Is Enbridge Stock a Good Buy in 2024?

If you’re considering buying Enbridge stock in 2024, then you need to be aware of the company’s individual performance, its dividend growth rate, and recent developments in the energy industry. These indicators pretty solidly show why Enbridge has historically been an excellent investment, and will continue to be going forward.

If you’re looking for more information on comparable investments check out our article on the Best Canadian Pipeline Stocks. And if you’re looking for more dividend stocks like Enbridge, across different industries, check out our article on Canadian Dividend Kings.

Want To Buy Enbridge Shares? Price, Performance & Analysis

- Enbridge Stock Price: 48.64

- Dividend Yield: 7.25%

- Price-to-Earnings (P/E) Ratio: 41.51

- 5yr Earnings Per Share Growth: -3.23%

- 5yr Dividend Growth: 7.35%

- Payout Ratio: 271.26%

Our Enbridge Stock Analysis

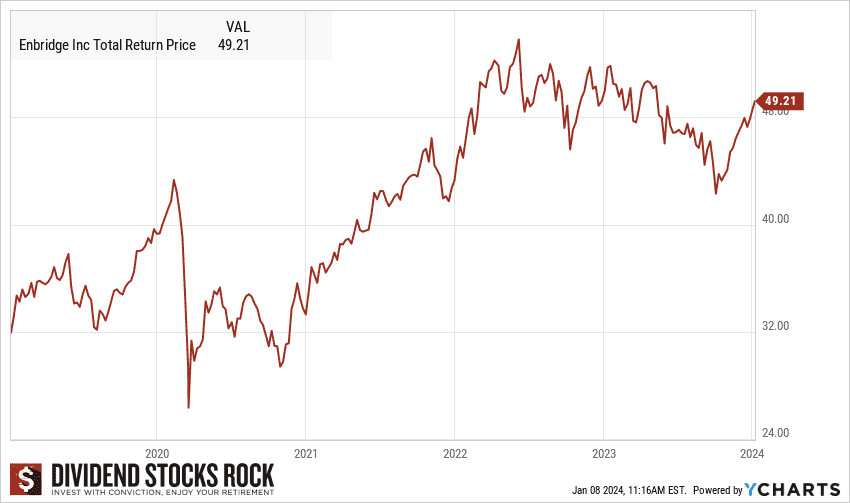

- At $48.64 per share, Enbridge seems like a solid investment to buy and hold.

- It’s down from its most recent peak in early 2022.

- Dividend yield is very high at 7% on average.

- 5 year dividend CAGR sits high at above 7% as well.

- Recently announced bid for capacity on two gas transportation paths.

Our Enbridge Stock analysis shows that Enbridge is prime for buying. We see that it presents a compelling opportunity for long-term investment as it is strongly positioned in the Canadian pipeline sector.

Enbridge boasts a 7% dividend yield which is quite high and we don’t expect it to come down anytime soon. We expect the stock price to recover from the energy crisis and demand for oil to remain high.

To explore further insights on investing in long term buys, we recommend referring to our guide on the best long-term investments in Canada.

Should I Buy Enbridge Stock Right Now?

When buying Enbridge stocks, you know what you’re getting; a company that moves almost a third of the oil produced in Canada and the United States across its pipelines. With a market advantage of that size, it’s always good to keep Enbridge as part of your portfolio.

In 2023, despite a decline in worldwide GDP growth and increased carbon taxes, it is expected that Canadian LNG production will hit new records. It’s no question that Enbridge as a pipeline company will tremendously benefit from this. However, It’s important to note that Enbridge will not be the only one competing for market growth, just recently a price war has been brewing in Alberta, after Enbridge slashed its prices.

If you’re looking for energy stocks that are less oil price dependent, check out our list of the Best Renewable Energy Stocks.

In terms of recent developments, just last year Enbridge acquired a 30% stake in a new LNG development in British Columbia, signifying more diversification beyond just the oil pipeline business. More recently Enbridge made an announcement regarding its bid for capacity on two gas transportation paths. This signifies the company’s proactive approach to securing future opportunities and expanding its operations within the gas transportation sector.

Overall, we trust that Enbridge will provide investors with reliable returns, even under high pressure markets like we see today. The company has consistently delivered in the past, and while that is not an indicator of future performance, we believe Enbridge’s management will effectively navigate upcoming challenges.

How To Buy Enbridge Stocks

You can utilize Canadian online brokerage services to buy Enbridge.

At MDJ, we prioritize focusing on discount brokerages to help our readers navigate choosing a broker to go with. We regularly ensure to keep our list of top online brokerages in Canada up to date, offering readers not just the finest overall recommendations but some of the best promotional offer codes currently accessible in the market.

Once you have registered for an online brokerage account, it becomes a simple process to buy Enbridge shares, as well as any other stocks for that matter. Simply use the search bar to search for the ticker symbol, in this case “ENB”, and determine the number of shares you want to buy.

For example, let’s say you want to invest $5,000 in ENB shares, and the current price of Enbridge stock is $50. You would enter “100” and select “market limit,” and then your online broker will present you with a prompt stating, “Do you want to buy 100 shares of ENB at $50 each, totaling $5000?”

Once you confirm the order, the online broker will handle the remaining steps. Congratulations, you now own a portion of one of Canada’s largest pipeline companies! An investment that we recommend holding onto for quite a while.

Enbridge Stock Historical Dividend Performance

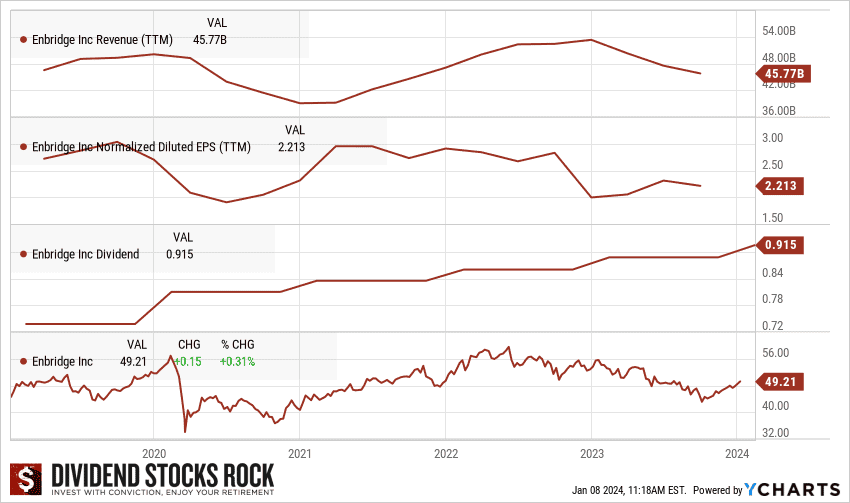

Over the past few years, Enbridge’s dividend has consistently increased alongside its revenues, as shown in the graph. As an investor, I am confident because this steady growth shows that Enbridge’s management and market position in the Canadian pipeline industry is expected to remain consistent in the long run.

I hold a great deal of confidence that Enbridge will consistently yield high dividends. I’m also pretty confident that the Canadian pipeline sector will consistently deliver returns to its investors, due to the increasing demand in energy, both in Canada and the United States.

If you’re looking for more information on dividend investing, look no further than our updated list of Best Canadian Dividend Stocks, and if you’re looking for a comparable investment to Enbridge, check out our guide on Canada’s Best Energy Dividend Stocks.

As someone who invests for my future, I prioritize steady growth rather than short term capital gains. In the case of Enbridge, it has delivered a respectable 4.6% dividend growth rate over the past three years. Currently Enbridge sits between its peers as the TC Energy Corporation has a 5.8% dividend growth rate and the Pembina Pipeline Corporation has a slightly lower 1.9% dividend growth rate.

When I’m looking for a comprehensive analysis to compare dividend stocks, including advanced statistics and a broader range of stock options, I always utilize Dividend Stocks Rock (DSR) as a guide for dividend investing.

Enbridge Stock Forecast

On May 5, Enbridge announced its financial results for the first quarter of 2023, reporting adjusted earnings of $1.7 billion. This figure has remained relatively stable compared to the same period in 2022.

Enbridge continues to sustain a robust project pipeline, indicating a promising outlook for future growth. As one of the dependable dividend stocks listed on the TSX, Enbridge demonstrates a commitment to providing reliable dividend payments to its shareholders.

For more information on stocks listed on the TSX, check out our guide on the Dogs of the TSX.

Enbridge has a proven history of delivering shareholder satisfaction, instilling confidence in its future prospects. When assessing Enbridge stock for 2024, it is important to acknowledge the company’s consistent track record of success and anticipate its ability to overcome potential obstacles.

If you’re considering whether Enbridge is a solid investment, the outlook is promising. This is dependent on the macro-economic environment and energy industry trends, however, Enbridge benefits from a solid foundation and effective management, positioning it favorably for long-term growth and stability. If you’d prefer going with a passive investing strategy rather than picking individual stocks, take a look at the Best ETFs in Canada for 2024.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Latest Articles

- « Previous

- 1

- …

- 77

- 78

- 79