Common Myths About Stock Market Risk

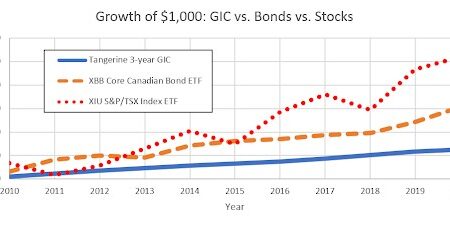

Over the years, we have found that most investors have quite exaggerated views about stock market risks, especially after 2008. While we do always advocate low risk investing here in MDJ, primarily by investing in dividend stocks, we also wanted to touch on the subject again of operating in an exaggerated environment such as the one we have now in 2021.

This time around we’ll deal with bear markets and how to handle a market crash. For further reading you can check out these articles about how does the stock market work in Canada, and how to hedge against inflation by investing in stocks.

bear markets has created fear, much of which is completely unrealistic, based on actual market history. These exaggerated fears have seriously negative results for many Canadians:

- Being too cautious during the great buying opportunities when markets are low.

- Investing far too conservatively to be able to reach their retirement goal.

Here are the facts regarding some of the most common misconceptions and myths.

1. The stock market is so risky that it can fall by 50-90%.

The short term risks are definitely significant, but the crash of 2008 has many people believing the risks are much higher than they actually are. When you invest in stocks, you need to understand that market losses of 30-40% happen (rarely), but losses of 50-90% in one year have never happened.

The worst losses, both single and multiple calendar years (excluding the 1930s) are between 30-40%. The worst calendar periods from top to bottom were 1973-74 and 2000-2, both of which were declines of 38%. 1

Monthly or daily data, or periods less than a year, may produce somewhat more extreme results, including some between 40-50%. Using monthly data in Canadian dollars, the worst 1-year period in the last 25 years has been -31.0% for the global stock market (MSCI World), -30.6% for the U.S. (S&P500) and -36.6% in Canada (TSX60). 4 Newspaper stories showing losses between 43-50% are based on the worst day and usually have been for periods less than a year, but also exclude dividends.

Occasionally, currency can make this worse. The most glaring example is the S&P500 in Canadian dollars being down 32% from 1999-2008, but most of this was the currency. Not only is this is the only 10-year negative period in the S&P500 (excluding the 1930s) since 1871, but currency made it even worse. The market was also down 14% (1.5%/year), but the U.S. dollar was down another 19%. 1&4

Including the 1930s, the worst calendar period was 1929-32 – 4 negative years in a row with a total loss of 63%. The total loss from the highest to lowest day was 83%, but huge gains just before and after this decline limited the calendar loss to 63%. 1 Our opinion is that the 1930s period will not happen again. Governments made it far worse after the initial crash by raising taxes and interest rates, and not standing behind bank deposits, which are huge mistakes they would not make again.

Therefore, assuming the future is like the last 140 years (excluding the 1930s), the biggest losses we should reasonably expect for periods one year or longer are 30-40%. There have been only 3 of these since the 1930s, but 2 of them were this decade. 1

2. “Secular bear markets” (periods of more than 15 years with no growth) have happened.

Quite a few articles and books have been published showing bands of no growth from 1929-49 and 1966-82. However, all these graphs excluded dividends from the returns for some reason, even though they are a significant part of stock market returns. The actual returns during these periods were 3.7% and 6.7%/year. 1

Despite widespread belief, when you include the total return of the stock market, you will see that secular bear markets have never happened! It is a popular myth.

Even the 1930s were not a sideways market. We really had a 4-year huge crash followed by an 11-year massive recovery.

3. The stock market sometimes crashes and takes decades to recover.

One of the biggest fears of most investors is a 10-20 year period of no growth and what that can do to their retirement plan. This fear is grossly exaggerated, both because it has not happened in history and because of the pattern of these periods.

The longest period of no growth (excluding the 1930s) was only 10 years (1999-2008).In fact, all 7-year periods had a gain, except for 3 – 1929-42 (14 years), 1999-2008 (10 years) and 1966-74 (9 years). 1

The pattern of these periods is the other reason that this fear is exaggerated.

Very few people understand how the longer bear markets work. They did not START with a market crash and then take years to recover (again excluding the 1930s). The longest periods with losses ENDED with a large market decline. They were periods of somewhat lower returns that END with a sudden, but short crash. The long periods with no gain for 9 or 10 years were periods that ended with a sharp drop that dipped briefly below the starting level.

The fear is that the market will drop and take 10-20 years to recover. The fact is that the worst periods had a sharp drop that recovered quickly. It was just that the lowest point had briefly dipped below where it had been 9-10 years earlier.

For example, the 9 years from 1966-74 ended with a big loss in 1973-74. The first 7 years (1966-72) had a gain of 7.0%/year. Then came the 2 large losses in 1973-74 that dipped briefly below the January 1966 level. 1

The only long period with a loss ended in 1974. The 2-year periods ending in 1973 or 1975 both had gains. If you START with the big losses in 1973-74, then they had fully recovered in only 2 years by 1976.

In short, while the 9-year period from 1966-74 had a loss, the longest the market stayed down was only 4 years. The 3 declines in that period (1966, 1969 and 1973-74) all saw complete recoveries in 1-2 years! 1

The only other period of more than 6 years without a gain was the 10 years from 1999-2008, which ended with a big loss in 2008. The 9 years ending the year before (1999-2007) had a gain of 3.6%/year. 1

The market has not been down for 10 years – only 1.

4. Market recoveries can take many years.

Recent news stories have claimed opinions of market “experts” that believe the markets will take a decade or more to recover from 2008.

However, recoveries from market declines have consistently been surprisingly quick.

From the bottom of the 25 calendar periods with market declines (excluding the 1930s and 2008), the market fully recovered the following year 16 times, in 2 years 6 times, in 3 years 1 time and 4 years 2 times. 1

So, 88% of declines (22 of 25) had completely recovered in 1 or 2 years. The longest recovery from the bottom was only 4 years! This is far less than most people would think.

Having a previous career in private industry, the fact that recoveries have happened quickly makes complete sense to me. During the recession in 1992, we started a massive effort to restore profits to the normal level. There were weekly cost-cutting meetings with every single cost examined and every idea to reduce headcount considered. We had aggressive promotions to maintain sales, and bid on low margin jobs to keep people working and average down fixed costs. We implemented “Kaizen” (Japanese system of continuous improvement) and ISO9002 (quality management system).

The entire atmosphere was intense and all spending questioned. Profits were back to normal the following year, but all the initiatives were maintained for several years.

This type of major effort to restore profits is the norm in most companies whenever there is a decline in profit or share price, which is the main reason we believe that the stock markets have consistently recovered quickly from declines.

Sources:

- Our own research by analyzing the calendar total returns of the S&P500 in US dollars since 1871.

- Classic book “Stocks for the Long Run” by Prof. Jeremy Siegel that has data from 1802-2006.

- Morningstar as shown in Andex Charts.

- Morningstar.

- Toronto Real Estate Board.

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Hi Cannon,

I agree. There is usually a huge difference between an investor’s return and the return of his investments. This is a constant issue for use with our clients, since people are more likely to invest after a big up year and then not invest when the market is down and cheap.

I’m not aware of a complete enough study, but the Dalbar study is a good indicator. It shows that investors in equity mutual funds earn on average about 1/3 of the return OF THE INVESTMENTS THEY OWN.

So, if you pick an average fund (not hard) and just hold it, you will have triple the return of most investors!

The reason is that investors continually buy what is currently “doing well” and sell it when it is not. In other words, investors continually buy high and sell low.

I’m not aware of a study like that with stocks, except for one study of hundreds of thousands of discount brokerage accounts that showed that the vast majority of trades are dumb. In the majority of trades, the investment sold subsequently out-performed the stock bought.

I recall some studies from the 1990s bull market that showed that most amateur investors lost money over the long term in a bull market, but I don’t remember the details now.

With indexes, ETFs, dividend stocks, etc. the general rule of thumb is that the more you trade, the worse you do. There are no specific studies we are aware of, but we are quite sure that investors in broad indexes or dividend stocks that hold for a long time will probably do okay, but investors in ETFs are constantly tempted to trade and likely will do very badly.

Day-traders and market timers are unlikely to even show a profit after decades of investing in bull markets.

In general, I’m sure amateur investors in stocks do worse than those in mutual funds, because they also tend to trade more often. The Dalbar study shows that even with mutual funds, the average investor loses 6-7%/year because of trading, which is about three times the typical MER. With individual stocks for most investors, I’m sure this loss from trading is quite a bit more.

One other study showed the average investor made 20% lower than they claimed. The average investor claimed to have made 15%/year, while the actually lost 5%/year.

As the old saying goes: “Your portfolio is like a bar of soap. Every time you touch it, it gets smaller.”

I agree that most people would be better with a forced government pension program, but I certainly would not want one for myself.

Ed

I think a more interesting figure would be the actual returns of investors’ portfolios. I would imagine that they would be significantly different because they would run the gamut from 30 different mutual funds to a few that have adopted the Couch Potato style to those who have focused on dividend income and others who use options and shorting strategies.

To me that is more telling – it is one thing to state that the individual indices returned X% but it is quite another to coldly look an investor in the eye and tell them that if they are average they might only earn half of that X%.

The challenges most people have with diverting sufficient income to investing, selecting an investment style and investments that are appropriate and yet change as their circumstances do must be fraught with peril. But to do nothing could be even worse.

I think that if the government were to offer a supplementary pension plan that the vast majority of Canadians would be well served utilizing such an option.

Hi Steve,

A lot has happened in 140 years. We have not had a black President, but there have been thousands of bank failures, World Wars, depression, huge bull and bear markets, shocking high and low inflation, etc. If something did not happen in the last 140 years, it would be hard to predict.

Of course, anything COULD happen, but 140 years of data gives us a very good idea of what is normal and what to expect in almost any market.

The purpose of the article is to show how resilient the stock market has been in all kinds of conditions and that risks, especially long term, are a lot lower than most people believe.

The reason that the US and Canada have not had 20 years of a big negative like Japan is that they have never had a boom like Japan. The Nikkei was up from about 200 in 1970 to 40,000 in 1989 – and that excludes dividends.

The return of the Nikkei from 1970 to now is about the same as the S&P or TSX – about 10%/year.

Periods of huge bull markets or bubbles have historically been followed by periods of underperformance to return the total return to a more normal return. We believe that is the main reason the S&P500 has made nothing in the last decade – a return to normal after the tech bubble ending in 1999.

Some writers such as Ken Fisher (“The Only 3 Questions You Need to Ask”) and Dimson, March & Staunton (“Triumph of the Optimists”) show that over the long term, it seems nearly all indexes have similar returns. Fisher argues that riskier indexes, such as the NASDAQ, have about the same return long term as the core indexes. The returns of stock markets of 16 major countries from 1900-2000 range between 7.6% and 12.5%/year, with 6 being between 11.6-12.5%/year and 8 being between 8.9-10.1%/year.

There were some huge crashes and booms, but they were followed by periods to make it up. Hyper-inflation from 1910-20 in some countries was made up by the boom of the 1920s. The Great Depression of the 1930s in some countries was made up in the 1940s. Some countries lost WWII in the 1940s and had massive crashes but made them up in the 1950s. And Japan’s huge asset bubble of the 1970s-80s was offset by the big decline in the 1990-2000s.

I’m not aware of any example of a major country where a decade-long major market decline was not essentially made up the previous or following decade (or 2 in Japans case), although it did happen in quite a few countries’ government bonds.

If we ever have a 20-year bear like Japan, it will almost definitely either be after a bubble many times larger than the tech bubble or before an unbelievably big recovery.

Ed

Hi Retirement Investing,

I’ve read quite a few articles subtracting multiple factors from returns, but I don’t know what to learn from them. I can understand excluding inflation to see the purchasing power effect, but why exclude dividends?

Try the same thing with bonds – subtract the interest payment and inflation and what happens – oh,my god, they lost money every single year! They still have not recovered from the decline in 1800.

There is no knowledge of any value in this, though.

Ed

Hi Bob,

Good point, but the recoveries we show from market declines all take into account the right math – that you need a somewhat larger gain to make up for a loss.

Ed

Hi Balance Junky,

I showed the down periods with and without the 1930s, since that period has dominated all negative stats. Many people (us included) believe that the 1930s period would not happen today, because it was made far worse by government actions.

The government did not stand behind the banks, which resulted in a run on the banks, and tried to balance its books by jacking up taxes and cutting expenses.

I’ve read some articles that claim that 2008 would have been a 1929-32 type crash if the government had responded the same.

Economists may not have taught us much, but that is one thing governments have learned.

Ed

Hi Four Pillars,

Of course, anything could happen, but if it has not happened in 140 years, then it is probably very unlikely.

The largest multi-year declines (excluding the 1930s) are similar to the largest single year declines – and both are less than most people think. The worst year since 1871 was 2008 at -37% and the worst multi-year declines were -38% (tie between 1973-4 and 2000-2).But losses over 50% have not happened in calendar years.

Ed

Hi Omagh,

I agree completely. investing with the investment All-Stars and studying them is the way to success. How did you “stand on the shoulders of giants” with your portfolio?

Ed

Hi Money-Bags,

Thanks for your comments. If you plan to pick your own stocks, you should definitely get educated first. It is far more complex than it looks.

Ed

All great points, but I have to say, in the 30s, the overall economic demands were quite a bit lower, so a similar stock market crash might have different outcomes in today’s times.

Till then,

Jean