Financial Freedom Update (Q2) 2020 – V-Shape Recovery Edition ($60,550 in Dividend Income)!

Welcome to the Million Dollar Journey 2020 (Q2) Financial Freedom Update – the V-Shape Recovery Edition! If you would like to follow my latest financial journey, you can get my updates sent directly to your email, via Twitter or Facebook, and/or you can sign up for the monthly Million Dollar Journey Newsletter.

For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I have shifted my focus to achieving financial independence. How? I plan on building my passive income sources to the point where they are enough to cover our family expenses. That is, our goal is to reach $60,000 in passive income by the end of 2020 (achieved this quarter!)

Here is a little more detail on how we came about the goal of $60k per year in passive income:

Financial Goals

Our current annual recurring expenses are in the $52-$54k range, but that’s without vacation costs. However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury). If money ever becomes tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income to be have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year in passive income by end of year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full time salaries (we are currently an one income family). At that point, I would have the choice to leave full time work and allow me to focus my efforts on other interests, hobbies, and entrepreneurial pursuits.

The Previous Update

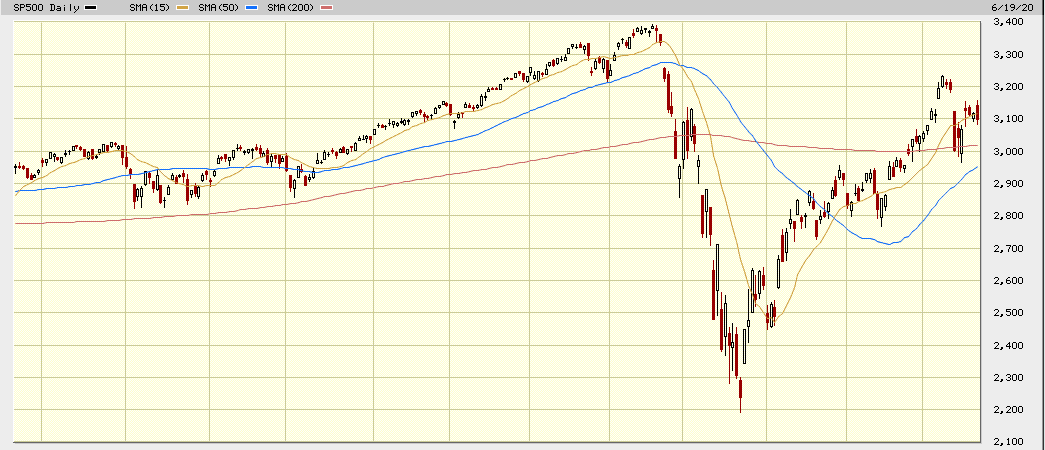

In the previous Q1 2020 update, I wrote about the novel Coronavirus (COVID19) impact and the ensuing market panic that resulted in the fastest 35% stock market correction in history. As a little bit of background, anything past a 20% correction is considered a bear market. I’ve read that an average bear market corrects between 30-35%, while the more severe bear markets (like the financial crisis) can reach 50%.

Volatility is normal for the stock market. This is one of the reasons why you may want to increase your bonds exposure as you approach retirement as it will reduce volatility and help reduce the impact of withdrawing during an inevitable market correction.

Keep your eye on the horizon and keep investing for the long term. Consider market corrections as an opportunity to add to your quality holdings at fire-sale prices. In the future, 20-30 years from now, the market will be higher and you’ll be thankful that you had the foresight that you were buying while everyone else is selling.

In light of the correction, we deployed quite a bit of capital in Q1 which resulted in a healthy bump in forward-looking dividend income.

Here is a summary of the last update:

Q1 2020 Dividend Income Update

| Account | Dividends/year | Yield |

| Smith Manoeuvre Portfolio | $7,900 | 3.96% |

| TFSA 1 | $4,200 | 4.72% |

| TFSA 2 | $4,000 | 4.75% |

| Non-Registered | $3,600 | 4.22% |

| Corporate Portfolio | $28,500 | 3.77% |

| RRSP 1 | $7,900 | 2.59% |

| RRSP 2 | $3,400 | 2.44% |

- Total Portfolio Value: $1,263,610

- Total Yield: 4.71%

- Total Dividends: $59,500/year (+7.8%)

Current Update

Oh, how times have changed (again) since the last update! From stock market all-time highs (first half of Q1 2020) to the fastest 35% correction in history (second half of Q1), and now almost back to all-time highs again (S&P500)!

Some may question this recovery as too fast too soon, and they may be right. The stock market is known to be forward-looking, but the most recent recovery was propped by the infinite liquidity by the US. What happens next, in the short term, remains to be seen. However, the market has proven time and time again that over the long term, it will continue to chug along in an upward direction.

While I deployed a lot of capital in Q1, this most recent quarter resulted in less investment on my part. Partly because of less capital available to invest, but also the quick recovery caused me to pause a little.

As I’ve mentioned in many other updates, I like to buy quality dividend companies (and indexes) when their valuations are attractive. In other words, when they are being sold off (ie. dip). You can see some of my favourite Canadian dividend stocks here.

Thus far in this past quarter, I deployed capital into the following positions:

- iShares MSCI All Country World ex-Canada (XAW)

- Brookfield Infrastructure (BIP.UN/BIPC)

- CIBC (CM)

- Manulife (MFC)

The goal of the dividend growth strategy is to pick strong companies with a long track record of dividend increases. In terms of dividend increases, despite the fastest correction in history, this year has proven to be lucrative for dividend growth investors.

2020 Dividend Raises

So far in 2020, the Canadian portion of my portfolio received raises from:

- CU.TO (3% increase)

- MRU.TO (12.5% increase)

- CNR.TO (7% increase)

- XTC.TO (5% increase)

- BIP.UN (7% increase)

- BCE.TO (5% increase)

- SU.TO (10.7% increase)

- GWO.TO (6.1% increase)

- TRP.TO (8% increase)

- RY.TO (3% increase)

- MG (9.6% increase)

- TD.TO (6.8% increase)

- CM.TO (3% increase)

- PWF.TO (10% increase)

- MFC (12% increase)

- ENB.TO (9.8% increase)

- TRI.TO (5.5% increase)

- TD.TO (6.8% increase)

- CM.TO (3.0% increase)

- ENGH.TO (22% increase)

- CNQ.TO (13% increase)

- POW (10% increase)

- EMP.A (8% increase)

But what about dividend cuts? 2020 has been especially tough on dividend cuts. With an oil crash and many companies closed during this pandemic, struggling companies have made the decision to preserve capital by either suspending their dividend or cutting the dividend.

There have been a number of casualties so far in my portfolio namely positions in (mostly energy-related):

- High Arctic Energy (HWO)

- NFI Group (NFI)

- Inter Pipeline (IPL)

- CAE (CAE)

- Husky Energy (HSE)

- Suncor (SU)

- Ensign Energy (ESI)

- Mullen Group (MTL)

- Leon’s Furniture (LNF)

- Pason Systems (PSI)

For a more complete list of dividend cuts of 2020, you can see a full list here.

Top 10 Holdings

In our overall portfolio, here are the current top 10 largest holdings:

- iShares Core MSCI All Country World ex Canada Index ETF (XAW)

- Emera (EMA)

- TransCanada Corp (TRP)

- Fortis (FTS)

- Enbridge (ENB)

- TD Bank (TD)

- Canadian National Railway (CNR)

- Royal Bank (RY)

- Canadian Utilities (CU)

- Bell Canada (BCE)

Dividend Income Update

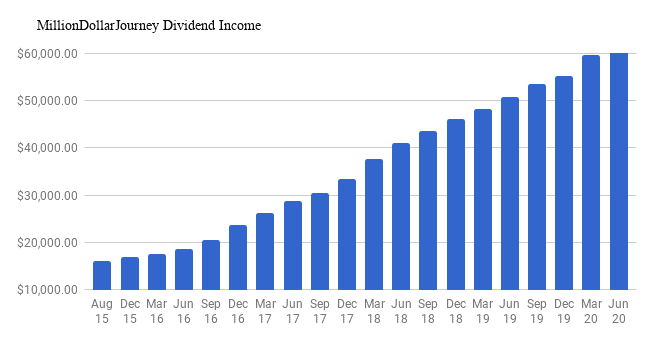

As you can see in detail below, over the last quarter we have increased our dividend income from $59.5k to $60.5k which represents a 1.7% increase quarter over quarter.

While it represents the smallest quarter/quarter increase since I’ve started reporting, it still represents reaching our long term goal of $60k in dividend income!

Hitting a major milestone feels great and for me, provides a greater sense of financial security and freedom. The best side effect of having a significant source of passive income is that it feels like I’m choosing to work which contrasts with my perspective of work earlier in my career.

As with achieving previous financial milestones, it’s a marker within a longer financial journey. It’s time to reflect, and set new financial goals – maybe in the next update!

Here are the numbers.

Q2 2020 Dividend Income Update

| Account | Dividends/year | Yield |

| Smith Manoeuvre Portfolio | $7,700 | 3.96% |

| TFSA 1 | $4,250 | 4.72% |

| TFSA 2 | $4,000 | 4.75% |

| Non-Registered | $3,700 | 4.22% |

| Corporate Portfolio | $29,500 | 3.77% |

| RRSP 1 | $8,000 | 2.59% |

| RRSP 2 | $3,400 | 2.44% |

- Total Portfolio Value: $1,513,160

- Total Yield: 4.00%

- Total Dividends: $60,550/year (+1.7%)

Final Thoughts

A combination of deploying less cash than normal and dividend cuts has resulted in the smallest dividend bump since I have started reporting. On the bright side, the dividend cuts were in relatively small positions, so while the cuts stung a little, they were not disastrous. Further into the bright side, we have finally hit our long term goal of $60k in dividend income!

If you are also interested in the dividend growth strategy, here is a post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

If you want a simpler investing strategy that outperforms most mutual funds out there, check out my post on the best all in one ETFs in Canada. As you can tell, I’m also a fan of indexing as the iShares XAW is my top individual holding.

Keep investing that cashflow and stick with a long-term plan. Your future wealthier self will thank you for it.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

What would your tax rate be if you just had the dividends as income on 60K?

You’d end up owing about $2,000 in Fed/Prov combined tax if you lived in Ontario Daryl (just as an exmaple).

Congratulations on hitting your goal of 60k dividend income but also on the huge increase to your portfolio’s value.

Well done. More impressive is the $300K bump in total value!

Your quarterly graph is interesting to see as it goes up linearly. I have to look at mine by quarter to see if it behaves the same.

The great thing is that it won’t stop at $60K. It will keep going up with the dividend growth.

Wow congratulations FT! Amazing news!

Wow congrats on reaching your goal early.

Now that you’ve reached the goal what’s next? A new goal or a lifestyle shift?

MDJ –

HELL YEAH. Nice job reaching the goal and I agree – my 2nd quarter investments have been significantly less than earlier, due to uncertainty in the market and earnings and difficulty in finding an undervalued dividend investment.

What’s next? $65k next year?

-Lanny

Congratulations FT!

Big accomplishment. Did you do anything special to celebrate? What is your next goal? Reduce your working hours?

Congratulations on reaching this milestone!