Financial Freedom Update May 2023 – First Update of the Year ($73.8k in Dividend Income!)

Welcome to the Million Dollar Journey May 2023 Financial Freedom Update – the first update of the year! If you would like to follow my whole financial journey, you can get my updates sent directly to your email, via Twitter and/or Facebook.

For those of you new here, since achieving $1M in net worth in June 2014 (age 35), I shifted my focus to achieving financial independence by building my passive income sources to the point where they are enough to cover our family expenses. Mostly through passive index and tax-efficient dividend investing.

Here is a little more detail on our passive income goals:

How it all Started – Original Financial Goal

I always find it interesting to look back at previous goals. Here was the big goal after hitting the Million Dollar Net Worth milestone:

Our current annual recurring expenses are in the $55k range (after-tax), but that’s without vacation costs (and no mortgage payments). However, while travel is important to us, it is something that we consider discretionary (and frankly, a luxury).

If money ever becomes tight, we could cut vacation for the year. In light of this, our ultimate goal for passive income is to have enough to cover recurring expenses, and for business (or other active) income to cover luxuries such as travel, savings for a new/used car, and simply extra cash flow.

Major Financial Goal: To generate $60,000/year (after-tax) in passive income by end of the year 2020 (age 41).

Reaching this goal would mean that my family (2 adults and 2 children) could live comfortably without relying on full-time salaries (most recently a one-income family). At that point, I would have the choice to leave full-time work and allow me to focus my efforts on other interests, hobbies, and entrepreneurial pursuits.

Achieving Financial Freedom: You may be thinking, 2020 is long gone – what has happened since then? I’m happy to report that we reached financial independence in 2020 (a little ahead of schedule)! While the goal now is to continue building and reinvesting those dividends within the portfolio I’m finding that as the years go by, more focus is being put on indexing.

Having said that, I haven’t sold any dividend positions in favour of index ETFs… yet. In fact, since leaving full-time salaried work, those juicy dividends have been paying our bills! Find out below how much our passive income has grown over the years!

Financial Independence Update – May 2023 – First Update of the Year

All investors can agree that last year was a volatile year for the markets. The S&P500 started 2022 peaking at 4800 and ended the year at around 3800, a fairly dramatic 21% drop (not including dividends).

This year, on the other hand, looks to be shaping up better – at least so far! As of this week, the S&P500 is floating around the 4100 level which is a YTD gain of around 7.9% (not including dividends). Will this performance last throughout the year? Who knows, the markets still have the same headwinds: inflation (albeit growing less than last year); tightening of the money supply; and higher interest rates (appears to be flattening).

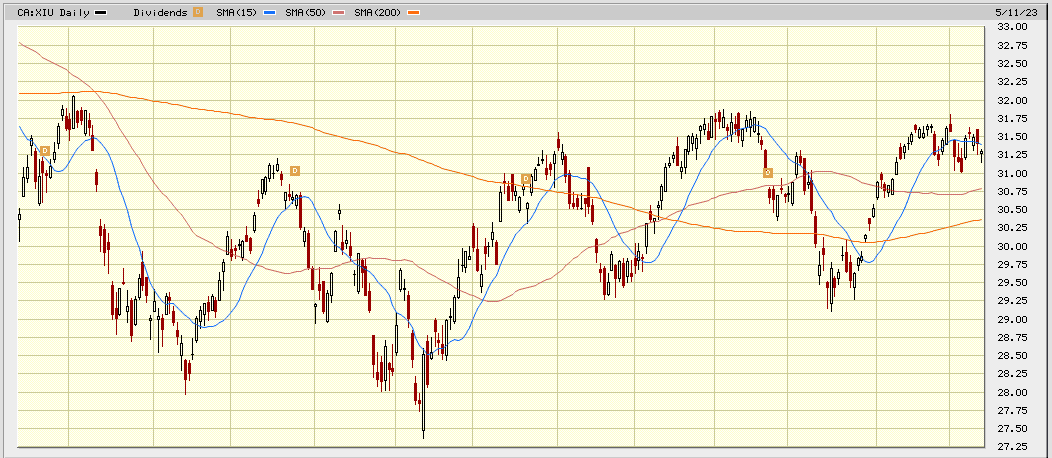

The TSX has also been fairly strong so far in 2023. While it has been a bit of a see-saw ride over the last few months, the main Canadian index is up about 5% YTD (not counting dividends).

What should a young investor do? When you have cash available, close your eyes and continue buying. Research shows that if your time horizon is long enough, it’s not about timing the market, but time in the market.

How Often and When do I Make the Decision to Buy?

I like to buy quality dividend companies (and indexes) when their valuations are attractive. In other words, when they are being sold off (ie. dip). You can see some of my favourite Canadian dividend stocks here.

As I’ve mentioned in previous updates, I’ve left full-time salaried work which means I’m spending those dividends that I’ve grown and nurtured over the last 15+ years. As a result, my investment cash position has dwindled down over the years, so no more large investment purchases – at least for now!

Most of the portfolio additions are driven by reinvesting those growing dividends. In 2023 thus far, I have deployed modest amounts of capital into the following Canadian dividend positions:

- TD Bank (TD)

- Emera (EMA)

- Capital Power (CPX)

- BCE (BCE)

- Waste Connections (WCN)

- Brookfield Infrastructure (BIP.UN/BIPC)

- TC Energy Corporation (TRP)

- Index ETFs (not quite dividend stocks, but they are likely included in the indexes!)

The goal of the dividend growth strategy is to pick strong companies with a long track record of dividend increases. Since the last update, there have been more dividend increases – check them out below.

2023 Dividend Raises

So far in 2023, the Canadian portion of my portfolio has already received dividend raises from the following companies:

- CU.TO (1% increase)

- MRU.TO (10% increase)

- CNR.TO (8% increase!)

- BIP.UN/BIPC (6.3% increase)

- CNQ.TO (5.9% increase!)

- NTR.TO (10% increase)

- BCE.TO (5.2% increase)

- BEPC.TO (5.5% increase)

- TRP.TO (3.3% increase)

- ENGH.TO (18% increase!)

- TRI.TO (10% increase)

- T.TO (3.56% increase)

- L.TO (10% increase)

- WN.TO (8% increase)

- FTT.TO (5.9% increase)

- H.TO (6% increase)

- SLF.TO (4% increase)

Top 10 Holdings

Our top 10 holdings move around quite a bit. This time around, it’s a good mix of industrials, infrastructure, utilities, energy, telecom, and bank stocks.

In our overall portfolio, here are the current top 10 largest dividend holdings:

- Fortis (FTS)

- Canadian National Railway (CNR)

- TD Bank (TD)

- Royal Bank (RY)

- Brookfield Infrastructure (BIPC/BIP.UN)

- Telus (T)

- Emera (EMA)

- Enbridge (ENB)

- BCE (BCE)

- Bank of Montreal (BMO)

*not counting index ETFs (they are my largest holding).

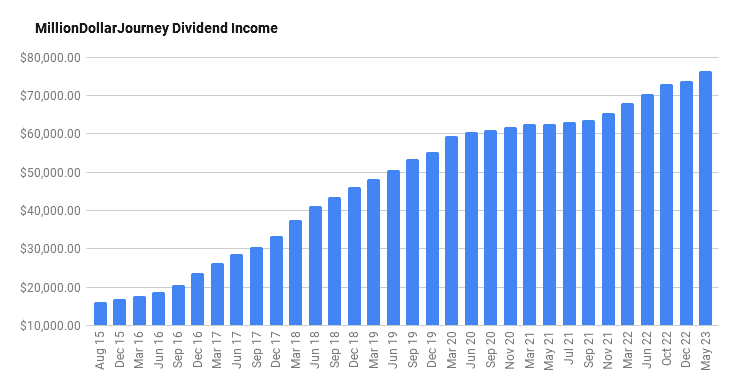

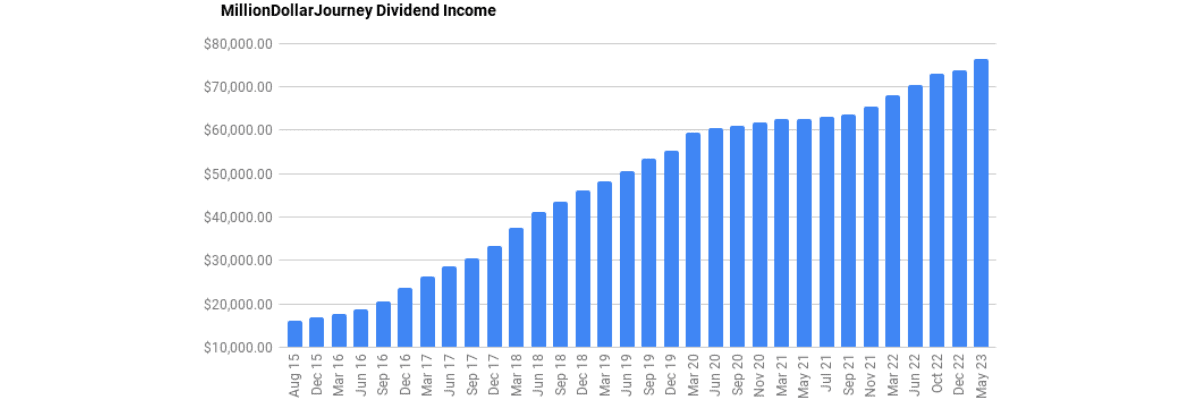

Dividend Income Update

As mentioned, there have been a number of healthy dividend increases and we managed to deploy some capital into dividend stocks.

As you can see in the chart below, the dividend increases have really made a difference in increasing our forward annual dividend income to $76,400. Given enough time for portfolios to compound, slow and steady does work!

The dividends are counted from all of our family accounts including non-registered (including leveraged account via the Smith Manoeuvre), RRSPs, corporate investment account, and TFSAs.

Final Thoughts

With the bear market in 2022 behind us, 2023 has started off strong, but will it last? The real question is, does it matter? If you look at the global markets on a daily basis, the dips and sell-offs (ie. volatility) can be scary! However, if you zoom out and look at the long-term trend, the dips are more of a resting phase before moving higher.

Regardless of market conditions, what also keeps my mind at ease is that the dividends keep rolling in. This is one of the major benefits of dividends for retirees – getting paid regardless of the markets being up or down!

I’ve noticed that other dividend investors/bloggers are comparing their dividend income to a comparable income/hr. $76k/year equates to about $38/hr in passive income (based on a 40-hour work week), and depending on how the investments are structured, most of that can be tax-free!

I wrote a post about withdrawing from your RRSP or TFSA where, with no other income in retirement, you can make up to $50k in dividend income (within a taxable investment account) and pay very little to no income tax (depending on the province). The benefits are even greater if you can split the dividend income with a partner/spouse.

If you are also interested in the dividend growth strategy, here is a post on how to build a dividend portfolio. With this list, you’ll get a general idea of the names that I’ve been adding to my portfolios.

If you want a simpler investing strategy that outperforms most mutual funds out there, check out my post on the best all-in-one ETFs in Canada. I’m a fan of indexing as the iShares XAW is my top individual holding.

Keep investing that cash flow and stick with a long-term plan. Your future wealthier self (sooner than you think!) will thank you for it.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

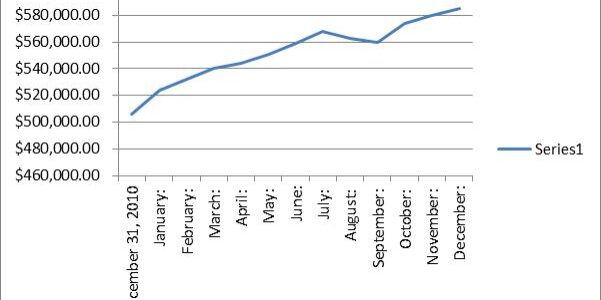

Roughly how much is the total value of the accounts generating the dividends included here.

If you look at his Sep 2021 update, he includes the dividend portfolio breakdown and the respective yields, you can then back calculate to get a rough estimates of his net worth at the time and kind of extrapolate from there. I’d imagine he’s pretty close to 2 million now, if not over that mark since the underlying stocks would’ve appreciate in share price too.