Best Industrial Stocks in Canada For 2024

With the market shifting to defensive mode, Canadian industrial stocks are back in style. Investors are clearly in the mood for solid (boring?) dependable earnings that can keep up with an inflation-heavy environment.

While Canadian railroad stocks and Canadian airline stocks are technically considered Canadian industrial stocks, we decided that they needed their own articles.

While the Toronto Stock Exchange isn’t exactly teeming with great industrial stocks – aside from the railway duopoly, we’ve put together a look at some of the more prominent large-cap options available.

Personally, I still like the risk-reward of Canada’s telecommunications stocks and Canadian bank stocks (amongst others) more than the industrial sector, but obviously at a certain valuation point, any company can become a gem!

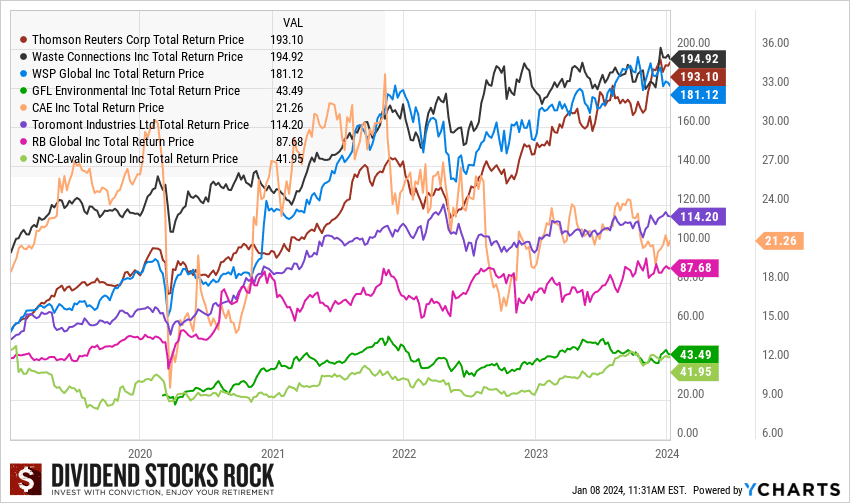

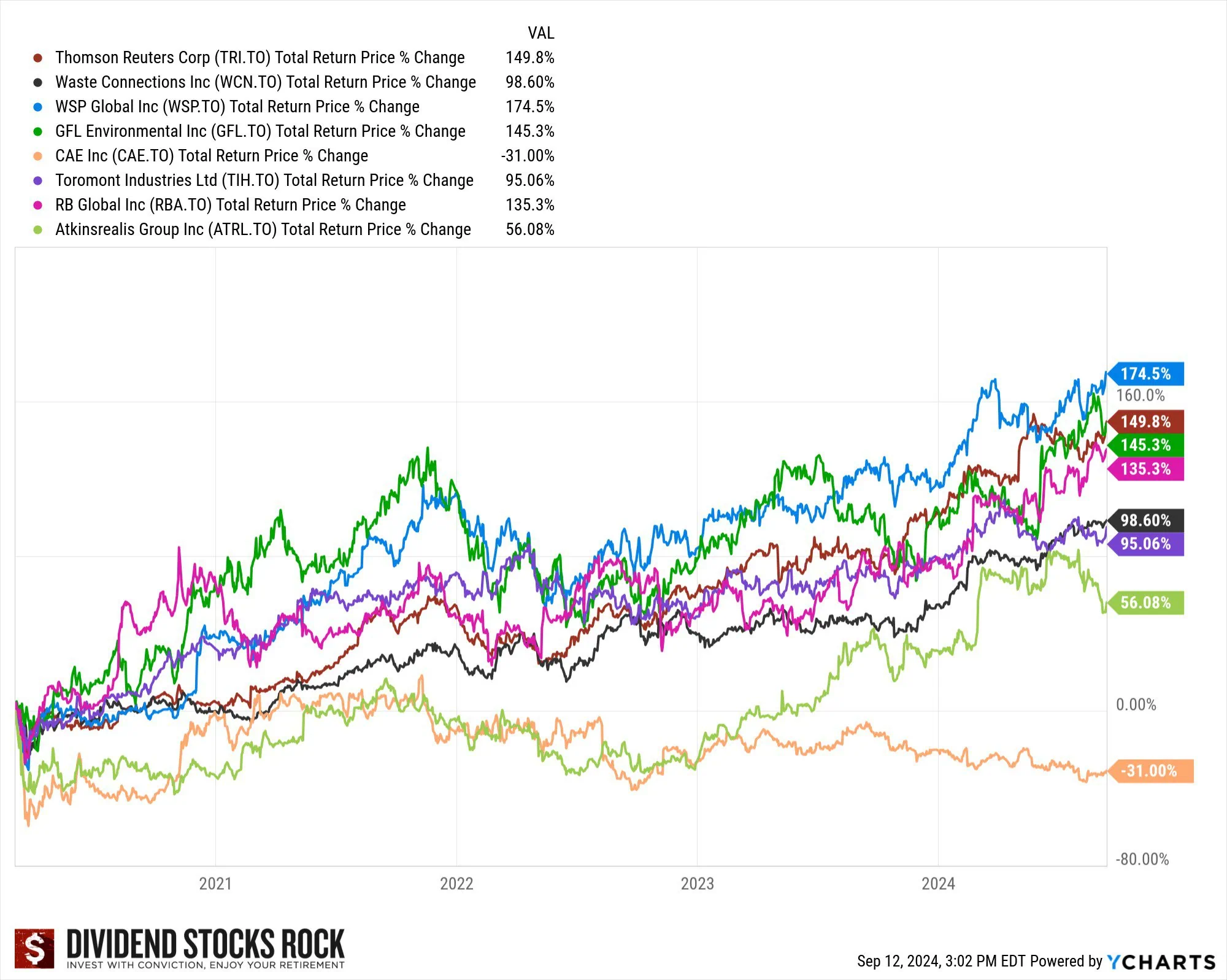

Canadian Industrial Stocks Performance Chart

All data and picks featured in this article are powered by Dividend Stocks Rock (DSR) – a powerful stock analysis service operated by Canadian financial expert and blogger Mike Heroux. DSR not only offers a free newsletter with updated stock picks and monthly (free!) webinars, but also access to a host of advanced tools. Read our full DSR review or visit their site by clicking the button below.

Top 4 Industrial Stocks in Canada (other than railways)

1) Waste Connections (WCN)

- P/E Ratio: 51.00

- Market Cap: 41.10B

- Dividend Yield: 0.74%

There is a reason why Waste Connections (WCN) has been one of Canada’s best industrial stocks over the last few years…

People need waste removed in all seasons – and in all economic conditions. It’s a recession-proof business, and WCN has proven capable of extending its scale advantages as it incorporates lots of smaller companies under their banner. Since merging with Progressive Waste in 2016, the company has churned out profits.

Now operating in 44 states and six provinces, WCN has diversified into oilfield waste treatment, solid waste, commercial recycling, large-scale shredding, dumpster rental, portable toilets, and many other “boring but profitable” logistical businesses.

While the dividend yield is pretty paltry at current valuations, management has proven that it is willing to reward shareholders by increasing payouts. Going forward only two things really worry me.

1) WCN may have “picked the low hanging fruit” when it comes to acquisitions, and further growth might not be quite as possible.

2) The current valuation is still really highly priced.

Tough to go broke hauling garbage and delivering porta potties though!

2) Thomson Reuters (TRI)

- P/E Ratio: 28.65

- Market Cap: 60.47B

- Dividend Yield: 1.85%

After selling its Refinitiv financial assets to the LSE Group, Thomson Reuters is dependant more than ever on its “Big 3” tax and accounting business. While the company is a massive corporate behemoth that includes news flow, global print, and law services amongst its revenue-generators, the service-provider is more and more a tax and accounting play.

That said, it’s about as all-encompassing in that field as you can be. Leading the way in moving software and workflow tools to cloud-based platforms has allowed the company to continue to grow. With more than 80% of revenue coming from subscription-based customers, cash flow looks strong for many years to come.

With a painstakingly built empire that spans the entire planet, Thomson Reuters is a great company that probably got overvalued during the pandemic (along with most other “tech and information” companies).

With the company announcing a $1.2 billion stock buyback for 2022, along with a 10% dividend increase, there are much worse places to park your cash as you wait for volatility to subside.

3) CAE (CAE)

- P/E Ratio: 84.62

- Market Cap: 9.41B

- Dividend Yield: N/A

CAE is an interesting play on the renewed demand for air travel. As a Canadian company that specializes in training pilots across several industries, CAE gets 50% of its revenue from aviation services, and remainder from its defense and healthcare verticals.

One of the few Canadian industrial stocks to have excellent geographical diversification, roughly 35% of its revenues come from the USA, 27% from Europe, with the remainder from the rest of the Globe.

Due to the fact CAE is one of the few players in a relatively specialized niche, its customers tend to stick with the company, even if they were gained through acquisition. The problem is that the aforementioned niche just went through pretty much the hardest downturn in its history!

Given the eye-wateringly high P/E ratio, investors clearly expect CAE to take advantage of not only the massive demand to train new pilots coming out of the pandemic – but also for their defense and healthcare divisions to increase revenues as well.

Before the pandemic, CAE proved that it was on track to dominate its field, and grow sustainable profit margins. It remains to be seen just how fast they will be able to great back on track, as their last quarterly financials left much to be desired.

4) WSP Global (WSP)

- P/E Ratio: 33.24

- Market Cap: 16.00B

- Dividend Yield: 1.11%

While WSP Global is definitely not a Canadian dividend king (not having raised its dividend since 2011), it is a really diversified professional services company with clients all over the world.

WSP provides design services in the fields of engineering, infrastructure, power and energy, mining, and commercial industry. It has been quickly expanding into sustainability over the last decade as well.

Growing from its strong engineering services base, WSP has focused on buying smaller consulting and design companies over the last few years and has successfully leveraged its brand to gain pricing power.

Overall, another solid Canadian industrial stock that works as a defensive play, but doesn’t hold any proprietary technology or monopoly on which to base long-term earnings increases.

It will have to depend on management continuing to show expertise in growth-by-acquisition in order to provide growth. A proven company that is a leader in their field, but this valuation is certainly pricing in premium growth.

Other Canadian Industrial Stocks to Consider: GFL, TIH, RBA, and SNC

Some other Canadian industrial stocks often discussed by Canadian investors include GFL Environmental, Toromont, Ritchie Brothers Auctioneering, and the infamous SNC-Lavalin.

Coming from all corners of the industrial sector these companies are important to providing Canadian investors with diversity (especially considering the extent to which Canadian indexes are dominated by financials and mining companies) and are solid companies to buy at specific valuations. Unfortunately, at this time, I just can’t see that the value is there.

Best Industrial ETF Canada

The BMO Equal Weight Industrials Index ETF (ZIN) is the best Canadian industrial stocks ETF. Because it “equal weight” the ETF is not dominated by the largest companies in the index, with no stock holding taking up more than 4% fo the fund.

While it is a quick and easy way to diversify amongst the large industrial stocks on the Toronto Stock Exchange, ZIN comes with a hefty 0.62% MER that I’m not a huge fan of.

Truth be told, it’s not like there are a ton of Canadian industrial ETFs to compare with!

Canadian Industrial Stocks FAQ

Final Word on Canadian Industrial Stocks

While there are some solid companies available in the Canadian industrial sector, it just isn’t our cup of tea at the moment. With Canadian energy stocks and Canadian bank stocks raking in profits, there is simply more opportunity elsewhere.

That’s not to say of course that we wouldn’t be up for revisiting the world of Canadian industrial stocks in the future when profits catch up to valuations.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Re: “The Best Industrial Stocks in Canada”

Seriously, no “Exchange Income Fund”? I would rank it in the top 5.