May 2007 Net Worth Update (+3.04% )

It’s time again for my monthly net worth update – The May 2007 edition.

This month has shown another modest increase mostly due to savings, a small tax return, and organic gains in my RRSP account.

I had a question from a reader about my last net worth statement. The reader asked how I calculated the pension amount. For me, I take the pension amount on my wife’s statement at the beginning of the year, then add her contributions to the pension on a monthly basis. In her case, it’s $300/mo.

Assets

Cash: $4,500 (+0.00%)

Savings: $35,190(+10.3%)

Registered Investment: $47,500 (+6.53%)

Pension: $17,200 (+1.77%)

Non-Registered Investment Account: $47,450 (+1.59%)

Real Estate: $ 264,500 (2 properties) (+0.00%)

Vehicles: $17,175 (2 vehicles) (-2.00%)

Total Assets: $433,515 (+1.66%)

Liabilities

Mortgage Debt(from 2 properties): $174,677 (-0.19%)

Other Liabilities: $8,000 (-0.00%)

Total Liabilities: 182,677 (-0.176%)

Total Net Worth: ~$250,838 (+3.04%)

Started 2007 with Net Worth: $224,000

Year to Date Gain/Loss: +11.98%

I’m fairly happy with the progress that I’ve made thus far in 2007 where we’ve reached the quarter million mark!. However, with the pending move this year, I expect some turbulence in future net worth increases.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

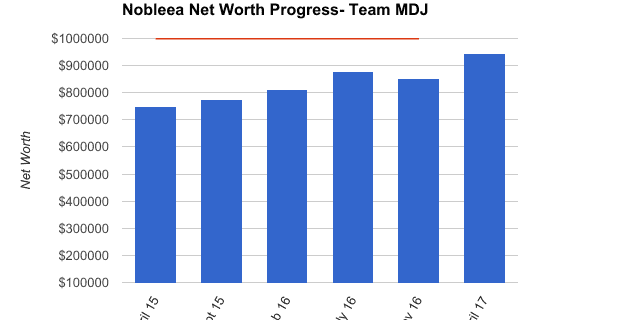

Nobleea! It really depends on how to want to keep track of your finances. Technically speaking though, Net Worth = Assets – Liability. A primary residence is considered an Asset. How I normally calculate the value of my primary residence is the price I would receive if I sold the house after real estate and legal fees.

Unfortunately, I don’t have the luxury of living in a hot housing market.

Most financial planning books I have read do not include the value of your primary residence (or mortgage) in calculations for net worth. Does your goal of millionaire by 35 include the net worth of your primary residence as well? For those of us living in hot housing markets such as Calgary or Edmonton, this would certainly help our cause!

Thanks for the encouragement guys.

FinancialBlogger: The $35k in savings is in a PC Financial savings account (4%). The reason why we’re saving the cash is because we plan on purchasing a new home soon, and we’ll use most of the cash then towards a down payment.

QCash: Good point! But I like sudden 10% jumps in savings. :)

Good job FT.

One thing I do though is if I know I have a income tax return coming, I set up an “accounts recievable” account on my NW statement because the cash you recieved is actually a credit against the income tax you paid last year.

It should be included in your NW statement of 2006 at Dec 31, 06.

That way, it doesn’t skewer your results (10% in savings increase) from what you normally would do month to month.

At the same time, if there are taxes owing, I set it up as an account payable at Dec 31.

Usually, I have a small return and my wife usually owes a little so the two amounts usually balance each other out so the overall effect on my NW is not huge.

Q

May have to rename your blog to TwoMillionsDollarJourney.com.

FJ

Well done, MDJ. According to the rule of 72, you’ll be worth $1 million in 3 years, assuming you can grow your net worth at 24% per year.

FJ

I’ll say that’s impressive – just looked up your age in the ‘about’ section.

When I was 27,28 I had about $15k in rrps, $15k in personal debt and no other assets so you are miles ahead of where I was.

Hi MDJ, That is quite impressive for your age actually. Small question, are you investing this 35K in Savings or it is just left as liquid cash in case of trouble?

Cheers,

FB.