9 Ways I Reduced My Taxes Last Year

In this article:

With 2008 done and over with, it’s that time of year to start thinking about the dreaded T word… taxes. On one hand, I enjoy strategizing about legitimate methods to reduce income tax. On the other hand, I don’t enjoy paying them.

Below are 9 ways I reduced my income tax in 2008 which can also be used for tax planning in 2009.

- Maximized my RRSP – This is perhaps the easiest and most common method for the everyday Canadian to reduce income tax. With higher income this year, I made it a point to maximize my RRSP this year. How does this tax deduction work? Check out this post on how to calculate the tax return on your RRSP contribution. If you have a spouse that isn’t working, then a spousal RRSP might be something worth looking into.

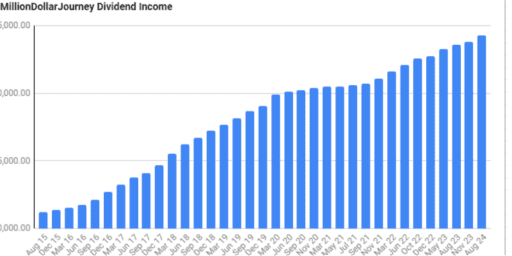

- Opened an Investment Loan for my Non-Registered Equities – We’ve all heard the advice to never invest purely for the tax benefits. This is no exception. In this case, I opened an investment loan to take advantage of my home equity and invested the proceeds in strong dividend paying companies. I’m hoping that over the long term, the dividends will provide a steady stream of income beyond the interest payable. In other words, I’m started a modified Smith Manoeuvre investment strategy. What are the tax benefits? The interest charged on the loan is tax deductible. The larger the investment loan, the larger the tax deduction. The higher the marginal tax rate, the more appealing this strategy becomes.

- Claimed my Home Office – With a home based business there is an opportunity to claim the home office as an expense. What can be claimed? A portion of home expenses as a percentage of the entire living space along with equipment purchased for the business. For example, if the home office is 10% of the living space, then 10% of the mortgage interest, property tax, insurance, and utilities can be claimed as a tax deduction.

- Kept my Medical Receipts – Even though we have free health care in Canada, prescription medication costs can add up! With the pregnancy and baby this year, we had higher than normal medical bills which can be claimed if they exceed a threshold (~$2000 or 3% of your income, whichever is less). Eye glasses, dental visits, physiotherapists, chiropractors etc. also count.

- Donated to Charity – Philanthropy not only has the benefit of helping others who need it most, it can also provide tax benefits. Money or stock donated to a registered charity is eligible for the donation tax credit. I’m personally trying to increase my charitable donations on an annual basis.

- Tax Loss Selling – Any equity sold in a non-registered account for a loss is eligible to claim the capital loss. I took advantage of this strategy this year to raise cash to pay down my mortgage in addition to reducing capital gains tax paid in the previous three bull years. Note that capital losses can only be claimed against capital gains 3 years back or carried forward indefinitely.

- Invested in Business Growth – Buying “stuff” for a business simply for the tax reasons is a terrible idea. However, investing in business growth and claiming the expense is another story. This year, I expensed business advertising, a little business travel, and spent more on hosting to support online growth.

- Organized all my Business Receipts – This goes hand in hand with investing in business growth, but keeping your receipts organized can help a great deal. Technically, you cannot claim an expense unless you have the physical receipt. In the past, I would misplace a lot of receipts. Over the past couple years, I’ve used a filing cabinet to store tax receipts in an organized manner.

- Family Account Structuring – With my wife on maternity this year, she had a reduced marginal tax rate. With that said, we let her high interest savings account accumulate in her name untouched, while using my savings to pay down the mortgage etc. This does not save a large amount of money, but every bit counts!

How did you organize your affairs in a tax efficient manner this past year?

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Posted in Tax Minimization

@Dan Thanks a lot, Dan. I appreciate it.

@Arsinel CRA states that you can’t claim child care expenses if the child care was provided by someone who isn’t arm’s length. In other words a mother, father, etc. Here is a description from CRA that should help: http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns206-236/214/pymnts-eng.html

Hello! I would greatly appreciate it if anyone could answer the following burning question for me. My wife and I have two children (both under four years old). My wife runs a family day care at home and obviously our children attend her day care. The question is this: can we pay child care to the day care and claim child care expenses later when we file our income taxes? And if this is possible, would it be in our advantage to do so?

noblea,

you don’t amend previous year’s return, you simply file a T1A with this year’s return, http://www.cra-arc.gc.ca/E/pbg/tf/t1a/README.html

As to your second question, you will see from the form itself, you can apply the refund to any 2008 taxes owing.

No need to hire expensive accountants, a simple search on CRA’s website does the trick.

Nobleea, you may have to contact an accountant on that question. I’ve claimed capital losses before, but it was an accountant who took care of it.

FT, how do capital loss carry backs work? Do you essentially amend your previous years tax returns?

What if you owe money for this tax year (not due to capital gains), but then the loss carry back would give you a refund for previous years? Do you still pay the amount owing and then they’ll refund you for the previous years based on the amendment?

For the medical expenses the decuction is allowed for 12 months of expenses as long as the 12th month falls in 2008.

For example on the 2008 taxes I could write off expenses from Feb 1, 2007 to Jan 31, 2008

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ncm-tx/rtrn/cmpltng/ddctns/lns300-350/330/lgbl-eng.html

gmr, i’m not sure about medical expenses, but I know that you can add up 2007 and 2008 charitable donations and claim it under one spouse.

Can someone give me an easy answer on the medical bills and Charitable donations?.

Can I add up all my Medical Expenses and Charitable Donations for 2007 and 2008 and can I claim them in a lump sum in each catagory on my taxes.

Thank you.

Abid- I was positive that you could carry over previous unclaimed medical expenses from previous until researching further after reading DK’s post above. Despite my perscription and treatment amounts being considerable they have never been large enough to make a difference on my taxes being a student and having extended heath coverage through my parents work. I found this helpful:

“For both parts of the medical credit, the total

qualifying medical expenses will include

those paid within any 12-month period

ending in the year. Therefore, you have some

flexibility in choosing the 12-month period,

and obviously should pick the period in

which the most expenses were incurred. In

the year of death, this period is extended to

any 24-month period that ends in the year.”

Borrowed from http://www.apa-ca.com/en/PDF/Tax%20Letter%20September%202008.pdf

I guess we will both have to round up all of our receipt and see which 12 month period ending in 2008 cost us the most money!

Rob & Peter,

In my travels I read that you can claim your 20% paid portion of your benefits but you can only claim your contribution to the plan if it is not taken pre-tax from your income.