Interactive Brokers Canada Review 2026

Interactive Brokers Review

-

Simplicity for Average Canadian Investor

-

Account Variety

-

ETF Trading

-

Monthly Fees

-

High Volume Traders

-

App Rating

-

Customer Service

Interactive Brokers Review Summary:

Interactive Brokers, also referred to as IBKR, has been serving Canadian investors since late 2000, offering a broad selection of investment options. Globally, it’s a trusted name, and it is especially popular among forex traders. However, many of the platform’s most attractive rates and features that make it popular outside of Canada are unfortunately not offered to Canadian clients.

If you’re not an active or forex trader, IBKR might not be the right fit. While it provides access to products like fractional shares, cryptocurrencies, and options, its dated and cumbersome platform can make the trading experience frustrating. When other brokers offer the same products with smoother, more user-friendly interfaces, it’s hard to justify sticking with a platform that feels behind the times.

Fortunately, there are excellent alternatives within Canada. Both Qtrade and Questrade outperform Interactive Brokers with simpler pricing, lower fees, superior customer service, and intuitive platforms.

So, if you’re searching for one of the best online brokers in Canada, IBKR likely won’t make your shortlist. To understand why, read on for our full Interactive Brokers review, where we break down its fees, features, and overall service in detail.

Pros

- Low foreign currency exchange fees

- Access to stock exchanges outside of Canada and USA

- Geared toward advanced international day traders

- The IBKR margin interest rate is consistently low

Cons

- Tax liability possibilities for Canada

- Poor Mobile App

- Complex trading platform

- Poor customer service reputation

What is Interactive Brokers?

Interactive Brokers Canada is part of the parent company Interactive Brokers Group, Inc., which has been around for nearly 50 years and boasts consolidated equity capital of $19.5 billion. Its mission has always been to develop technology to help traders maximize their potential. Interestingly, way back in 1983 they were one of the pioneers of using technology to give their traders an upper hand.

They introduced the first handheld computers used for trading. Since then, they have remained committed to integrating technology to provide mobile and desktop trading platforms for their clients, among other technology-driven services.

Comparing Interactive Brokers to Our #1 Discount Broker: Qtrade

| ||

|---|---|---|

| Canadian ETFs | Free to buy and sell | Two pricing structures: Fixed pricing for non-brokers, and high volume traders will be on a tiered pricing structure. |

| User Experience | Excellent - consistently ranked #1 in Canada. Built for Canadian users exclusively. | Mediocre at best. Aimed at professional international stock traders. Good value if you need day trading platforms. |

| Foreign Exchange Capability | None (other than CAD to USD) |

|

| Safety | CIPF Member | CIPF Member |

| RESP Accounts | Available | Not Available |

| Research Tools | Has been at the top of Canadian brokerage ranking in this category for over a decade. | Geared towards an international pro-day-trading audience. |

| promotion | $5,000 Cash Back + Unlimited Free Trades | NONE |

| Sign Up | Visit Qtrade | Visit Interactive Brokers |

Is Interactive Brokers Safe and Secure? It’s Complicated

Like other discount brokerages in the Great White North, Interactive Brokers Canada is regulated by the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF).

BUT – and this is a massive BUT – there is a very important question mark when it comes to using any US-based online brokerage as a Canadian resident. This question mark comes in the form of the interpretation of US Tax Law. It’s not that Interactive Brokers is in and of itself unsafe for Canadians to use from a tax standpoint, it’s that the USA has some unique tax rules when it comes to inheritance tax.

It gets complicated in a hurry, but the basic idea is that the US taxes “US In Situs Assets” at the time a person passes away. The estate of any Canadian resident who owns over $60,000 worth of assets at the time of their death must file a tax return in the USA. IB is obviously located in the USA, so the question quickly becomes – do investments in my Interactive Brokers account fall under US inheritance tax law, are they considered “US In Situs Assets”?

The answer is… *drumroll*… no one really knows.

It appears to boil down to whether your investments are considered “domiciled” in the USA. That phrase is being debated by people smarter than myself each year in the USA. I know that my go-to resource for international personal finance is author Andrew Hallam, and he does not use IB for this exact reason.

Now if you’re a USA resident, or a USA Citizen, then you’re going to have to deal with US estate taxes anyway – so this drawback to going with IB is not really relevant. If you live in Canada however, I just don’t think saving a couple of bucks on non-ETF transactions is worth it.

So while your investments are likely as safe as possible from hackers or fraud, it’s perhaps the US taxman that you have to be most careful of.

Can I Buy Canadian Stocks and ETFs on Interactive Brokers?

Yes – you can definitely buy Canadian stocks on Interactive Brokers (IBKR).

You can also buy ETFs, mutual funds, options, and several other Canadian investments using the brokerage.

As of a few years ago, Canadians can also take advantage of the fractional share and ETF purchasing that has been available to US clients for quite some time. This definitely makes trading more accessible for some clients, and is a positive move by the brokerage.

In fact, if you’re looking to purchase stocks from around the world (and not just use a straight forward ETF to get international stock exposure), then International Brokers allows you to buy on 160 markets, in 36 countries, in 28 currencies.

Personally, I’ll stick to the Toronto Stock Exchange and international ETFs, but professional day traders rave about the flexibility that it offers. If you’re looking for more information on ETFs in Canada, you’ll appreciate our Best All-in-One ETFS in Canada 2026 Article.

Interactive Brokers Review: Fees in Canada

International Brokers operates brokers in over a hundred countries, so their fee structure is difficult for many Canadian investors to understand. It’s not nearly as straightforward as those from purely Canadian brokers.

When it comes to figuring out which Interactive Brokers Canada fees you’ll pay, you first need to understand that there are fairly different pricing mechanisms depending on what type of assets you’re buying or selling.

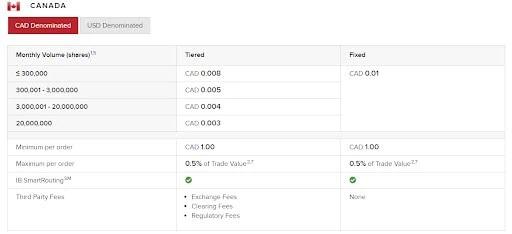

For stocks and ETFs there is a tiered rate (see below) or a fixed rate.

The fixed rate is a penny per share for Canadian stocks – with a $1 minimum. If you buy 1,000 shares, you’d pay ten bucks. If you buy 20 shares, that’ll cost you a loonie.

The tiered pricing model is really for professional traders making hundreds of trades or making really large trades.

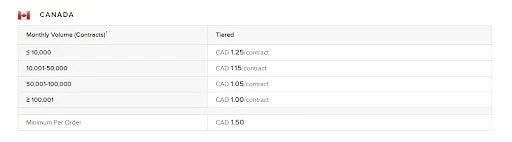

Now if you’re buying and selling options with IBKR Canada, you’ll want to know about the following tiers:

Interactive Brokers Review: Platform and Tools

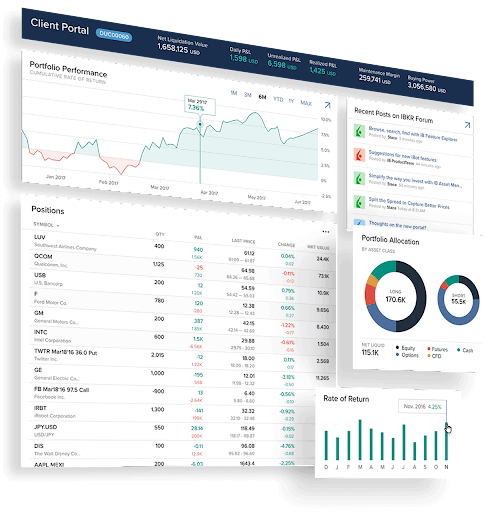

Like most online brokerage platforms, the web-based version of IBKR offers users a main client portal page. They have recently made some upgrades to their Client Portal homepage, which offers key account metrics at a glance, portfolio performance, tools and services, and access to quick trade functions.

If you want a bit more, they’ve got it. Detailed quotes, advanced charting, and access to investment news are also available on the Client Portal. Want to see more, but not ready to take the leap? You can try the free trial of the Portal if you’re not quite ready to commit.

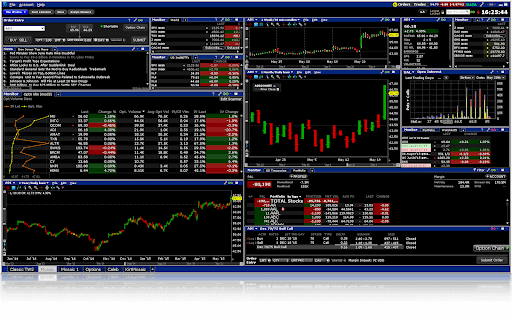

As all traders in Canada will be using the regular version of IBKR, they will be using their platform called Trader WorkStation (TWS). While this platform might be great for more experienced traders who trade in high volumes, it might not be so great for the average investor.

Within the Trader WorkStation, there are two workspace options: TWS Mosaic and Classic.

TWS Mosaic is more of an all-in-one, comprehensive work space, making it easy to trade, get quotes, and use technical research tools in one spot. Users can also create and interact with watchlists and charts here.

TWS Classic offers users a quick way to place orders, and has a bit more to offer in terms of tools and algos.

Interactive Brokers Account Types: TFSA, RRSP, Non-Registered

Interactive Brokers Canada offers most account types, but the glaring omission of RESPs and RRIF options really hurts them in cross Canadian comparisons. Here is a list of the accounts they do offer:

- Non-registered accounts (both CAD and USD)

- Joint Accounts

- Margin Accounts

- RRSP

- TFSA

- FHSA

- Informal Trust

- Formal Trust

IBKR Mobile App Review

The Good: The Interactive Brokers mobile app probably has more features than any other broker app out there. You can exchange forex, futures, and much more.

The Bad: The complaint about this broker has always been… the number of complaints. In fairness, they are trying to troubleshoot and answer questions from investors all over the world, so it isn’t exactly an apples-to-apples comparison with a Canada-only brokerage.

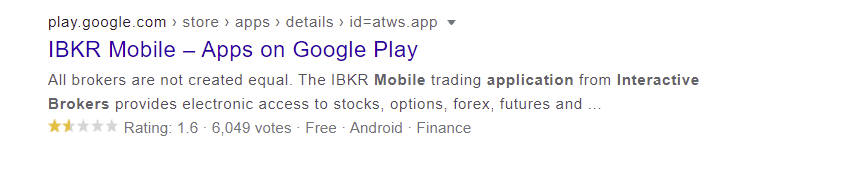

The Ugly: It is needlessly complex and the user experience continues to be a bit lacking. However, it seems as though they have been working hard to rectify the issues. Since our update, they have gone from a 1.6 on the Google Play store to a 4.5. The reviews still mention lots of bugs that need to be worked out before it can earn a better rating.

Frequently Asked Questions

Interactive Brokers Cryptocurrency Trading

Tired of letting Robinhood and Wealthsimple have all the fun, in September of 2021, Interactive Brokers began allowing their clients to trade cryptocurrencies.

The brokerage is teaming up with the Paxos Trust Company (PayPal’s US crypto arm) to offer these new options (at typically low commissions compared to rivals).

Currently this feature is only available to US residents, but as stated in a past press release they intend to make the crypto venture available to international audiences in the future.

IBKR Margin Interest Rate and Currency Conversion

One of the ways in which IBKR really tries to differentiate itself from other brokerages when it comes to attracting day traders and professionals, is by offering very low margin rates.

For folks that aren’t sure what margin rates are – don’t worry, you probably don’t need to know!

“Trading on the margin” is when you borrow money from a brokerage (it acts sort of like a bank in this instance) and then you use that borrowed money to purchase investments. IBKR can decide to recall the loan at any time (often referred to as a “margin call”). Clearly this is a risky proposition for the average investor.

If you’re into leveraging up using borrowed money however, then it’s probably important to note that International Brokers Canada is consistently amongst the lowest margin rates in Canada, with a 0.5-1.5% margin in addition to their benchmark rate.

Similarly, the vast majority of Canadian investors will never need to use currency conversion through their brokerage account. That said, if you’re planning to invest in a wide variety of stock exchanges around the world, then the IBKR currency conversion advantage could be a deal breaker.

Who Is Interactive Brokers Best For?

It’s true that Interactive Brokers has made meaningful strides over the years with improvements such as upgrading its platform and introducing features like fractional share purchasing. Still, these improvements aren’t quite enough to keep pace with other Canadian brokerages, especially for the average self-directed investor.

For professional day traders, options traders, or forex enthusiasts, IBKR does stand out with its advanced tools and competitive pricing. However, for most Canadians, there’s a major drawback: the tax complications. The last thing you want is trouble with Uncle Sam, which is the main reason why we personally steer clear of IBKR, and you may want to do the same.

Even setting taxes aside, the fact remains that there are simply better options available. That’s why Interactive Brokers doesn’t make our list of the Best Canadian Discount Brokerages.

Take Qtrade, for instance. It offers outstanding customer service and a full range of account types, including RESPs, all with low, transparent fees. Check out our full Qtrade review to see why it earns our top spot as the #1 brokerage in Canada.

correction: IBKR will not do in-kind transfers from one account type to another. The bank will.

One of the very few drawbacks to IBKR is that they will not do in-kind transfers between accounts.

So if you decide for example that you want to transfer your shares from a margin or cash account, to a TFSA, on the expectation that paying a small amount of capital gains tax now beats potentially paying a lot more later, then you’re out of luck — IBKR won’t do it.

I ended up having to do an ATON transfer of my TFSA from IBKR to one of the bank brokers which do in-kind transfers.

“It appears to boil down to if your investments are considered “domiciled” in the USA. That phrase is being debated by people smarter than myself each year in the USA. I know that my go-to resource for international personal finance is author Andrew Hallam, and he does not use IB for this exact reason.

“Now if you’re a USA resident, or a USA Citizen, then you’re going to have to deal with US estate taxes anyway – so this drawback to going with IB is not really relevant. If you live in Canada however…”

Interesting comment.

What if you transfer your account over from IB to BMO. RBC or whatever a few days before you die?

Does that get around the tax problem?

As far as I understand it, this would work Jason. I know I’ve actually talked to some people who have shown their signficant others how to transfer assets to another broker as quickly as possible – with the intent that this will happen before they inform any broker or financial institution that a person has passed away. I suppose if you had already opened accounts in Canada, it could be done in one phone call? Not 100% sure, not having done it myself!

Serious system error

I am day trader.

I have Apple stocks for a while, and the average price is about 162 dollars before January 19. On January 19, I bought in 5 Apple stocks on the price 170 dollars. On January 20, the average price of my Apple stocks was changed to about 172 dollars. And I didn’t buy in any Apple stocks afterwards. How is this possible? This issue is very serious. What happened to the average price of my Apple stocks?

I have called your Chinese Services in Canada to report this issue, and looking for resolutions. They didn’t give me any reasonable answers, just hanging up my phone. Then I tried to call them again. But your Chinese Service was suspended. This is very frustrating experience for the services.

Interactive Brokers has eliminated its activity fees, i.e. the monthly fees, in July 2021

I trade options in both IBKR and Questrade. Questrade typically costs 3 times more expensive than IBKR in commissions. I also trade futures and IBKR is the cheapest in town, hands down. IBKR also excels in executions speed and performance. Education, charts, tools etc. are first class with IBKR. The only drawbacks could be their steep learning curve and the not insignificant capital requirement.

The only reason I am keeping Questrade is for diversification, i.e. not all eggs in one single basket. I also keep my long equity positions in Questrade as their stock commissions are quite competitive.

Jordan, in reading your article I’m astounded by the possibility that holdings within a RRSP held with Interactive Brokers Canada may in fact be taxed by the us IRS in the event of death of the account holder. This seems incomprehensible to me and to be honest I have trouble believing how it could possibly be true. Otherwise absolutely no Canadian would have an RRSP (or any other account) through IB Canada. IB Canada presumably has many thousands of account holders and I’m sure many of them have died over the years. So surely there would be some record (or online complaints by others) highlighting this significant issue. Can you clarify?

Charlie – simply Google US domiciled investments in the event of death. No official case precedent that I’ve been made aware of – and trust me, I’ve asked.

Hello Kyle, a quick google search of that sentence let me read some minutes and to me it sounds like the Canadian US estate tax treaty majorly increases that threshold up from $60k to 11,2 million worldwide assets (simplified) and doubled again when left to a surviving spouse. On top of this treaty that is set to expire 2025 RSP’s are recognized tax exempt vehicles in the USA. But thank you for the warning that over $60k a form 706-NA needs to be filled for US owned stocks to be tax exempt.

This however would be the case if you own it at a Canadian broker too, a good point in favor of owning Canadian based EFT’s instead of US stocks directly!

Hi Serge,

It has yet to be definitively stated anywhere that I’m aware of that “domiciled” refers to only where the ETFs are listed, and not the company you are using to broker the purhcasing and holding of the assets. Hopefully it’s just where the ETF is based, but I personally know several millionaires who refuse to hold their assets in IB because of this hazy legal quandry.