US vs Canada: Trump Tariffs Lead to Trade War

With so many Canadian plugged into the latest Trump Tariff news, I felt that I needed to get an updated trade war column out as soon as possible!

So what I’m going to do today is update an article I wrote back when we were taking our first baby steps into Trump Tariff reality. Below you’ll see a ton of info on what tariffs are, what Canada’s situation is in regards to the big picture effect on our economy, and finally, what the impact is likely to be on your portfolio.

But first, just to bring you up to speed, here’s what the President announced in his big “Liberation Day” speech – complete with grade-five-science-fair-style cardboard visual aid.

- A baseline tariff of 10% will be imposed on nearly all imported goods from all countries. This tariff is set to take effect on April 5, 2025

- Canada and Mexico will not – for the moment – be part of that 10% baseline tariff.

- Canada and Mexico trade is basically now broken up into three categories: goods that are USMCA-compliant, goods that are not UMSCA-compliant, and goods that are in sectors that Trump wants special rules for.

- USMCA-compliant goods are actually in the best spot of any imported goods in the world right now – as they get to enter the USA tariff-free!

- Goods that are not UMSCA compliant are still under the 25% “Fentanyl Tariff” rules.

- We already knew about potash and fossil fuels having their own 10% tariff rules, but it appears that lumber, steel, and aluminium will continue to have their own special place on the Trump Tariff list as well.

- Likely the biggest Canada-related news was that the 25% tariff on automobiles will be applied to Canadian-made vehicles (despite the USMCA explicitly outlining this as being illegal).

In regards to the rest of the world, the most noteworthy developments were:

- An additional 34% tariff on China, resulting in a total tariff of 54% when combined with existing duties.

- European Union: A 20% tariff.

- Japan and South Korea: 25% and 24% tariff respectively.

- India: 26% tariff.

- Vietnam: 46% tariff.

- Many many many other tariffs.

As we hit publish on this article, countries around the world were announcing retaliatory tariffs and US stock market futures were showing that the overall US stock market was set to lose 4% as it opened on April 3rd.

The best quote that I heard in regards to summing up this whole mess was from Flavio Volpe, president of the Automotive Parts Manufacturers’ Association who stated that the new tariff situation was “like dodging a bullet into the path of a tank.” He went on to write, “The. Auto. Tariff. Package. Will. Shut. Down. The. Auto. Sector. In. The. USA. And. In. Canada,” and then, “Don’t be distracted. 25% tariffs are 4 times the 6/7% profit margins of all the companies. Math, not art.”

It appears that the rest of the world is finally waking up to the same reality that Canada and Mexico have been experiencing for the last two months. There’s much more that could be written about the gnashing of teeth and simply incredible quotes from the President such as, “An old-fashioned term that we use, groceries. I used it on the campaign. It’s such an old-fashioned term, but a beautiful term: groceries. It sort of says a bag with different things in it.”

Oooook.

For now, take a deep breath and read what I had to say a month ago in regards to your stock portfolio. The reality was true then, and it’s true today. In my predictions column back in late December I wrote:

“One of the most pressing questions for Canadian businesses in 2025 is whether the newly elected U.S. president will follow through on his promises of large tariffs on Canadian imports.

Trump’s fixation on trade deficits could lead to a significant shake-up in the global economy. He appears intent on generating tariff income to support the legislative groundwork for corporate tax cuts. His “national security” justification may lack substance, but it could still trigger sweeping trade policies.

I don’t actually believe that Mr. Trump understands how trade wars actually work, and he hasn’t cared to learn anything new in several decades. So the hopes better angels will talk him out of this are perhaps misplaced.

I believe even more strongly that the President-elect doesn’t understand how trade balances work, and consequently, he does not understand that in buying goods from Canada with a strong US Dollar, his constituents (US consumers) are winning! There is no “subsidization” of Canadian business going on here.

While a blanket 25% tariff on all Canadian goods seems unlikely, a more targeted 10-15% tariff on non-energy products feels probable. If that happens, Canadian businesses would face a challenging environment, and retaliatory tariffs from Canada could escalate tensions further.

My guess is that we’ll see some major disruption in Canadian manufacturing, with supply chains snarled, and some factory commitments being delayed indefinitely as companies decide to move more operations within the USA for the next few years at the very least. I’d also be pretty worried if I was a farmer and/or worked in the dairy industry. Some of these tariffs might come off when the overall North American trade deal is finalized.”

I’d say that held up pretty well!

The key here is definitely not to panic. The Canadian stock market has actually held up pretty well so far – and as always, it’s key to remember that the vast majority of the companies in Canada’s stock market DO NOT depend on selling specific goods to the USA. It’s also worth noting that a lot of companies that weren’t previously UMSCA-compliant are likely to become so in a hurry. If that happens, there might actually be a lot of Canadian companies in an enviable position relative to the rest of their global competitors as they will have no tariff to worry about (for now) versus 10%-50%+ for other countries.

This isn’t going to be good for any of the world’s economies, but the Trump Tariffs are already proving very unpopular with US Citizens and even among Republican politicians. Read on for more detailed reasoning on why you don’t need to do anything drastic in the face of these latest Trump tariff developments, and the broader US – Canada Trade War that has now expanded to include the rest of the world.

Trump (Delayed) Tariff Details

So – what is a tariff anyway?

A tariff is a tax by a government on foreign goods coming into a country. The import company (or person) pays the tax to the US federal government. In the vast majority of cases, the company then turns around and sells the imported product for a higher price (and possibly also takes a hit to their profit margin).

Trump’s tariff summary:

- A 25% tax on all imports – aside from oil. This happens on Tuesday, February 5th.

- A 10% tax on oil. This is supposed to kick in on February 18th.

- Mexico will see a 25% tax on all of its imports.

- China will get a comparatively light 10% tariff on its imports.

- Canada will respond with two-phases of tariffs in response. They will total $155 billion of US goods.

- Mexico hasn’t finalized details but announced tariffs ranging from 5% to 20% on US imports including pork, cheese, fresh produce, manufactured steel and aluminum.

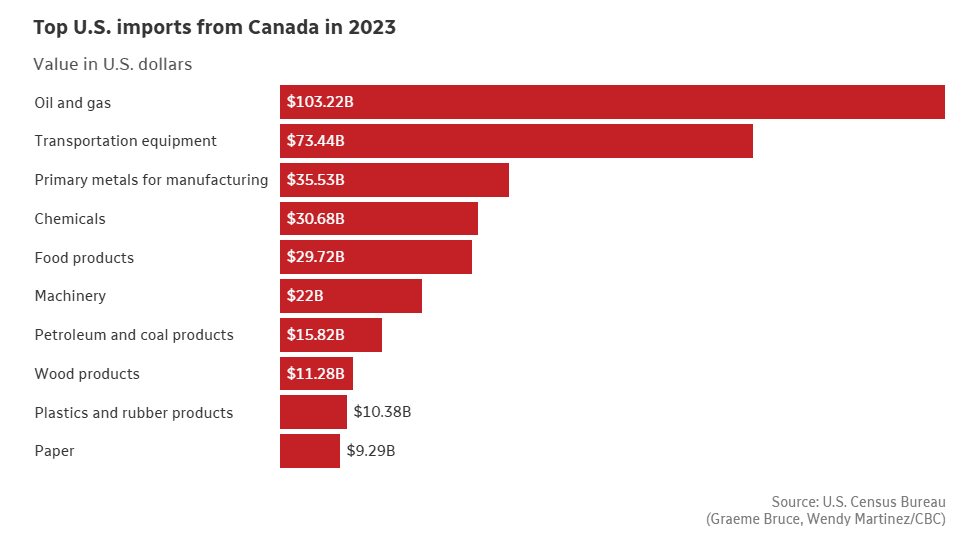

If you’re wondering what we send to the USA – it’s a lot (we don’t have 2024 numbers finalized yet).

The potential fallout from U.S. tariffs looms large. If the worst-case scenario unfolds and these tariffs stay on Canadian companies for more than a month or two, economists estimate it could push Canada into a three-year recession, shave three percentage points off our GDP, and wipe out 1.5 million jobs. While forecasts vary, one thing is clear – the economic risks are significant. It would likely be even worse for Mexico.

The USA isn’t going to get off the hook easily either. Predictions range between their GDP shrinking .3% to 1%. That range doesn’t give a precise picture of the fact that counter-tariffs will be heavily targeted with the goal of inflicting maximum pain to companies that are important to Republicans’ electoral chances. I wouldn’t want to be in the US alcohol or consumer goods business right now.

American consumers are going to immediately see higher prices on agricultural goods, lumber (which means more expensive houses), gasoline (especially in the midwest), and vehicles.

When it comes to cars, the idea that the tariffs will somehow shutdown Canadian factories and move them to the USA overnight is ridiculous. What will happen is that the complex supply chains involved for North American manufacturers will get much more expensive, and consequently it will make the final product more expensive.

Vehicle companies like Toyota, BYD, Volkswagen, and Hyundai must be licking their chops at the North American car industry shooting itself in the foot. It could be that in the long-term companies do think twice about opening new factories in Canada or Mexico, since this sort of chaos is exactly what drives CEOs crazy.

I personally think that there will be significant political blowback once prices start to rise, the stock market is going to send a strong signal, and Trump will give Mexico and Canada a way out in a couple weeks. The way out will likely include some videos to be shown that say how the border is now super safe – the safest in the world – and a promise to renegotiate the very trade deal that he signed last time (and called terrific).

That said, in my predictions column a month ago, I stated that I was pretty sure some form of tariffs were going to happen. I don’t think it has anything to do with drugs and the border. There are two main reasons Trump is blowing up one of the most peaceful international partnerships of all time:

1) He wants to create long-term uncertainty in the manufacturing world and illegally (by the standards of his own trade agreement) push companies to do more manufacturing in the USA.

2) Trump needs Tariff revenue to make the budget work for the massive tax cuts he is planning.

In both instances Team Trump knows they can put tariffs on and then take them off in 6-12 months after they have accomplished both of their goals – but before inflation has risen too much. The lack of specific demands by the White House supports the theory that this really has nothing to do with national security – but Trump needs some sort of justification for these destructive tariffs. Anyone who thinks they know where this is going for sure is lying.

Trump’s Trade War and My Stock Portfolio

Despite the dark clouds on the economic horizon, the Toronto Stock Exchange (TSX) has shown surprising resilience. Since Trump first floated the idea of a 25% tariff on Canadian imports, the S&P/TSX Composite Index has barely flinched – although it did fall on Friday and will likely open lower on Monday.

There are a few reasons why the Toronto Stock Exchange hasn’t seen its value plummet. Those same reasons are why I think panic selling right now is not a great move. Here are a few thoughts on what the tariffs (both in the short term, and then in the long-term after the vaunted report on world trade practices comes in April) might mean for the Canadian stock market.

- Many investors continue to assume that political realities will force Trump to come to the negotiating table, and that companies have prepared for a few weeks of tariffs (stockpiled supplies etc). Therefore, the overall impact will be minimal.

- The stock market is NOT the same as the economy. The economy is going to feel a pinch – but the biggest Canadian companies are somewhat insulated. Rogers isn’t going to sell fewer phone plans. A 10% tariff isn’t really going to impact oil sales in the short term, and definitely won’t impact the amount of fossil fuels flowing through pipelines.

- The Canadian stock market is chiefly made up of companies that provide services or companies that sell commodities on world markets. Shopify provides services. The big banks and insurers provide services. Those companies shouldn’t see an immediate hit to their bottom lines.

- Big manufacturers will take a hit – there just aren’t many of them left in Canada. Companies like Honda, GM, and Ford have large factories in Canada – but their stocks are not listed on Canadian stock exchanges.

- Small- and Medium-sized businesses will be the first to feel the pain from these tariffs. Eventually that will have “ripple-up” effects, but it won’t affect the profitability of the largest Canadian companies in the short term.

- A falling Canadian Dollar will help the Canadian economy sell goods all over the world. Consumers will feel the impact through inflation, but export-based companies will see increased demand for their products. Canada oil, potash, natural gas, etc., just get cheaper for Americans to buy the lower our dollar goes.

- The government has already said they will cut interest rates and pour fiscal stimulus in. That’s always great news for company valuations.

- Retaliatory tariffs by Canada will help a few Canadian companies on the margins as more people “buy Canadian”.

- Perhaps the biggest thing one needs to keep in mind today is that negative news has already been baked into stock market prices. In other words, the time to sell was last week or two months ago. If you’re in now, you might as well stick to your asset allocations strategy and see how it plays out.

So What Should I Do?

Sadly… When it comes to Trump tariffs and your portfolio, there probably isn’t a lot you can do. The bad news has already impacted a lot of valuations.

At this point, there seems to be no way to predict the final outcome. Trump claims that his goal is to prevent fentanyl from crossing the border. That’s likely just to satisfy the legalities of tariffs being declared. If stopping fentanyl from reaching the US is the goal, how in the world does one justify a tariff that is 250% higher on Canada than it is on China?

Consequently, the only thing we really know for sure is that Trump is solely responsible for these tariffs, and that we don’t know what his goals are. That means it’s very hard to predict the short-term and long-term consequences in regards to Canada’s economy and your portfolio. Obviously, if the economy enters a recession after 2+ months of these tariffs, it will eventually hurt the railways and the banks, etc. That said, if it’s over relatively quickly, the damage to corporations’ bottom lines should be pretty minimal.

It’s also worth noting that while Canadian stocks are valued somewhat above historical averages right now, they’re by no means as “stretched” as their US counterparts. There are many reasons for that, and I’m not saying American stocks don’t deserve their price premium – I’m just pointing out that expectations for Canadian profits weren’t sky-high before Trump tariffs came into play, so they might not have that far to fall.

Oh – one other thing worth mentioning is that we’re not really sure how this is all going to shake out when it comes to interest rates. It’s very likely that we continue to cut rates in Canada if unemployment starts to creep up as the result of a tariff-driven recession. On the other hand, if inflation rates start to go up as a result of less competition to produce goods, as well as increased costs to do almost anything, then there will be pressure to dial back those key interest rate moves.

While I confidently predicted that the Trump tariffs would come to fruition a month ago, I’m much less sure of where things are headed now. Trump has already signalled that counter-tariffs from Mexico and Canada would result in yet more tariffs being dumped on each country. This is generally how trade wars begin, and they get ugly quickly, so the potential is certainly there for really bad outcomes.

On the other hand, if Canada uses this newfound sense of purpose to lower provincial trade barriers, build better export infrastructure, and then negotiates its way out of the Trump tariffs – we could end up in a much better spot than we started. Especially if Trump raises tariffs on China and other countries around the world (thus giving us a market access advantage again).

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Stay in your seat and fasten your seatbelt.

This article was highly informative. I was, however, hoping to see some ideas around investing during the current climate. Or is it best to keep some cash on hand to invest at lows in a month or two?

Hi Chantal,

I personally wouldn’t be actively investing. If you find yourself quite nervous, it’s probably a sign you need to rebalance your long-term asset allocation strategy right?

Great post Kyle

The arguments and first set of bullets clearly covers and explains the context- great summary.

The rest of the article is also great, thanks!

Hi Jaime – appreciate the kind words!