Investing in Commodities in Canada 2024

If you have been like many investors and sticking with an easy, passive all-in-one ETF, but looking to try out something a bit more active, investing in commodities in Canada could be just the thing to scratch that itch.

Commodities are consumer products such as energy, metals and agriculture tend to fare particularly well in times of high inflation. As inflation rates continue to rise worldwide, we can expect commodities to continue to surpass stock returns. So, now is the perfect time to consider adding commodities to your portfolio.

In this article, you will find out how investing in commodities compares to another popular investment strategy-dividend investing. In addition, you’ll learn more about what commodities are, whether or not they are safe investments, as well as our top picks for commodities ETFs.

At the end of the day, the more diversification you have in your portfolio, the more possibilities there are to reap the rewards. Both Canadian commodities as well as dividend stock investing are excellent options in this regard.

We have a full rundown of the Best Canadian Dividend Stocks, as well as the Canadian Dividend Kings that are excellent resources for those looking to learn more. Right now you can also get a special discount offer on the very best Canadian dividend resource, Dividend Stocks Rock (DSR):

| Dividend Investing | Commodities Investing | |

| Risk Level Over the Short Term | Moderate | Very High |

| Risk Level Over the Long Term | Low | Very High |

| Key Metrics | Dividend Yield, Earnings Per Share, Dividend Payout Ratio, Dividend Increases, Length of Dividend Streak | Supply and demand outlook, moving averages, momentum tracking, buy & sell signals, Consumer Price Index, US Dollar |

| How You Make Money | Companies make profits, and the Board decides to pay shareholders in the form of dividends and/or the stock market decides your shares are worth more and consequently the shares that you own go up in price. | The value of the commodity goes up or down depending on the supply and demand of the entire market at that given moment in time. Ideally, you “buy low and sell high” – but this often happens much quicker than it does with stocks/shares of a company. |

| Tax Treatment | Canadian dividends (with some capital gains as well) are tax efficient in Canada – especially in retirement portfolios. | Quick capital gains generated by commodities (no dividends disbursed here) will be taxed at 50% of your marginal tax rate (likely to go up to 75% soon) if invested outside of your RRSP or TFSA. |

| Return Potential | Solid market-matching returns over the long-term (possible outperformance of the overall index, especially in low-tech Canada) | High – especially if you are actively trading daily. |

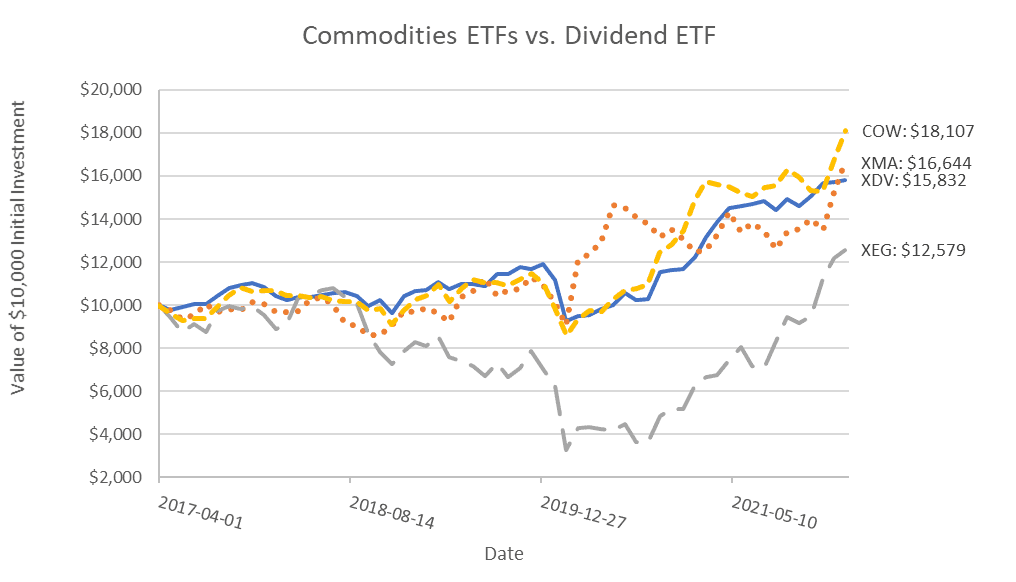

The following chart compares the hypothetical five-year growth of a $10,000 initial investment into XDV (one of our recommended Canadian dividend ETFs) with the same investment into three commodities ETFs: XMA, XEG, and COW (yes – COW – is a real thing).

These commodities ETFs will be covered in more detail later in the article. For now, just know that XMA represents the metal resources sector, XEG represents the energy resources sector, and COW represents the agricultural sector.

Over five years, an initial $10,000 investment into the dividend ETF XDV turns into $13,909, assuming all dividend distributions are reinvested.

Over the same time period, also assuming distributions are reinvested, the same initial investment goes on quite different rides through the commodities ETFs.

An investment into the metals sector would see a little less but similar return as investment into the dividend ETF. Agriculture has done well over the last five years and an investment into COW would have beat the performance of the dividend ETF by a decent margin. But the energy sector has not fared so well and an investment into XEG would have performed terribly compared to the dividend ETF benchmark.

We would have lost money on our investment into the energy sector.

Of course, the results could be quite different if we looked at different time periods and compared different sectors but I hope this chart shows how different commodities investing can be from dividend investing.

A commodities investor should expect more volatility, less certainty, and more speculation compared to the stable portfolio of a dividend investor.

But both investors can easily execute their respective strategies using our favourite online brokerage Qtrade, or with Questrade and Wealthsimple.

What are Commodities?

Oil, natural gas, minerals, corn, wheat, and even cows are examples of commodities.

The simplest definition of a commodity is that it is a uniform resource.

Commodities are the base materials that make modern life possible. Commodities fuel our vehicles, heat our homes, feed our families, and provide the raw materials to produce everything around us.

Imagine a lemonade stand business, the lemons, sugar, and water are the commodities that sustain the lemonade stand business. Sure, customers are important but without the underlying commodities, the lemonade stand could not operate.

A key characteristic of a commodity is that a unit of a commodity is interchangeable with another unit of the same commodity class.

When you fill up your car at the gas station, do you care where each litre of the gasoline came from? By the time that gasoline reaches your car, it is already an aggregate of gasoline from multiple sources.

Generally, the source of a commodity doesn’t matter. As long as units of a commodity meet sufficient quality threshold, all those units can be aggregated together.

There are generally four broad categories:

- Metals: which include gold, silver, and copper.

- Energy: which include oil, natural gas, and heating oil

- Livestock: which includes live cattle, lean hogs, and chickens.

- Agricultural: which include barley, rice, and soybeans.

Should Canadians Invest In Commodities?

Commodity prices generally tend to keep up with inflation.

If anything, rising prices of goods can be caused by rising prices of their underlying resources. So changing prices of commodities themselves can drive inflation. In that sense, investing in commodities can be an inflation hedge.

Commodities can be good investment vehicles for diversification. The biggest stock market indices (onto which many index linked ETFs are based) are increasingly concentrated in the tech and finance sectors.

For example, at the time of this writing, the top five stocks in the S&P 500 are Apple, Microsoft, Amazon, Alphabet (Google), and Tesla.

Here in Canada, the TSX 60 has historically been dominated by the big five banks, and occasionally a tech darling like Shopify (which held a spot near the top of the index until recently). It can be prudent to diversify your investments into real, physical resources to balance the heavy allocation in tech and financials.

Commodities typically do well in a growing economy. If people are buying more things (in our consumption based economy), then more resources are needed to make those things. With consumer demand roaring back post pandemic, it could be a good time to invest in commodities. But do keep in mind that the current prices should already have some of that expectation incorporated.

How Have Major Commodities Stocks Performed Over the Last 5 Years?

Commodities might be profitable investments, but it would be a stretch to call investing in commodities “safe”.

Commodity prices can be extremely volatile.

As an example, take a look at the five year crude oil price history in the graph below, the per barrel price hovered around $40-$50 in 2017, then climbed to over $70 in 2018, dropped back down to $40, then fluctuated between $50-$60 through 2019 before collapsing in early 2020.

For a brief time period at the onset of the North American COVID-19 pandemic lockdowns, oil prices actually entered negative territory. That is, oil owners could not sell their oil, they were PAYING to have their oil taken away. Since then, the price of oil has recovered and is climbing towards $80/barrel.

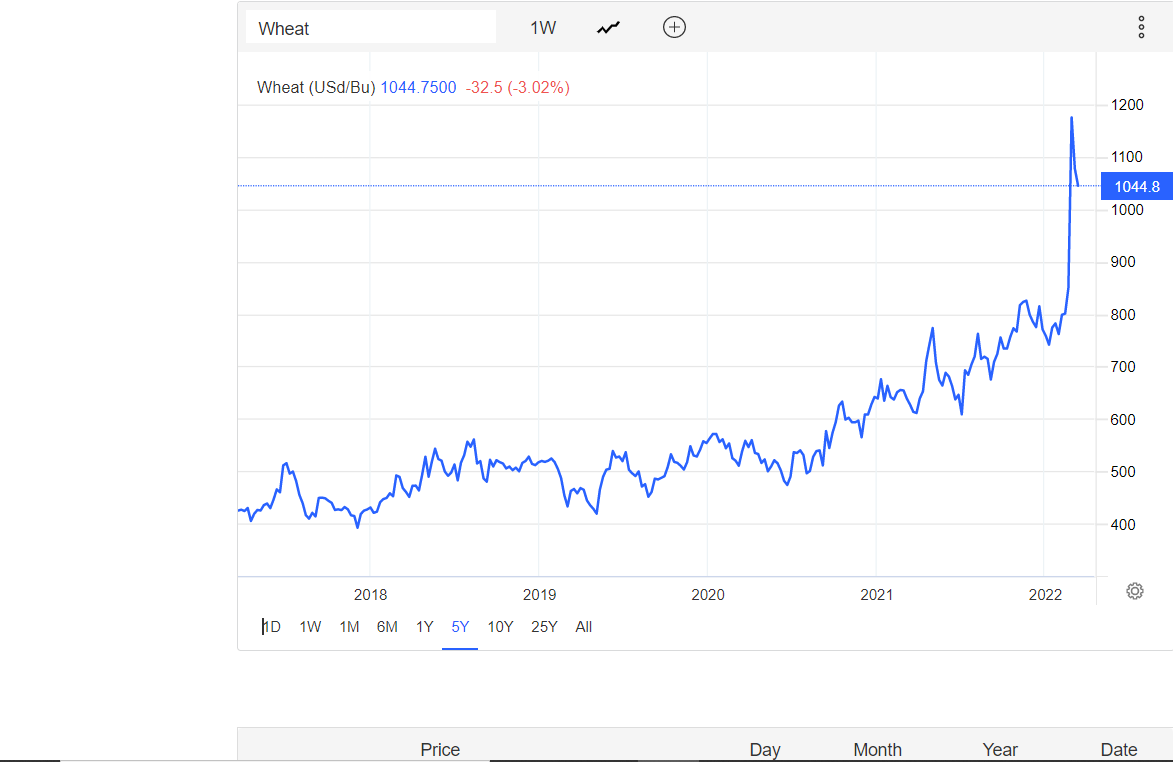

The collapse of oil prices at the beginning of 2020 may be an anomaly but there are other examples of volatile commodity prices. Here is the five-year price history of wheat:

And here is the five-year price history of steel:

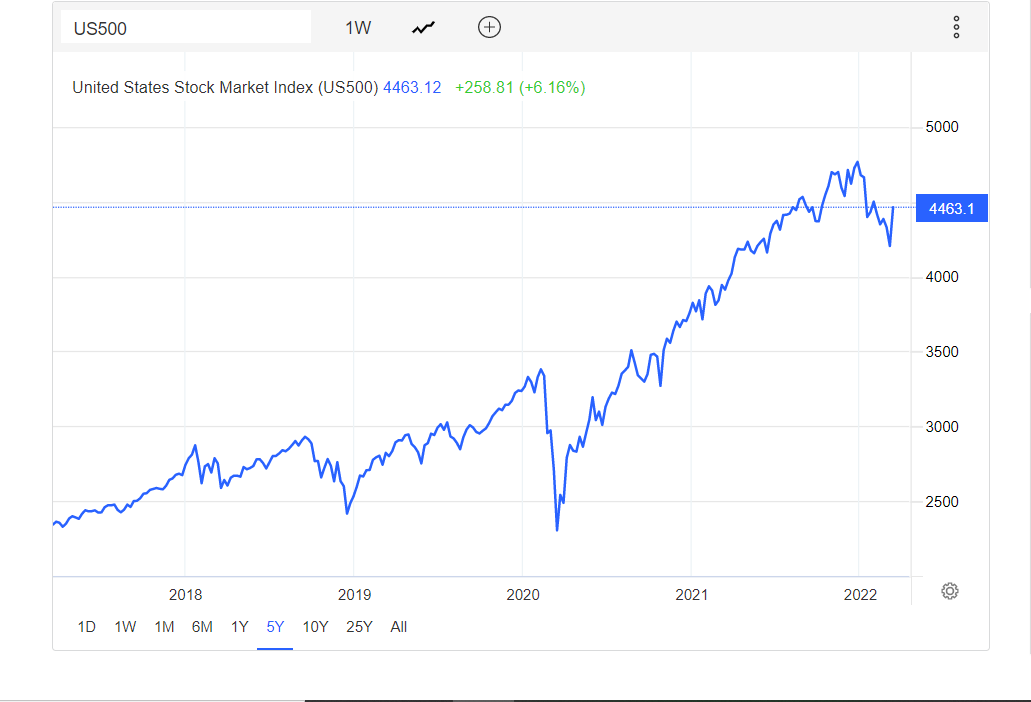

For comparison, here is the price history of the S&P 500 index over the same five-year period.

Are Commodities More Volatile Than Other Investments?

The S&P 500 has its ups and downs too, but the fluctuations are in general milder than the fluctuations in the commodity prices. Prices of many commodities tend to be more volatile than a broader market index like the S&P 500.

Volatility is not necessarily a bad thing (see our guide on trading the volatility index for some examples on that).

It can present opportunities to buy up investments on the cheap. It just requires discipline and a steady resolve from the investor. Some may not have the stomach to hold volatile investments, nor the patience to wait for opportunities through volatility.

What Determines the Price of Commodity Stocks?

Fundamentally, commodity prices are determined by supply and demand – a basic Economics 101 principle.

In practice, there are countless factors that affect the supply and demand sides. Accurately predicting commodities’ price movements requires intimate understanding of intricate, dynamic, and globally interconnected supply chains.

Aside: The plot of the film Trading Places involved trading concentrated orange juice, a commodity. The film’s main characters discover a rival investment firm has secret, advanced access to the oranges crop report. They swap the report with a forged copy that reports a big harvest when, in fact, the actual report calls for a poor harvest season.

The rival firm, expecting a big harvest based on the forged report, corners the market by buying up huge amounts of orange juice futures contracts.

The main characters, holding the real crop report and knowing the harvest is actually very poor, shorts the same orange juice contracts. When the poor harvest is reported to the public on the news, the price of the futures contracts collapse, the rival investment firm is bankrupt, and the main characters become immensely wealthy.

Okay, this is a Hollywood fiction but the financial mechanisms depicted are real. This story illustrates that commodity prices are affected by countless factors, some of those factors may even be financial shenanigans not fathomable to the typical investor.

Commodities themselves don’t produce cash flow during ownership like profitable businesses or even bonds. Profits come only from price arbitrage: your ability to buy low and sell high.

Warren Buffett likens it to “buying a lump of something and hoping someone else pays you more for that lump two years from now.” To successfully and consistently be profitable is difficult.

Are Commodities a Safe Investment?

Value of commodities are typically tied to their utility (manufacturing, consumption, etc.) but some have other uses. For example, gold and silver and other precious metals are used as a store of asset value by some governments and individuals.

Some commodities prices are also subject to political whims. I think it’s well known that oil prices are tied to geopolitics. Other examples include President Trump’s 2018 imposition of steel and aluminum tariffs and their effects on steel and aluminum prices. Again, countless factors influencing commodity prices.

Weather, politics, consumer preferences, and black swan events like a global pandemic are all impossible to predict accurately. Therefore, prices of commodities are impossible to predict accurately. The complex and unpredictable supply and demand dynamics makes commodities risky, speculative investments.

So are commodities a safe investment?

Likely not. If that’s what you are after, read our guide for the best low risk investments in Canada for 2024 instead.

But, high risk can bring high reward. So read on to learn some ways you can invest in commodities.

Commodities Investing for Beginners – Investing in Commodity ETFs

Technically, the most direct way to invest in commodities is to buy the actual raw materials oneself and sell them to businesses that use the materials. That’s what a broker does.

Realistically, most people would not be interested in being a broker. So trading commodities futures contracts is really the most direct way to invest in commodities, but it’s not a beginner friendly approach.

Futures trading is typically reserved for highly experienced investors with access to a brokerage account that is authorized to trade futures contracts.

Futures trading also requires high leverage, which magnifies profits and losses. Margin calls can require large sums of cash deposits at short notice. Beginners should stay away from directly trading futures contracts.

So how to invest in commodities in Canada? Well, the easiest approach is to buy commodities ETFs. iShares, Vanguard, and Horizon all have broad commodity ETFs for Canada:

- iShares S&P/TSX Global Base Metals Index ETF (XBM)

- iShares S&P/TSX Capped Materials Index ETF (XMA)

- iShares S&P/TSX Capped Energy Index ETF (XEG)

- iShares Global Agriculture Index ETF (with the cheeky ticker symbol: COW)

- Vanguard Materials ETF (VAW)

- Vanguard Energy ETF (VDE)

- Horizons Gold ETF (HUG)

- Horizons Silver ETF (HUZ)

- Horizons Crude Oil ETF (HUC)

- Horizons Natural Gas ETF (HUN)

The iShares and Vanguard ETFs aim to track indices made up of stocks in the respective sectors. With these ETFs, you’re just investing in resource companies and not directly in the resources themselves. Of course, the fortunes of resource companies should be tightly linked with the prices of resources but just know there is an additional layer of separation between you and the physical resources with the iShares and Vanguard ETFs.

On the other hand, the Horizons ETFs each focus on an individual commodity and seek to track the performance of a futures index of the respective commodity. These Horizons ETFs get you closer to investing in actual commodities futures contracts compared to the iShares and Vanguard ETFs.

What’s the best commodity ETF on the TSX depends on your preference. Pick the sector that you’re interested in first, then decide if you’d be satisfied investing in just the stocks of resource companies or would you prefer to invest directly (as much as possible) in commodities futures contracts.

These listed ETFs can be easily bought and sold using online brokerages like Qtrade, Questrade, or Wealthsimple Trade.

Three Commodity ETFs From The New York Stock Exchange and Nasdaq

If you want more worldwide exposure to commodities, you can find slightly lower MERs on the American stock exchanges, but keep in mind that unless you’re investing inside an RRSP there could be US-based tax implications here.

Invesco DB Commodity Index Tracking Fund (DBC): Is an energy-heavy ETF, but has a selection of many commodities from around the world. It’s up nearly 35% since the start of the year. While it’s down at the moment, it has grown consistently since 2019.

First Trust Global Tactical Commodity Strategy Fund (FTGC): You’re paying for an actively managed ETF here, where they use options contracts to lock in gains for specific commodities that managers feel are trending in the right direction. Currently full of metals like gold, copper, silver, and aluminum.

iPath Bloomberg Commodity Index Total Return ETN (DJP): Technically DJR is an Exchange Traded Note (ETN) but it’s essentially the same investments as an ETF for practical purposes. You’ll get instant exposure to 24 different commodities, selected on the principles of: economic significance, diversification, continuity, and liquidity. It’s currently 42% agriculture and livestock, 22% Energy, 18% precious metals, and 17% industrial metals.

Buying Commodity Stocks Outside or Inside Canada

A slightly more advanced approach to commodities investing is to buy individual stocks in resource companies.

If you are not satisfied with the asset allocation of the broad commodities ETFs listed above, you can tweak your own allocation by buying individual stocks in companies like Vale, BHP Group, or Rio Tinto.

Vale is one of the world’s largest nickel mining companies. Vale is also a major producer of copper, gold, silver, other metals, and coal. Buying this one stock would expose you to the metals and energy commodity sectors.

Aside: recently, Vale made Ontario headlines when the main cage (worker elevator) in its Sudbury mine broke down. Thirty-nine workers were trapped underground for a few days. The trapped workers had to manually climb over 1,000m to get out through escape shafts. That’s about the height of two CN Towers! All workers eventually made it out safely. I’m sure you can imagine how these kinds of news can affect the stock price of a company like Vale.

BHP Group is a large global resources company that produces copper, uranium, oil, natural gas, coal, and other precious metals. Buying BHP stock would expose you to the metals and energy commodity sectors. Rio Tinto is a similarly large resource mining company that produces iron ore, copper, diamonds, gold, and uranium. That’s another option for exposure to the metals sector.

On the Canadian front, Nutrien is the largest producer of potash in the world. It’s also the third largest producer of nitrogen fertilizer in the world. It is the result of a recent merger between Agrium and PotashCorp in 2018. Nutrien produces key resources for agriculture, therefore, ownership of its stock would expose you to the agricultural commodities sector.

Buy and sell commodities stocks online through brokerage accounts already mentioned or through their apps. Check out our review of Best Trading Apps in Canada.

Advanced Commodities Investing For Canadians

As mentioned earlier, futures contracts are realistically the most direct way to invest in commodities. I won’t go into more details here because it’s beyond the scope of this article for beginners and, frankly, beyond my knowledge and experience. Futures contracts and derivatives trading should really be left to the professionals.

The average investor can get exposure to the commodities market through broad index ETFs and resource company stocks covered above.

Bonus: Buying Precious Metals in Canada

As mentioned earlier, some commodities have uses beyond their utility in producing goods.

Gold, silver, and other precious metals are used by many as stores of value.

Some consider precious metals a safe hedge against inflation. Due to their popularity with individual investors, gold and silver are a bit more accessible compared to the rest of the commodities world.

Holding physical gold or silver can be one way for average investors to participate in the metals market. Just watch out for high fees and price markups. You also have to consider safe storage of those physical assets.

Resale can be tricky too. Banks will buy back the gold they sold you but you will have to present the original receipt and verify that the product is in perfect condition.

Each bullion dealer will also have their own requirements for buying back your gold. And I’m sure all dealers and banks will have a big spread between their selling price and buying price. Along with their fees, the dealer price spreads put further drag on your potential profits.

Investing in Commodities – FAQ

Should You Invest in Commodities?

Now could be the right time to allocate a percentage of your portfolio to commodities investments. The economic landscape is still looking volatile for the year ahead and commodities can help provide a bit of protection in uncertain times.

In the past, futures contracts were the most widely used way to invest in commodities, but that won’t be the best option for the average investor.

Now that a number of commodities index ETFs are available, the average investor can easily purchase a wide range of commodities stocks, no expertise in futures trading necessary. All you need is an account with one of the Canadian online brokers, and you can start purchasing commodities ETFs today.

The main thing to remember is that while commodities can be a good hedge against inflation now, they are more volatile than other stocks out there. So, if you plan to take the leap into commodities trading, just be sure you’re ready to ride out the storm.

If you’re keen on learning more about commodities related information, check out our article on Canada’s Best Energy Dividend Stocks and the best mining stocks in Canada.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?