Claiming Capital Loss from a Delisted Stock

With Nortel becoming delisted, there are thousands of investors out there still holding the delisted stock. So what happens next? How do you claim the capital loss?

As I’m not a tax expert, I contacted Tax Guy to help me out with that question. Here is what he came back with.

If you own shares of a company that are worthless because the company is bankrupt (under the Bankruptcy & Insolvency Act) or is being wound up (under the Winding-Up and Restructuring Act), you can elect to have a deemed disposition and re-acquisition at nil value (essentially you are considered to have sold the shares for $0 and then re-purchased them again for $0).

Even if the company has not officially declared bankruptcy you can still make the election if:

- The company is insolvent (i.e. it has defaulted on its loans and cannot pay it’s debts);

- It has ceased operating (this is different than de-listing or ceased trading);

- The shares have a nil market value (in this case it’s shares, traded on a stock exchange or not are worthless); or

- It is reasonable to expect that the corporation will be dissolved or wound up and will not carry on business in the future

Any of these conditions allow you to claim a capital loss. If the shares ever regain value again, the adjusted cost base (ACB) is $0 and you will have a capital gain when you actually sell them.

A note about de-listing: Just because a stock has ceased trading or has been de-listed from a stock exchange does not itself mean that a deemed disposition can be claimed. It is possible to de-list or cease trading and continue operations.

The Process Of Claiming The Loss

It is important to remember that if you have worthless shares in an RRSP, RRIF or TFSA (registered accounts), then you cannot claim a loss at all.

If the shares were held outside a registered account, then you report the capital loss using Schedule 3 of the Federal Income Tax return. You must also file an election in the form of a written letter indicating that you are claiming a deemed disposition under subsection 50(1) of the Income Tax Act.

There you have it, for all those investors still holding Nortel stock in a non-registered investment account, you can claim the capital loss (assume sold at $0) by using Schedule 3 of the Federal Income Tax Return.

Thanks again to Tax Guy for taking the time to help me out.

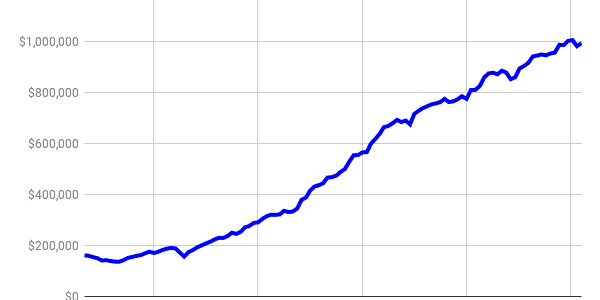

I've Completed My Million Dollar Journey. Let Me Guide You Through Yours!

Sign up below to get a copy of our free eBook: Can I Retire Yet?

Hello,

I am inquiring on behalf of my mum. thank you for the information provided. I would like to know, how do I go about getting hold of documentation showing ownership of Nortel stock and the subsequent losses which followed? I believe these documents have bee misplaced.

Thank you in advance for your direction.

Sincerely,

Sandra O.

100% of all NOVA CHEMICALS shares were bought in 2009 by International Petroleum Investment Company.The shares were bought out at $6 each; the company is no longer trading publicly.

I had 210 shares in JTWROS with my mother. She passed away in Jan. 2013. I cashed the certificate in August (2013) and banked the $1,260.

So how do I report this on my income tax?

@Christina, if you sold now you can carry forward your capital loss indefinitely to offset future gains so it is not required to hold for 2 or 3 years for that reason.

Note that I sold my nearly worthless position in NT last year. TDW did not charge the full commission and only enough the cancel the shares for about $0.30. That was really the cleanest and cheapest solution.

Would it be possible to hold the Notel stocks and sell it in 2 or 3 yesrs?

I am asking this questions as I did not have any capital gains last year, so I prefer to sell it later when I do have gains to offset on my tax claims.

Does it make sense? I live in Canada.

Christina

My stock Campbell Resources TSX : CCH was delisted a couple of years back..but is trading on OTC BB under the symbol CBLRF and still shows up in my account as CBLRF..its worthless and hard to get rid off as there are no bids or asks.

So how do I claim a capital loss for it as it still shows up on the OTC BB which is not really a stock exchange but an Over The Counter Bulletin..and still shows up in my account as CBLRL although the company is essentially bankrupt and insolvent.

How long do you have to claim the stock that was delisted on your return. For example I have a stock that was delisted 3-years ago which I never followed this procedure for (thereby never claiming capital loss) – can I still fill in Schedule 3 – 3years later?

Jeff

Hi, Can anyone tell me if Oilexco, T.OIL, meets the requirements for making a Capital Loss claim on my 2009 Tax Return (through the deemed sale of my shares)? I am using Quicktax to file, so if I can claim the loss, how would I go about it? Thanks. A Naive Almost Septuagenarian

Neil: i don’t think you’d be able to sell your Nortel stock…on what exchange does it trade on? I don’t believe it is on any exchange.

Do warrants or rights that have expired worthless qualify for this?

Hi great thread…a related question on Nortel stock…As all of you, I too unfortunately still own Nortel stocks….

So in order to show it as a capital loss in my tax return…do I actually need to sell the stock, and re-buy it ? Or its an assumption which leads to the point that whatever u spent on purchasing the stock is ur actual loss ?

Also, if I do need to actually sell the stocks, then how do I do that ?

And if I dont need to sell the stocks, but put the details on Schedule 3, then do I need a tax receipt or something of that sort as proof, or just a share certificate is enough ?

If I am filing taxes online, then do I need to send some documents to CRA regarding this – OR its pretty sure that my return is going to be audited and that I will have to provide the documents then (dont care if its audited..just for info)..

Finally, as per conflicting posts above, that Nortel might / might not be counted under section 50…today, is it considered under that section or not…ie. can i claim a loss or not ?

Thanks a lot.

Neil, check out this post on selling Nortel as a delisted stock.