Ask the Readers: What’s in Your Wallet?

The personal finance blog group, The Money Writers, came up with the idea of writing a post about the contents of a blogger’s wallet. As it’s a regular occurrence for me to bare all (financially) on this blog, I agreed to play along as some of my readers may be curious as well.

What’s my philosophy on what I carry in my wallet? I try to keep things as minimalistic as possible, but as a fan of rewards points, it can lead to more than a few cards in the wallet.

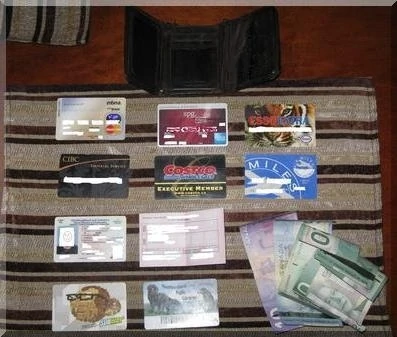

A picture is worth a thousand words, so here is a picture I took last night of the contents of my wallet:

- The Wallet – Starting at the very top, you’ll see my 12 year old wallet that has seen better days. What else did you expect from a frugal guy?

- Credit Cards – At the top left, you’ll see my main credit card – The MBNA Smart Cash credit card. This is a no annual fee card and is my pick for the top cash back credit card in Canada. This card will give you 2% cash back on gas and groceries, up to $400 in spending per month and 1% on everything else. Next to that you’ll see the American Express SPG credit card. You may be thinking, what is a fee based card doing there? I signed up for this SPG card as I’m already committed to the program from collecting points via the canceled MBNA SPG Mastercard. The first year annual fee was waived with the AMEX, so I figured it would extend my points by another year as points get lost after one year of inactivity. I’ll likely cancel the card before they charge me for the next year.

Update April 2013 – We’ve cancelled our SPG AMEX and added the Capital One Aspire Cash World card to complement the Smart Cash Card. We use the Smart Cash for gas/groceries up to the monthly 2% limit, then use the Capital One card for everything else (1.5% cash back).

Update Sept 2013 – The Capital One Aspire Cash World has been discontinued. You can see my picks for the next best cash back credit card here.

- Rewards Programs – To the right of the AMEX, you’ll see my Esso Extra card. I tend to stick with the same gas station which I’ve read is good for the car, and also good on the points. I use the Esso points mostly for free car washes. Other rewards programs that I follow are Airmiles and on occasion, we share a Subway sandwich if we are on the run.

- Bank Cards – I used to carry two bank cards, but have reduced to only carrying my CIBC card as I rarely use the bank machine for my PC financial account. I’ve been doing my banking with CIBC for years, thus the black convenience card.

- Other Cards – In my “misc” cards pile, there’s my Costco Executive Membership, my drivers license, insurance, and, of course, a library card. Since we’ve been doing a lot of our shopping at Costco, the upgrade to the Executive membership made sense as it pays for itself with 2% cash back. The library card also gets quite a bit of use as it’s a fun destination for the kids.

- Cash – Hard to believe but I didn’t know how much cash was in my wallet until I took everything out. I like to have a few $20’s around in case cash is needed which is actually quite rare. I tend to use a credit card for everything possible.

How do the contents of my wallet compare with yours?

Here are the wallet contents from some of the The Money Writers:

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Costco Capital One Mastercard

Debit card

Driver’s License

these are really the only 3 I use with any regularity. The rest really should go into a 2nd wallet storage type so the primary wallet does not get too big (similar to George Castanza in Sienfeld)

Driver’s License

Health Card

PC Debit Card

PC MC

CIBC Visa (only if places don’t accept MC, seems to be getting more frequent)

Air Miles (gas only – this will soon be gone as moving to another town where I can fuel up at PC-related gas station for instant cash-back for groceries)

Pizza Pizza card (occasional lunch at work)

$5 (I try to keep $20 in wallet at all times)

The more people continue to use credit cards and not cash, the more we are headed to a cash-obsolete society. We are giving up our right to privacy and allowing the government (and other institutions) to trace every expenditure AND every move we make (when purchasing). Not the kind of world I care to live in.

CASH BABY!!

two credit card, two debt cards, blood donor card, cash would have liked more than i found, photos of wife and children, and that is it ,thanks for the post

Totally off topic but I love that it is Canadian content! Really helps a fellow canuck relate :) Excellent post

Regarding comment #20

Wallet goes in front right pocket. Easier access, and more comfortable when sitting. Cheers

@marina: Get your SIN card and Birth Certificate out of your wallet! There’s no reason to carry those anywhere.

Here is what i have in mine

SIN

BIRTH CERTIFICATE

OHIP CARD

AIR MILES CARD

TD BANK CARD

TD BUSINESS ACCESS CARD

TD BUSINESS VISA

CIBC AEROGOLD VISA

CANADIAN TIRE OPTIONS CARD(FOR CANADIAN TIRE MONEY)

CAPITAL ONE CREDIT CARD WITH 5.9% interest rate

I have $100 in bills and about $10-12 in change in my wallet.

I don’t drive and my husband has the costco card.

Some people should really just print or stick the barcodes of their bonus cards onto a cardboard one.

Or understand that there’s no need to carry around family photos and museum cards that are not needed for the moment.

I recently bought a new lady-like and grown-up wallet. It has quite a few pockets so I’m carrying all manner of things with me.

Driver’s license

Library card

Bank card

My beloved Visa Debit card

Health membership card

Movie points card (kind of irrelevant since I work there)

University book shop life membership (a really great discount!)

Store reward points (jewelry, beauty, expensive department store)

Cash — no more than $40

Receipts, lists, coupons and a fitness timetable for the gym

It doesn’t bulge and everything fits nicely.