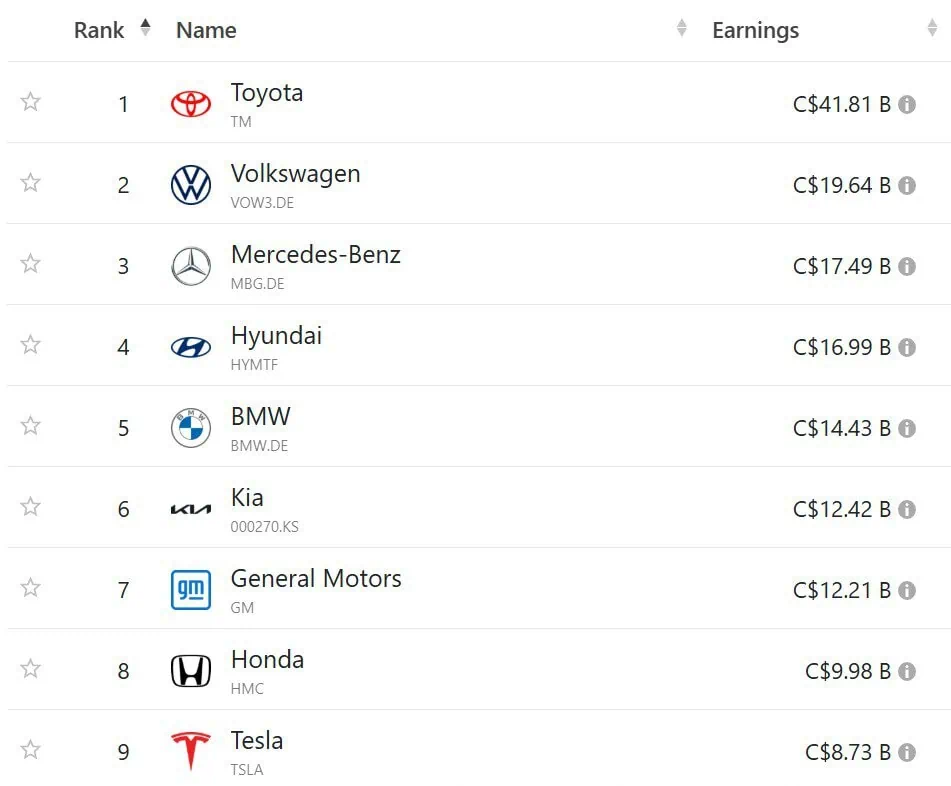

Meanwhile, here is what the profits of those car companies looked like over the last 12 months.

You don’t have to be an investing genius to figure out those two graphics don’t make a lot of sense when considered together. Sure, I get it, Elon is best buddy to the guy in charge. I just don’t see how that adds up to folks buying more Teslas. In fact, I’d argue that it is an awful branding move with the exact demographic of folks who want to buy Teslas!!!

With Musk splitting his time between several companies and leading government departments that aren’t actually official government departments, I don’t see a lot of reasons to believe Tesla is going to continue to grow earnings exponentially.

I’m not saying the company will go bankrupt or anything. I think their cars are still an excellent product and their charging system is an incredible asset. I’m excited about their commitment to producing a lower-priced model in 2025. I just don’t think the company is going to make more money than the rest of the world’s car makers put together! Right now, Tesla’s P/E is about 120x. That’s just way too high – and it’s pretty simple math.

In fact, I’d argue that Tesla isn’t even the most promising of the new car makers out there stealing market share from the traditional leaders. Over at my Moneysense column, I’ve been writing about how great the BYD (Build Your Dreams) car company is for a couple of years now. They first got on my radar when I found out Warren Buffett owned a substantial part of the company.

I think BYD is a massive threat to Tesla’s worldwide sales – in fact, it’s already bringing in more revenue than Musk’s baby. The 100% North American tariffs on Chinese EVs will ensure Tesla keeps their dominance in our market (and ensures we pay more than we have to for EVs), but the rest of the world is quickly waking up to the fact that Tesla isn’t the only EV-maker in town. And that doesn’t even account for the increasing competition in the EV market, the reluctance of many consumers to switch to EVs, AND the fact EV subsidies are likely to go out the window in many countries in the next couple of years.

Should I Sell Everything Before 2025?

Look, it’s worth reiterating that while I sound pessimistic here, there are some slower-motion reasons to be optimistic as well. Generally speaking, almost every year, human beings get better at producing goods and services. That will continue to be true.

It’s also key to remember that while there are always good reasons to worry, ultimately, betting against companies’ collective ability to make money over the long-term has always been a bad move when it comes to North America and the last hundred years.

I could write a positive-sounding version of this article that highlighted areas such as AI productivity, probability that tariffs will be quite low and come off sooner rather than later, American consumers will continue to spend (and power world economy growth) as they are now certain the economy is “suddenly” going in the right direction, etc.

Heck, there were some really good growth stories out there in 2024 like India, Mongolia, Senegal, Vietnam, Cambodia, Malaysia, Indonesia, and the Philippines – they just got very little media attention. I really think Argentina might be the next country to see explosive growth in the years ahead. If the Russian-Ukrainian war ends (and it looks possible some version of a ceasefire could happen), all the economies in that region would immediately benefit, and perhaps the world’s decision makers would realize that peace is far more profitable than war.

At the end of the day, MANY more people look dumb than look smart if they sell their assets in preparation for a market collapse. Sure, you could end up as the next guru in a “Big Short-type” of movie – but you’re much more likely to end up missing out on the steady march of progress the world’s largest companies have generally enjoyed.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

I share the same observation about Tesla. At the end of the day, an EV is a car that moves people from A to B. Sooner or later, traditional car manufacturers and EV-centric new comers (like BYD and many other out of China) are going to figure out many versions of EVs that has good enough mileage and various functions and features that cater different demographic. And Tesla’s well-designed models are but a limited choices of cars among the sea of EVs. It is NOT like the Apple’s iPhone vs. the rest of the phone world kind of situation. iPhone has a true first-mover advantage, which lies in their proprietory OS and well-gardended and highly “addictive” ecosystem, and they have not stopped (although to me they are also slowing down) leading the smartphone innovations. What is really critical to Apple’s success is, a phone is a device that gets all your attention. A car, on the other hand, is first and foremore a piece of “tool” that moves people. It is against the core function of this tool to have too much smart, IT features as that will at some point serve as “distraction”, sometimes even fatal distraction, of the main function. I personally value my safety much much higher than some fancy feastures offered by the Tesla. I even dislike its big touch screen because there are reduced mechanical controls and too much touch-only funtions that take my eyes off the road too much to be good on safety.

In any case, Tesla will become less and less of the only game in town, and people tend to value more choices, difference choices, due to the differetn asthetic tastes and function preferences from people. Tesla may continue to be a very profitable car company, but at current P/E ratio, it means buying its stock at current price will take 120 years to get back your money’s worth. It just really does not make much sense from an investment point of view and sooner or later investors are going to realize that. Must may be the president-elect’s darling right now but even if he is the president himself, it is only going to be 4 years right? 120 years are a lot longer than that!

A very well written piece. Thanks I enjoyed it immensely. Canadian immigration policy has taken what seems to be a 180 degree turn & future demand has to be affected for residential real estate. It will be very interesting for me to watch over the next couple years

Excellent article. Thank you for a balanced picture.