The Best Countries for Canadians to Retire Abroad

A few years ago I never would have considered writing an article about the best countries for a Canadian to retire abroad.

Why would anyone want to leave Canada, right?

Then my wife and I moved overseas to accept teaching positions, and I became aware of a broad range of geography-inspired lifestyle possibilities. I was so curious about what was possible, that I even wrote a free eBook for Canadian expats.

Then I spent much of 2023 and 2024 traveling the world and staying for an extended period in many of the “potential retire abroad” countries that we discuss below!

It turns out there is a pretty sizable group of people who want to retire sooner, retire sunnier, retire with fewer taxes, and retire in style – which can definitely be accomplished by retiring outside of Canada. I think that group has gotten even larger in the past few months due to the changes in Canada’s capital gains taxation laws.

Retiring abroad in another country is not going to be the answer for all Canadians. If living close to family 12 months a year is extremely important to you, or if you really enjoy winter, or perhaps you just hate air travel – then retiring abroad probably isn’t for you. That’s 100% fine – obviously many retired Canadians have an excellent standard of living and love spending their golden years in Canada.

I simply wanted to let Canadians know what their options are, that they really can receive their pension if they retire abroad, and that many people from all Western countries are pursuing this lifestyle in order to retire sooner and maximize their purchasing power.

Quick Note: When I talk about retiring abroad for Canadian citizens, I’m referring to actually living – or “residing” (that’s a key term for legal purposes) – outside of Canada. I’m NOT talking about being a snowbird, and/or visiting other countries for 180 days each year.

Being a snowbird is another good retirement option for a lot of people (especially for affluent Canadians), but this article is about actually cutting residential ties to Canada, and enjoying another country’s medical system, tax rates, etc.

- Should You Consider Retiring Abroad as a Canadian Expat?

- Bad Reasons for Not Wanting to Retire Abroad as a Canadian Expat

- Can I Get My Pension (CPP and OAS) if I Live Outside of Canada?

- What Happens to my RRSP and TFSA if I Retire in Another Country?

- How to Decide Which Country to Become an Expat In?

- Should I Retire in Portugal, Spain, France, Italy or the Rest of Europe?

- Should I Retire to Thailand, Malaysia, or the Rest of Southeast Asia?

- Should I Retire In Panama, Ecuador, Costa Rica or Mexico?

- Should I Retire to the USA?

- FAQ About the Best Countries for Canadian Expats to Retire In

Is Your Retirement Savings On Track?

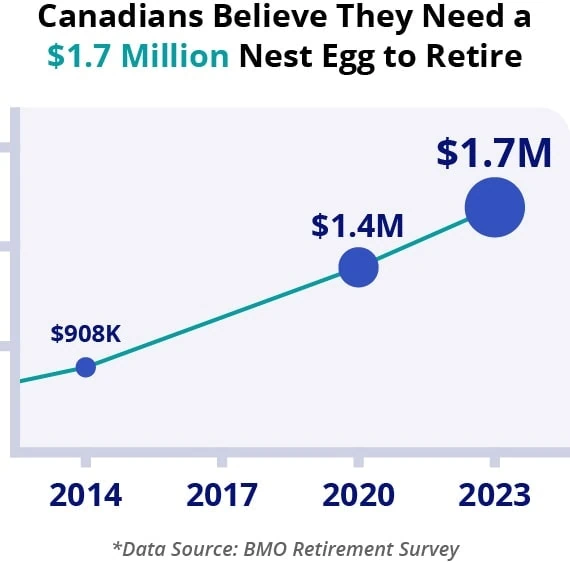

Each year BMO does a retirement survey that asks Canadians a wide range of questions. You can see more details about how they got that figure here.

The problem is that most Canadians don’t really understand how their income and expenses will interact in retirement. Are you saving enough? Find out for sure with the first online course for Canadian retirees (click here for more details).

Should You Consider Retiring Abroad as a Canadian Expat?

Before you read any further we should really answer the critical question first: Should you consider retiring to another country as a Canadian expat?

We’ll get to discussing pensions and specific candidate countries here in just a second, but if it’s just not a good fit, then there’s no point in going forward. I’m generating this list of the best countries to retire in after talking to 200+ international teachers about their retirement plans, as well as doing my own research.

There’s also one authority who I shamelessly steal from and trust above all others when it comes to international living – Andrew Hallam. For those who don’t know Andrew, he is a former international teacher who grew up in Canada. He has written several personal finance books, and has lived in many places around the world – including Panama, where he and his wife now call home. I should also give an assist to international retirement expert Tim Leffel, whose writing and podcast episodes I also leaned on.

In other words – I’m not just Googling some top 10 list and regurgitating what some intern wrote about where you should retire!

Without further ado, let’s take a look at what might predispose you to considering a retirement abroad.

If you:

- Enjoy new experiences and meeting new people…

- Want better medical care than Canada has to offer…

- Are open to communicating with family through long-term stays back in Canada AND welcoming them to your new country of residence (as well as through online chats of course)…

- Crave earlier retirement or want more purchasing power in retirement…

- Find yourself getting more and more tired of Canadian winters…

- Want a safer location than your current Canadian community…

Then you should definitely consider making the tradeoffs and taking the plunge to become a Canadian citizen who has retired abroad.

Bad Reasons for Not Wanting to Retire Abroad as a Canadian Expat

As we said up top, there are some really good reasons for not wanting to retire in another country. The paperwork and tax considerations involved in severing residency and getting settled into your new country isn’t a walk in the park.

Being away from your former support network and/or your family is a big leap for some folks. That said, there are also a lot of misconceptions about living abroad. Let’s bust a few common myths.

Myth 1: Retirement Abroad Means Going to a Country That Isn’t Safe.

People visibly recoil in disbelief when I tell them that the city of Doha, Qatar is by far the place in the world where I have consistently felt most safe. Inevitably my wife has to come to my defense and explain why we feel so safe here.

While driving at night can be a bit of an adventure, there is essentially zero risk of theft or violence. You routinely see designer handbags and other expensive items left unattended. There are no natural disasters to worry about, and we are minutes away from world class healthcare. Police response times are almost instantaneous. We can’t say those things about anywhere else that we’ve lived.

All this to say – keep an open mind about what a “safe country” looks like.

To be honest, the idea of “safety” being ranked by country is a little odd and misleading at the best of times. Most seasoned travelers will tell you that real “on-the-ground safety” is determined by personal choices and individual neighborhoods – not entire countries.

That said, you’re not going to find Canada at the top of many “most safe countries” lists. Qatar and neighboring UAE actually came in #1 and #2 in the most recent Numbeo ranking (based on thousands of users contributing data about their personal experiences). While US News does rank the two Gulf countries lower than Canada, they still come in the top 30.

If you’re researching country-wide safety, you might come across the Global Peace Index. While these ratings are probably about as valid as any other country-wide metrics, keep in mind that this ranking includes a lot of consideration of factors that the average person might not think about when they look at personal safety.

For example, spending a lot of money on the military or nuclear weapons is considered a big negative to your country’s Global Peace Index score – whereas I personally don’t see those factors as having all that much to do with if I feel safe.

There are many neighborhoods in Canada that I wouldn’t feel safe in, and of course, there are many more neighborhoods where I would feel reasonably safe – so it doesn’t make much sense to average out all of those places and base my decision about where to live on a Canada-wide scale, right?

Similarly, I’ve recently met hundreds of people who live in countries that I might think twice about from a safety reputation perspective – but they can explain in precise detail why they feel quite safe in their chosen community.

Myth 2: Giving up my Canadian Healthcare Will Leave me Dead or Broke

I think this myth might have been a bigger deal ten years ago, as most Canadians who I know aren’t exactly thrilled with the current state of their province’s healthcare system.

Talk to people who have lived not only in “great healthcare countries” like Singapore and France – but also talk to folks who have lived in places like Thailand, Malaysia, or Panama. They’ll tell you that the private medical care they receive is both relatively affordable, and substantially better than what they received in Canada for all but the very worst-case scenarios. (I’d argue most provinces in Canada have generally done a pretty solid job when it comes to providing immediate life-saving care and/or long-term treatment of debilitating diseases… but perhaps that’s up for debate these days as well.)

In a recent email exchange, Hallam explained to me that he recently got back from France. While there, he called, booked an appointment with a medical specialist within a few days, and then had two follow up appointments where he received excellent medical care.

The total bill for this government-subsidized, but semi-private series of visits to a specialist (on short notice) to one of the top medical systems in the world?

$165.

If you read Hallam’s columns and his book Expat Millionaire (a must read if you’re really serious about trying out the expat life) you’ll see that he often refers to the doctors in places like Mexico, Panama, and Malaysia by saying, “The best doctors here are as good as anywhere in the world.”

Private or public/private hybrid healthcare is very affordable in the vast majority of countries we’ll describe below. Most expats don’t even worry about insurance for things like dental care, as it’s easier and cheaper to pay out of pocket.

In most cases you can purchase worldwide medical insurance to cover medical needs that would put you out of pocket by a significant amount. If you get to be a very advanced age and really want to take advantage of Canada’s free-at-the-point-of-delivery healthcare system, you can always move back to Canada fairly easily.

After talking to several dozen Canadian international teachers I have yet to meet a single one who prefers the healthcare where they grew up over the private healthcare options where they now work. Many of them even prefer the free or highly-subsidized public healthcare systems of places like Portugal and Spain to that of Canada.

Myth 3 – I Have to Give up my Canadian Citizenship to Retire Abroad

Citizenship and residency are not the same thing. If you chose to retire in another country and live as a Canadian expatriate – you are 100% guaranteed to keep your Canadian citizenship, your passport, and your right to move back home to Canada at any time.

What you will lose is residency-based privileges such as provincial healthcare and access to the Guaranteed Income Supplement (GIS) program.

As a resident of another country, you will be subject to the tax laws and visa requirements of that country, but in exchange, you will not have to pay Canadian taxes on any income earned outside of Canada. If you don’t own property in Canada it’s quite probable that you won’t even have to file a tax return.

Myth 4 – If I’m not a Citizen of a Country and I’m not Working There, I Can’t Live There as a Full-Time Resident.

Every country in the world handles their residency and visa applications a little bit differently. In all of the places on our “best countries to retire abroad” list that we discuss below, there are fairly straightforward ways to get long-term residency visas, or even permanent residency status.

It does require a little navigation of paperwork, but if you scan some expat Facebook groups you’ll usually be able to find all kinds of help and answers to the most common questions.

Long story short: A lot of countries out there want upper-middle-class retirees to come and spend money!

Myth 5 – I Visited That Country as a Tourist For a Week and it Cost $2,000, so I Can’t Afford to Live There all Year!

I have spent a ton of time researching the cost of living in different areas over the last few years in order to prepare for my extended travels. I’ve interviewed over a dozen people who are currently staying in medium-term rentals (think 1-3 month AirBnB stays), as well as talking to dozens more international teachers about what they found the real cost of living on the ground was in their respective countries.

The general conclusion was that most Westerners overestimate the cost of living in many countries because their only interaction with these places is through action-packed holidays and/or luxury hotel stays.

As with most budgeting realities, there are cost-of-living tradeoffs involved no matter what country you stay in. That said, the places I recommend below (with a big assist from Hallam, international retirement expert Tim Leffel, and the International Living publication) all come with reduced price tags even if you want to pursue a very similar lifestyle to what you had in Canada. If, on the other hand, you embrace eating at least some meals in a more local style, and/or generally living like locals do, then you can really cut costs in a hurry.

For example, the average Portuguese resident’s income is below $32,000 CAD. Canada’s average income is almost double that amount. Considering Portuguese resident taxation is generally higher than Canada’s (especially at lower income levels), it makes sense that everyday purchase costs reflect that reality.

For example, you can get a beer for a dollar. (And you can even buy it at a cafe!) Given that many Portuguese senior citizens collect a pension of about $500 CAD per month, and that Portugal is one of the more expensive destinations on our countries to retire to outside of Canada list, you can see how your Canada-based savings and pensions payments can stretch further when spend abroad.

Myth 6 – You Need to Learn a New Language if You Live in Another Country.

One of the privileges of being a native English speaker is that much of the world will bend over backwards to cater to you. Honestly, the degree to which people who speak other languages will accommodate us is one of our big takeaways from international teaching. The language proficiency of so much of the rest of the world is routinely both humbling and embarrassing given that English is the only language my wife and I can communicate in (for now).

If you live in an expat-friendly part of any of the countries we list below, you’re going to interact daily with not only a lot of English-speaking expats, but also a group of self-selecting locals who have significant financial incentives to speak English to you.

My wife and I have found that generally speaking, Millennials and Gen Zs from other countries attribute much of their practical English knowledge to the fact that a huge amount of the internet information that they consume is in English.

Now, that said, if you venture off the beaten path at all, decide to live in a less-Expat-ish rural area, or want to talk to folks who maybe haven’t spent their whole lives on the internet, then learning the local language can come in quite handy.

I know that when we travel, we get a TON of credit from locals for trying out 5-8 common phrases. Again, it can actually be embarrassing to see how thankful a local server can be if you simply try to engage with them in their mother tongue. We feel that we often see our already-excellent service go up a notch when we just say “Thank You” in the local language.

Many expats report that learning the new language and embracing a new culture is half the fun of retiring outside of their home country, while others humbly enjoy the fact that English has quickly become a fluent 2nd language for much of the world.

Are You Saving Enough for Retirement?

Canadians Believe They Need a $1.7 Million Nest Egg to Retire

Is Your Retirement On Track?

Become your own financial planner with the first ever online retirement course created exclusively for Canadians.

Try Now With 100% Money Back Guarantee*Data Source: BMO Retirement Survey

Can I Get My Pension (CPP and OAS) if I Live Outside of Canada?

Before we get to discussing the best countries to retire to outside of Canada, let’s directly address the #1 financial worry for most retirees: Can I get my CPP and OAS in another country?

The short answer: YES!

The more nuanced answer: yes… most of it… most of the time – and the government of Canada will even send it to you in your new country’s currency!

Remember that OAS and CPP are different programs. Also, you should take into consideration that your new country is going to have their own tax rules that you will now have to understand.

Finally, you will lose access to the Guaranteed Income Supplement (GIS) program if you move abroad.

Rules for collecting OAS if you live outside of Canada

- To be eligible, you need to have been a legal resident on the day you left Canada, and have lived in Canada for at least 20 years after you turned 18.

- Alternatively, if you haven’t lived in Canada for 20+ years, you might still qualify to collect OAS if you spent some years working in one of the 58 countries that Canada has a social security agreement with.

- You will collect “full OAS” if you lived 40 years in Canada (or a country on the above list). If you lived less than 40 years, a proportional amount will be taken off of your OAS payment.

- You will have to pay a 25% withholding tax to the Canadian Federal government, but that could be reduced to 15% if the new country you’re retiring in has a tax treaty with Canada (Portugal or Ecuador for example). This tax will come off of your OAS payment before it hits your bank account – no need to do anything on your end.

- That 15% or 25% usually isn’t a big deal because most countries are going to have a tax treaty with Canada, and what that means is that the tax you paid in Canada is going to generate a tax credit in your new country of residence. In plain language – it will all equal out in the end.

- It’s possible that if you’re living REALLY cheaply (like less than $15,000 CAD per year cheaply) you won’t actually owe the Canadian government any tax money. In that situation you could file a Section 217 tax return in order to get withholding taxes back.

- If you have the good fortune of earning more than the OAS threshold of about $82,000 on your worldwide income (including your OAS and CPP payments) in a given year, then just like if you lived in Canada, your OAS payment is going to be affected. In this situation, you may be asked to pay an OAS recovery tax unless you’re one of these 42 countries where the tax treaty specifically means you don’t have to worry about the OAS recovery tax. Don’t forget that with various income splitting strategies, couples get roughly $164,000 in combined “OAS space” before they have to worry about the threshold level.

- The Canadian government is even willing to send your OAS payment to you in your new country’s currency if you live in one of these 53 countries.

Rules for Collecting CPP if You Live in a Different Country

- To be eligible to receive a CPP payment no matter where you live, you simply need to have worked in Canada and contributed to the Canadian Pension Plan at some point.

- You can check out my CPP guide for more information on how much your CPP payment will be.

- You will have to pay a 25% withholding tax to the Canadian Federal government, but that could be reduced to 15% if the new country you’re retiring in has a tax treaty with Canada (Portugal or Ecuador for example). This tax will come off of your CPP payment before it hits your bank account – no need to do anything on your end.

- Like OAS, that 15% or 25% usually isn’t a big deal because most countries are going to have a tax treaty with Canada, and what that means is that the tax you paid in Canada is going to generate a tax credit in your new country of residence. In plain language – it will all equal out in the end because your new country is probably going to ask you to pay taxes anyway.

- Like OAS, it’s possible that if you’re living REALLY cheaply (like less than $15,000 CAD per year cheaply) you won’t actually owe the Canadian government any tax money. In that situation you could file a Section 217 tax return in order to get withholding taxes back.

- The Canadian government is even willing to send your CPP payment to you in your new country’s currency if you live in one of these 53 countries.

What Happens to my RRSP and TFSA if I Retire in Another Country?

You can check out my free Canadian Expat eBook for the full details on how taxation of your investments will work upon leaving Canada and severing your residency.

The good news is that if your entire investment portfolio is held within your RRSP and TFSA, then you’re not going to owe any capital gains taxes upon leaving Canada. The even better news is that the CRA is not going to ever tax you again on the investments held within your TFSA.

You can move wherever you want, the interest, capital gains, and dividends that collect in your TFSA will not be taxed during the year and they will not be taxed when you take them out of the TFSA and spend them in your new country of residence.

You should also know that since you’re no longer a Canadian resident, your days of contributing to a TFSA and/or RRSP are behind you as you’re no longer going to be accumulating new contribution room. There might be RRSP/TFSA-ish investment account options in your new country, but that obviously depends where you move. (You’re retired, you should be focused on spending that money anyway!)

Now, taking money out of your RRSP is a bit of a different story. In many ways it’s similar to your OAS and CPP payments that we just discussed. Here are a few considerations for when you withdraw money from your RRSP or RRIF while living abroad.

- You will generally pay a 15% or 25% withholding tax to the Canadian government. Just like with the OAS and CPP, if Canada has a tax treaty with the country you moved to, this withholding tax will generally be used to offset taxes you’d owe in your new country.

- If you move to a country that doesn’t have a tax treaty with Canada AND you earn very little money in a given year, then you should consider filing a section 217 return in order to get some or all of your withholding tax money back.

- Many countries will consider withdrawals from your RRSP/RRIF to be “foreign pension income” which may mean favourable tax treatment. It will be worth checking with an expat tax specialist once in your new country.

- If you take the minimum RRIF withdrawal, then no withholding tax will be automatically applied at the source. That said, you will still owe tax to the CRA unless you are earning less than $15,000 or so per year as the CRA is going to determine the tax rate on that withdrawn RRSP/RRIF money based on your worldwide income.

Private Workplace Pensions: If you have a private workplace pension (whether that’s through a private company, or you were a public employee like a Teacher or a nurse) then it will be treated very similarly to the RRSP/RRIF considerations discussed above. How your new country decides to tax that money is obviously up to them.

Now – here’s an important thing to remember. While you may not owe Canadian taxes on the investment gains made inside a TFSA or RRSP account, you definitely could owe taxes in your new country. Read my Canadian Expat eBook for more information on the different types of taxation in the world.

How to Decide Which Country to Become an Expat In?

Tim Leffel has written a ton of great information about retiring abroad, including a cool book called A Better Life for Half the Price. He has written and spoken about how important it is to try out your new “candidate country” before moving there. He believes that if you spend a month or more somewhere, and make a real attempt to dive into the local culture, then you’ll have a much better idea if the place was meant for you. You can then put a fair amount of weight in the “trust your gut factor” in terms of deciding which country to move to.

The problem is that “trust your gut” is hard to quantify and compare across many different countries – so this is my best attempt to combine information from the key sources that I’ve already mentioned. As always, keep in mind that within countries, there can be wide differences in the variables we discuss below.

For example, when we look at Portugal, Spain, and France, living in Lisbon, Barcelona, or Paris is going to be a massively different experience (and require a massively different bank account) than living in smaller cities in those countries.

Without further ado, here are the comparison points that I have found most people want to know about when it comes to choosing countries to retire in.

- Ease of getting residency status for a retiree (visa, permanent residency, etc)

- Cost of living

- Medical situation (cost, availability, private vs public)

- Weather

- Safety

- Tax situation (depending on where you will get your income)

- Cost and availability of flights to Canada

- The closer the time zone to Canada the easier it is to stay in touch with friends & family.

Should I Retire in Portugal, Spain, France, Italy or the Rest of Europe?

When I asked Andrew Hallam what his top recommendations were for Canadian expats, he said that there were a ton of great options, but he’d probably recommend Portugal, Spain, and France. I’d add rural Italy to that list as well, for all the same reasons I’ll detail below.

He’s not alone in making these recommendations, as International Living (a publication that depends on data generated from actual expats living in those countries) rated Portugal as #2, Spain #5, Greece #7, and France #9 for 2024.

Canadians will love the inexpensive and elite medical care available in these European countries. The cost of living outside of the major urban centres is very affordable (not so much in the big famous cities), the weather and safety are better than the vast majority of Canada.

When it comes to the ease of getting residency and/or the overall tax situation, Portugal has been an incredible value in the past, but the last couple of years have seen it really scale down these tax benefits and the availability of their Golden Visa program. Spain followed suit in 2023.

It is now substantially more difficult to get long-term residency in these two countries, and/or requires a larger investment. If you’re willing to keeping working in some capacity as you “retire abroad” it’s possible that new digital nomad visas might be worth consideration in these European countries.

For up-to-date information I recommend asking to join expat social media groups in these countries. Unfortunately, you might get a very “Canadian feel” when it comes to navigating the bureaucratic mazes that these European countries have in place when it comes to securing a long-term visa status.

While still relatively close to Canada, these European “dream destinations” are perfect for culture lovers who have $3,000-$4,500 CAD per month to spend in retirement. There are a ton of cheap travel options to enjoy once you’re on the European continent. It wasn’t long ago that Portuguese retirements cost a little more than half of that amount, but word got out, and I’m not sure you’ll find it easy to spend much less than $2,500 CAD these days.

While they don’t appear on a lot of best places to retire lists, I’d also take a really hard look at lesser-known European countries such as Greece, Slovenia, Georgia, Bulgaria, and the rest of Eastern Europe or the Balkans (admittedly, more attractive if/when the war ends).

The cost of living is a really effective draw in these places, but you may have to sacrifice a little on some of the other comparison factors. Personally, I fell in love with Georgia when I visited, and the combination of fairly straightforward residency paperwork and excellent tax incentives make it very appealing to a particular type of expat retiree.

2024 Update: My wife and I were fortunate enough to spend a month in the Azore islands (Portugal), a month in Coimbra, Portugal, and a month split between Porto and Lisbon in the final three months of 2023.

My personal experience echoes the pros and cons of what I wrote about above. The weather is great and the slower-pace of life is a real thing. That said, our long-term experience with many Portuguese in our day-to-day living gave us a strong indication that they’re getting a bit sick of so many tourists and expats “invading” their country. This is especially true in both Porto and Lisbon.

The days of Lisbon being a “cheap place to retire” are definitely gone. Porto was a bit less expensive, but still nowhere close to the deals you can find elsewhere in the world. (I would point out that for my money, I’d much rather live in and visit Porto.)

My read on things after talking to several dozen local Portuguese people and expats on the ground in Portugal, is that there are still some really great opportunities available for people who are willing to go off the beaten path and look at life in smaller cities. This path gets even more attractive if you’re willing to learn a little Portuguese and want to embrace the slower pace of living.

Perhaps our biggest takeaway: If island life is your thing, you should really think about the Azore islands. We weren’t aware of how many Azorean/Azorish (we heard both frequently) people had made their homes in Canada over the last 80+ years.

Consequently, there are great direct flight options from Toronto and Montreal (seasonal). The Azores are as beautiful as the internet makes them out to be (i.e. “The Portuguese Hawaii”) and are significantly cheaper than Porto and Lisbon.

Should I Retire to Thailand, Malaysia, or the Rest of Southeast Asia?

If you’re looking for an excellent combination of rock-bottom prices, warm culture, high safety levels, and surprisingly good infrastructure & medical care – then countries such as Thailand and Malaysia deserve a second look.

Admittedly for Canadians, these countries aren’t the easiest to get to, they are very warm and humid for much of the year, and life happens in entirely different time zones – but for thousands of Canadian expats, the benefits outweigh the costs in this decision.

The more I read and talk to expats who have actually lived in Malaysia and Thailand specifically, the more impressed I am with the incredible leaps in medical expertise in both countries. Both Hallam and International Living commented on this aspect in detail.

Obviously there are other excellent low-cost places to live in Southeast Asia, but they either lack the infrastructure/medical advantage of Malaysia and Thailand, or the paperwork necessary to ensure a long-term visa is very difficult/expensive.

I would argue that between the two, as of 2024, Thailand has a decisive lead for Canadian retirees based on their excellent retirement visa program and the fact you can get direct flights from Vancouver (whereas there are currently no direct flights from North America to Malaysia).

The Thai retirement visa program for folks 50+ is that you simply have to put $30,000 CAD (roughly – depends on exchange rate) in a Thai bank account – or prove that you have monthly income (such as a combination of pension/CPP/OAS/annuity) of about $2,300 CAD per month.

They want you to have this money so that they know you can support yourself while in Thailand, because you are not allowed to work in the country while on the Thai retirement visa.

Malaysia used to counter that Thai visa program with perhaps an even better offering called the “Malaysia My Second Home” (MM2H) visa. However, this program was changed significantly during Covid (after allowing 57,000 long-term visas in the preceding years), and its future is in flux.

As of 2024, there are still key details of this visa program to work out, but in the final days of 2023 the government did release some new updates. New MM2H applicants will need to make a fixed deposit of between 500,000 to 5,000,000 ringgit (the Malaysian currency) – or about $145,000 to $1.45 million in Canadian Dollars. There are three corresponding tiers that MM2H visas will be separated into. Make sure and look into this situation carefully if you’re considering Malaysia.

If you’re looking to either cut costs to the bone, or get luxury-for-less, it’s tough to beat Thailand once you get out of Bangkok and the tourist centres. You can find numerous expat couples who brag about living well on $1,200 CAD per month in cities such as Chiang Mai, Ko Chang, Chiang Rai, or Pak Nam Pran.

2024 Update: My wife and I stayed two months in Chiang Mai in January & February of 2024. We used our beautiful Airbnb rental as a home base to explore northern Thailand. After two months, I guess our conclusion would be… look there are some major trade offs when it comes to making a retired life in a developing country. Some people LOVE those tradeoffs – but we’re probably not those people.

The good parts of living in Thailand (outside of Bangkok especially) are not exaggerated. The people are very kind, it is much less expensive than North America, the medical care/hospitals looked very good in Chiang Mai (with many expats we met saying it beat what they had at home), and the food could be incredible. We had the best dental cleanings of our life in Chiang Mai for less than $30!

That said, if you want to consistently grab a coffee, eat in middle-upper restaurants, and live in an upper-class villa/condo, then you’re going to need more than $1,200 CAD per month. We probably averaged closer to $2,200 per month in Chiang Mai.

Admittedly we were not being particularly budget-conscious, and we made a point of eating at some of the best restaurants in the city (in addition to trying the famous street food). Paying long-term rents, would take that number down considerably, as we were paying Airbnb prices during prime season.

Also, there are some trade-offs that would really start to wear on us personally if we were staying in Thailand year round. The pollution issue is very serious. Additionally, we learned that much of southeast Asia is quite reliant on hordes of “scooters” (think “dirt bike” or “small motorcycle”) to get around.

This makes it quite difficult to live a pedestrian-friendly lifestyle if you live in the urban parts of Thailand. Now, it’s important to point out that many retirees love getting on their scooter and driving to wherever they want to go, or they live in a more rural walking-friendly part of the country.

Perhaps our biggest takeaway was that dealing with the Thai immigration system is incredibly frustrating. This was a consistent theme not only for expats in Thailand, but also in Portugal, and many countries. I believe that most folks considering retiring abroad would be best served to get a personal recommendation for a local “fixer” to help guide them through the application process.

These are often westerners who have lived in that area for a couple decades, and who are often married to a local (so they are aware of “how things get done” and have some level of functioning local language to fall back on).

All that to say that we can see why some people love Thailand, and love retiring in Thailand – just make sure that you are definitely that type of person. I’m pretty sure the same would hold true for Malaysia.

Should I Retire In Panama, Ecuador, Costa Rica or Mexico?

Both Leffel and Hallam have decided to make their long-term residency in Central America (Mexico and Panama respectively) – so perhaps that is ultimately the strongest possible recommendation? Both cite countless firsthand conversations with longtime expats in these countries as evidence that a very comfortable retirement at a fraction of the price you’d pay in Canada is very possible.

There is no doubt that for North Americans especially, the prospect of low taxes, unending sun, great private healthcare options, and very low cost living – all while staying in the same time zone and being a relatively short plane ride away – means that many central and south American countries offer unparalleled value.

International Living rated Mexico, Panama, Ecuador, and Costa Rica in spots 2,3,4 and 5 respectively (right after Portugal) in their best countries to retire to list.

Of course there are always trade offs. Parts of these countries are quite dangerous – and don’t let anyone tell you otherwise. One of my good friends is from Ecuador, and while she can’t wait to retire back home, she has an absolutely terrifying story of being kidnapped for a few hundred dollars.

Now, she’s quick to point out that it happened at night, and she shouldn’t have taken an unmarked taxi – she should’ve known better – but that’s still a red line for some retirees. It might be worth noting that she and her Canadian husband have decided to retire to Manta, Ecuador, as opposed to the more “colourful” capital city of Quito.

Similarly, there are tens of thousands of American and Canadian expats living in Mexico who understand that there are some parts of the big country that are very dangerous – but they simply choose not to go there, and/or not do a lot of 2AM partying in places that might attract a certain rules-optional demographic.

I have also had several friends who have been physically threatened in Canadian cities as well (some in broad daylight), and I’ve had my Canadian home broken into twice. On a separate occasion I waited over an hour for the police to respond to an emergency call in regards to someone threatening physical violence. I think the bottom line is that one has to weigh safety risks fairly, and given how difficult it is to really get to the bottom of crime statistics, I think it’s worth reiterating that specific location matters a lot more than country-wide statistics.

Go to these places and stay for a month. Meet locals, meet other expats, ask them for their lived experience – then make your decision. Finally, remember that you shouldn’t compare relative safety to a perfect utopia, but rather the alternative towns/cities you were considering for retirement residence.

In giving Panama, Mexico, and/or Costa Rica a fair shake you might just fall in love with Central/South America’s:

- Incredible weather

- Luxurious lifestyle you can purchase for $2,000-$2,500 CAD per month (see Numbeo.com for details on specific areas)

- Warm and inviting local culture

- Relatively easy ways to get long-term visas

- 50% discounts for seniors on sports, concerts, hotel stays, airline tickets, etc.

- Potentially paying NO TAXES on income if immigration plan is setup correctly

2024 Update: While my wife and I didn’t personally visit Panama, Ecuador, Costa Rica, or Mexico over the past year, we talked to several people who were in the process of retiring, or who had successfully retired in all four places. Their thoughts largely continued to confirm everything that I wrote above.

Most notably, being close to Canada/USA (and in a similar time zone), the outstanding weather, excellent healthcare, and comparatively easy paperwork (relative to the stories I heard from Europe and Asia) made these four central/south American countries highly desirable.

And that might be part of the potential problem… too many expats are moving, so prices are edging up in all four areas. Higher prices were especially prominent in Costa Rica. If you don’t have an investment portfolio to fuel spending in Costa Rica, it might be difficult to keep up.

More than ever, I think one needs to do their homework on neighborhood-specific safety in Ecuador and Mexico. Drug cartel battles have really picked up in both places, and I’d personally be getting pretty nervous. That said, everyone has a different risk tolerance for these things.

My Ecuadorian friend still wants to retire in Manta, but even he was shaken when the mayor was assassinated last year in the latest drug-related battle. Various crime index readings will tell you that Manta is substantially safer than Guayaquil and cities close to the Colombian border. Cuenca is safer still.

Interestingly, American cities such as Memphis, Baltimore, and Detroit, are all considered about as dangerous as anywhere in Ecuador – and there are plenty of folks living in those cities. In a Canadian context, our more dangerous cities are still rated safer than Manta, but slightly higher than Cuenca.

Again, it’s probably worth repeating that safety often boils down to being aware of surroundings and day-by-day choices made about where to live and where to visit – as well as what time of day you are referring to.

Should I Retire to the USA?

I left our big cousin to the south for last because while it might be one of the most compelling options for Canadians to spend several months per year in (*cue the snowbird migration each November/December*), it is very difficult to retire there if you are not an American citizen. If you watch the news at all you might be somewhat familiar with the uh… passionate debate around non-Americans gaining residency status in the USA.

The USA does not have a retirement visa program. There is a “golden visa” option if you have $800,000+ to invest, but I’d argue there are better options around the world for that price.

Consequently, it’s not really worth talking about the rest of our retire abroad checklist, as the USA will continue to be much more of a “spend 6 months or less” retirement destination for Canadians.

FAQ About the Best Countries for Canadian Expats to Retire In

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Thank you, Kyle for this great article. It was not only informative, but quite funny as well. At times, I was LOL from the spin of “soft sarcasm” and “black humour”. I will read your Ebook later this week as I am now planning more seriously for my retirement (in 2 to 2.5 years). I feel quite overwhelmed though – not so much with the financial planning (that has started many years ago); it’s more about which country to choose based on tax ramifications, and medical/health insurance…Being a Canadian from Quebec, my preferred choice would be Mexico since it is closer, same time zone, etc…But yes, I am a bit weary and at a loss about finding the “right” location/city in Mexico….Having said that, your article is a very good starting point in helping me organize my thoughts and decision process. Hope you continue writing these articles and sharing your experience ….

Glad to hear that it helped Mady! If I could be so bold as to make another recommendation, you might want to check out my course on Canadian retirement, I think you’d find some great value there. It also has a full money-back guarantee!

This is the article and ebook needed after tons of research. Really impressed!

my question, I will be getting a pension from my employer (government job) due to a PTSD.

If i retire abroad, will my income be taxed only in the residing country? I would move to Europe where there is a treaty with Canada, so I know i won’t be double taxed.

I just don’t understand if they can withhold a percentage (15-25%) or if it only includes OAS and CPP contributions and not the income i earn.

in the end, i will be getting taxed at the same rate in Quebec if i live in Italy, spain, Portugal etc.

thanks and keep up the good work

Hi Alec,

Good question… not sure on that one. I know for sure they can withold OAS and CPP payments, and that recouping that money ultimately depends on the tax treay between the two countries. I would think an employer pension would be the same way.

This is great, thanks Kyle. We are planning retirement in the next few years, currently in Vancouver. We are exploring options like downsizing in Canada and being snowbirds or just living elsewhere in the world. Costa Rica, Spain, maybe even Croatia are all considerations. I have Polish citizenship so moving to the EU should be easier for me though I haven’t really looked into it. I’m not sure if that extends to my wife, who is Canadian.

You might find Croatia not nearly as affordable as it used to be! Especially now with the full EU status!

I am jealous of your EU credentials for sure, and I believe your wife should get pretty automatic residency status if not citizenship (which would be more complicated and depend on Polish laws). A rural small city in Spain would make a lot of sense to me.

Kyle, I’m in the same boat as the above person. My wife has an Irish passport but is not a citizen yet the passport allows her to live in the EU. I on the other hand only have a Canadian passport and citizen ship. Both our sons live in the EU (and are not coming back to Canada). Do I qualify via marriage to also live in the EU and not run a fowl of Schengen rules?

If you’re not sure but know someone who specializes in this, I’d appreciate their contact information. I’ve searched and can’t find the answer or a legitimate consultant to help.

Hi Kevin,

It would depend on what Ireland’s residency laws are. Obviously eventually you’d like to get your Irish Citizenship in this situation, but you only need your Irish residency to live in the EU.

I’d personally contact the folks at Objective Financial – they handle a ton of expat stuff. I know Andrew Hallam recommends them as well.

although I know there is a departure tax when leaving Canada I never see it written about as something that people see as prohibitive. Is there a way around the departure tax and or ways to mitigate it?

Not that I’ve seen Pat. I think a lot of the reason that you don’t read much about it, is that most folks don’t have a lot invested outside of a TFSA and/or RRSP. It does sting non-registered accounts and real estate for sure. If you try and do something fancy with dividends and corporations, they’re going to get you on increased corporate tax rates and that 25% witholding tax in the years to come.

What do you think of Latvia? ( I like winter)

I’ve never been, but the Baltics seem really cool to me Dagv, and are definitely on my bucket list. Heck, if climate change continues at its current pace, Latvia or Estonia’s winter is going to basically be a 2005 Canadian spring!

Also what are the rules around residing in another country, while still virtually managing a brick-and-mortar business in Canada? Can you earn a Canadian income without having a Canadian address?

That’s going to be a tough one as well Mitchel. The difficulty is going to come with the CRA deciding if you have in fact severed residency. Owning a company in Canada is going to be make it difficult to claim your fully severed. That said, you can do it – but your company will now have a much higher tax rate due to it being owned by a non Canadian. There are non-Canadian owned corporations that operate in Canada – so it’s possible. But like I said, it’s going to make life a lot more complicated. You’re going to have to pay non-resident corporate tax on that company, and then a witholding tax rate on the non-elgible dividends generated as well.

thank you so much for the reply. So essentially when it comes to business taxes, citizenship isn’t the only factor, but actually residing in the country is a more determining factor. Interesting because I’m not sure if I’ll ever “fully” retire. Because I love what I do as a business owner. But I wouldn’t hesitate to step back and live elsewhere while it continues to run.

Yup, residency is the key when it comes to taxes.

One option I might think about is to take a minority stake in your company. This would mean that it is now a “Canadian Controlled Private Corporation”. Thus it would qualify for lower tax rates. You’d still have the dividend witholding tax, but that’s manageable.

Alternatively, completely selling the company, and having the new owner pay you a salary or freelance rate might also work.

once someone changes their official residence and loses their Canadian medical coverage, what is the process of regaining it?

In the event that someone needs to move back to Canada for a severe condition that their private coverage abroad may not cover?

i think that’s a fear for a lot of seniors, considering people are working and retiring later in life. The chances of developing complex conditions is higher.

Hi Mitchel,

“Regaining” your medical is roughly the same as any other new resident in Canada. You have to prove residency and then you will get your new provincial health card. The specifics vary by each province. The idea of moving back home to get coverage for a severe condition isn’t really an option.

That said, when you say, “private coverage abroad” I wonder if you’re talking about travel insurance – and not health insurance? Most health insurance packages that I’ve looked at include the majority of serious debilitating disease. That said, there is no doubt that complex health issues are no fun to navigate no matter where you are.

Thanks for replying. Ya I was referring to health insurance. Obviously I don’t expect you to have details on all the options available in every country. But just imagining it might suck for a person to discover that they require an expensive medication that isn’t fully covered. Or something reoccurring like weekly dialysis which might tip a person into a higher premium that is out of budget for their standard Canadian pension.

without getting into too much detail I can say I’m on a med right (not permanent) now that costs me $60 per bottle that I know some ppl in the states are paying $300 a bottle for.

That is a logical fear Mitchel. I will say for sure that comparing to the US isn’t a good starting point, as I can almost guarantee they will have the highest cost meds around. Here’s how I know that: When you look at getting full healthcare coverage around the world, there is usually 2 quoted rates. One for coverage that includes the USA, and one that includes everywhere except the USA. The difference in premiums is massive.

You’d have to get a direct quote from an insurance company in regards to your preexisting condition. I personally have looked into IMG and Cigna and have found them both responsive – if pricey for the more “full service” options. You could also ask your doctor if your specific medication is available to purchase outside of Canada. I would think there are very few medications that you can buy in Canada that you can’t buy for a similar or lower price in Thailand or Portugal. I’m sure there are examples, and I’m certainly not firsthand experienced – but obviously folks exist with these conditions in other countries I’d assume?

In regards to weekly dialysis… I’d probably stick to Canada just for the difficulty in mechanics of care if that was the case. Maybe snowbird instead of full out residency shift.

As an american who is now living in canada i can vouch for that as ive had to file bankruptcy twice, because of health care issues! And im a young dude!!

Really good article and thanks for the links.

My situation is a bit different in that my wife and children have Irish passports. My wife can move to the EU and get all the medical benefits right away. My kids currently work in Europe and aren’t coming back to Canada.We both still work.

I haven’t found anyone who can answer my question. As a spouse with only a Canadian passport (citizen) whether or not I can easily move to Europe without restrictions such as medical or limited stays in the Schengen areas.

Hi Kevin,

What you would need to do in order to get medical is get some sort of residency status in an EU country. There is obviously unique rules for each country. This site seems to explain the exact process for Ireland: https://www.citizensinformation.ie/en/returning_to_ireland/residency_and_citizenship/returning_to_ireland_with_your_non_eea_spouse.html Once you have residency as outlined in that article, then you start the naturalization process to become an Irish citizen. Make sense?

Thanks for sharing the informations Kyle. I am from Southeast Asia, have lived in Europe ( Germany and France , still have family there ) and came in Quebec in 1993. The first years, I was homesick ( cultural shock ) and the cold and long winter here didn’t help much. It was always in my mind to go back to Europe when retiring. But now that I am from a few year to retirement, I think I will stay here. Canada is the best and safest country to live . I will travel and enjoy the travelling, but I don’t leave Canada which is my home .

That’s excellent Lili. Glad that it has worked out so great for you. You really think Canada is the safest country in the world though? Where I lived certainly was not.

Wow! Another comprehensive post full of valuable information.

A couple of questions:

1) For OAS eligibility, I checked some of the forms on the CRA link you shared (58 countries with social security agreements) but they seem to be for those who were detached or sent while working for a Canadian entity. Do you know if the eligibility extends to working for a non-Canadian company or entity?

2) Though all the countries you mention do have a generally lower cost of living, I can say from personal experience, that many countries, like Mexico, are experiencing high inflation which coupled with a weak CAD definitely mean you have much less buying power. I recently wrote this post Cheap living in Playa del Carmen is an urban myth | by Tracy Collins | HustleVentureSG | Feb, 2023 | Medium where I do a line-by-line comparison against International Living and show that Playa del Carmen costs at least $4K USD compared to the famous $2K budget touted in earlier years.

3) I also noticed with keen interest at the bottom of the LATAM section that you mention Potentially paying NO TAXES on income if immigration plan is setup correctly – I am very interested to learn more about this. Having just left the Middle East, I am already a non-resident of Canada for tax purposes. This is exactly the type of advice I’m looking for as I navigate the rules in Mexico. But if it’s not relating to Mexico specifically, I’d still like to learn more in case there’s another more favourable tax advantageous country like Panama etc.

Thanks again as always…

Hi Tracy,

Thanks for the detailed comment! I’ll try to make sure that I get everything here.

1) I am certain that if there is an agreement between the countries that it extends to non-Canadian entities as well.

2) Absolutely true. The days of Playa, Panama City, or much of Costa Rica being “cheap cheap” are gone I think. (We actually got married in Porto Aventuras, so I’m familiar with the area.) I know that folks in Lisbon have really criticized IL in the past as well. The Canadian Dollar has held up much better against the SE Asian currencies and it’s actually still not too bad against the Pound and the Euro either. I think long-term it’s not too bad a bet, so hopefully that evens out.

3) If you sign up for the expat eBook it has more info on this Tracy. It’s all based around the idea of “territorial taxation”. If you want to chat after you read the ebook, I give my booking details in follow up email. I personally know several people paying 0% tax in Panama at the moment.