Net Worth Update August 2010 (+1.56) – RRSP Contribution

Welcome to the Million Dollar Journey August 2010 Net Worth Update – RRSP Contribution Edition.

It’s a little past halfway through the year and I finally got my act together and made our RRSP contributions. I figured since our cash savings was buiding up, we might as well put it to some use. The bright side is that we’ll get the tax deduction for 2010 tax year, but the other side is that I’ll need to find a place to invest the cash. In total, we contributed $23,000 in our combined RRSP’s which is pretty close to our contribution limit for the year.

What do you typically do with cash sitting in an investment account? Do you simply put it in a money market fund? Or perhaps short term bonds?

I haven’t been doing too much buying lately, with most of the action happening within the RESP acccount. If you recall, the RESP account is indexed with the TD e-Series set of low cost mutal funds. As it’s a common theme, it was close to 40% cash, but I managed to transfer some to the various funds during the correction in July. I’ll be moving more of the cash with every market dip going forward.

In terms of savings, besides the contributions, our cash savings was stronger than usual as we finally collected on some long overdue receivables.

On to the numbers:

Assets: $ 537,350 (+1.02%)

- Cash: $4,500 (+0.00%)

- Savings: $35,000.00 (-30.00%)

- Registered/Retirement Investment Accounts (RRSP): $98,000.00 (+0.26%)

- Tax Free Savings Accounts (TFSA): $19,700 (-0.47%)

- Defined Benefit Pension: $30,800.00 (+1.15%)

- Non-Registered Investment Accounts: $11,600.00 (-5.69%)

- Smith Manoeuvre Investment Account: $54,500.00 (-0.91%)

- Principal Residence: $283,250 (+0.00%) (purchase price adjusted for inflation)

Liabilities: $66,400.00 (-2.64%)

- Principal Residence Mortgage (readvanceable): $11,800.00 (-14.49%)

- Investment LOC balance: $54,600 (+0.37%)

Total Net Worth: ~$470,950.00(+1.56%)

- Started 2010 with Net Worth: $399,600.00

- Year to Date Gain/Loss: +17.86%

Some quick notes and explanations to net worth questions I get often:

The Cash

The $4,500 cash are held in chequing accounts to meet the minimum balance so that we pay no fees (accounting for regular bill payments). Yes, we do hold no fee accounts also, but I find value in having an account with a full service bank as the relationship with a banker can prove useful.

Savings

Our savings accounts are held with PC Financial and ING Direct. We usually hold a fair bit of cash in case “something” comes up. The “something” can be anything that requires cash such as an investment opportunity that requires quick cash or maybe an emergency car/home repair. We also need cash to cover any future tax liabilities.

Real Estate

Our real estate holdings consist of a primary residence plus a rental property. The value of the principal residence remains valued at the purchase price (+inflation) despite significant appreciation in the local real estate market.

Pension

The pension amount listed above is the value of both of our defined benefit pension plans. I basically take the semi annual statement and add the contribution amounts (not including employer matching) on a monthly basis.

Stock Broker Accounts

Another common question is which discount broker do I use? We actually have accounts with multiple institutions. I’m hoping to reduce the number of accounts that we hold in the near future. Here is a review of some of the more popular online stock brokers.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Just want to clarify Frugal .. u mentioned u save roughly 50% of gross income each month. I am jst blown away. are u sure u meant 50% of gross and not net.

i am guessing u are in the highest tax bracket (or maybe a notch down) .. so u are getting upto 40% – 50% of ur gross taxed. ie inhand u get 60% of gross .. of which u save 50%.

so u basically spend just 10% of the gross monthly??? that doesn’t make sense! can u clarify? if this is true .. this is phenomenal!

Thanks

@Sam, a common misconception is that someone in the highest tax bracket gets 50% of their money taxed away. The truth is that the tax system works in tiers. For example, someone in ON making more than $127k gets taxed 46.41%. You may think that it’s 46.41 on every dollar, but it’s only on every dollar greater than $127k. Below that it’s 43% down to $82k and keeps reducing down the line. So say I make $120k myself in NL, the overall taxation on my income would be around 33%. However, our family income is split between me, my wife and the business. So overall, our family taxation is probably closer to 25% after all tax deductions.

Hey how are ya?, was wondering what happened with you rental property ? did you sell ? why ? im interested in getting a rental property and just was curious what motivated you to sell, what kind of challenges you had and so on, would be a good article to write about or if out there , please send me the link, would be appreciated.

Thanks

I am blown away by your net worth. I am curious, how much of your networth is from forced savings/ increases in salary vs. actual investment profit?

Regarding sitting on a large amount of cash for retirement, Moneysense did an analysis recently on a couple that had alot of cash and were almost paralyzed when it came to spending it. It seems the savings habit gets hard to break once you retire. I am sure they have info on their website about this couple.

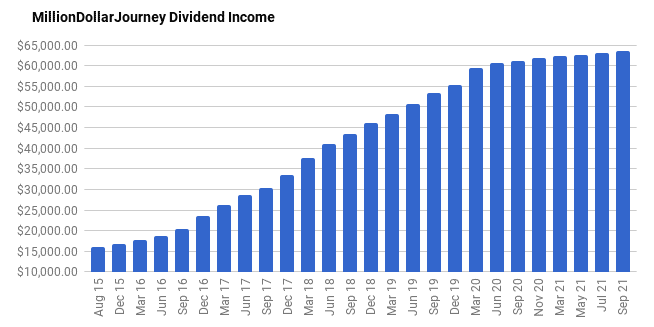

I love following various bloggers net worth updates… I’m 38 and hit 1m in net worth this past April and am now just about at 1.1m. Don’t know what I expected, but my life has remained remarkably unchanged by acheiving millionaire status. I think the magic moment will arrive when my investments are able to generate close to what I make in current salary… then I will retire… age 45 at the very latest…

Living below your means is the best way to get ahead, bar none….

@FT: I read through all the Smith Maneuver articles and I was wondering if it’s possible to do that investment strategy using TD E-Series index funds or an ETF that tracks an index. Or is the tax benefits of dividend investing too advantageous to ignore?

Thanks.

@ Mark, afaik, you can basically use any equities for the SM and still remain tax deductible. As long as it has the “potential” to produce income. So to answer your question, yes you can use TD e-series or index ETFs.

@ youngandthrifty: It’s not a set percentage as our income is variable, but I would say that it’s close to 50% of gross income.

Wow, this is very impressive, even if you are posting your net worth as a couple. You are definitely zooming along on your way to 1mil by 35.

May I ask what your % that you save per month is of your gross monthly income?

Just curious about what your strategy is if inflation gets out of control. I can’t imagine having tens of thousands sitting in high interest savings accounts will be a good plan. The obvious thing, I suppose, is to buy some silver and gold. We seem to be at a turning point in history, financially, in my opinion. The US has printed unprecedented amounts of money, plus there are trillions in unfunded liablities, which realistically cannot be paid back. And because Canada is tied economically to the US, couldn’t we easily be on the cusp of unprecedented inflation? If that is the case, then a net worth of $1 million will have absolutely no meaning. Remember, everyone in Zimbabwe were multitrillionaires before the currency collapsed. What do you think?

Very impressive numbers even in a down economy. Ive been following your site for some number of months and its cool to see an increase in net worth. I believe once you hit a specific threshold you can easily increase your net worth by investing wisely. Great job!